A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here. You can listen to an audio version of the newsletter by clicking the same link.

New York

CNN Business

—

The British pound hit a record low against the dollar on Monday after UK Prime Minister Liz Truss, a fan of “trickle-down economics,” announced a sweeping spending and tax cut plan to rescue the British economy from recession on Friday.

What’s happening: Investors were taken aback by the new government’s choice to institute its largest tax cut in 50 years while boosting government spending and borrowing with inflation near 40-year highs. Citibank analysts called the decision a “huge, unfunded gamble for the UK economy.” Markets dropped precipitously on the news.

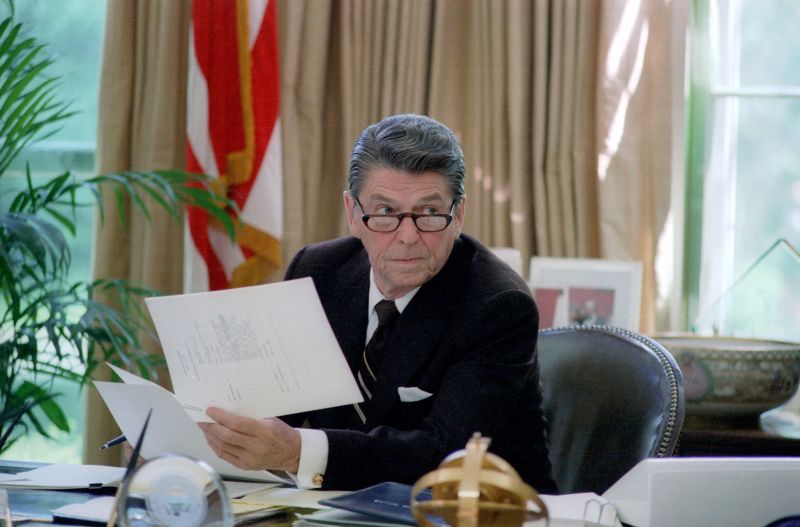

But Truss took a cue from former US President Ronald Reagan as she defended her actions. The government is “incentivizing businesses to invest, and we’re also helping ordinary people with their taxes,” she told CNN’s Jake Tapper last week, referencing Reagan’s trickle-down ideals.

So is she right? Let’s dust off our history books and see.

Interesting parallels: When Reagan arrived in Washington in 1981, inflation rates were nearly 10% and tight monetary policy had taken interest rates to over 19%. But much like Truss, Reagan argued that massive tax cuts and deregulation would stimulate productivity and he championed a sweeping tax cut that was passed by Congress that year.

Truss’ government points to that as proof that lowering taxes doesn’t necessarily drive up prices. Inflation fell and growth surged under Reagan, it says.

But the policy came at a price. According to US Treasury estimates, Reagan’s tax cuts reduced federal revenues by about 9% in the first couple of years. Meanwhile, unemployment kept rising.

Congress concluded the sweeping tax cuts were unsustainable. With Reagan’s approval, it raised taxes by a lot in 1982, 1983, 1984 and 1987.

A lesson from history: “When tax cuts are really too big to be sustainable, they’re often followed by tax increases,” wrote David Wessel, director of The Hutchins Center on Fiscal and Monetary Policy.

And in the near term, for the United Kingdom, there’s also a huge risk to its currency. The US dollar appreciated during the Reagan tax cuts because it benefits from global reserve currency status. A strong currency helps contain inflation and makes imports cheaper. Britain, seeing record drops in its own currency, doesn’t have that advantage.

The bottom line: The British pound will likely hit bottom in three months, wrote Goldman Sachs economist Kamakshya Trivedi in a note Monday. “But if [tax] policy does not eventually change tack, then we would expect Sterling underperformance to persist for longer,” he said.

That’s bad news for markets around the globe. S&P 500 companies that have a global footprint are getting hit hard by the strong dollar and weakening pound — about 30% of all S&P 500 companies’ revenue is earned in markets outside the United States.

The last time taxes in Britain were cut this much, there was rampant inflation, a massive jump in debt and eventually an IMF bailout. “It’s difficult to see how the pound can recover from here,” wrote Fiona Cincotta, senior financial markets analyst, at City Index, in a note. “Investors are rapidly pulling out of UK assets, and who can blame them?”

We know the British pound is falling against the dollar, but what does that mean exactly?

A falling pound is dire news for an economy that may already be in recession, reports my colleague Julia Horowitz. As the value of sterling falls, it becomes more expensive to import essential goods typically paid for in US dollars like food and fuel. That could fan decades-high inflation that’s stoking a cost-of-living crisis for millions of households.

Then there’s the rapid rise in borrowing costs for the government, businesses and households. Investors expect Britain’s central bank, the Bank of England will need to increase interest rates much more aggressively to get inflation in check.

A fundamental tension between the central bank and British government could also fan volatility. While the Truss government wants to boost demand to take the edge off a recession this winter, the Bank of England is trying to cool the economy so it can put a lid on the fastest price increases among G7 countries. That friction will reduce confidence in the path forward.

“If markets still don’t have faith in the fiscal picture, I’m not sure how the Bank of England wins this,” Mujtaba Rahman, managing director for Europe at the consultancy Eurasia Group said.

Global central banks are jacking up interest rates with no end in sight until high inflation is vanquished, reports CNN’s chief business correspondent Christine Romans. Here are five groups feeling the pain as a result.

Investors: By the looks of last week’s stock market action, Wall Street is waking up to the fact the Fed will remain aggressive. Bond yields are rising, making stocks look less attractive.

Then there’s Goldman Sachs’ S&P 500 price target downgrade, its fourth this year, to 3,600 from 4,300. That’s a whopping 16% cut. For stock investors, the gloom is palpable. The pathway to a soft landing seems more difficult by the day.

Homebuyers: Mortgage rates have more than doubled from the record low last year of 2.87% to just over 6% last week. That adds more than $700 in monthly interest payments to the same house purchased a year ago.

Last week, Fed Chair Jerome Powell told me that renters would also be feeling the pain. “Hope for the best, plan for the worst,” he said about rental price inflation. “You’ve just got to assume that it’s going to remain pretty high for a while.

Car buyers: The average interest rate for a 60-month new car loan was 3.85% at the beginning of the year. It is now hovering above 5%.

The market to buy a new or used car is still out of whack because of pandemic-related supply-chain problems. Higher interest rates make financing a car — when you can find one — even more expensive.

Workers: Powell and the Fed have been clear that they will tolerate, and may even desire, a higher jobless rate to cool inflation. The US economy has added back 3.6 million jobs this year and recovered all the jobs lost in the pandemic, but the Fed’s inflation crusade could result in a loss of 1.2 million.

The Conference Board releases September US consumer confidence data at 10:00 a.m. ET.

The US Census Bureau releases new home sales at 10:00 a.m. ET.