One of the most certain ways to create wealth and build a stream of income is by investing in real estate. Is this investment still profitable?

Table of Contents

- Is Real Estate a Good Investment Now?

- Which Real Estate Investing Strategy Is Best?

- How to Start Investing in Real Estate

Over the years, the real estate market has created many millionaires. This is why it remains a top investment option for people who want to create wealth for their future. However, you must keep in mind that this isn’t a get-rich-quick scheme. Don’t expect overnight success.

This isn’t to scare you. If you follow the right strategies and expert tips like we’ve outlined in this blog, real estate can be your best vehicle to create wealth and grow it over time. This blog is for beginner real estate investors who are reeling from the idea of whether real estate investing can make them rich.

Is Real Estate a Good Investment Now?

Many beginner investors are still at crossroads on whether they should try investing in real estate or other alternative traditional investments, such as stocks. It is mainly due to the sharp rise in housing prices in 2020-2021. The increase was brought about by the following:

- Low mortgage interest rates

- Low housing supply as many real estate property owners chose to refinance instead of sell

- Low housing supply as many homeowners were hesitant to sell due to the pandemic

The three factors above also led to an imbalance in the demand and supply of housing stocks or inventory. Some real estate experts and financial pundits even expect the housing market to collapse any time between now and 2023.

However, is it the truth? Is now the right time to invest in real estate?

Our answer is yes. Now is the best time to invest in real estate. And there are a couple of reasons to believe so:

There’s No Housing Bubble Waiting to Burst

Let’s start by demystifying the myth that the real estate bubble is about to burst. There’s no bubble to start with. It’s too simplistic to assume that the market will collapse simply because of the substantial rise in housing prices.

In 2002, irregular lending practices resulted in a housing market crash. They increased the number of buyers since many people qualified for mortgages, which, in turn, drove the housing prices up.

Many approved homebuyers shouldn’t have qualified for the loans since they didn’t have the money to buy the homes in the first place. Many homebuyers defaulted on the loans a few years later. It led to a spike in the supply of homes at reduced prices. This is how the bubble burst.

Today, this isn’t the case. There are strict regulations that control lending practices. In addition, borrowers must go through a stringent underwriting process. Lenders must adhere to the regulations, and buyers must strive to keep their credit scores high.

Ultimately, there’s no real estate housing market bubble waiting to burst.

Related: US Housing Market Crash 2022: What to Do as an Investor If It Happens

Rental Rates are Rising Dramatically

The median rental rate in the US increased by a record-high 17.5% in 2021. While the spike has slowed down in 2022, it’s still higher than in the pre-pandemic years.

Since there’s high inflation still influencing the economy, rents are expected to continue rising. It presents a strong case for why investing in real estate right now makes sense. You should consider taking advantage of the rising rents in the coming decade.

Balanced Market

At the height of the pandemic, the housing market became a “sellers’ market.” In such a situation, sellers have more control over the selling prices since demand exceeds the supply. Since there’s less inventory, sellers have a higher advantage.

In 2022, however, the market is becoming more balanced as the supply and demand become more in sync. It is a good thing for beginner investors with money since home prices are becoming more affordable.

Which Real Estate Investing Strategy Is Best?

So, now that you want to get started in real estate investing, which is the best strategy to follow?

There’s no one-size-fits-all answer to this question. The best strategy for you depends on your situation. How much money do you have to start investing? What are your investing goals? How will you create wealth? How long do you want to hold the investment?

These are some of the questions you should answer if you’re serious about making it in the real estate investing scene. What works for you may not work for someone else.

That said, let’s look at some of the best real estate investment strategies for you to choose from.

Rental Properties

Renting out properties is also known as the “buy and hold” strategy since many investors use it as a long-term investing strategy. As the name suggests, you’re investing in residential real estate, such as multifamily properties, then lease them out to tenants for rental income.

It’s even better if you can manage investing in the multifamily property at a price lower than the fair market rate since it boosts your rate of return on investment. You might need to get financing from various sources, such as conventional lenders or other alternative sources of financing.

Types of Rental Strategies

There are basically two rental strategies:

- Long-term rental strategy: This is the most common rental strategy where landlords rent their real estate properties to tenants for extended periods, say six months or a year. In this strategy, you receive monthly rent from your tenants. The tenants are in charge of the cleaning and basic maintenance since the multifamily property is now their responsibility.

- Short-term rental strategy: The short-term rental strategy has gained a lot of popularity in the past few years due to the emergence of short-term rental platforms, such as Airbnb. In this strategy, landlords rent their real estate properties to guests for a minimum of one night where they charge a nightly rate. Unlike long-term residential properties, short-term rental owners are responsible for cleaning and maintenance.

