Eager real estate investors are wondering about the US housing market predictions 2023 in an attempt to prepare for the best investment decisions.

Table of Contents

- What Has the US Housing Market Been Like This Year?

- 19 Experts Predict What the US Housing Market Will Be Like in 2023

- How Should Real Estate Investors Respond to These US Housing Market Predictions 2023?

While the predictions of many experts were that the real estate market would crash as a result of COVID-19, it did not happen. On the contrary, since the onset of the pandemic in early 2020, we’ve witnessed one of the hottest housing markets in recent decades.

Low inventory, skyrocketing home prices, and fluctuating interest rates pushed many first-time home buyers out of the housing market. Meanwhile, the effect on investors was mixed, depending on their target market, financing options, and previous experience in property investing.

Amid this tight seller’s market that we’ve been witnessing in the US housing conditions in the last couple of years, investors are longing for some relief. Early predictions of real estate experts point in the direction of positive news for both home buyers and property investors.

Most importantly, the deceleration in home price growth is expected to provide for the entry of new buyers with more limited budgets in 2023. However, the US housing market is not projected to enter into a recession in the coming year or so. But as always, different local markets will behave differently, so investors need to keep a close eye on the location they have in mind.

To learn about the major predictions for the US housing market 2023, keep reading. We will also show you how Mashvisor can help enhance your real estate investment decisions in this developing market.

What Has the US Housing Market Been Like This Year?

Before we get into the US housing market predictions 2023, let’s look at how the residential real estate market performed in 2022 and how close it came to expectations. In brief, we can conclude that due to various domestic and international factors, the 2022 housing market exceeded most experts’ predictions in mid-2021 and early 2022.

The US Housing Market Remained a Seller’s Market in 2022

Specifically, as we head towards the end of 2022 and the beginning of 2023, we’re still experiencing a hot seller’s market across the US.

The main driver behind this has been spiking home prices. According to Zillow housing data, the typical home value, close to $356,000 currently, has increased by 18.2% year-on-year. Using a different methodology, Realtor.com reported a median listing price of $435,000 in August of this year, representing a 13.4% growth on an annual basis.

In both cases, this goes above all predictions of a rise of 3%-4%, as shown in our 2022 real estate market forecast.

The second factor that assured that we don’t enter into a buyer’s market this year is low inventory. This month, Realtor.com announced a 6% decline in the number of new listings and a 27% increase in the number of active listings compared to the same period last year.

However, this rise in inventory in the housing market has started only recently, with insufficient listings impacting the majority of 2022 so far.

Meanwhile, the rise in mortgage rates pushed many buyers out of the US housing market, bringing a slight cooldown and preventing an overheating of the market. Based on Freddie Mac data, the 30-year fixed-rate mortgage is reaching 5.89%. While housing experts expected interest rates to go up in 2022, this exceeds their wildest predictions.

Geographical Shifts Continued in Housing Demand

In 2020, the pandemic started a new trend – the movement of many, especially working-age individuals, from large urban housing markets to smaller, rural locations. Health concerns and the accelerating remote working environment enhanced this trend, which dictated much of the dynamics in the 2022 housing market.

Major California cities like San Francisco, San Jose, and Oakland comprised some of the housing markets to cool down the fastest, according to Redfin’s real estate market analysis. Primary markets like Seattle, WA; Denver, CO; Austin, TX; Las Vegas, NV; and Phoenix, AZ also witnessed significant deceleration in property prices.

At the same time, home prices continued to go up quickly in many secondary and tertiary housing markets due to growing demand from those working remotely.

However, this trend is expected to slow down and even reverse in 2023 and beyond as more companies are asking their employees to return to the office.

The Profitability of Real Estate Investments Went Up

Home prices, real estate inventory, and mortgage rates are all crucially important for investors. Nonetheless, return on investment is the main factor at which property investors look to evaluate the housing market’s performance in a particular year.

In this regard, the 2022 housing market performed just as expected. The rental market continued to recover after the initial shock of the Coronavirus pandemic, which affected profitability in a positive manner.

