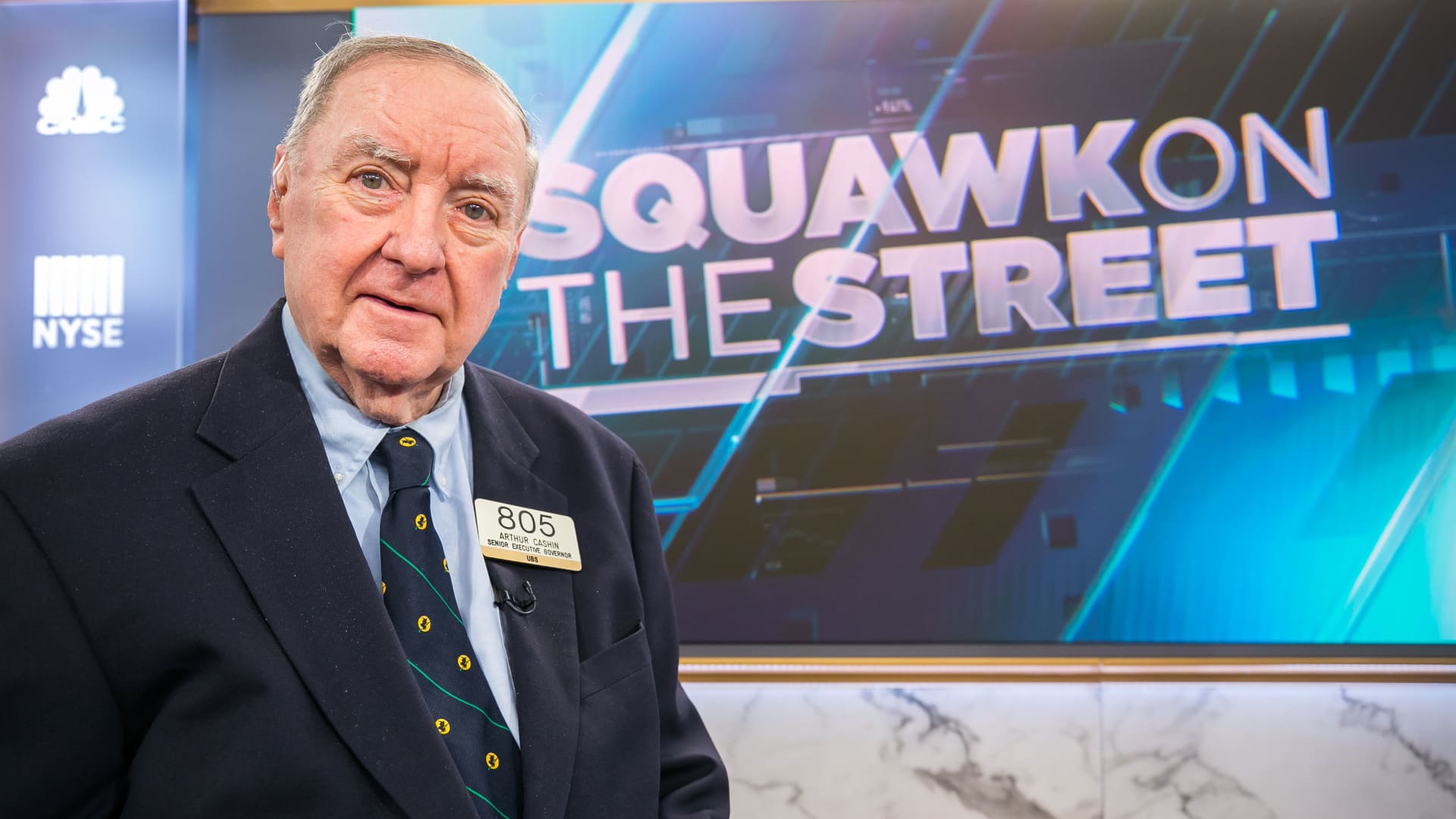

Art Cashin, UBS director of floor operations, is wary of this week’s two-day monster rally in stocks. “The rally was very impressive, unfortunately I was not happy with the spark that started it, that event-risk routine,” he said on CNBC’s “Squawk on the Street” on Wednesday. Cashin sees the rally as started by the Bank of England’s move to scrap the selling of gilts (U.K. government bonds) and begin temporarily buying long-dated bonds to calm a potential market meltdown that was caused by the new government’s budget. Later, the government had to reverse its plans to drop its top income tax rate. Furthermore, the United Nations Conference on Trade and Development recently warned central banks that continued interest rate hikes could hurt the global economy. “Part of the move that we saw, and it’s really a terrific two-day rally, is people assuming that the Fed and other central banks might pause,” said Cashin. What’s up next Next, Cashin said he will be watching for earnings season, which begins soon. Until then, he’ll be on the lookout for markdowns to estimates. He’s also impressed by a few other things in the market, such as the yields on Treasury inflation-protected securities, which seem to show that inflation is coming down and may even be close to the Federal Reserve’s 2% target. “One swallow doesn’t make a summer, but keep your eye on the TIPS yield here,” he said. If inflation does continue to come down, it could cause policymakers to halt rate hikes and reflect on their next move, Cashin added. “We don’t want to see them actually turn around,” he said. “We just want to see them pause and reflect.”