Have you been looking for the best real estate app for buyers? Read on to find out why Mashvisor is your best bet for a real estate app.

Table of Contents

- 4 Challenges to Buying a Real Estate Investment Property in 2023

- How Can Mashvisor Help Real Estate Investors Find & Buy a Property?

Technology has evolved to become an essential aspect of our daily lives. Companies in different sectors have also adopted technology to streamline various processes. The real estate industry hasn’t been left behind.

Modern-day real estate investors want efficient processes with minimal or no setbacks. They need easy access to investment property listings, market analytics and data, and off-market property deals. Needless to say, technology has transformed the real estate investing scene. If you need to succeed, you must use the best real estate app for buyers there is.

However, selecting the best real estate app for buyers may be intimidating initially, especially for beginners. It is because there are many options out there. Furthermore, not all apps provide all functions you need in one package. It is why Mashvisor is the best real estate app that you can get.

In today’s blog, we’re going to look at some reasons why we believe Mashvisor is the best app for real estate buyers. But first, let’s look at some common issues buyers face that Mashvisor can help solve.

4 Challenges to Buying a Real Estate Investment Property in 2023

First, we need to understand some of the major issues that potential property investors face so that we can see why they need the best real estate app for buyers.

1. Market Unpredictability

The real estate market has seen a lot of changes in the past few years. First came the pandemic that almost rendered all industries on their knees. After that, there was the surging inflation that many experts predicted would lead to a housing market crash. The pandemic resulted in major changes in property preferences and market demands.

The changes are just to show you that the real estate market is always subject to major ups and downs. Sometimes, they can occur in such a short period that leaves many investors confused, especially because the industry relies heavily on market conditions.

It means that there’s barely ever a guarantee that your investment will turn out as profitable as you expect it to. For example, you might invest in a rental property when the market is hot.

If the market cools down, you might end up offloading the property at a lower price than the initial investment even if the property generated rental income. The property’s value might go down due to market changes.

You should always understand such dynamics before investing in a property. Put yourself in a position to understand the market, its past, current, and future trends, and how the economy is expected to affect the market.

It will help you plan ahead and stay prepared for any outcome. Besides, it’ll help you determine whether investing in a property at a certain time is the best decision or not.

Related: Will the Housing Market Crash in 2023?

2. Bad Investment Locations

Location is everything when it comes to real estate investments. You should first consider the location you’re going to invest in even before you start searching for investment properties. Unfortunately, many investors don’t know how to tell whether a location is the best for property investments or not. Such a situation presents a huge risk due to several reasons.

Firstly, your location determines the demand for rental properties. In some cases, you might think that a location is the best for investing since the rental rates are low. However, low rental rates could mean that the supply of rental properties supersedes the demand.

Secondly, you want to learn what common factors would make you steer clear of certain locations. For example, always consider the crime rates in a location. It can be the primary factor that determines your property’s occupancy rates.

In addition, your investment location determines the rate at which the property value appreciates or depreciates. If a certain location offers a low appreciation rate, it may not make financial sense since you’ll sell the property at a loss. It means that you should never invest in a property based on its buying price alone.

You can avoid the above pitfalls by carrying out a market analysis to choose the best location to invest in. Keep reading to find out how you can conduct an in-depth market analysis.

3. Negative Cash Flow

In investing, cash flow refers to the amount that is left from your revenue after settling all property expenses, such as taxes, mortgage payments, insurance, and utilities. Another major challenge that investors face is not using the best apps and resources (for buyers) to determine whether their investment property will generate positive or negative cash flow.

If a property generates positive cash flow, it leaves the property owners with enough profits after paying all the expenses. On the other hand, negative cash flow means that the expenses are higher than the revenue. Negative cash flow means that the business is making losses.

A real estate investor runs the risk of investing in a negative cash flow property if they don’t conduct an investment property analysis first. The best way to avoid such a challenge is by accurately estimating the property income and expenses. Of course, the property needs to be in the best location so market analysis is also an important step for positive cash flow.

The above step is very important and should be thoroughly conducted since even small expenses can add up and determine your cash flow. We’ll also show you how Mashvisor helps you here.

4. Vacancies

Vacancy rate challenges also affect many real estate investors today. First, you need to know that just buying an investment property doesn’t guarantee full occupancy. While it’s possible to achieve the best occupancy rate possible, don’t ignore the possibility of high vacancies or vacancy turnovers.

Your tenants are your major source of income when you invest in rental properties. High vacancies mean that your property won’t be profitable. You might not make enough to pay for the mortgage, insurance, taxes, property management, and utilities.

To avoid this challenge, you need to conduct thorough housing market and investment property analyses.

