Someday, you won’t be able to find cheap rental properties for sale under one million dollars, but, luckily for you, that day is not today.

Table of Contents

- What Is the State of the US Housing Market in 2022?

- 3 Ways You Can Find Cheap Rental Properties for Sale

- 10 Cities With Cheap Rental Properties for Sale in 2022

In the past couple of years, we’ve seen real estate prices rise to unimaginable levels, causing many potential buyers and investors to change their minds. However, despite the drastic increase in median property prices, it is still possible for beginner investors and first-time buyers to find cheap rental properties for sale.

In this article, we’ll start off by giving you a brief review of the state of the housing market in 2022 following the onset of COVID-19. More importantly, we’re going to discuss three different ways you can find cheap rental properties for sale and why Mashvisor might be the best approach for you.

Finally, we’ll provide you with a list of cities that we believe might be the best markets for investing in cheap rental properties according to our data.

What Is the State of the US Housing Market in 2022?

Before 2020, finding cheap rental properties for sale was getting progressively easier over the years as more online platforms and websites offered tools and services to help buyers.

However, despite all the currently existent tools and facilitators that real estate investors and homebuyers have access to, finding a cheap rental property for sale in 2022 isn’t easy.

The reason isn’t that the process is difficult. On the contrary, the process of finding cheap properties for sale in the US is quite simple, as we will later discover. However, the number of markets that offer cheap real estate is still going down this year.

Nowadays, the median price of houses in the US is sitting at just above $600,000. In previously popular and accessible markets, however, house prices could easily go above $1,000,000.

But how exactly did it happen?

The Real Estate Market in the COVID-19 Era

Before COVID-19, real estate prices were growing, but not nearly as sharply as they were in the past couple of years.

Although there were plenty of markets with median prices that are too expensive for the average buyer, they did not make up the majority of real estate markets in the US. Suburban and rural markets, in particular, were seen as very affordable or cheap in most places.

But as the pandemic broke out and living in metropolitan and crowded cities was no longer desirable, most investors and buyers turned their sight to the rural markets.

If you’re wondering why houses are cheap in New York nowadays, here’s the main reason. It’s because people left the city and bought houses in rural and suburban areas. The demand for housing in such areas rose dramatically in a very short amount of time.

The increase came from both second-home buyers, as well as investors who saw the opportunity to profit off of this new shift in demand. However, while the higher demand played a huge role in increasing the prices in these markets, it wasn’t the main reason.

The main reason why it’s hard to find cheap rental properties for sale in 2022 is the lack of inventory. When the housing demand was increasing, the construction of new homes in most markets in the US came to a halt. It meant that there weren’t enough homes for sale to satisfy the growing demand from home buyers.

All of the above factors together resulted in the current state of the housing market and why finding cheap rental properties for sale is now a major challenge.

Is the Real Estate Market Recovering?

Now that you know the state of the real estate market in the past couple of years, you might be wondering: is it a good idea to buy a property now?

The answer is yes!

Many potential buyers and investors seem to be turning away from investing in new properties this year, but it doesn’t mean that you should, too. The reason why people are too afraid to buy is that earlier this year, many believed that the market would crash before the end of 2022.

But, as we all know from the market’s stats since the start of the year, the increase in property prices is slowing down significantly and is expected to normalize by 2023. Also, we are now seeing a gradual recovery in housing inventory, as construction resumes and demand slows down.

Additionally, the decrease in demand means that sellers will be more likely to sell below their asking price. You are likely to face less competition now than if you were to invest two years ago.

Finally, while most beginner investors are struggling to find cheap rental properties for sale, you’re about to learn how you can find cheap rental properties with ease.

Of course, you can also check out the list of cities where we think you’ll get the best chance of finding cheap rental properties for sale that promise a high return on investment.

Related: The State of the US Real Estate Housing Market in 2022 (So Far)

3 Ways You Can Find Cheap Rental Properties for Sale

When it comes to finding cheap rental properties for sale, there are several ways to do so. Depending on your preferred approach, some ways will be more time-consuming, might cost more, or might require more experience to pull off than others.

However, regardless of the way you choose to find cheap rental properties for sale, you will generally be following similar steps.

So, let’s talk about the three most common ways to find cheap rental properties for sale in 2022.