Recent nationwide data from Mashvisor shows that the average cash on cash return on Airbnb rental properties across the US is 3.47%. The average rate of return on long term rentals is 2.34%.

The most important takeaway for investors is that vacation rentals quickly regained their position as the more profitable rental strategy. While both traditional and Airbnb rentals can bring positive cash flow and good return, short term rental properties are more beneficial, on average.

19 Experts Predict What the US Housing Market Will Be Like in 2023

To provide you with the most comprehensive and accurate US housing market forecast for 2023, we talked to 19 experts nationwide.

While real estate experts have different predictions on exactly how things will play out in the residential market next year. Nevertheless, this quote from Boyd Rudy, Associate Broker at Dwellings Michigan, summarizes their general sentiments in the best way:

“It’s sure to be an exciting year for the US housing market.”

So, here are the most prominent US housing market predictions 2023, according to those who’ve spent decades in the industry.

Various External Factors Will Be Driving the Residential Real Estate Market Next Year

The last few years clearly demonstrated the sizable impact exogenous factors – like the pandemic and the war in Ukraine – can have on the US housing market. While we cannot predict such major events in the future, it’s clear that domestic and international factors will continue affecting real estate.

Here is what Jon Sanborn, Co-Founder of Brotherly Love Real Estate, says in this regard:

“The US housing market is being driven by external factors such as rising gas prices, inflation, and Covid-19. As such, the rising interest rates are making it hard for the average buyer.”

Carter Crowley, Co-Owner, Licensed Realtor, and Senior Acquisition Manager at CB Home Solutions, adds to the list of external factors dictating the state of the housing market:

“There are just too many things impacting real estate right now. The supply chain disruptions aren’t anywhere close to being over. Lumber and concrete are still short. So the construction of new homes has decreased or stopped in some areas. Mortgage rates are on the rise… I expect the market to slow down by a big margin in 2023.”

According to experts, the dependence of the housing market on economic and social developments is a major reason for the difficulty of predicting what will happen. For example, Devon Wayne, Founder and Owner of ASAP Cash Offer, says:

“The US housing market is unpredictable as it’s affected by many factors such as job security, inflation, market saturation, and interest rates. Nevertheless, economists predict that it will continue to grow steadily throughout 2023 as more people move to larger metropolitan areas and there is still a large amount of pent-up demand from the housing bust of 2008.”

Unsustainable Home Value Spikes Will Be Over

When asked “Will house prices go down in 2023 USA?,” experts agree that the housing market will see a cooldown. Even if home prices are not starting to go down yet, the increases will be smaller next year.

Daniel Cabrera, Real Estate Agent, Contractor, and Founder of Sell My House Fast San Antonio, predicts that:

“Property prices are expected to increase by almost 2% in 2023. As a result, home sales will further decline.”

Similarly, according to Will Rodgers, Real Estate Consultant at Keller Williams:

“In 2023, prices will soften. In some housing markets, this could mean that homes stop appreciating.”

Darren Craft, Founder and President of Worth Insurance, explains the impact of insurance costs on home values:

“The cost to insure residential real estate is rising faster than inflation. This combined with rising mortgage rates should deliver a substantial pullback in home prices in 2023.”

Jeff Johnson, Real Estate Agent and Acquisition Manager at Simple Homebuyers, shares similar predictions:

“The US housing market is predicted to face a peripheral change in 2023. Home prices are not expected to fall, as the Federal Government will not be lowering interest rates. However, it will cause a minor escalation in housing prices of 1% to 2%.”

Expected appreciation trends in the coming year are giving experts a reason to be optimistic about the housing market. Rebecca Hidalgo Rains, CEO and Managing Broker at Integrity All Stars, says:

“The outlook for the real estate market in 2023 is trending in a positive direction. Every expert in the industry that our team has talked to expects interest rates to go down next year and for the average home price to appreciate at the 4% to 5% value we are used to.”

Affordable Housing Will Remain a Challenge

The fact that industry professionals don’t expect real estate values to continue skyrocketing in 2023 doesn’t mean that they will fall either, at least in the majority of housing markets. In other words, there won’t be a real estate recession.