Related: What Is Vacancy Rate and How to Keep It Low

How Can Mashvisor Help Real Estate Investors Find & Buy a Property?

So, how does Mashvisor help real estate investors and why is it the best real estate app for buyers?

Let’s start by defining what Mashvisor is.

What is Mashvisor?

Mashvisor, founded in 2014, is an online real estate app that seeks to equip real estate investors with the best tools and resources to make the best investment decisions. The platform helps investors identify lucrative investment markets and neighborhoods and browse profitable investment properties. It also helps evaluate whether the said investment opportunities make financial sense or not.

Many investors choose to make investment decisions without conducting thorough scrutiny. However, Mashvisor makes the investigation simple and straightforward. You don’t need to worry about the reliability and usefulness of the data you find on our platform. It also saves you a lot of time that you’d otherwise use to carry out the analyses manually.

As such, we can say that Mashvisor helps you in the following ways:

- Locate and analyze the best locations for buyers for property investments

- Spot the most lucrative investment properties in the said locations

- Evaluate whether the properties will do well as long-term rentals or short-term rentals

Now that we’ve covered the basics, let’s see what Mashvisor can do for you.

What Does Mashvisor Do for Real Estate Investors?

The platform helps you do the following tasks easily:

Learn Real Estate Investing Basics

Most new real estate investors don’t know where to start. The knowledge center is one of the best resources on the Mashvisor platform. Our real estate blog offers you all the knowledge you need to understand real estate investing better.

Our blog posts are well organized on the real estate app to make it easier for you to find whatever information you’re looking for based on your needs or interests.

For instance, we’ve dedicated one category specifically for newcomers where they can learn the best investing basics. There’s another section that teaches investors how to spot high-performing rental properties with a high return on investment. Other categories focus on how to conduct market and property analyses.

In short, the Mashvisor knowledge center encompasses everything you ought to know about real estate investing.

Related: 20 Best Markets for Real Estate Investing in 2023

Market and Neighborhood Analyses

As we mentioned, location is one of the most important factors in real estate investing. It is why we include the best tools in our app to help you locate the best neighborhoods for investing.

Carrying out neighborhood analysis is important since different neighborhoods within the same area may offer different returns. Two neighborhoods in the same market may come with different rental incomes, occupancy rates, property expenses, and returns on investment.

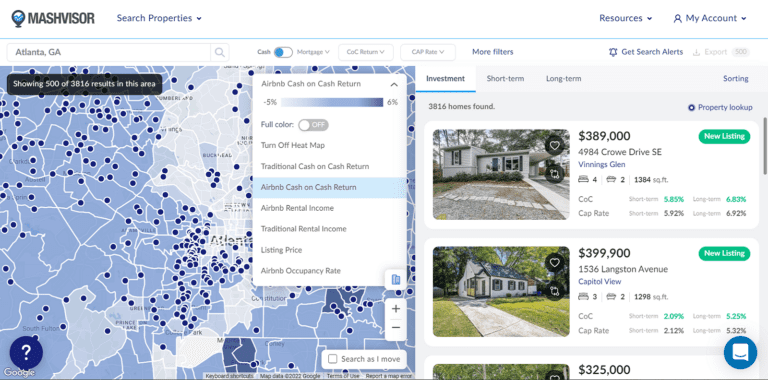

Mashvisor’s real estate heatmap is the best app for market analysis. It is a color-coded app that uses different colors to display different results. The darker areas are often high-performing neighborhoods while the lighter ones are dormant ones.

The results are shown based on your search criteria. You can set up your criteria using the following metrics:

- Listing price

- Traditional and Airbnb rental income

- Traditional and Airbnb cash on cash return

- Airbnb occupancy rate

The app is a fast way to find out the best places to invest, based on your budget and income requirements.

Mashvisor’s real estate heatmap provides a color-coded representation of a particular location’s performance based on several metrics.

Search for Profitable Property Listings

The Mashvisor app also facilitates the property listing search process. If you’ve selected one of the best locations to invest in, you need to know that not all properties there are profitable. You still need to find high-performing properties in the neighborhood.

Our Property Finder app is the best for this purpose. It saves you lots of time by showing you available listings in your location of choice. You simply need to set up the following filters:

- Distance

- Budget

- Rental strategy

- Property type

- Number of bedrooms and bathrooms

The Property Finder app will then display the listings that match your search criteria in the location. The results are displayed in descending order based on the cash on cash return for your preferred rental strategy. In short, the best-performing properties are displayed first so that you can focus on them right off the bat.

Investment Property Analysis

The Mashvisor app is also helpful when it comes to investment property analysis. Once you’ve found the best potential investment properties, you need to analyze them further to determine whether they’ll generate the expected returns. You need the best app for such an important task.

