[ad_1]

If you are a real estate investor looking for new lucrative investments, here is why this is the only Airbnb analytics tool you’ll ever need.

Table of Contents

- How to Analyze Airbnb?

- Why Mashvisor Is the Only Airbnb Analytics Tool You’ll Ever Need

If you’ve been a part of the real estate industry for quite some time now, you’ve certainly seen the housing market go through some major changes—and one of them is dealing with available data and information.

As a real estate investor or Airbnb host, you are aware of the importance of having access to reliable and accurate analytics that will allow you to evaluate your future investment better.

That is generally easier said than done, though.

Real estate investors have access to a handful of tools that all seem to promise the accuracy of the information they provide—but are they all up to the job?

Currently, there are only a few Airbnb analytics tool options that are capable of satisfying an investor’s needs—and one of them happens to be our own, Mashvisor.

That’s why, today, we’ll focus on the features of this Airbnb analytics tool, what advantages it brings with it and why every Airbnb investor should know about it.

Stick around for more.

How to Analyze Airbnb?

Before you officially start using your chosen Airbnb analytics tool, you should be familiar with the basics—and by that, we mean proper and in-depth research of the Airbnb investment.

Here’s the thing:

There was a time when Airbnb analytics weren’t even in the game, and investment tools that are available today were not an option. Instead of relying on such tools, real estate investors had to embark on these ventures in the “traditional” ways.

Granted, some of these traditional methods are still considered useful today—because they involve face-to-face communication and up-front viewing of the property. However, they can also prolong the whole process considerably.

So, without further ado, here’s how to analyze your Airbnb investment property—and get the best of both worlds when analyzing your investments.

Locating the City

First things first:

Investors should know their way around the US housing market. And by that, we refer to the current shape of the housing market, nationwide trends, and the advantages and disadvantages associated with it at the moment.

Whether they’re dealing with a nearby community or another state, investors should do their best to get a hold of the information they need to proceed with their investment plan—Airbnb analytics.

The first step to analyzing an Airbnb investment is deciding on a particular area or city where you would like to purchase your investment property. Investors are encouraged to look at the bigger picture and make a selection of the most lucrative locations for Airbnb investments.

To save you time—and spark your interest—here are a few cities that are considered Airbnb investment hotspots of 2022:

- Charlotte, NC

- Michigan City, IN

- Westbrook, ME

- Maynardville, TN

Based on the information they gather, investors can then make a narrower selection of cities where this type of investment would pay off the most.

Every investor knows that the right location is crucial for making such a decision. So, in that sense, acquiring information through Airbnb analytics gives you direct insight into profitability and gets you one step closer to reaching your goals.

Related: 40 Best Cities for Airbnb Rental Income in 2022

Knowing the Airbnb Regulations

Before proceeding with obtaining Airbnb analytics and making additional plans for your Airbnb investment, you mustn’t forget one crucial thing—checking Airbnb regulations for the city you’re planning to invest in.

In order for your Airbnb investment not to go down the drain and leave you without any profit, you need to take the time to become familiar with Airbnb regulations.

What does this mean?

Simply speaking, it’s about checking the Airbnb rules and short-term rental laws in your area.

Some cities, unfortunately, can have stricter regulations regarding renting an Airbnb property, which can take a toll on the investor’s profit.

Here are a couple of points investors should add to their checklist:

- Checking whether Airbnb listing is allowed or not

- Checking which regulations apply to the city you’re trying to invest in

- Researching and obtaining the necessary permits

- Checking the tax rules

- Deciding on the insurance policy that you need for your property

- Writing a description for your property

Related: Is Airbnb a Good Investment Considering All of the Regulations?

Deciding on the Type of Property

Your next step should be choosing the type of investment property you want to put your money in. The housing market trends can significantly affect this—so the first step would be looking into the Airbnb analytics of each type of property.

When it comes to short-term investments, you can typically choose between:

Apartments

Even before the pandemic, the Airbnb analytics for apartments were looking pretty good to investors. The biggest reason for the frenzy surrounding such types of accommodation is the price difference.

