Miami real estate is hot and if you want to invest there, it’s essential you know what the Miami housing market predictions are for 2023.

Table of Contents

- How Has the Miami Housing Market Performed So Far in 2022?

- What’s Next for the Miami Housing Market?

- Top 10 Miami Housing Market Locations to Invest in 2023

Home prices continue to increase in Miami, and many sellers are enjoying the higher prices because they get paid a lot of money for their houses. Even after being hit by the pandemic in 2020, Miami’s housing market recovered strongly, with the growth even accelerating in recent months.

Since the Miami housing market is strong and shows no signs of slowing down, many local and international investors are flooding the market. And because of the influx of investors, many experts are giving their Miami housing market predictions for 2023. And as an investor, you should know what the forecasts are.

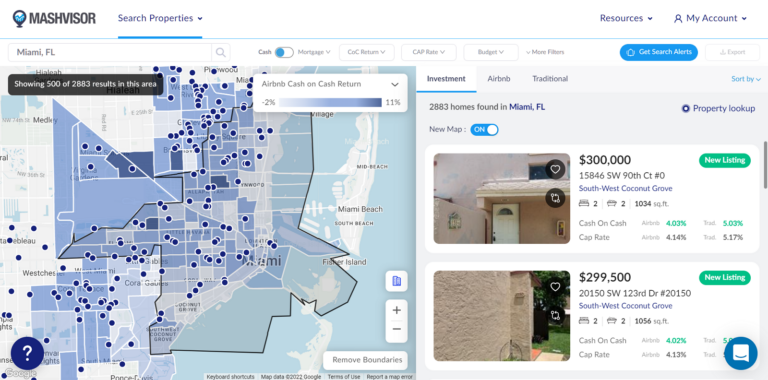

In this article, you will discover the Florida housing market predictions for 2023, which will help you make better buying decisions. You will also be shown the best neighborhoods in Miami to buy properties. Also, you will discover how to use Mashvisor’s tools to find a good neighborhood and a profitable property that guarantees consistent positive cash flow.

How Has the Miami Housing Market Performed So Far in 2022?

To better understand the Miami housing market predictions, it’s important to first look at how the housing market has fared so far. It will allow you to better understand why investors love investing in Miami. Here is the real estate data for Miami, FL in September 2022, according to Mashvisor.

- Median Property Price: $657,052

- Average Price Per Square Foot: $404

- Days on Market: 79

- Monthly Traditional Rental Income: $2,556

- Traditional Cash on Cash Return: 2.70%

- Traditional Cap Rate: 2.76%

- Price to Rent Ratio: 19

- Monthly Airbnb Rental Income: $2,961

- Airbnb Cash on Cash Return: 2.35%

- Airbnb Cap Rate: 2.40%

- Walk Score: 49

As you can see from the above data, the Miami housing market is booming. It makes the city a suitable choice for real estate investment. Miami is such a great place to invest in real estate. Some of those reasons include property prices, inventory, and demand.

Factors Affecting Price Movement

In 2020, 26,345 homes were sold in Miami. The number went up by 49.5% to 39,394 houses sold by the end of 2021. Observers attributed the increase to price movements. Real estate investors prefer to own investment properties in Miami because many people like living and conducting businesses there.

The demand for housing is high in Miami because of its low mortgage rates and zero income taxes. Not just housing, the need for office spaces also rose because of the presence of large corporations. Many multinationals prefer to locate in Florida because the state is tax-friendly to business owners.

Another reason for the increased housing demand is that Miami is attractive to tourists and retirees. Because people visit Miami all year round, the demand for housing always goes up. It keeps the prices of traditional and Airbnb rentals consistently high.

Understand that the price of housing in Miami, Florida is driven by the law of demand and supply. When demand is high, prices go up.

Related: Median US Home Prices Up 46% Since Start of Pandemic

Factors Affecting Inventory

Some important factors play a role in the inventory of Florida’s housing market. But first, let’s define what housing inventory means. Housing Inventory is simply another name for active listings or houses for sale. It means the total number of properties that are listed for sale.

Some of the factors affecting the inventory in Miami are low mortgage rates, investors buying up homes in Miami, few new homes being built, and fewer property owners listing their homes. The above factors significantly contribute to the low inventory of Miami’s housing market.

With investors from across the globe taking advantage of the low mortgage rates faster than new ones are being built, it’s no wonder inventory is low in Miami. Also, due to the favorable conditions in Florida, many homeowners are reluctant to list their homes for sale.

Factors Affecting Demand

It doesn’t matter where a property is located. If the conditions are favorable, the demand for properties in that area will be high. And that’s why the demand for properties in Miami is high. The factors affecting demand for properties in Miami are low mortgage rates, higher rental income, and favorable tax rates.

We discussed low mortgage rates earlier. With the low mortgage rates in Miami, more people are buying up properties. Some property owners are even refinancing their homes to take advantage of low rates.