Combined with high interest rates, the issues with housing affordability, especially for first-time homebuyers, are expected to remain.

Casey Ames, Licensed Realtor at Gem State Cash Offer, explains the underlying reasons behind the ongoing lack of affordability in the US housing market:

“The housing market is going to see a cooldown in 2023. Overvalued homes will lose value and return to their actual worth. But mortgage rates are going to rise which will decrease affordability. Buyers will still face challenges because of the rates.”

As mortgage rates are a major driver of unaffordability, experts recommend that investors look into alternative financing options like owner financing, hard money loans, and loan assumption. However, not all the said options are available to homeowners.

Shaun Martin is a real estate professional, land developer, investment advisor, and CEO of We Pay Cash for Houses. He connects the lack of affordable housing for many with the continuing housing shortage at certain price points:

“Not that there are lesser homes, but the point that a lot of house buyers consider is the lack of available homes for the price that they can afford. The rising prices of mortgages have led to fewer available housing for cost-savvy buyers. This caused the market to look extremely high and overpriced for the average buyer.”

The US Market Will Be Shifting Towards a Buyer’s Market

One of the significant characteristics of the most recent US housing market has been its state of a seller’s market. But this reality is likely to change in 2023 even though the answer to the question, “Will home prices drop in the 2023 housing market?” remains largely negative.

Ismael Arjune, Principal Investor of Tristate Holdings 167 Inc, predicts that:

“More banks are selling their REOs and homeowners are listing their houses for sale now rather than wait until the housing market rebounds. The influx of housing inventory along with the diminishing pool of conventional buyers resulting from higher mortgage interest rates will turn 2023 into a buyer’s market.”

Isaiah Henry, CEO of Seabreeze, a property management company, shares a similar housing market forecast:

“Interest rates will continue to rise until inflation levels out. This means that house prices will decrease in 2023. We won’t see a crash like we did in 2008, but prices will start to decline. There will be fewer bidding wars, and more negotiations in favor of the buyer.”

Now, these US housing market predictions 2023 are definitely great news for investors with little experience and low budget.

Related: Buyers Market vs Sellers Market in Real Estate: Everything That You Need to Know

Regional Differences Will Continue into 2023

As Michael Shapot, Residential Real Estate Broker at Keller Williams, says, “Real estate is hyper-local.” So, while we can talk about US-wide housing predictions for 2023, it’s also important to look at the major local markets.

Let’s first see what experts respond to the question “Will home prices drop in 2023 California?” as the California housing market is one of the largest and most active nationwide.

According to Davon Wayne:

“As always, there will be regional differences across the country. For example, California and other West Coast states are predicted to see a larger increase in prices than the rest of the US due to continued strong economic and population growth. Meanwhile, Rust Belt states such as Michigan and Ohio are predicted to see slower growth due to their slower-growing economies.”

Similarly, Michael Hausam, Owner of Hausam Group, predicts that:

“Overall, coastal SoCal and most of the state as well will continue facing inventory shortage that will cause demand to outweigh supply, so prices will continue to increase.”

Brian Davis, Real Estate Investor and founder of SparkRental, takes a look at other locations across the housing market:

“We’re already seeing the “pandemic darling” cities dropping in value, while others that didn’t see prices jump so far, are holding steady or even still appreciating, with greatest concentration in the West. I expect to see this trend continue to play out in 2023, where some overheated markets correct to reflect local median incomes, and others continue seeing slow growth.”

These predictions once again remind investors of the importance of location when buying a property in the housing market.

First-Time Homeownership Will Increase Due to Increasing Rental Rents

The experts’ predictions on rental rates and homeownership are important for real estate investors, especially those buying long term rentals.

Zach Tetley, Co-Founder of Nexus Homebuyers, expects that:

“Inflation is at an all-time high globally, which puts the US housing market in a tough spot. Even rent control won’t stop landlords from increasing rent in 2023. Expect the highest rental rates. Hence, avoiding significant rent increases would be impossible for tenants. It’ll encourage Gen Z and Millennials to develop an interest in homeownership.”