Method 1: Traditional Way of Finding Cheap Properties for Sale

Traditionally, when you wanted to find real estate properties for sale, you didn’t have digital tools and an abundance of services to help you. Instead, you had to use whatever means at your disposal.

It meant having to gather data and information about each potential property in a particular market and run all the required calculations manually.

While it is no longer used as a primary method for finding cheap rental properties for sale, some of the methods that were traditionally used can still give you an edge even today.

Step 1: Preparation & Planning

The first step before you even try to find cheap rental properties for sale is to plan your investment and make the necessary preparations. This is perhaps the step that has changed the least over the years.

In the preparation and planning stage, you will want to figure out all of your finances. It means figuring out how much capital you can access, what your credit score is, what types of mortgages or loans you can qualify for, and, more importantly, what is your goal.

Not everyone who’s trying to find cheap properties for sale has the same goal in mind. Knowing exactly what you want to do with the property is very important at this point.

For example, do you intend to focus on generating passive income in the long term, or do you plan on selling the property after making a rental profit for a number of years?

The above questions can help you determine the type of market that you want to invest in based on that market’s long-term growth and development.

Step 2: Market & Property Analysis

The market and property analysis step is usually considered the most difficult when it comes to investing in rental properties. Although nowadays, you can find many tools and services that can help you and even analyze markets and properties for you, it wasn’t the case traditionally.

Instead, investors had to find other sources of data and do all of their calculations and rental comps by hand. They had to write down all of the data that they gathered about each property in a market and use a spreadsheet and a pencil to compare properties and find the best one.

In recent years, rental comps, in particular, have risen in popularity, due to how easy they’ve become with the help of online tools such as Mashvisor.

Step 3: Finding Properties for Sale

Traditionally, investors didn’t have access to online listing websites and sources where they can easily search for and find cheap rental properties for sale. Instead, they had to gather all the necessary data and search through multiple alternative and unreliable sources, such as:

- Driving around the local area looking for “for sale” sign posts

- Checking the newspapers daily to look for real estate property advertisements

- Going to social hubs and forums dedicated to real estate

- Gathering data from public records

While they are no longer used as primary methods for finding properties for sale, investors who use some of them nowadays can often find hidden gems that other investors weren’t aware of. It is especially true in markets with a high percentage of senior homeowners, who are more likely to use traditional methods for selling their homes.

Additionally, while there are plenty of modern methods that can help you find cheap rental properties for sale, most of them will only show you properties that are listed on the MLS.

But some of the cheapest and best investment properties for sale might be off-market properties that aren’t listed on the MLS or other public listing sites.

Method 2: Hiring an Agent to Find Cheap Properties for Sale

Depending on the type of investor you are, finding cheap rental properties for sale might come down to hiring the right real estate agent.

While most beginner investors opt for a hands-on approach when trying to find cheap rental properties for investment purposes, some prefer to hire an agent right away. Such an approach, however, can be costly.

But if you want to buy a cheap rental property and you’re willing to pay extra on hiring services to make the process easier, then this is the approach for you.

Unlike other methods, hiring an agent to help you find cheap rental properties for sale doesn’t have similar steps. Instead, your active role in the investment process will rely on your involvement and how much time and effort you’re willing to put in compared to how much money you’re willing to spend on services.

What it means is that you can hire services to handle everything on your behalf, such as investing through an investment fund or group.

Alternatively, you can hire an agent to handle specific steps for you, such as analyzing markets or collecting data about properties to present you with a few options.

However, it’s up to you to handle the rest in whatever way you see fit. Some beginner investors might choose to use the traditional method for finding cheap properties for sale while their agent handles all the calculations and analysis, for example.

But if you want to hire an agent and be involved in every step at the same time, then the third approach is probably the most suitable for your case.

Related: 10 Benefits of Hiring a Real Estate Agent

Method 3: Using Mashvisor to Find Cheap Properties for Sale

If you’re looking for the easiest, quickest, and best way to find cheap rental properties for sale in 2022, then your best bet is to use Mashvisor.

Mashvisor is a real estate platform that is designed specifically to help real estate investors find rental properties for sale through data and analytics. The platform focuses on rental properties, and it provides all analytics that are required when investing in such properties.

Additionally, Mashvisor separates traditional rentals from short-term or Airbnb rentals, allowing investors to find cheap rental properties for sale based on their desired rental strategy.