One essential aspect that you must consider before choosing any of the above rental strategies is the multifamily property management side. If you live in a multifamily property and you’re ready to take up these tasks, you can handle the property management yourself.

However, not everyone can do it, especially if you’re out of state. You can also opt to hire a real estate property manager or property management company in exchange for a percentage of the total monthly rent collected.

A multifamily property manager’s work includes tenant screening, bookkeeping, handling maintenance requests, scheduling repairs, collecting rent payments, and generally overseeing the running of the property.

Related: A Guide to Choosing the Best Rental Property Strategy: Airbnb vs Traditional

Advantages of Rental Properties

Among all the real estate investing strategies, rental properties are an effective strategy to create wealth in the long term. If you opt to hire a property manager, the property provides a passive income, which is the goal for most beginner real estate investors.

Inflation causes rent prices to go up. Landlords benefit since they can start collecting more rent. In addition, you get to enjoy the property’s value appreciation. As the demand continues to rise and the supply remains low, home prices will rise.

Disadvantages of Rental Properties

As we’ve seen, rental properties are one of the best strategies for investing in real estate and for an investor to create wealth. However, there are a few potential downsides that you must be aware of.

First, you must pay a lot of attention to your tenant screening. Remember, your tenants become responsible for taking care of your real estate property when you lease it to them. You don’t want to have rowdy and irresponsible tenants who keep breaking things and cost you a lot of money in repairs. You also want to have tenants who pay their rent on time.

Also, you want to keep your tenant turnover low. Tenant turnover is the time between when one tenant moves out and another moves in. Once a tenant vacates your property, you want to find another one fast. You lose potential income as long as your real estate property is vacant.

House Flipping

This strategy is also commonly known as fix and flip. The idea behind house flipping is investing in real estate properties that need repairs, carrying out the repairs and renovations, and reselling them at a higher price to make a decent profit.

Since nobody else wants to touch these properties, the key to this strategy is investing in the property at a much lower price than the market value.

While the description may make it sound easy, it’s far from it. As a beginner investor, you must keep many variables under control, and they’re many. You have to control the materials costs, contractor expenses, insurance fees, property taxes, and many others. What many investors fail to realize is that the repair costs are just a fraction of the total fix-and-flip expenses.

Due to the different variables and aspects that you need to oversee, house flipping is a suitable strategy for experienced real estate investors. Beginners may struggle since you need to know how to go about house valuation, sourcing for contractors, overseeing the renovations, and eventually marketing the real estate property.

Just like trading stocks is different from investing in residential properties, house flipping is also distinct in its own ways. For example, it is a short-term investing strategy since house flippers are usually looking to make profits in about six months.

This means that a house flipper needs to be in a position to offload the real estate property in due time otherwise they risk running losses. You’ll probably not have enough money in hand to keep paying the mortgage until you find a willing buyer.

Advantages and Disadvantages of House Flipping

The advantages of house flipping include:

- It offers quick returns.

- You don’t have to tie up your money in an asset for a long time.

On the other hand, the downsides include:

- You need a deeper knowledge of the market.

- Market fluctuations and changes can adversely affect your venture.

Real Estate Wholesaling

Real estate wholesaling is a perfect strategy for beginners since it doesn’t require a lot of capital to get started. It’s a kind of variation of the fix-and-flip strategy, just that a real estate wholesaler doesn’t take complete ownership of the property.

In wholesaling, a real estate investor finds a distressed property, gets it under contract for a discounted price, and estimates the required repairs and final fair market value. Then, they assign the contract to a willing buyer in exchange for a wholesaler’s fee.

The benefit of wholesaling is that it’s possible to get started with little money. You can follow a strategy called double closing, which involves investing in a real estate property on the same day you sell it to the investor. You can use the funds from the investor to close the deal.

However, the downside is that you may still need some money upfront. Also, you need to have a lot of market knowledge and be ready to spend a lot of time on the deal. Solid negotiation skills also come in handy since you need to convince the buyer to take the contract off your hands. If sales aren’t your forte, this strategy may not be the best for you.

In some states, a real estate property wholesaler must be licensed.

Related: Wholesaling Real Estate for Beginners: The Complete Guide

How to Start Investing in Real Estate

Investing in real estate isn’t rocket science. Simply observe what successful real estate investors did in the past and borrow a few tips. Luckily, there are many successful real estate investors who are willing to hold your hand and show you the ropes.

Alternatively, there are many real estate videos, blogs, books, and tutorials that you can find online. The downside is that consuming a lot of information can be overwhelming and can lead to more confusion. It is why we’ve come up with this guide comprising easy-to-follow steps.

So, how do you actually get started in real estate?

