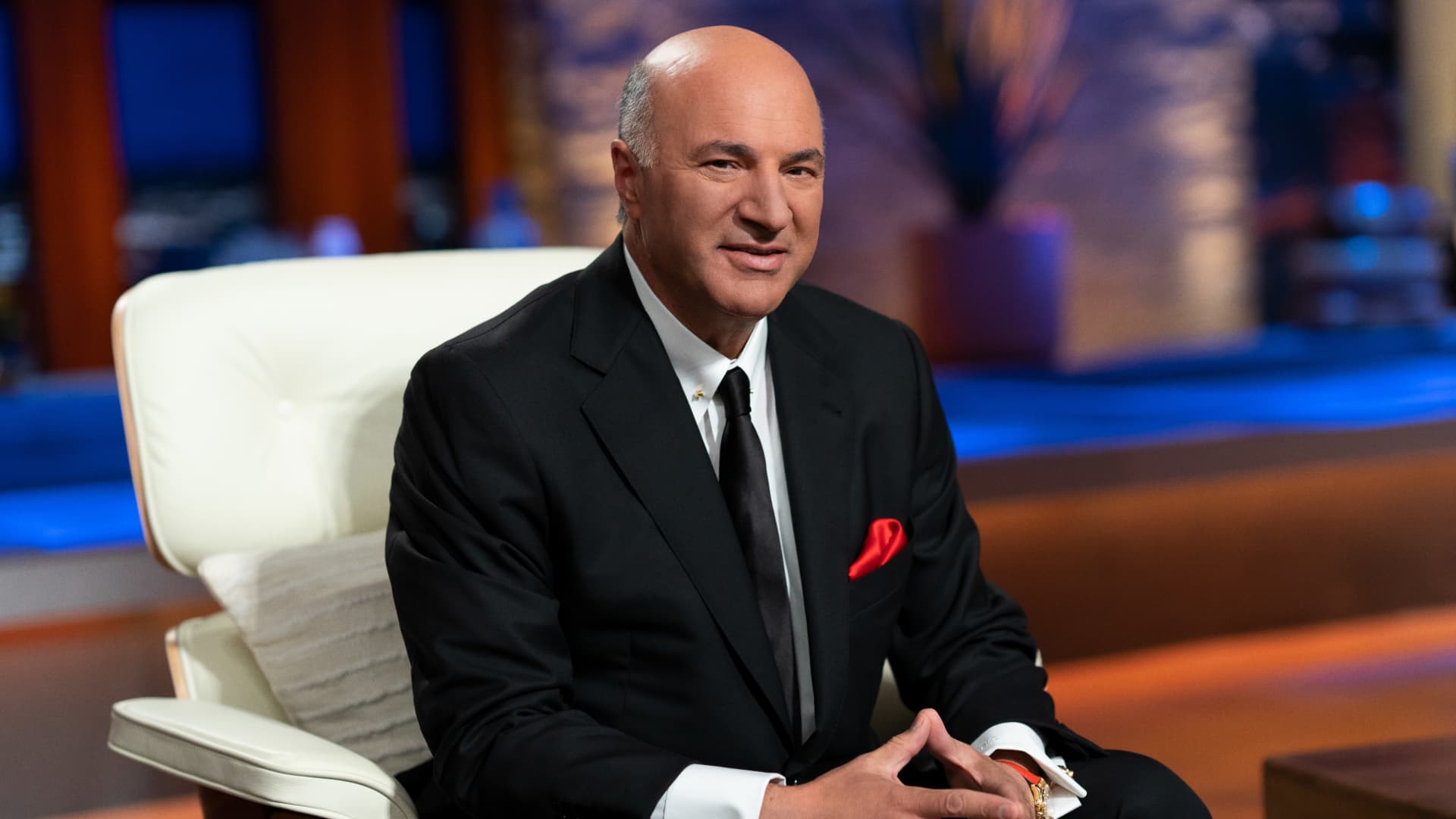

U.S. stocks saw a sharp sell-off on Tuesday as investors assessed the implications of a hotter-than-expected August inflation report. Market watchers are now bracing themselves for a 75 basis point hike at the Federal Reserve meeting next week, with Nomura having a more bearish view of a full percentage point hike. Billionaire investor Kevin O’Leary is also predicting a hike of 75 basis points, though he thinks it will “most likely” be a 100 basis point one. “It was assumed only 48 hours ago that the Fed’s terminal rate would be 4%. And that would be the maximum in terms of rate hikes, but we’re past that now,” O’Leary, who is chair of O’Shares Investments, told CNBC’s ” Street Signs Asia ” on Wednesday. “That level of uncertainty in terms of terminal rates, where the Fed will stop raising, is now officially an unknown. And so that’s extremely problematic for the markets,” he added. But O’Leary said now’s a good time for investors to jump into stocks, even as some may chase record-high Treasury yields, which are typically seen as risk-free. The yield on the 2-year Treasury , the part of the curve most sensitive to monetary policy, climbed to 3.794% at one point on Tuesday, its highest level since November 2007. “If you’re an investor, maybe the best thing to do here is — since you can’t guess the bottom — is to take opportunities on days like today and buy stocks that you think are attractive,” he said. “If you are an investor like I am, you have to find stocks to put to work because you can’t say there’s no alternative when you get 3.79% [yield] on Treasuries. But frankly, if you want to get a 6% to 8% return, you’re going to have to put some money in harm’s way,” he added. Top picks O’Leary’s top picks to navigate the volatility include chip giants Broadcom and Nvidia . “These stocks have been decimated and yet they’re still growing. They’re still needed. The whole idea that we’re going to stop needing semiconductors is ridiculous,” the venture capitalist said. O’Leary also likes IBM as another safe bet. “IBM is probably the most hated name in technology. An old dinosaur company that has over 5% of dividend yield and is re-constructing itself into a web-based company. That’s another name you can hide in the weeds with,” he said. Bank stocks also look attractive to him, with the sector trading at an average book value of 1.1x — a level that he said has “traditionally been a great place to buy.” Read more Morgan Stanley says an investment ‘boom’ is coming to India, and names the stocks to play it Forget oil — coal is hot right now. Here are 2 stocks to play it, according to the pros Wall Street is calling for value over growth. Morningstar says this fund is ‘one of the best’ Energy stocks could also enjoy tailwinds going into the winter months, which have “traditionally been good” for the sector. In particular, he believes natural gas will be a “big story” if the war between Russia and Ukraine continues. He believes natural gas is a “long term secular story,” as the commodity is “desperately needed” by Europe amid the continent’s standoff with Russia over gas supplies, and also because of efforts to offset carbon emissions in the U.S. by switching to natural gas. “Energy has been volatile because it’s also playing against the recession game globally. The reason the price of oil is corrected as people have been shown the demands will slow down. But I’ve seen no metrics for that. I don’t see in any way how that’s going to happen,” O’Leary said, pointing to a production cut by OPEC+ and the closure of a key Russia pipeline. But there remains the “risk of peace” to the energy story. “The price is energy is tied to the Ukrainian war … if all of a sudden there was an agreement worked out with the Russians, you would see the price of oil correct significantly,” he said. — CNBC’s Lee Ying Shan contributed to this report.