Instead of having to hire an agent to provide you with access to reliable MLS data, or having to drive around each neighborhood looking for cheap homes for sale, you can simply use Mashvisor.

Step 1: Preparation & Planning

As we’ve said before, the step of preparing and planning for your investment hasn’t changed much over the years. If you’re using Mashvisor to find and buy cheap rental properties, then you’re going to mostly follow the same process as if you were using the traditional method.

However, Mashvisor provides you with much more flexibility in terms of the markets that you can include in your search, the types of properties, or the rental strategy that you want to use. It means that you can include more specifics in your planning stage.

For example, since Mashvisor allows you to search for not only MLS and off-market properties, but also foreclosures, it allows you to consider a fixer-upper type of investment strategy.

Additionally, the platform provides you with tools that let you make future projections in seconds with ease. By using such tools, you can make predictions about your investment and the different types of results if you use different financing methods or mortgages.

All of the above features mean that you will have more flexibility than ever when trying to find cheap rental properties for sale in any market in the US.

Step 2: Market & Property Analysis

When it comes to getting market-wide analytics to help you find the best cheap rental properties that are for sale, Mashvisor is an invaluable tool that you should use. This is because of two reasons.

Firstly, Mashvisor’s platform gathers data from several reliable sources, such as the MLS, for traditional listings, Airbnb for short-term rentals, and other sources.

The data that Mashvisor provides also includes property types that are especially hard to find anywhere else, such as foreclosed properties and off-market properties that are for sale. It means that the platform utilizes and offers massive amounts of data that you can access, and that is crucial for real estate analytics.

Secondly, the analytics that Mashvisor provides are generated by sophisticated and complex machine-learning algorithms that have been evolving and improving over the years. With the amount of data that it has access to, the platform’s AI is able to compare properties and markets across the US to produce its insights and results.

It includes important figures and metrics such as median property prices, average rental rates, markets’ average occupancy rates, and even cap rates and cash on cash returns.

All of the data is easily accessible and is provided in a simple and understandable user-friendly manner that you can even share with other people, such as your real estate agent.

If you’re looking for the perfect tool to help you find affordable markets where you can buy cheap rental properties that are profitable, then Mashvisor is your best option.

Step 3: Finding Properties for Sale

Finally, when it comes to finding cheap rental properties for sale and deciding which one to buy, Mashvisor provides tools for that as well.

In addition to providing market-wide data and averages, it lets you see each property’s information, which includes data analytics and investment opportunity analytics. It means that you can use the platform to search for properties based on specific details and metrics.

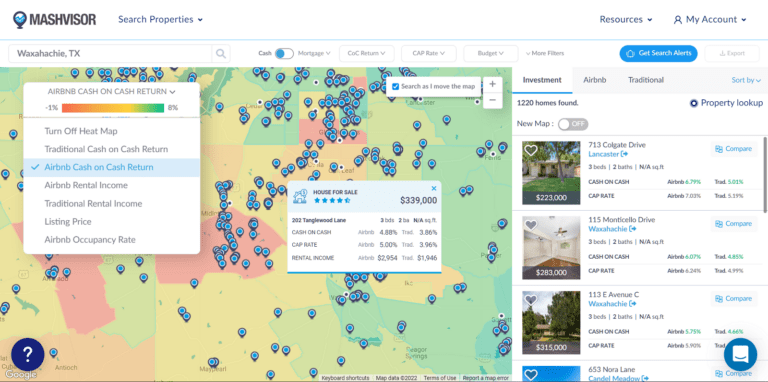

With Mashvisor’s investment property search feature, you can use the heatmap tool to search for a specific market, such as a city or a neighborhood, and look at properties there. On the heatmap, you will see each property that is listed for sale.

Additionally, by using the available filters, you can narrow down your search based on the following:

- The price of the property

- Rental income

- Cash on cash return

- Property type

- Size of the property

- Number of bedrooms/bathrooms

- Rental strategy (traditional or Airbnb)

- Age of the property

Finally, when clicking on any property you will be taken to that property’s analytics page. The page will include all of the details and information that are available about that property, including photographs and the owner’s contact information.

More importantly, the analytics section includes a rental property calculator that calculates values like the cap rate and the cash on cash return.

Lastly, and perhaps most importantly, at the bottom of the page, you will find a rental comps section that compares the property with other similar properties around it.

