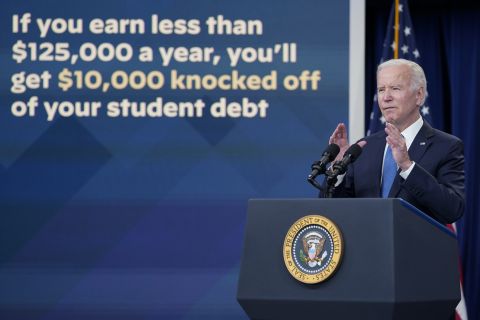

Federal student loan borrowers can now apply for up to $20,000 in debt forgiveness, thanks to a new plan announced by President Joe Biden in late August.

The administration officially launched the application Monday, following a brief “beta period” over the weekend during which its team assessed whether tweaks were needed.

Not every student loan borrower is eligible for the debt relief — only federally held student loans qualify and private student loans are excluded.

Where can you find the application?

You can complete the short application at: Studentaid.gov

What kind of federal loans are eligible?

There are a variety of federal student loans and not all are eligible for relief. Federal Direct Loans, including subsidized loans, unsubsidized loans, parent PLUS loans and graduate PLUS loans, are eligible.

But federal student loans that are guaranteed by the government but held by private lenders are not eligible unless the borrower applied to consolidate those loans into a Direct Loan by Sept. 29.

The Department of Education initially said these privately held loans, many of which were made under the former Federal Family Education Loan program and Federal Perkins Loan program, would be eligible for the one-time forgiveness action – but reversed course in September when six Republican-led states sued the Biden administration, arguing that forgiving the privately held loans would financially hurt states and student loan servicers.

Defaulted Federal Family Education Loans and defaulted Perkins Loans are still eligible for the debt relief even if they are privately held.

What year is the income threshold based on?

Eligibility is based on a borrower’s adjusted gross income for either tax year 2020 or 2021. Adjusted gross income can be lower than your total wages because it considers tax deductions and adjustments, like contributions made to a 401(k) retirement plan.

Will I have to pay taxes on the amount of debt canceled?

Borrowers will not have to pay federal income tax on the student loan debt forgiven, thanks to a provision in the American Rescue Plan Act that Congress passed last year. But it’s possible that some borrowers may have to pay state income tax on the amount of debt forgiven. There are a handful of states that may tax discharged debt if state legislative or administrative changes are not made beforehand, according to the Tax Foundation.

Are current students eligible for forgiveness?

Yes, some current students are eligible. Eligibility for borrowers who filed the Free Application for Federal Student Aid, known as the FAFSA, as an independent will be based on the individual’s own household income. Eligibility for borrowers who are enrolled as dependent students, generally those under the age of 24, will be based on parental income for either 2020 or 2021.

What about debt from grad school?

Yes, if your income meets the eligibility threshold.

Find more answers to your questions here.