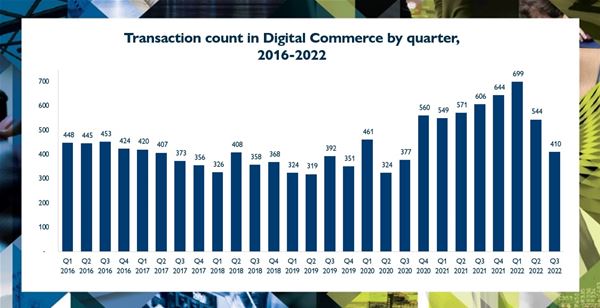

- Q1 2022 saw a record 699 Digital Commerce M&A deals

- Q2 deal transactions fell to 544 and Q3 to 410 deals

London, UK – 5 October 2022. Hampleton Partners’ Digital Commerce M&A Market report reveals that whilst the number of global M&A deals in Q1 shot up to 699, things took a sharp turn in Q2 2022, when 544 deals were recorded, down 22 per cent on the previous quarter. Q3 experienced a further decline in deal making with 410 deals announced, a 41 per cent drop from Q1.

Between 2020 and early 2022, propelled by Covid-19 and a phenomenal investment frenzy, Hampleton’s M&A analysis showed transaction volumes breaking records with every new quarter. The Digital Commerce sector saw over 2,300 deals in 2021 a 38 per cent increase on 2020 figures (1,722 deals) and a 70 per cent increase on 2019 figures (1,397 deals).

Digital Commerce Transactions 2016-2022

Ralph Hübner, sector principal, Hampleton Partners, said: “Digital Commerce M&A transaction volumes have been knocked back to more normal, pre-pandemic levels now that Covid-19 restrictions have loosened and spending patterns are shifting away from online retail and back to brick-and-mortar stores and services.

“The market has also experienced post-pandemic inflationary pressures, armed conflict in Ukraine, broken supply chains, and central banks hiking interest rates in an attempt to curb inflation. In May 2022, the value of e-commerce stocks plummeted. Then, in a negative flywheel effect, many other industries linked to online retail and e-commerce saw a sharp decline in market capitalisation or valuation.”

Outlook for Digital Commerce M&A

Ralph Hübner continued: “We’re going to see an evolution and a transformation of the Digital Commerce M&A market. Buyers will continue to buy, but will do so with different motivations, at more considered valuations, and with different investment criteria.

“Firstly, less traffic in M&A deal pipelines and fewer fundraising attempts overall may allow companies looking to sell or raise funds to stand out – a near impossible feat over the past two years amid an overcrowded market.

“Secondly, financial sponsors will continue to drive many deals, as they are still sitting on huge amounts of dry powder, but they’ll be watching out for the impact of broader market dips and interest rates rises.

“All these factors point to both financial and strategic buyers being more conservative with their valuations and more selective with their investments.”

Hampleton Partners’ Digital Commerce M&A Market report highlights how the boundaries between sector segments are continuing to blur and analyses market trends, fundraising and M&A deals to provide a realistic portrayal of Digital Commerce M&A in a post-Covid world. It covers the intersection of internet services & portals; online retail; media, social & gaming; agencies & service providers and digital commerce software.

Download the report here:

https://www.hampletonpartners.com/reports/digital-commerce-report/

ENDS

Media enquiries, copies of the report, photography or interview requests, please contact:

Jane Henry

Email: jane@marylebonemarketing.com

Mob: +44 789 666 8155

Note to Editors:

Hampleton Partners’ Digital Commerce M&A Report uses data and information from the 451 Research database (www.451research.com), and S&P CapitalQ. Sources cited include Bloomberg, McKinsey & Company, TechCrunch, and MarketplacePulse.

About Hampleton

Hampleton Partners advises technology company owners on M&A and growth financing transactions with strategic buyers or financial investors.

Hampleton’s experienced deal makers have advised hundreds of tech industry shareholders and provide hands-on expertise and unrivalled advice to entrepreneurs looking to sell their companies, partially exit, or to accelerate growth.

With offices in London, Frankfurt, Stockholm and San Francisco, Hampleton offers a global perspective with sector expertise in: Enterprise Software, Digital Commerce, IT & Business Services, Artificial Intelligence, Autotech, Cybersecurity, Fintech, Healthtech, HR Tech, and Insurtech.

Follow Hampleton on LinkedIn and Twitter.

For more information visit https://www.hampletonpartners.com