Invest in the Right Location

Nothing is more important when it comes to real estate investing than location. Location determines how much you’ll be investing in the real estate property for, how much rent you can charge, your property’s occupancy rate, and your rate of return on investment.

The general rule of thumb is “It’s better to have a bad house in a good location, than a nice house in a bad location.”

Some factors that you should consider when looking for a good location include:

- Unemployment rates

- Population growth

- Infrastructure projects

- Property taxes

- Job market

- Landlord-tenant laws

These are a lot of factors to consider when you’re doing everything manually and yourself. This is why you need to use software tools.

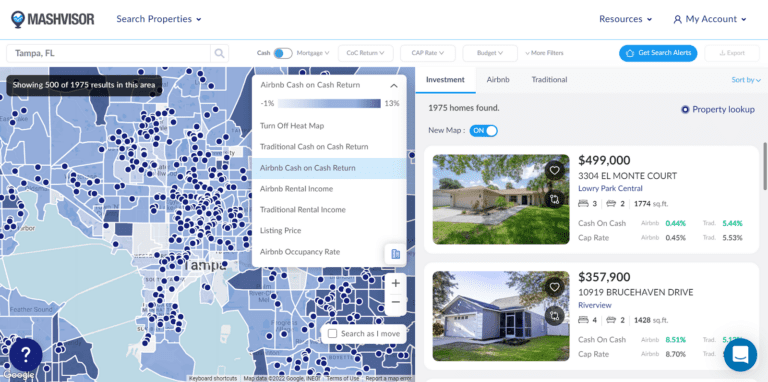

Mashvisor’s Real Estate Heatmap can help you choose the best location for investing. It enables you to find the best-performing markets based on your search criteria. With the heatmap tool, you can search for potentially lucrative properties using the following filters:

- Traditional and Airbnb Cash on Cash Return

- Traditional and Airbnb Rental Income

- Listing Price

- Airbnb Occupancy Rate

You can use Mashvisor’s heatmap tool to find the best-performing markets based on your search criteria, such as cash on cash return, rental income, listing price, and occupancy rate.

Invest in a Profitable Property

Once you’ve found a few potential locations for investing, you need to look for profitable investment properties. There are many real estate properties listed online for sale. However, you want to find one with a high-profit potential and that matches your goals.

This is where the Mashvisor Property Finder tool comes in. You can use the tool to find properties with the highest profit potential based on your search criteria. Simply use the following filters to set your search criteria:

- Location

- Selling Price

- Property Type

- Rental Strategy

- Number of Bedrooms

- Number of Bathrooms

Once your search criteria are complete, the tool displays the real estate properties that match your requirements in order of performance. It means that the most profitable properties are ranked first.

Get Your Numbers Right

Every successful real estate investment begins with due diligence and research. Part of conducting due diligence involves doing the right calculations. Running the numbers will reveal to you everything there is to know about the real estate property and whether the deal is worth pursuing.

Carrying out calculations will not only tell you how much money you can expect to make from your property but also how much property expenses you’ll have to settle. This makes it easier to understand your monthly cash flow and, ultimately, your return on investment.

The best tool for this function is the Mashvisor investment property calculator. The calculator helps you carry out a comprehensive investment property analysis without worrying about the accuracy or reliability of the results.

The investment property calculator helps you compute the following important metrics:

The best thing about this calculator is that it gives you estimates for both traditional and Airbnb rental strategies. It is essential in helping you select the ideal rental strategy to make money and achieve your investment goals.

How to Invest in Real Estate With Little Money

Since we’ve looked at different real estate investing strategies and how to start investing in real estate as a beginner, one question may linger, “Is it truly possible to get started with little money?“

There’s no single answer to this question. Firstly, any investor knows that money begets money. In most cases, you must make a substantial investment for you to create wealth. Real estate investing is expensive. The industry is mostly controlled by the wealthy. It means that it might not be possible to get started with absolutely no capital. However, like many different situations, there are outliers.

Luckily, real estate investing has been made accessible to people from all tax brackets. There are various inexpensive ways to get started in real estate investing. Strategies like wholesaling and house hacking allow you to get started with as little as $1,000. Others include real estate syndication, crowdfunding, seller financing, and real estate investment trusts (REITs).

Bottom Line

Investing in real estate is a tried and tested way to generate income and build wealth. There are various strategies that you can choose for investing in real estate. They include investing in residential properties, wholesaling, and investing in fix-and-flip houses. Before choosing a strategy, be sure to define your goals since every strategy is unique in its own way.

Getting started in real estate investments can be overwhelming at first, especially due to all the different information available online. Thankfully, you don’t have to lose your sleep over this process. Simply ensure you’re investing in the right location, find a lucrative investment property, and carry out a comprehensive investment property analysis. Fortunately, Mashvisor is here to accompany you in every step of your investment journey.