Matt Teifke, Founder and CEO of Austin Real Estate Brokerage, shares a similar rental rates forecast:

“Rental rates will continue to rise as demand for rental properties remains high. We’re seeing more and more people move into rentals, whether it’s because they can’t afford to buy a home or they simply prefer the flexibility that renting offers.”

Danny Marshall, Real Estate Agent and Advisor at Mortgage Rate Guru, thinks that:

“The rental market in the United States is expected to remain strong in 2023. This is due to the fact that many people cannot afford to purchase a home and the number of young adults who are choosing to rent instead of buy.”

Some experts consider that the ever-increasing rents in the US housing market will push many to look into homeownership. This trend will be further enhanced by expected government policies.

According to Dan Green, Executive Director of Homebuyer:

“Home buyers can expect Congress to pass multiple first-time home buyer stimulus programs including the $15,000 First-Time Home Buyer Tax Credit and the $25,000 Downpayment for Equity Act, which will help stave off a drop in US home prices.”

Traditional rental property investors need to keep an eye on the developments in these housing predictions before making a move.

Demand for Vacation Rentals Will Stay Strong

In case you’re leaning towards investing in short term rentals for sale, it’s important to take a look at 2023 housing predictions in this regard as well. Overall, experts are expecting very positive trends in the Airbnb rental industry.

To begin with, Jennifer Spinell, Real Estate Professional, Investor, Investment Advisor, Founder, and CEO of Watson Buys, believes that:

“Vacation rental properties will become increasingly popular in the coming years. With many people hesitant to travel, I think more and more people will look to rent vacation homes as an alternative.”

Matt Teifke supports this prediction for the housing market 2023:

“We’ll see a continued rise in vacation rentals, as more and more people are looking for ways to travel safely. Vacation rentals offer a great way to social distance while still being able to enjoy a change of scenery.”

So although the pandemic had a nearly devastating effect on the short term rental industry at first, the long term impact is expected to be positive. The remote working environment and the demand for safe travel options within the domestic housing market will further boost investor interest in vacation rentals for sale.

How Should Real Estate Investors Respond to These US Housing Market Predictions 2023?

Knowing what to expect in the housing market in 2023 is one thing. But knowing how to react to expert predictions is another thing. Thus, in this section, we will look at what all these forecasts and trends mean for residential property investors and what course of action they should take in the coming months.

Don’t Wait Further to Buy Your First Investment Property

The past couple of years has been challenging – to say the least – for buyers in the US housing market, including investors. But some long-expected relief is about to happen in 2023. So, our advice to investors is to no longer wait to buy their first or next rental property. The sooner you buy an investment property, the sooner you can start making money from real estate.

Moreover, it’s too early to know the answer to the question, “Will the housing market be better in 2024?” So there’s no point in postponing your investment decision.

Overall, 2023 is forecast to be a good time to buy real estate. Home prices are expected to calm down, inventory to increase, the housing market to shift to a buyer’s market, mortgage rates to grow less steeply, and alternative financing to be more abundant.

As always, investors will have the upper hand, whether they search for long term to provide housing to tenants or short term rental properties to host guests.

To start looking for profitable rentals for sale across the US, sign up for a 7-day free trial of Mashvisor. Our tools turn three months of real estate research and analysis into 15 minutes.

Invest in Traditional Rentals in Housing Markets With High Price to Rent Ratios in 2023

While experts predict rising rental rates to push some renters towards homeownership, this is far from housing predictions that long term rentals are no longer a profitable option.

On the contrary, the experts’ consensus on the fact that rents will continue to go up despite rent control means that investors can benefit from a higher return on investment.

The key, however, is to buy properties in markets with a high price to rent ratio.

Related: What Price to Rent Ratio by City Should Investors Expect in the US Housing Market?

It might sound counterintuitive as high price to rent ratios mean that home prices are relatively high compared to rental rates. However, it also signifies that rental demand is strong. It is because homeownership is unattainable for the average buyer in this housing market. High occupancy and low vacancy result in a higher rate of return for long term rental investors.