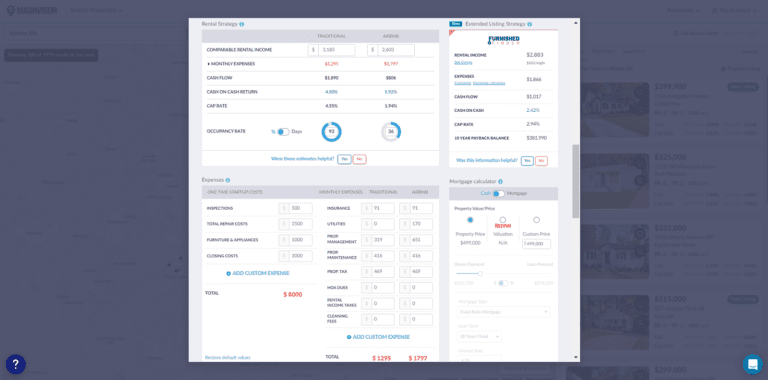

Mashvisor’s investment property calculator helps you invest in profitable rental properties. It helps you carry out a detailed analysis of property listings you’ve found on the platform. The app is necessary so that you can invest in positive cash flow properties with a high return on investment potential.

Our calculator app allows you to run a reliable analysis of the property you’re interested in, as well as any other property in the US housing market. It provides you with the following crucial figures for each property:

- Traditional and Airbnb rental income

- Traditional and Airbnb cash flow

- Traditional and Airbnb cap rate

- Traditional and Airbnb occupancy rate

- Traditional and Airbnb cash on cash return

- One-time costs, such as inspection fees, closing costs, and repairs

- Recurring expenses, such as taxes, insurance, property management, HOA dues, and utilities

Mashvisor’s investment property calculator helps investors perform a detailed analysis of property listings and identify those with a high return on investment potential.

Besides the rental property calculator, we also provide a mortgage calculator app. The app helps you choose the best financing option for your investment. You can select the following options on the app:

- Financing method (Cash or mortgage)

- Property buying price

- Down payment

- Mortgage type (Fixed rate mortgage, adjustable mortgage, or interest-only mortgage)

- Loan terms

Once you’ve set up the filters, the mortgage calculator app will incorporate the mortgage payments and down payment into the calculation. You can then see how they’ll affect your return on investment.

Choose the Best Rental Strategy

The best thing about the Mashvisor app is that it helps buyers choose the best rental strategy for their investment goals. Most real estate platforms either focus on the traditional rental strategy or the Airbnb strategy. Mashvisor stands out from other platforms since it provides data for both strategies so you can see which one matches your goals best.

Successful real estate investors don’t only consider the neighborhood and property when investing. They also know the rental strategy is a significant factor. The traditional rental strategy is the best strategy in some locations while the Airbnb strategy works best in others.

Regardless of the data you find on the Mashvisor app, be sure to carry out your own research on the local Airbnb rules and regulations. Short-term rentals are banned outright in certain locations, while, in other areas, they are heavily regulated. Our blog also provides useful information.

Access Homeowners’ Data

Sometimes, home buyers want to invest in off-market properties. Off-market properties refer to listings that aren’t publicly listed for sale. You won’t find such properties on listing sites, newspaper ads, or any other public platform.

In some cases, their owners intend to sell the property but want to do it privately. In other cases, the owners do not intend to sell but will not say no to the best offer. Some of the listings are referred to as pocket listings since owners and agents keep them private until they find a motivated buyer.

The most significant advantage of off-market properties is that you can purchase them at a bargain since the price is most not the seller’s concern. Another advantage is that there’s less competition from other buyers so you don’t need to rush to close the sale.

One main challenge for buyers willing to purchase off-market properties is that it’s hard to find the owners’ details. Since the said properties aren’t posted on public platforms, you may need to think of other ways to find the information. It can be extremely challenging when you’re a beginner without a good network in real estate circles.

The Mashvisor platform offers an important app to assist you. The Property Marketplace app was launched to help investors gain access to off-market properties, such as foreclosures, bank-owned properties, short sales, and auctions.

Final Thoughts: The Best Real Estate App for Buyers

There are dozens of real estate apps out there. However, Mashvisor is the best real estate app for buyers in 2022. The app helps investors solve many of the challenges they face, such as being unable to choose a profitable neighborhood and predict a property’s income. It also helps accurately estimate the property’s cash flow and return on investment.

The best thing about Mashvisor is that you don’t need to be tech-savvy to use it. The app is straightforward and simple to use. More importantly, Mashvisor will help you make wise business and investment decisions, whether you’re a beginner or an experienced investor.