Conducting a market rental rate analysis is important before investing. It helps you determine an investment property’s profit potential.

Table of Contents

- What Is a Rental Market Analysis?

- How to Carry Out a Rental Market Analysis

- Best Online Tool for Rental Market Analysis

- 5 Cities With High Rental Rates

Over the years, investment rental properties have proven to be lucrative. However, not all properties in all housing markets are profitable. Some housing markets aren’t ideal for rental property investments. It is why investors must carry out various analyses to ensure that they put their money into properties with excellent profit potential.

A rental market analysis (RMA) is an essential step for real estate investors to analyze a property’s profit analysis. The analysis involves looking at comparable properties, assessing the housing market and neighborhood, and then calculating the average rental rate.

If the RMA result is positive, it means that the cash flow from the rental property is higher than the rental property expenses. In this case, the property is worth investing in. On the other hand, a negative result means that you should be wary.

Thankfully, you can carry out a comprehensive RMA using online real estate software, such as Mashvisor.

In today’s blog post, we’re going to look at what a rental market analysis is and how to carry out one. Since we want you to succeed, we’ll also list some top markets for rental property investment based on Mashvisor’s latest housing market report.

What Is a Rental Market Analysis?

A rental market analysis is a housing market evaluation that involves analyzing the rental market and property data to determine the investment potential. An RMA is an important tool for real estate investors looking to invest in a long-term rental property for the long run.

An RMA is quite similar to a competitive market analysis (CMA). Both analyses are carried out by evaluating a few comparable investment properties and computing key property metrics.

However, a CMA is mainly done by a real estate agent to determine a property’s fair market value for their client. On the other hand, an RMA is carried out by real estate investors to determine a property’s potential returns. Investors can save themselves from purchasing a low-return rental property by conducting an RMA.

Also, an RMA helps landlords set a fair rental value for their properties. Setting a rate that’s too high will compel your tenants to look for more affordable housing. On the other hand, low rental rates mean that you’re losing on potential profits.

When done correctly, an RMA can give you insights into a fair market rental rate and potential returns. How do you carry out an RMA correctly?

How to Carry Out a Rental Market Analysis

As you already understand by now, you must conduct a rental market analysis to find out the market rental rate for the neighborhood you’re interested in. Besides helping you understand the housing market’s average rental rate value, it will also help you understand the property expenses in your area of interest.

That said, the following important steps will help you understand the local housing market rental rates:

1. Analyze the Neighborhood

Location is one of the most important factors that affect an investment property’s profit potential. Your housing market determines how much rental rates you can set for your rental properties, as well as how much property expenses you need to settle. It is why you must choose your investment location wisely.

When it comes to the investment housing market, many people will only think of the city or state. However, your analysis should narrow down to the specific neighborhood. It is because different neighborhoods in the same city may offer different rates of return on investment.

In the same breath, some may be better suited for long-term rental properties, while others are ideal for short-term rentals.

Neighborhood Analysis

As such, a neighborhood analysis should be the first step when conducting an RMA. It will help you select a neighborhood that not only offers a reasonable rental rate but also generates a good rental demand.

So, what factors should you watch out for when conducting a neighborhood analysis?

Here are some pointers to watch out for when analyzing a housing market for rental property investment:

- Job growth and employment rates: The availability of jobs and low unemployment rates mean that many people in the housing market enjoy access to income opportunities to afford the rent. Also, it means that many professionals are constantly moving from other housing markets in search of employment opportunities in such neighborhoods. It is a good sign that your rental properties will enjoy a good demand.

- Public transportation: Many renters consider accessibility to public transportation before renting a house. Don’t assume that all your tenants will own cars. Ensure they can access public transportation to their jobs, schools, or other activities.

- Quality education: If you’re looking to invest in properties that can host families, ensure that your housing market offers quality education. Invest in a neighborhood where your tenants’ kids can receive quality public and private education.

Other Considerations

Listed below are a few more things to consider when doing a neighborhood analysis:

- Amenities: Invest in a housing market with good access to amenities, such as parks, shopping centers, libraries, and many others. In addition, ensure the area’s walkability score is high so that your tenants can easily access the amenities on foot.

- Medical services: Should your tenants get seriously sick at night, they want to be near medical facilities. Ensure you invest in a housing market where your tenants can access medical services when they need them.

- Safety: Nobody wants to live in a housing market where they keep worrying about their safety. Invest in a secure neighborhood with no or minimal crime rates.

Your housing market is the only constant thing that you invest in. You can change your property’s features, curb appeal, and amenities, but you can’t change its housing market. It is why you should take neighborhood analysis seriously. You can identify a good investment neighborhood by following the above criteria.

Related: Real Estate Investing for Beginners: A Guide to Neighborhood Analysis

2. Gather Subject Property Details

Once you’re familiar with the housing market and what its profit potential looks like, you can begin looking for the subject property details. You want to collect as much information as you can.

Ordinary homebuyers will look for basic details, such as the housing market, square footage, features, and price. However, as an investor, you should go deeper and also evaluate other criteria, such as days on the market, amenities, and concessions.

