President Biden plans to formally announce his plan for forgiving student debt for some borrowers Wednesday afternoon, which includes forgiving $10,000 for borrowers who make less than $125,000 per year and extending the payment freeze one final time.

The announcement has three key parts, the official said:

First, it includes $20,000 debt cancellation for borrowers who received Pell Grants while they were in college. That applies to borrowers making less than $125,000 or $250,000 if they are part of a household. Sixty percent of borrowers, the official said, have Pell Grants, noting that the “majority of borrowers are eligible for $20,000 in relief.” The official said that a “strong majority of borrowers are folks who come from lower income, middle income.”

The federal student debt totaling $1.6 trillion for over 45 million borrowers is a “financial weight on America’s middle class,” a senior administration official said, noting that the burden “falls disproportionally on Black borrowers.”

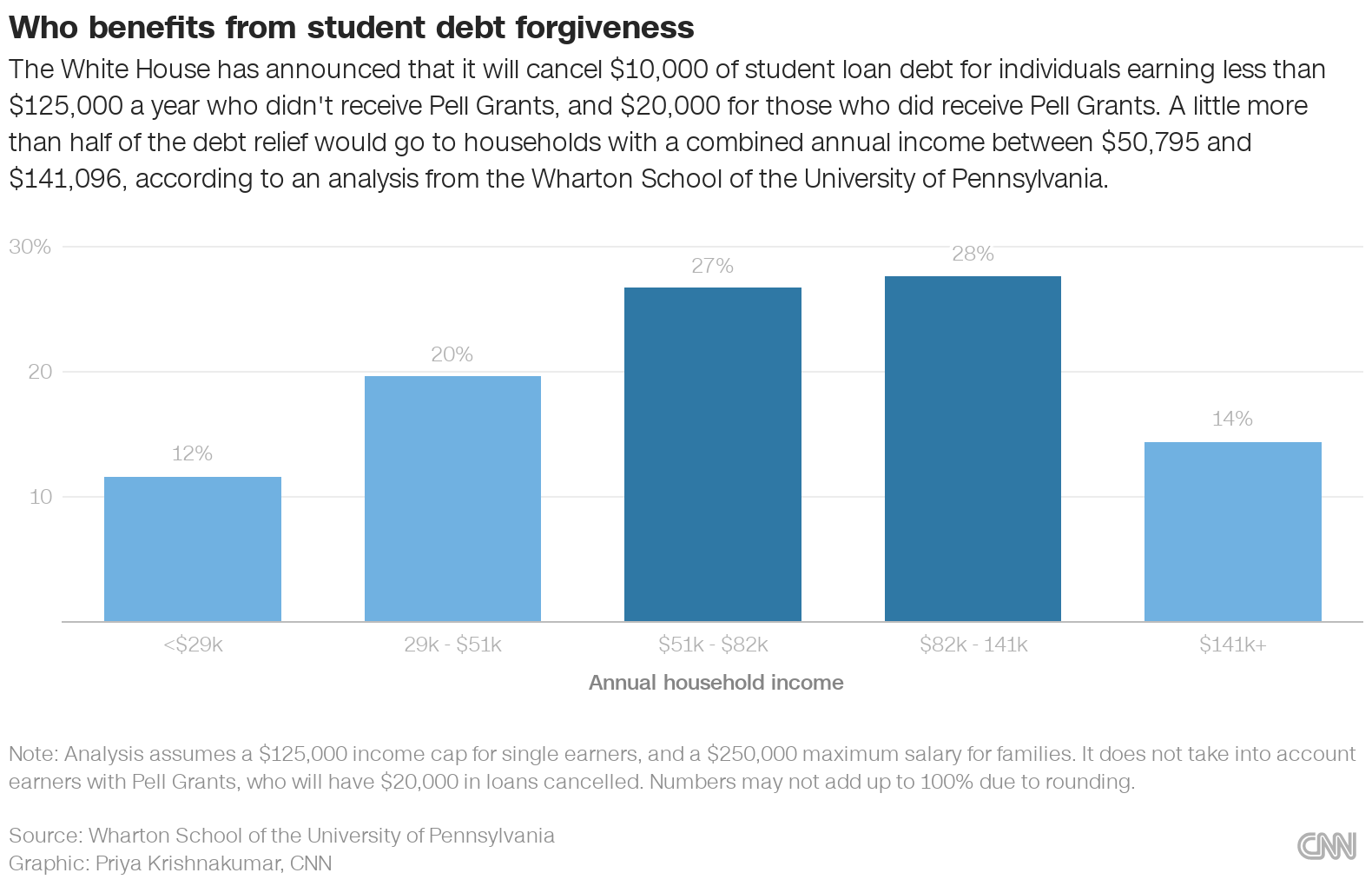

The official noted that nearly 90% of those relief dollars “will go to those earning less than $75,000 a year,” and suggested that it will help “narrow the racial wealth gap.”

Second, the US will also extend the pause on student loan payments “one final time” through Dec. 31, 2022.

The official also addressed the move’s impact on inflation.

“The President is taking one step that has a negative fiscal impulse, collecting more payments from borrowers, and one step that has a positive fiscal impulse, offering debt relief to borrowers most in need. In terms have an impact on inflation relative today our view is that those steps largely offset. There are certain conditions and assumptions under which it could well be neutral or deflationary,” the official said.

Third, the Department of Education will reform the income-driven repayment system, capping what borrowers pay each month, the official said.

“The President will announce proposed reforms to income-driven repayment so that both current and future low and middle-income borrowers will have smaller monthly payments. The proposed rule for undergraduate loans would cut in half the amount that borrowers have to pay each month from 10% to 5% of discretionary income,” the second official said.

Here’s a look at who benefits from the plan: