Different credit bureaus have different scores

This is why different credit bureaus may show different scores.

Buzz60

Need a loan to buy a house? Applying for a new rewards credit card? Acing the lender’s credit check will get you the best deal.

Keeping score is a big part of life. In sports, it determines who wins and who loses. In academia, grade transcripts and GPAs dictate who gets into Ivy League schools. And in the banking and business world, credit scores impact whether you qualify for a mortgage, the amount of interest you pay on loans, and maybe even if an employer will hire you.

Paying bills isn’t a game. Credit bureaus keep a monthly score of your payments. And banks and credit card companies use your credit score (which is calculated using information in your credit report) to size you up and predict how likely you are to repay a loan.

“A credit report and credit score are like a report card from school,” said Mark Reyes, senior financial advice manager at Albert, a personal finance app. “They tell lenders how well you have performed when it comes to borrowing and paying back money.”

What is a good credit score?

Your credit report includes financial details, such as how much you owe on loans and credit cards, payment history, total credit available to you, and age of your open accounts.

The three consumer credit bureaus that compile reports are Experian, Equifax, and TransUnion. Your credit score, a three-digit number from 300 (poor) to 850 (exceptional), is what lenders use to determine your credit worthiness.

“Your credit score is one of the most important numbers in your financial life,” said Ted Rossman, senior industry analyst at Bankrate.com. A score above 740 (deemed “very good” by credit bureau Experian), he adds, is typically what you’ll need to get the best terms on loans. Scores that dip below 670, dubbed “fair” credit, will result in higher borrowing costs and lower chances of getting approved for certain credit.

What helps build your credit the most?

Pay your monthly bills on time–always.

Don’t amass lots of debt relative to your available credit. Lenders like to see a “credit utilization” ratio of 30% or less. So, if you have $10,000 of credit available, your balance should be less than $3,000.

Everything you need to know about credit: New to adulting? Here’s what you need to know about credit

What interest rate hikes mean for you: Fed raises interest rates by 0.75% again: Here’s how it will hit your wallet and portfolio

Showcase a long credit history that highlights consistent on-time payments over time.

Manage a diverse mix of credit. Lenders like to see that you can oversee all types of debt, such as credit cards, mortgages, and car loans.

Keep the number of credit applications and inquiries to a minimum to avoid looking overextended or desperate.

There’s a steep price to pay for having a low FICO score. For example, the national average for a 30-year fixed rate mortgage is 4.755% for buyers with a FICO score of 760 or above, versus a rate of 5.368% (or about a half of a percentage point more) for FICO scores of 660-679, according to myfico.com.

On a $300,000 mortgage, the borrower with the lower FICO score would pay $113 more per month, or $40,680 over the life of the 30-year loan. “It sounds like a half of a percentage point is not that big a deal, but it can add up,” Rossman said.

What does your credit score mean?

The more pristine your bill-paying history is and the higher your credit score, the better you’ll look in the eyes of lenders—and the better terms you’ll get on loans and other types of credit.

Credit histories are more than numbers, though. Lenders, employers, landlords, and even utilities and mobile phone carriers, use credit reports to gauge your financial health and habits.

“It is viewed as kind of a responsibility score,” Rossman said. If you’ve consistently managed your debt responsibly over time, the belief is there’s a likelihood you’ll continue to do so in the future.

While most people have multiple credit scores generated by the three credit bureaus and the credit-score modeling companies FICO and VantageScore, the most used credit score is from FICO, which is used by 90% of lenders.

