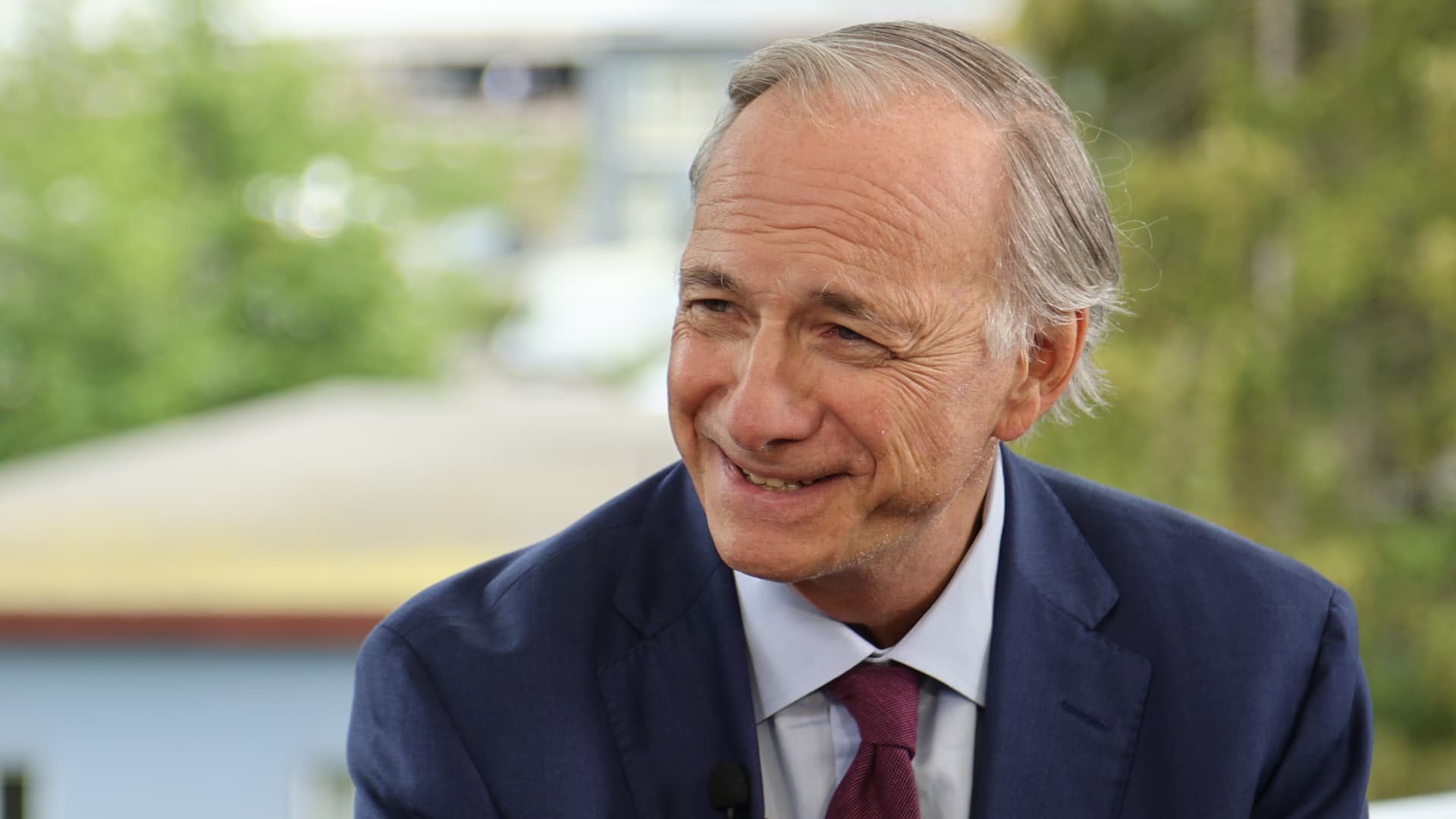

Billionaire investor Ray Dalio is having a change of heart about cash. The founder of Bridgewater Associates, one of the world’s largest hedge funds, had been calling it “trash” since the purchasing power of cash diminishes amid rising inflation. Late Monday, he tweeted about his shift in thinking. “The facts have changed and I’ve changed my mind about cash as an asset: I no longer think cash is trash,” he wrote. “At existing interest rates and with the Fed shrinking the balance sheet, it is now about neutral—neither a very good or very bad deal. In other words, the short-term interest rate is now about right.” Cash as an asset has started to come back into focus as higher interest rates have led to it finally providing some return. The market turmoil also has investors looking for a safer bet. The Dow Jones Industrial Average and S & P 500 notched their biggest monthly losses in September since 2020. The Dow ended the quarter down 6.66%, finishing its third consecutive negative quarter for the first time since the third quarter of 2015. The S & P 500, meanwhile, hit a three-quarter losing streak for the first time since 2009. While stocks started October off with a rally, experts expect the turbulence to continue as the Federal Reserve continues to hike rates and fears about a possible recession grow. In September, Dalio predicted a rise in rates to about 4.5% will drag the economy down and result in a 20% plunge in equity prices.