Seek to collect the following property details:

- Address

- Property status (whether currently on the market, foreclosure, or set to be available on the market)

- The number of bedrooms and bathrooms

- Property amenities (swimming pool, fitness center, parking spots, etc.)

- Square footage

- Listing price

- Listing date

- Days on market

Collecting such information can be extremely easy with online tools such as Mashvisor. Mashvisor’s Property Finder tool allows you to collect a property’s information in just a matter of minutes. Simply click on the search results and you’ll be directed to a page with every detail you need to find out about a property.

In case the property isn’t listed on the platform, simply enter its address, zip code, neighborhood, or city in the search bar.

3. Assemble Comparable Properties

It’s now time to look at a few properties that are comparable to the subject property.

Real estate comps refer to properties with similar features and characteristics to the subject property. The comps are important since they’ll help you determine the average housing market rental rate in the neighborhood.

You want to identify at least five comparable properties to calculate the average rental rate. However, you should know that not every property that is in close proximity to the subject property is a comparable property.

Ideally, you want to compare apples with apples, not oranges. The comps should be as similar to each other as possible. That’s why you can’t assemble real estate comps without collecting as much information about the subject property as possible.

How Do You Spot a Real Estate Comp?

Here are some pointers to look at when looking for real estate comps:

- Proximity: Real estate comps should be located close to each other. In an urban setting, they should be located no further than three blocks. Those in a suburban area can be located within a few miles of each other, while rural properties can be further away.

- The number of bedrooms and bathrooms: If the subject property is a two-bedroom house, get other two-bedroom properties. The same applies to the number of bathrooms as well.

- Square footage: All the properties should be of the same size.

- Lot size: If you’re interested in a single-family home, all the properties should come with the same lot size.

- Property condition: They should be in the same condition category, such as renovated, distressed, original, etc.

Another important factor to consider when selecting real estate comps is when the property was sold. The comps should’ve recently been sold. It is because the housing market keeps changing. You want to use recent home prices in your calculations.

Also, check how many days the comps spent on the market. If the property stayed on the market for too long (more than 60 days), then it might be overpriced or come with a major defect. If it’s priced too high, then you can adjust the value down by about 5%.

Using an Online Real Estate Tool

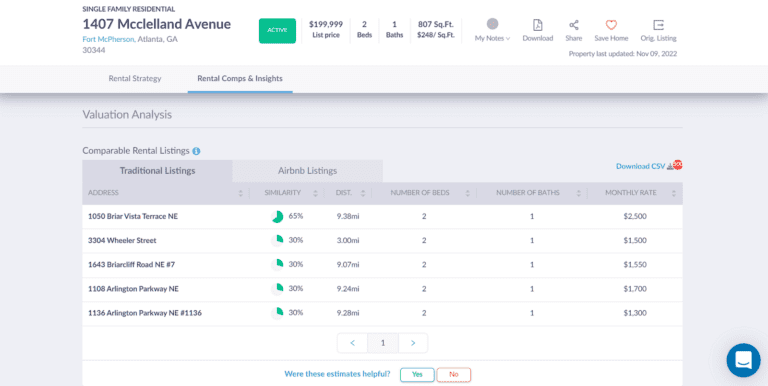

As you can already tell, identifying real estate comps all by yourself can be an arduous task. Luckily, you can use online real estate tools, like Mashvisor, to identify comps easily in any housing market. Our platform provides you with real estate comps so that it’s easier for you to calculate the average rental price in any housing market.

Our investment property calculator allows you to download a report containing all comparable property listings in the housing market of interest. The report provides you with all the necessary data that will help you in the next step.

Related: How to Find Rental Comps Using Mashvisor

Mashvisor’s real estate comps tool helps investors determine the average market rental rate in a particular neighborhood.

4. Calculate the Rent per Square Foot

Now that you’ve identified a number of rental comps, you can now start carrying out your calculations to gain a deeper insight into the fair market rental rate.

How do you do the calculations?

First, you must have each property’s rental rate with you. Divide the rental estate by the square footage to find the rent per square foot. You can then calculate the average rent per square foot by dividing the figure by the number of rental comps.

After getting the average rent per square foot in the housing market, multiply it by the subject property’s square footage to see if it has a good return potential.

For example, let’s assume that you’re interested in a single-family home. You’ve collected three comps and calculated their average rents per square foot to be $3.50, $4, and $4.50. Your calculations will look like below:

$3.50 + $4 + $4.50 = $12

$12/3 = $4

The average rent per square foot for a single-family property in the housing market is $4. The next step will be to multiply this figure by your subject property’s square footage to determine whether the rental rate makes sense.

Assuming the subject property comes with a square footage of 120, your calculation will look like below:

$4 * 120 square feet = $480

You can subtract the projected monthly property expenses from the above result to determine whether the investment would make sense.

Best Online Tool for Rental Market Analysis

As you can already see at this point, conducting a rental market analysis requires a lot of work. If done manually, it could take you at least three months to find the fair market rental rate. Based on how real estate prices change fast, your calculations could be inaccurate by the time you’re done.

