New York

CNN Business

—

Meta on Wednesday posted the second quarterly revenue decline in its history since going public and warned that it is making “significant changes” aimed at cutting costs ahead of 2023, as it confronts an economic downturn that is hitting its core online advertising business.

For the three months ended in September, Meta

(FB) posted revenue of $27.7 billion, down 4% year-over-year and slightly above Wall Street analysts’ expectations. The Facebook parent company posted its first-ever quarterly revenue decline during the June quarter.

The company reported net income of nearly $4.4 billion — less than half the amount it made during the same period in the prior year and below analysts’ projections.

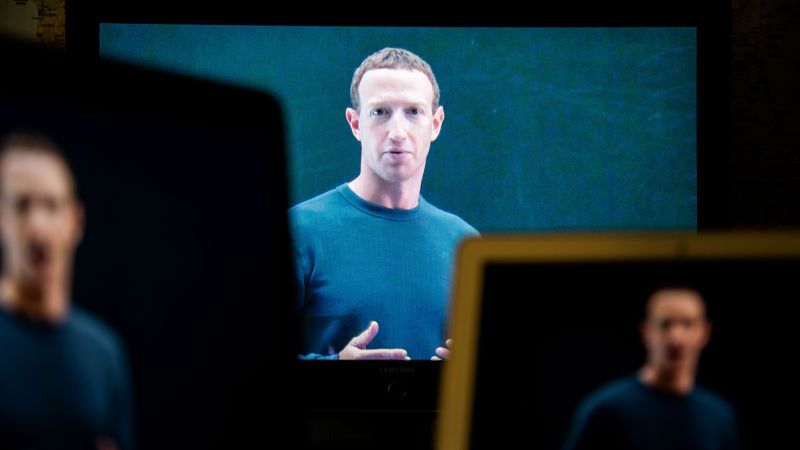

“We’re approaching 2023 with a focus on prioritization and efficiency that will help us navigate the current environment and emerge an even stronger company,” Mark Zuckerberg, Meta’s founder and CEO, said in a statement.

Meta’s stock fell almost 17% in after-hours trading Wednesday following the results.

Demand for online advertising has declined in recent months amid rising inflation and fears of a looming recession. Tech companies like Google and Snap have also seen hits to their ad revenues. Meta CFO David Wehner said on a call with analysts following the report that the average price per ad across Meta’s platforms fell 18% during the quarter.

At the same time, Meta’s user growth is slowing amid heightened competition from rivals like TikTok. Meta reported having 2.96 billion monthly active users on its core Facebook app at the end of the quarter, up 2% year-over-year. That’s down from the 6% growth rate it posted in the year-ago quarter. Daily active users on Meta’s family of apps grew 4% to 2.93 billion, down from the 11% increase it posted the year prior.

Zuckerberg noted on the call that Instagram now has more than 2 billion monthly active users and WhatsApp has more than 2 billion daily active users.

These challenges to its core business come as Meta is funneling billions of dollars into an ambitious new bet to build a future version of the internet called the metaverse that likely remains years away.

Wehner said operating losses from the company’s metaverse ambitions, which are categorized under its Reality Labs unit, are expected to “grow significantly year-over-year” in 2023. Reality Labs lost nearly $3.7 billion in the September quarter, and has cost the company a total of $9.4 billion so far this year. Revenue from the Reality Labs unit also fell by nearly 50% year-over-year in the September quarter.

Altimeter Capital, a Meta sharehoder, last week wrote an open letter calling on the company to reduce its headcount expenses by at least 20% and its annual capital expenditure by at least $5 billion, and to limit its investment in the metaverse to no more than $5 billion per year.

In Wednesday’s report, Wehner said the company is “making significant changes across the board to operate more efficiently.” Executives said the company expects headcount at the end of 2023 will be roughly in line with or slightly smaller than the 87,314 it reported as of the end of September (an increase of 28% from the year prior).

“We are holding some teams at in terms of headcount, shrinking others and investing headcount growth only in our highest priorities,” Wehner said. He also hinted that the company could shrink its physical office footprint.

Zuckerberg said on the call that the three key areas of investment for the company in the coming year are its AI discovery engine that’s powering Reels and other recommendations, ads and business messaging, and its future vision for the metaverse. Meta earlier this month unveiled its newest virtual-reality headset, the Meta Quest Pro, and touted its potential for business customers.

In the final three months of the year, Meta expects quarterly revenue between $30 billion and $32.5 billion. On the high end, the projection would mark a 3.5% year-over-year decline from the same period in the prior year.