Another reason for the high demand for housing in Miami is the high rental income. More local and foreign investors are pouring money into Miami’s housing market because of its high rental income.

Also, Florida is a tax haven for both income earners and business owners. Firstly, the tax rate for personal income in Miami is 0%. Secondly, the corporate income tax rate in Miami is around 5.5%. Due to Miami’s low tax rates, real estate investors tend to flood the market and drive up demand.

Other Factors Affecting Real Estate Market Performance in Miami

Other factors that affect the performance of the Miami housing market are demographics, economy, and government policies.

Demographics include age, income, and migration patterns. Often, the said factors are ignored when looking at the performance of a housing market. The demographics of a city like Miami play an important role in the performance of the housing market. For instance, the migration pattern to Miami is high, therefore demand and price will be high.

The economy is another important factor that affects the performance of the housing market in Miami.

It’s simple. If the economy is booming, interest in the housing market will increase. On the other hand, if the economy is weak, out-of-state investors will tend to shy away from the local market. As of 2017, Miami is the 12th largest economy in the US, with a gross domestic product (GDP) of $344.9 billion.

Related: 20 Most Popular Cities for Gen Z Renters

What’s Next for the Miami Housing Market?

We’ve discussed the factors that affect the performance of the housing market. Now, here are some of the Miami housing market predictions for 2023.

- Mortgage rates will reach 7% by the end of 2023, according to the predictions of the Economy Forecast Agency.

- Home prices are expected to rise by 33% by 2023 according to the Miami Herald.

- The Economy Forecast Agency expects home value growth to return to 5% in 2023.

Will Home Prices Drop in 2023 in Miami?

According to the National Association of Realtors (NAR), the average price of houses now is 45% higher than in March 2020. In Miami, CoreLogic predictions state that home prices should go up by 9.8% in April 2023.

Mortgage rates could rise to 7% for the next few months and should level out to around 5% by the end of the year. Because people keep migrating to Miami and some pay cash for homes, buyers keep outbidding themselves, raising the prices of the said homes. If the intense competition continues, the prices of homes in Miami will keep rising in 2023.

What Will Inventory Look Like?

With both local and international investors snatching up homes in Miami, expert predictions state that inventory will be low in 2023. But with the rental rates in the Miami housing market expected to rise next year, it will lead to buyers enjoying more choices and home prices leveling down.

When the prices of homes in the Miami housing market level down, with time, inventory might grow steadily. Normally, inventory increases six months after rates go up. However, the post-pandemic housing market is not like the others.

Fannie Mae’s predictions state that the price growth of properties in Miami will be slow in 2023, and an increase in inventory can help to avoid a housing market disaster. But since households are looking for homes due to a growing family, inventory in Miami’s housing market will still be low, even though new construction is taking place in the market.

Will Demand Increase?

The current increase in demand in the Miami housing market is because many individuals and corporations are migrating to the city. They are attracted by Florida’s favorable tax rates, which are one of the lowest in the US. The state does not impose a personal income tax and charges around 5% corporate income tax.

If the above conditions remain the same, including other favorable factors, demand in the Miami housing market will continue to rise. Even though the increase in home prices is concerning to some homeowners, it is great news to real estate investors whose sole aim is to buy properties to rent out.

Due to the high inflation rate and economic slowdown in recent times, we should see a slight decline in the demand for properties in 2023. But the housing market in Miami is expected to hold its own as compared to previous recessions.

Other Noteworthy Predictions

The 2023 market predictions above are some of the things you should look forward to. But there are other noteworthy predictions that we think you should be aware of, and they include:

More Cash Buyers

In 2023, more investors will be less reliant on mortgages because they will choose to buy their homes in cash. Since there is plenty of cash in the system, and Miami is one of the more affluent cities in the US, there will be an increase in the number of cash buyers in the market.

Interest Rates

Right now, interest rates are rising. Experts predict that by the end of the year, the rates should be around 5% and 7%. But by 2023, the rising rates should level out. It is good news for investors who are unable to buy properties with cash and rely on mortgage to finance their purchase.

Related: When Will Mortgage Rates Go Down in 2022?

Higher Cost of Building New Homes

Smart investors know that building new homes can help them hedge against inflation. But as inflation rates go up, so does the price of new homes. It simply means that the cost of materials to build a new home is going up. No thanks to the suppliers.

Top 10 Miami Housing Market Locations to Invest in 2023

After looking at the Miami housing market predictions for 2023, you may feel comfortable with the market and may be looking to buy some properties. If you are, understand that location is paramount to your success. A good location will guarantee positive cash flow.

Listed below are 10 of the best Miami neighborhoods for both traditional and Airbnb rentals in 2023, according to Mashvisor’s September data.