Here’s the thing:

Most short-term visitors find hotel stays too expensive, with services significantly limited. Airbnb accommodation managed to use them to its advantage and attract a huge number of people.

Apartments are definitely at the top of the list. They are more modernly designed than hotels, are flexible in terms of time, and provide a completely new and better atmosphere for guests.

Townhouses

The next option would be townhouses. These houses are attached to other homes, and they mostly consist of several stories and rooms.

One could argue that a townhouse is the best type of real estate for investors with the necessary finances and are able to provide comfort to more than one guest at a time.

In some cases, townhouse complexes carry a historical value with them because of their structure—which can help your listings stand out in the crowd.

Shared Rooms

Shared groups are also one of the options that investors can consider.

The Airbnb analytics for shared rooms may appear attractive to investors for one pretty simple reason—the group travel trend.

Shared rooms imply sharing space with others. And as it turns out, younger generations love planning group trips and booking such types of accommodation. It’s convenient for the hosts—and can be a budget-friendly alternative for the visitors.

Beach Houses

Another type of property that delivers satisfactory Airbnb analytics would be beach houses.

Beach houses are the preferred option—in the US, at least—for families who want to spend their summer vacation in a beautiful and affordable location.

However, Investing in this type of property can be a double-edged sword. Investors must look at seasonality, weather conditions, and potential return on investment for beach houses.

Failing to conduct proper research regarding the location or the property itself can eventually take a toll on the investor’s profit-related aspirations. Yes, it happens more often than you think—which is why we stress the importance of research and analytics.

Checking the Stats for Nearby Airbnbs

Here is where the research takes on a more serious approach:

After you’ve potentially found a desirable investment property, you’ll need to tackle the actual Airbnb analytics.

What do we mean by this?

Well, in essence, this step involves looking at the numbers that will hopefully give you better insight into the (un)profitability of your Airbnb property.

Here’s a list of the most important Airbnb analytics data:

- Neighborhood data analysis

- Airbnb rental income

- Airbnb costs and fees

- Airbnb rental income

- Airbnb cash flow

- Airbnb return on investment

In a few moments, you’ll see why Mashvisor is arguably the best Airbnb analytics tool for real estate investors.

Checking Your Finances

After taking a deeper dive into Airbnb analytics, you’ll need to look at your financial situation and consider how you plan to purchase and invest in the property.

Examine your options:

Would the best option for you be to take an investment property loan—or have you already accumulated sufficient financial resources to purchase the property on your own?

Newbie investors should by no means ignore this step. It’s highly advisable for them to seek financial guidance from institutions—as well as fellow investors who can give them first-hand insights and information.

Why Mashvisor Is the Only Airbnb Analytics Tool You’ll Ever Need

We already hinted at Mashvisor being the best analytics tool for real estate investors—and it is finally time to explain and justify those claims.

As we’ve already said, analytics are crucial. They offer insights into the property’s profitability and can help you reach a final decision regarding your Airbnb investment.

So, with that said, the following section will discuss the Airbnb analytics that Mashvisor offers and explain what it is that makes the platform the best in the business.

Market-Level Airbnb Data

When we talk about “market-level analytics,” we’re referring to real estate and neighborhood data.

If you’re a real estate investor contemplating buying an investment property in 2022, there is a pretty good chance that you’ll need some first-hand (and up-to-date) info on the real estate market.

On that note, Mashvisor offers investors a chance to gain better insight into the demand for short-term rentals. Now, once you narrow down your list, you can make use of the following metrics:

- Median Listing Price

- Average Airbnb Occupancy Rate

- Monthly Airbnb Rental Income

- Average Airbnb Return on Investment

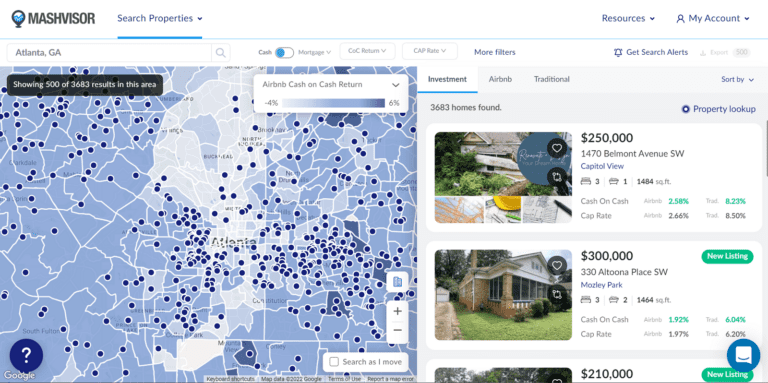

As for the neighborhood data, investors will also have access to Mashvisor’s Heatmap tool. The tool provides the investor with a comprehensive visual representation and accurate numerical data regarding their neighborhood of interest.

Using the heatmap significantly shortens the time that investors would otherwise spend searching through numerous websites and potentially finding inaccurate or outdated info.

You can use Mashvisor’s heatmap tool to get a comprehensive visual representation and accurate data for your preferred location.

Property-Level Airbnb Data

Perhaps the most important reason for relying on analytics is property-level research. Given that Airbnb is a type of property that won’t be occupied by one guest for an extended period, it’s essential that you study the profit you can expect.

On that note, as an Airbnb analytics tool, Mashvisor presents the investor with:

Airbnb Rental Income

With the help of Mashvisor, you’ll quickly come to a decision regarding how much you should charge for rent. Our analytics tool finds potential comps and helps the investor determine the potential income of their Airbnb property.

Airbnb Costs & Fees

The next factors that are of great importance here are the costs and fees the investor should pay. Mashvisor’s Airbnb Profit Calculator does the math for you and estimates the property’s expenses.

Airbnb Cash Flow

In investing, cash flow refers to rental income minus expenses. Needless to say, with Airbnb, there are going to be a lot of expenses—mainly because many more people will pass through your property.

Mashvisor allows you to get an idea of the potential Airbnb cash flow from your preferred property. The analytics tool will help you decide whether or not to pursue the deal.

Airbnb Occupancy Rate

The occupancy rate is undoubtedly one of the deciding analytics for investors in the Airbnb business. It refers to the ratio of the time your rental property was occupied versus when it was vacant. Of course, investors should strive toward analytics that indicates a higher occupancy rate.

Mashvisor allows investors to access and review the occupancy rate in mere seconds—and as such, occupancy levels can play a pivotal role in your chosen investment strategy.

Related: What Airbnb Occupancy Rate Can You Expect in 2022?

Airbnb Return on Investment

Mashvisor essentially helps the investor see the bigger picture. The Airbnb analytics tool is crucial in considering the return on investment in the early stages of planning your venture.

Why?

The Airbnb analytics tool lets you gather all sorts of data and run the numbers through the system, ensuring that you’re not left with inaccurate results.

The above are just some of the key metrics that Mashvisor, as an analytics tool, capably provides, putting the platform at the top of any real estate investor’s list.

Summing Up

We’ve successfully completed the topic of why Mashvisor is the best Airbnb analytics tool for real estate investors looking to generate profits from their investment strategy.

In real estate investing, dealing with up-to-date information is by far the most important thing. Investors should be able to make use of accurate analytics that can help them move forward with their strategy.

And we can confidently conclude:

Mashvisor is one of the best-performing and most accurate Airbnb analytics tools on the market right now. They are easy to navigate and enable investors to get into the smallest bits and pieces of their investment analysis.

The real estate platform’s analytics tool can help you estimate your Airbnb rental income. It can also assist you with calculating the Airbnb cash flow, Airbnb costs and fees, and Airbnb median listing price, among other things.

Finding the right analytics tool that meets all your expectations can be challenging. However, Mashvisor has proven that it surpasses the competition and provides all of the necessary information to make a well-planned Airbnb investment.

So, if you’re keen on investing in Airbnb any time soon and you are ready to make a detailed plan for your next investment, don’t hesitate to ask for help from Mashvisor.

[ad_2]