Rental property investors are caught in the midst of the short term rental calculator–Excel debate. Which option is the best one for you?

Table of Contents

- Why You Need a Short Term Rental Calculator

- What’s Included in a Short Term Rental Calculator Excel Template?

- Where to Find the Best Short Term Rental Calculator

A career as a real estate investor, particularly that of a rental property owner, requires performing extensive due diligence to ensure that the chances of investment success are high. Every wise investor knows this by heart.

As an investor in rental properties, you should first know what the earning potential of an investment property is before going all-in. This requires knowing the market’s past performance, its current condition, and its future trends.

Investing in rental properties—both long and short-term rentals—have to be done with careful planning and thoughtful execution. Especially since real estate investing is not cheap. Regardless of your investment strategy, investing in real estate comes with a huge price tag and a heavy cost.

This is why investors should map out their moves and think strategically before making the jump. Due diligence is easier with the right tools. But investors, especially those interested in starting an Airbnb business, are caught in the middle of the short term rental calculator–Excel spreadsheet debate.

In this article, we’ll take a look at the advantages of using a short term rental calculator, like Mashvisor’s Airbnb calculator, over the more conventional Excel spreadsheet. In the end, we hope you will be armed with relevant information to help you make wiser investment decisions.

Related: How to Estimate Vacation Rental Income

Why You Need a Short Term Rental Calculator

Investing in real estate is one of the most lucrative investments if you do it right. A lot of folks are under the impression that as long as you buy a property, it will inevitably make you money. While it is somehow true, this is not always the case.

There have been countless times when things have gone sideways for investors. Instead of getting a good return on their investment and making a profit, they ended up losing money. All because they failed to do due diligence.

What Is Due Diligence?

Due diligence is simply performing the necessary tasks to ensure higher chances of success in any business or investing endeavor. For example, investors in short term rental properties need to know some of the following before making any financial decisions on a subject property:

- How much is the fair market value of properties in a given location? Now knowing this might make you buy an overpriced property compared to real estate comps in the area.

- What is the average cash on cash return rate for short-term rental properties in the area? Cash on cash return is used to determine the profitability of a rental property. Unlike a cap rate, cash on cash return takes into account financing in computing a property’s earning potential.

- What does the average occupancy rate look like in the area? A short term rental’s success is largely dependent on how many nights it is booked against the number of days it is available for booking.

- What are the different local regulations on short term rentals? Airbnb laws vary per state and county. Some locations are friendlier to short-term rental owners while others have stricter regulations.

There are, of course, plenty of other concerns that need to be addressed. And it is only with thorough research and study that you will be fully armed with the essential information to make a wise decision.

Gathering and collating these types of data and information can be done on rental property Excel spreadsheets. Another way is by using a short term rental calculator. To find out which option works best for you in the short term rental calculator–Excel template debate, let’s take a look at how each one will best serve you.

Related: How to Estimate Rental Income on Short Term Rentals Using Mashvisor

What’s Included in a Short Term Rental Calculator Excel Template?

The first component we will look at in the short term rental calculator-Excel spreadsheet debate is good old reliable Excel.

Microsoft Excel has been around for quite some time now. It has made life easier for countless people when it comes to organizing, tabulating, and computing different types of information and data. It is so popular that Google created an online version of Excel for greater accessibility.

Nowadays, you can work on an Excel spreadsheet even if you don’t have your computer with you. All you need is an internet connection and a Google account to access Google Sheets.

The question for investors is, “how can Excel or Google Sheets help with their short term rental investing?” Fundamentally, investors use Excel to analyze a property by comparing its cost to its potential cash flow. The premise sounds very basic but it can be quite complicated, especially with all the math. This is where using an Excel spreadsheet comes in handy.

It does take some time to familiarize yourself with the app. However, once you get the hang of it, it will make organizing data and crunching the numbers a lot easier.

Excel—or Sheets—can be used to analyze investment properties by setting up a rental property analysis spreadsheet. Here are four steps to creating a simple investment property analysis spreadsheet in Excel or Sheets:

Step 1: Estimate a Fair Market Value for a Subject Property

Getting a rental property’s fair market value can be done in several ways. It is best to utilize more than one method so you can get a fairly accurate estimate of the low, medium, and high values in the area.

One of the more common ways an investor does this is with the use of a comparative market analysis or CMA. A CMA allows you to take a look at real estate comps that have recently been sold or are actively listed.

Generally, real estate agents who have access to the MLS will gladly help you out by running comps free of charge. You may also turn to a real estate website like Mashvisor for market-accurate data. Mashvisor gives users access to a wide range of real estate market data that covers almost every location in the 2022 US housing market.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Once you have the data you need, you may start computing your potential investment returns using cash on cash return, cap rate, or gross rent multiplier (GRM).

Step 2: Make a Forecast for Your Operating Expenses

Once you know what the return on investment is like on a subject property and how much it will cost you, the next thing you need to do is find out the cost of owning and operating a short term rental business.

Starting an Airbnb business comes with certain operating costs necessary to keep your business afloat. Here are some of the things you need to factor in:

- Leasing fee

- Repairs and maintenance

- Utilities

- Landscaping

- Property management fees

- Property taxes

- Insurance

- HOA fees

- Mortgage payments (if you used financing to purchase the property)

If the property is being rented out, you can ask the seller for some of the details you need to make a proper rental property analysis. You may verify the information given to you by consulting with other real estate investors. You may also try talking to a local property manager for market-accurate details.