All of the above tools let you very easily find properties that you are confident will generate a profit. With all of that in mind, we highly recommend that you start using Mashvisor to find cheap rental properties for sale.

You can use Mashvisor’s heatmap tool to look for potentially lucrative properties in a specific neighborhood.

10 Cities With Cheap Rental Properties for Sale in 2022

If you’re wondering what markets you should search for cheap rental properties for sale in, the answer depends heavily on your personal investment plan and strategy.

Most investors, especially beginner ones, choose to buy a property in their local market or in the same state that they live in. So, it’s highly likely that none of the markets that are included in this list will be accessible to you. But it doesn’t mean that you can’t make use of this information.

You can use the following list to get an idea of what to expect and what standards to look for when trying to find other markets with cheap rental properties for sale in your state.

Of course, all of the data comes from Mashvisor’s platform, based on the most recent report for August 2022. You can access the same type and amount of data about any market that you’re interested in by using the platform’s search tool and exporting the data in an Excel sheet format.

Related: How to Choose the Best Location for Your First Rental Property

Our Criteria

To compile the list of cities below, we included cities with a good amount of cheap rental properties for sale, but that also come with promising numbers when it comes to investment opportunities. Here are the criteria for choosing the cities:

- Median property price is below $1 million

- With more than 100 listings for sale

- Average cash on cash return is at least 2%

- Price to rent ratio is 20 or above

- Airbnb occupancy rate is above 50%

It means that the markets offer affordable or cheap rental properties for sale, demonstrate a healthy inventory, and there are more people renting than buying.

Without further ado, these are our top 10 markets for investing in cheap rental properties, ranked from the lowest to the highest median property prices:

1. Waxahachie, TX

- Median Property Price: $479,440

- Average Price per Square Foot: $191

- Days on Market: 97

- Number of Traditional Listings: 159

- Monthly Traditional Rental Income: $2,002

- Traditional Cash on Cash Return: 2.25%

- Traditional Cap Rate: 2.30%

- Price to Rent Ratio: 20

- Monthly Airbnb Rental Income: $2,839

- Airbnb Cash on Cash Return: 3.60%

- Airbnb Cap Rate: 3.69%

- Airbnb Daily Rate: $233

- Airbnb Occupancy Rate: 64%

- Walk Score: 65

2. Largo, FL

- Median Property Price: $498,550

- Average Price per Square Foot: $303

- Days on Market: 64

- Number of Traditional Listings: 194

- Monthly Traditional Rental Income: $2,115

- Traditional Cash on Cash Return: 3.23%

- Traditional Cap Rate: 3.31%

- Price to Rent Ratio: 20

- Monthly Airbnb Rental Income: $3,518

- Airbnb Cash on Cash Return: 4.47%

- Airbnb Cap Rate: 4.57%

- Airbnb Daily Rate: $216

- Airbnb Occupancy Rate: 53%

- Walk Score: 53

3. Glen Allen, VA

- Median Property Price: $509,227

- Average Price per Square Foot: $202

- Days on Market: 64

- Number of Traditional Listings: 137

- Monthly Traditional Rental Income: $2,090

- Traditional Cash on Cash Return: 2.71%

- Traditional Cap Rate: 2.76%

- Price to Rent Ratio: 20

- Monthly Airbnb Rental Income: $4,770

- Airbnb Cash on Cash Return: 6.92%

- Airbnb Cap Rate: 7.04%

- Airbnb Daily Rate: $233

- Airbnb Occupancy Rate: 65%

- Walk Score: 33

4. Buckeye, AZ

- Median Property Price: $511,992

- Average Price per Square Foot: $258

- Days on Market: 21

- Number of Traditional Listings: 212

- Monthly Traditional Rental Income: $2,072

- Traditional Cash on Cash Return: 2.75%

- Traditional Cap Rate: 2.80%

- Price to Rent Ratio: 21

- Monthly Airbnb Rental Income: $3,580

- Airbnb Cash on Cash Return: 4.34%

- Airbnb Cap Rate: 4.42%

- Airbnb Daily Rate: $158

- Airbnb Occupancy Rate: 66%

- Walk Score: 72

5. San Bernardino, CA

- Median Property Price: $513,145

- Average Price per Square Foot: $1,607

- Days on Market: 41

- Number of Traditional Listings: 300

- Monthly Traditional Rental Income: $2,110

- Traditional Cash on Cash Return: 2.49%

- Traditional Cap Rate: 2.54%

- Price to Rent Ratio: 20

- Monthly Airbnb Rental Income: $4,009

- Airbnb Cash on Cash Return: 5.16%

- Airbnb Cap Rate: 5.25%

- Airbnb Daily Rate: $229

- Airbnb Occupancy Rate: 58%

- Walk Score: 34

6. Fredericksburg, VA

- Median Property Price: $513,301

- Average Price per Square Foot: $227

- Days on Market: 67

- Number of Traditional Listings: 632

- Monthly Traditional Rental Income: $2,050

- Traditional Cash on Cash Return: 2.97%

- Traditional Cap Rate: 3.03%

- Price to Rent Ratio: 21

- Monthly Airbnb Rental Income: $3,259

- Airbnb Cash on Cash Return: 5.09%

- Airbnb Cap Rate: 5.21%

- Airbnb Daily Rate: $137

- Airbnb Occupancy Rate: 69%

- Walk Score: 7

7. Melbourne, FL

- Median Property Price: $519,311

- Average Price per Square Foot: $263

- Days on Market: 49

- Number of Traditional Listings: 568

- Monthly Traditional Rental Income: $2,028

- Traditional Cash on Cash Return: 2.91%

- Traditional Cap Rate: 2.98%

- Price to Rent Ratio: 21

- Monthly Airbnb Rental Income: $3,349

- Airbnb Cash on Cash Return: 4.16%

- Airbnb Cap Rate: 4.25%

- Airbnb Daily Rate: $173

- Airbnb Occupancy Rate: 51

- Walk Score: 73

8. Ormond Beach, FL

- Median Property Price: $519,395

- Average Price per Square Foot: $292

- Days on Market: 77

- Number of Traditional Listings: 204

- Monthly Traditional Rental Income: $2,212

- Traditional Cash on Cash Return: 3.20%

- Traditional Cap Rate: 3.27%

- Price to Rent Ratio: 20

- Monthly Airbnb Rental Income: $3,177

- Airbnb Cash on Cash Return: 3.54%

- Airbnb Cap Rate: 3.62%

- Airbnb Daily Rate: $186

- Airbnb Occupancy Rate: 51%

- Walk Score: 52

9. Odenton, MD

- Median Property Price: $521,160

- Average Price per Square Foot: $353

- Days on Market: 117

- Number of Traditional Listings: 144

- Monthly Traditional Rental Income: $2,221

- Traditional Cash on Cash Return: 3.22%

- Traditional Cap Rate: 3.29%

- Price to Rent Ratio: 20

- Monthly Airbnb Rental Income: $4,397

- Airbnb Cash on Cash Return: 5.73%

- Airbnb Cap Rate: 5.84%

- Airbnb Daily Rate: $145

- Airbnb Occupancy Rate: 59%

- Walk Score: 60

10. Richardson, TX

- Median Property Price: $521,974

- Average Price per Square Foot: $236

- Days on Market: 30

- Number of Traditional Listings: 406

- Monthly Traditional Rental Income: $2,186

- Traditional Cash on Cash Return: 2.54%

- Traditional Cap Rate: 2.59%

- Price to Rent Ratio: 20

- Monthly Airbnb Rental Income: $3,517

- Airbnb Cash on Cash Return: 3.71%

- Airbnb Cap Rate: 3.78%

- Airbnb Daily Rate: $171

- Airbnb Occupancy Rate: 54%

- Walk Score: 41

Want to start searching for cheap rental properties on Mashvisor now? Click here.

Bottom Line: Finding Cheap Rental Properties for Sale in 2022

Finding cheap rental properties for sale in 2022 isn’t as hard as most people make it to be. Although there are many challenges that are present in today’s market, such as inflated prices and inventory shortages, there are plenty of markets where you can find cheap properties.

When it comes to finding the right way that suits you, chances are that Mashvisor is the best option that you have available. By using Mashvisor, you can find cheap rental properties for sale in markets that other investors might not even consider.

Want to know how you can find cheap properties even in markets such as NYC? Use Mashvisor, and you’re likely to find rental properties that are cheap and that you can rent out for a profitable rental rate.

As long as you keep in mind the state of the post-pandemic real estate market, you can avoid markets that have become too expensive and find new markets with cheap properties for sale.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.