Focus on the Airbnb Investment Strategy in the US Housing Market

Another prediction on which the majority of experts agree is that the vacation rental industry will continue to expand, driven by the pandemic’s aftereffects. This forecast is further supported by Mashvisor’s short term rental data analysis that shows a higher return for this strategy across the US housing market, as demonstrated above.

What it means for investors is that 2023 is a great time to start an Airbnb business. But to ensure good profit, you need to make sure that you:

- Choose a top Airbnb market

- Select a neighborhood with affordable home prices, above-average Airbnb daily rates, and strong Airbnb occupancy rate

- Check the local short term rental laws and regulations

- Find a property with a strong potential for high cash on cash return and cap rate

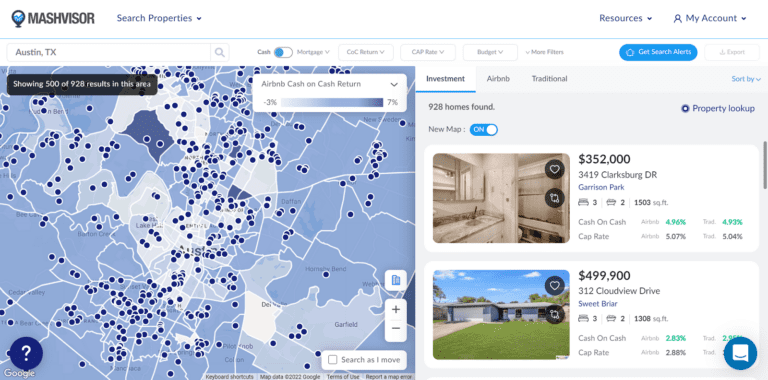

If you’re unsure where to start your Airbnb investment journey, Mashvisor can help. Our real estate heatmap and neighborhood analysis pages can show you the best areas for this rental strategy in any US housing market. Our investment property calculator can provide you with readily available rental property analysis for any MLS listing or off market property.

Related: 100 Best Short Term Rental Markets

Along with neighborhood analysis pages, Mashvisor’s real estate heatmap can help you find the best areas for Airbnb investment in any US housing market.

Look for Alternative Financing Options

As mortgage rates are expected to continue rising, it shouldn’t discourage investors. A common solution proposed by our panel of experts is turning to alternative financing options.

Hard money loans, private money lenders, seller financing, FHA loans, VA loans, rent to own, and house hacking are just a few of the investment loans that you can resort to.

The main tip for real estate investors in the US housing market 2023 with regards to financing is to retain an open mind and always look for creative solutions. Indeed, most real estate moguls started off with just a few hundred dollars before building an empire.

Diversify Real Estate Investments

Our general US housing market predictions 2023 are that fluctuations will remain. Home prices, interest rates, rental rates, and rental demand will continue changing. Moreover, COVID-19 showed us once again that we can never know when the next major exogenous factor will hit.

What this means for investors is that they should aim for maximum real estate portfolio diversification. Invest in different housing markets, in different property types, and in both long term and short term rentals. The more diversified your investments are, the more protected your portfolio will be.

Conclusion: The 2023 US Housing Market Will Provide New Opportunities for Investors

In sum, the US housing market predictions 2023 are pointing toward positive trends and outcomes for investors. The market is expected to cool down a bit without heading for a recession or a crash. The anticipated switch towards a buyer’s market with more inventory and home prices growing more slowly will open new opportunities for investors.

Whether you prefer to invest in long term or short term rental properties, there will be good deals in the US housing market. These are driven by increasing rental rates and growing demand for vacation rentals.

As always, the key to success in real estate investing is finding the right location, selecting a profitable property, relying on trustworthy data, and using the best tools.

One of these tools is Mashvisor, the best real estate investing app for 2023. Mashvisor will help you with your neighborhood analysis, investment property search, and rental property analysis. With a few clicks of a button, you can start finding top-performing traditional and Airbnb rentals for sale in the most profitable US housing markets.

Sign up for a 7-day free trial of Mashvisor to start investing in real estate now.