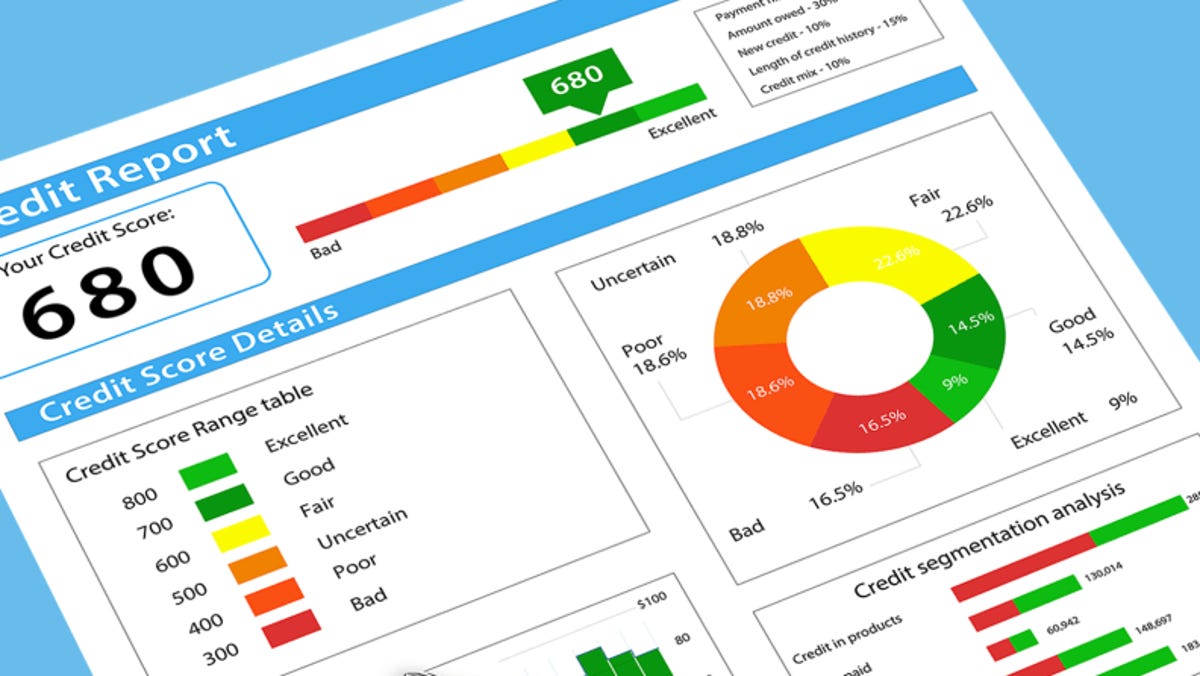

In general, your credit score is determined by five factors: your payment history (which accounts for 35% of your score); the amount you owe relative to your total credit limit (30% of your score); length of your credit history (15% of your score); credit mix (10% of your score); and new credit inquiries/applications (10% of your score).

How to get a copy of your credit report

You can now check your credit reports weekly from the three major credit bureaus for free at AnnualCreditReport.com. But checking every seven days might be overkill. Reviewing your credit history once a year, though, is inadequate, says John Ulzheimer, a credit expert and former employee at FICO and Equifax.

“Your credit report is too important to turn your back on,” Ulzheimer said.

A better timetable would be to check your credit report once a month or every few months.

“It’s a good way to monitor for errors and deter fraud,” Reyes said.

If you identify an error on your credit report, the Consumer Financial Protection Bureau says you should dispute the information with the credit reporting bureaus and explain in writing “what you think is wrong, (and) why,” and include documents that support your dispute. The CFPB also advises you to lodge a dispute with the company that provided the incorrect information to the credit bureaus.

How to learn your credit score for free

There are ways to check your credit score for free. Credit bureau Experian allows you to review your FICO score at no cost at www.experian.com. Credit Karma, a personal finance site, provides free scores at www.creditkarma.com. Credit card companies, including Citi and Bank of America, provide free credit reports online to customers. And Discover, American Express, and Chase offer free credit scores on their websites even if you’re not a customer.

The bottom-line? If you’re looking to borrow money, make sure your credit score is as high as it can be. If it’s too low, “you need to shift into score-improvement mode,” Ulzheimer said.