Step 3: Find Out the Going Rental Rates in the Area

After finding out the operating costs of a subject property, you must now determine the average rental rates in its location.

You can pretend to be a potential tenant and make some calls to find out how much other similar properties are renting for. You may also use online resources for this, such as Mashvisor. However, one advantage of speaking to a seller or leasing agent is you get to gauge how motivated they are to sell the property.

When it comes to setting rental rates for your subject property, it is more practical to go with conservative rates that are close to the actual market prices. This way, you can run different scenarios to see how a property will do under different market conditions. If the property barely breaks even when using top-market rates, you might want to look for other properties instead.

Step 4: Include Rehab, Repairs, and Updating Costs in Your Projections

Lastly, you should also consider how much it will cost you to make improvements on the property to make it on par with industry standards. Airbnb, in particular, has very strict and high standards. You will need to meet them to qualify for being accepted as a vacation rental owner.

If you have enough money to buy a turnkey property, you won’t have to worry about home improvements that much. However, most real estate investors are in the market for undervalued and distressed properties. These types of properties will give them better returns on their investment even after rehabilitation and updates have been made.

Once you have all of this information listed on your spreadsheet, you can now create columns and sections and add the appropriate formulas that will give you the numbers you need.

While an Excel spreadsheet is helpful in many ways, the other option—a short term rental calculator—is a much better tool to use for rental property analysis.

Related: How Much Can I Rent My House for? Use This Calculator

Where to Find the Best Short Term Rental Calculator

Owning a vacation rental property entails a lot of hard work. It involves dedicating a large portion of your day to overseeing your business and running operations. This includes constant monitoring of your performance as well as attending to different concerns related to your business.

One way to make things a lot easier is to use a short term rental calculator to help with the computations. An Excel spreadsheet is, indeed, quite helpful. However, it also has a higher risk of error since all the data you will input will be done manually. This means that miscalculations due to human error are highly likely.

Mashvisor’s Short Term Rental Calculator

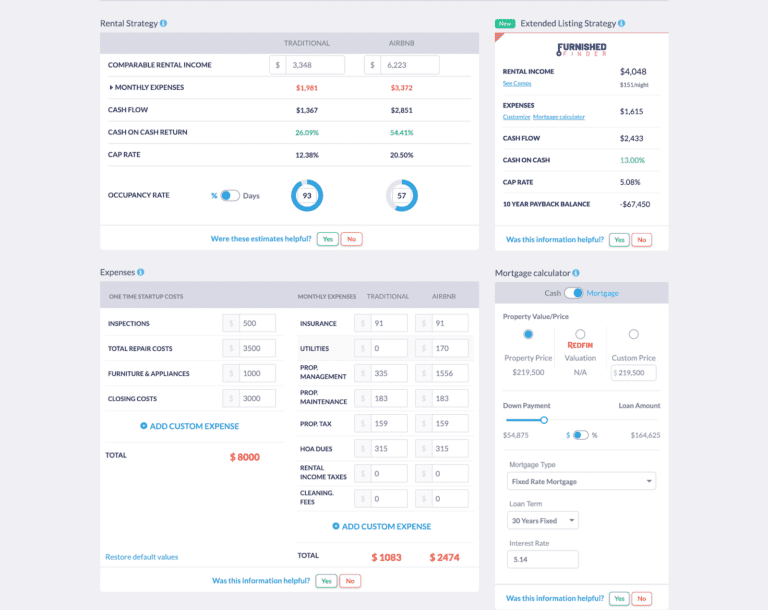

This is not the case with a short term rental calculator like Mashvisor’s Airbnb calculator. Mashvisor’s investment property calculator auto-populates fields with actual real estate market data. The AI used by the system minimizes human errors to a degree, which gives investors more confidence in running the numbers.

Mashvisor’s system uses data from highly reliable sources like Zillow, Realtor.com, and Airbnb and regularly updates its database.

The calculator is also highly interactive as it automatically adjusts and recomputes if you choose to enter data based on your own research. This gives you a more realistic projection of your ROI.

Mashvisor’s short term rental calculator not only lets investors perform computations with ease but also shows them the most profitable properties. The investment property calculator points them to neighborhoods that have high-yield properties. This makes the hunt for positive cash flow properties a lot faster and more efficient for you.

Once you narrow down your choices to a select few, you can then perform a more thorough analysis of each property.

When you start using Mashvisor as your real estate investing tool, you will find out first-hand that an investment property calculator is the best option to go with in the short-term rental calculator–Excel template debate.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

Mashvisor’s short term rental calculator already provides the numbers you need to help you evaluate a potential investment property.

Wrapping It Up

The short term rental calculator–Excel spreadsheet debate will not go away any time soon. At the end of the day, it is a matter of preference for the real estate investor.

An Excel spreadsheet is an excellent tool for monitoring a rental property’s performance and for computing potential profit. It does have a few setbacks, especially with higher chances of human error.

On the other hand, using a short-term rental calculator, like Mashvisor’s Airbnb calculator, ensures more accurate results. Because it is very intuitive and interactive, it minimizes human error in computations. It lets you make fairly accurate and realistic projections, which takes your investing game to a whole new level.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.