However, real estate investors today are lucky to be living in a digital world. Your best bet would be to use an online tool that helps you carry out the analysis faster. You can now easily and quickly carry out a rental housing market analysis from the comfort of your home.

Mashvisor’s investment property calculator is your best friend when carrying out an RMA. We’ve already talked about the tool when looking at real estate comps. However, its abilities aren’t limited to comps. You can use it to do much more.

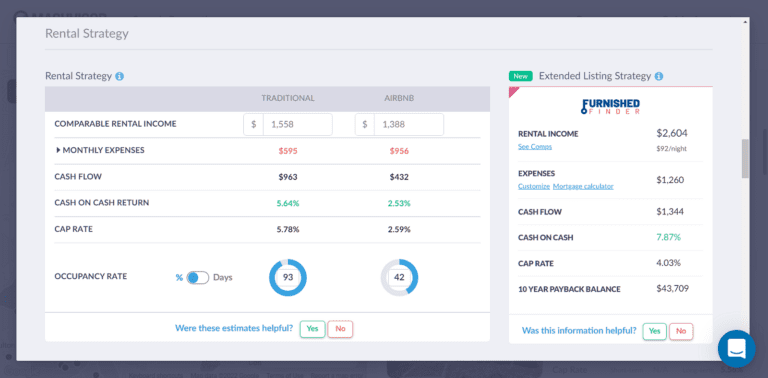

Our rental property calculator provides you with readily available crucial analytics for each property. The analytics include return on investment metrics, such as cap rate and cash on cash return. You also get occupancy rate data which is essential in gauging a housing market’s rental property demand.

The calculator also provides the said metrics at the neighborhood level. It saves you a lot of trouble that you’d go through when finding property data on your own.

And that’s not all. One outstanding feature of the tool is that it provides you with accurate and reliable metrics for both short-term and long-term rental strategies. Such a feature really sets the rental property calculator apart from its competitors.

Related: What Is a Good Cash on Cash Return?

Mashvisor’s rental property calculator provides investors with access to key investment property metrics, such as cash on cash return, cap rate, and occupancy rate.

5 Cities With High Rental Rates

Looking for the best cities to invest in can be a taxing activity, especially for beginners. That’s why we’ve done all the dirty work and come up with the following list of the best housing markets to invest in based on the market rental rate.

Note that the cities below are affordable since the average property price is below $1 million. They also offer the highest returns for long-term rentals, with their cash on cash return not falling below 2%.

We’ve ordered the following housing markets from the highest to lowest based on rental income, based on Mashvisor’s latest October location report.

1. Fountain Hills, AZ

- Median Property Price: $885,044

- Average Price per Square Foot: $359

- Days on Market: 92

- Number of Long Term Rental Listings: 122

- Monthly Long Term Rental Income: $3,161

- Long Term Rental Cash on Cash Return: 3.42%

- Long Term Rental Cap Rate: 3.46%

- Price to Rent Ratio: 23

- Walk Score: 39

2. Williamsburg, VA

- Median Property Price: $565,289

- Average Price per Square Foot: $223

- Days on Market: 62

- Number of Long Term Rental Listings: 181

- Monthly Long Term Rental Income: $2,139

- Long Term Rental Cash on Cash Return: 3.23%

- Long Term Rental Cap Rate: 3.31%

- Price to Rent Ratio: 22

- Walk Score: 81

3. Daytona Beach, FL

- Median Property Price: $431,383

- Average Price per Square Foot: $309

- Days on Market: 87

- Number of Long Term Rental Listings: 172

- Monthly Long Term Rental Income: $1,805

- Long Term Rental Cash on Cash Return: 3.08%

- Long Term Rental Cap Rate: 3.17%

- Price to Rent Ratio: 20

- Walk Score: 79

4. Covington, LA

- Median Property Price: $453,775

- Average Price per Square Foot: $194

- Days on Market: 68

- Number of Long Term Rental Listings: 142

- Monthly Long Term Rental Income: $1,788

- Long Term Rental Cash on Cash Return: 3.12%

- Long Term Rental Cap Rate: 3.20%

- Price to Rent Ratio: 21

- Walk Score: 74

5. Statesville, NC

- Median Property Price: $352,050

- Average Price per Square Foot: $187

- Days on Market: 105

- Number of Long Term Rental Listings: 103

- Monthly Long Term Rental Income: $1,485

- Long Term Rental Cash on Cash Return: 3.32%

- Long Term Rental Cap Rate: 3.39%

- Price to Rent Ratio: 20

- Walk Score: 69

To use Mashvisor to search for high-income rental properties in any housing market in the US, click here.

Key Takeaways

One of the most important processes before investing in a rental property is finding out the market rental rate. Conducting a rental market analysis will help you gain an insight into how much rent you can expect to make on a certain property.

One may wonder what the point of carrying out an RMA is. Well, you want to charge enough rent to be able to cover your property costs and have enough profit left over. You also want to set a rental rate that is fair enough to attract tenants. An RMA will help you strike this balance.

Mashvisor will help you find the market rental rate and do more for you in your real estate investing journey. Sign up today and start your 7-day free trial.