5 Best Miami Neighborhoods for Traditional Rentals

Here are the top five neighborhoods with the highest traditional cash on cash return in Miami:

1. Overtown

- Median Property Price: $693,750

- Average Price per Square Foot: $443

- Days on Market: 60

- Monthly Traditional Rental Income: $3,274

- Traditional Cash on Cash Return: 3.73%

- Traditional Cap Rate: 3.81%

- Price to Rent Ratio: 18

- Walk Score: 73

2. North Bayfront

- Median Property Price: $652,206

- Average Price per Square Foot: $384

- Days on Market: 81

- Monthly Traditional Rental Income: $2,561

- Traditional Cash on Cash Return: 3.57%

- Traditional Cap Rate: 3.70%

- Price to Rent Ratio: 21

- Walk Score: 74

3. Auburndale

- Median Property Price: $532,731

- Average Price per Square Foot: $364

- Days on Market: 97

- Monthly Traditional Rental Income: $2,685

- Traditional Cash on Cash Return: 3.31%

- Traditional Cap Rate: 3.38%

- Price to Rent Ratio: 17

- Walk Score: 70

4. South-West Coconut Grove

- Median Property Price: $738,777

- Average Price per Square Foot: $410

- Days on Market: 66

- Monthly Traditional Rental Income: $2,741

- Traditional Cash on Cash Return: 2.89%

- Traditional Cap Rate: 2.94%

- Price to Rent Ratio: 22

- Walk Score: 59

5. Alameda – West Flagler

- Median Property Price: $941,610

- Average Price per Square Foot: $566

- Days on Market: 83

- Monthly Traditional Rental Income: $2,994

- Traditional Cash on Cash Return: 2.25%

- Traditional Cap Rate: 2.30%

- Price to Rent Ratio: 26

- Walk Score: 74

Click here to find lucrative traditional rental properties in Miami.

Use Mashvisor to find profitable traditional and Airbnb rental properties in Miami, FL.

5 Best Miami Neighborhoods for Airbnb Rentals

You’ve seen the best neighborhoods in Miami for traditional rentals. Now, here are the top five Miami neighborhoods with the highest Airbnb cash on cash return.

1. Overtown

- Median Property Price: $419,000

- Average Price per Square Foot: $352

- Days on Market: 56

- Monthly Airbnb Rental Income: $3,769

- Airbnb Cash on Cash Return: 4.60%

- Airbnb Cap Rate: 4.68%

- Airbnb Daily Rate: $287

- Airbnb Occupancy Rate: 43%

- Walk Score: 86

2. South-West Coconut Grove

- Median Property Price: $738,777

- Average Price per Square Foot: $410

- Days on Market: 66

- Monthly Airbnb Rental Income: $4,097

- Airbnb Cash on Cash Return: 3.52%

- Airbnb Cap Rate: 3.58%

- Airbnb Daily Rate: $183

- Airbnb Occupancy Rate: 44%

- Walk Score: 59

3. Auburndale

- Median Property Price: $532,731

- Average Price per Square Foot: $364

- Days on Market: 97

- Monthly Airbnb Rental Income: $3,048

- Airbnb Cash on Cash Return: 2.96%

- Airbnb Cap Rate: 3.01%

- Airbnb Daily Rate: $168

- Airbnb Occupancy Rate: 47%

- Walk Score: 70

4. North Bayfront

- Median Property Price: $652,206

- Average Price per Square Foot: $384

- Days on Market: 81

- Monthly Airbnb Rental Income: $2,783

- Airbnb Cash on Cash Return: 2.04%

- Airbnb Cap Rate: 2.10%

- Airbnb Daily Rate: $238

- Airbnb Occupancy Rate: 40%

- Walk Score: 74

5. Alameda – West Flagler

- Median Property Price: $941,610

- Average Price per Square Foot: $566

- Days on Market: 83

- Monthly Airbnb Rental Income: $3,275

- Airbnb Cash on Cash Return: 1.07%

- Airbnb Cap Rate: 1.08%

- Airbnb Daily Rate: $154

- Airbnb Occupancy Rate: 44%

- Walk Score: 74

Click here to find lucrative Airbnb rental properties in Miami.

How to Succeed in Real Estate Investing in Miami

The Miami housing market predictions show that although home prices are increasing, the demand for houses in Miami will not be negatively affected. It is because Miami is an excellent location for real estate investors who are looking to buy properties for the sole purpose of renting them out through the traditional method or Airbnb.

You’ve also seen the top 10 neighborhoods to invest in for both traditional and Airbnb rental properties. The locations are the best so far, and if you want to buy properties in Miami, they will give you the most bang for your buck. But don’t forget to do your research into the properties you wish to buy.

To succeed in real estate investing in Miami, your best bet is to use a real estate website like Mashvisor. Mashvisor uses its Property Finder and neighborhood analysis tools to help you find lucrative properties in Miami. It ensures that you don’t need to guess which property or neighborhood will be profitable.

Click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.