Do you want to invest in vacation rentals but don’t know how to start? Read on to learn how to buy property for Airbnb to earn extra income.

Table of Contents

- How Does Airbnb Work?

- Is It Worth Buying a House to Put on Airbnb?

- How to Buy Property for Airbnb in 6 Steps

Investing in vacation rentals is an excellent way to earn additional income. As Airbnb became popular in 2011, many investors were able to reap the benefits of listing their properties on the home-sharing platform. However, when the pandemic hit in 2020, vacation rentals were one of the industries adversely affected.

Many Airbnb investment property owners significantly suffered from the impact of the global lockdowns. Many businesses closed down, and some Airbnb rentals stopped operating. But just as they say, when the going gets tough, the tough get going. Fortunately, after almost two years, tourism is now back on its feet.

Cities in the US are now reopening their doors to visitors. People from around the world are eager to travel again. Following the lifting of travel restrictions in late 2021, the Airbnb investment market is now attracting high demand and improved booking rates. Many new investors are interested in venturing into vacation rentals once again.

In this article, you will learn:

- What to look for when choosing the best income property for your Airbnb investment

- How to buy property for Airbnb in the right location

- How to use a real estate analytics platform like Mashvisor to find the right Airbnb property

- The important tools Mashvisor offers to help you find a profitable investment

- How to become a successful Airbnb owner

Keep reading to get started with your Airbnb business.

How Does Airbnb Work?

Airbnb is a term that refers to “air bed and breakfast.” It is an online marketplace where rental property owners list their vacation homes for rent. Travelers looking for a place to stay can search the platform and choose a vacation rental in the city where they are traveling. Then, they can contact the owner and book their stays directly through the Airbnb platform.

It’s important to note that Airbnb is just a platform and only works as an intermediary between the renters and the owners. It does not own the investment properties listed for rent. While most people refer to Airbnb as the home-sharing platform, Airbnb is only one of the many rental online marketplaces available today.

Several other home-sharing platforms also work like Airbnb, including VRBO, Homestay, and Booking.com. In this article, when we mention “Airbnb property,” we generally refer to a short-term rental investment property that’s being listed for rent on any of the online home-sharing platforms.

The principal idea of Airbnb and other similar home-sharing platforms is to provide an avenue for rental property owners to connect to potential renters. The platform is open not only to real estate investors. It is open to anyone with an extra home or spare room to rent out to people visiting their area. It allows hosts to earn extra money from renting out their property.

As an investment property owner, you can benefit from the wide audience reach of Airbnb and other similar platforms. When you list your vacation rental property on the online marketplace, you can advertise your rental to millions of users worldwide. Similarly, visiting guests can also take advantage of the easy browsing and booking procedures on the platforms.

Related: How Much Can I Rent My House For on Airbnb?

Is It Worth Buying a House to Put on Airbnb?

Due to the high Airbnb demand, there are lots of opportunities for Airbnb investing—so yes, it’s worth buying an Airbnb property. As mentioned, many travelers are now eager to go on vacations after two years of being in lockdown. Both international and local tourists are expected to visit the best destinations in the United States starting this year and beyond.

If you want to take advantage of the anticipated high demand for vacation rentals, then it’s a wise idea to buy a house to put on Airbnb. Aside from the expected high demand, there are other benefits to investing in vacation rentals, including the following:

- Earn a passive income

- Own a vacation home for your personal use

- Diversify your portfolio

- No need to rely on long-term tenants

- Earn potentially higher income

- Advertising on the platform is free

However, keep in mind that not all Airbnb properties are equally profitable. Many vacation rentals experience high vacancy rates because they invested in the wrong investment property. Also, other Airbnb owners are not as successful because they chose the wrong location for their vacation rentals.

Performing a thorough rental property analysis is essential in finding the perfect investment property. That is why it’s best to work with a reliable real estate analytics platform when you decide to invest in Airbnb.

How to Buy Property for Airbnb in 6 Steps

Now that you’ve learned that venturing into Airbnb can be a lucrative endeavor, the next thing that you need to find out is how to buy property for Airbnb. Owning a vacation rental is an effective way to boost your income. However, as we’ve mentioned, you must choose your investment property carefully to ensure profitability.

The following are the essential steps that you need to take when you are ready to buy a vacation rental investment home:

Step 1: Choose a Location

When investing in Airbnb rentals, choosing the right location is the most important step. One of the reasons why some Airbnb owners fail in the short term rental market is that they pick a location that doesn’t attract travelers. So, before you start searching for an Airbnb property to buy, you must learn how to find a good location first.

You need to decide whether it’s better to invest in your home city or buy an out-of-state Airbnb home. Make sure to do your research when short-listing your potential investment locations. Some of the things that you need to take note of are the following:

- Tourism: How strong is the tourism industry in the area you are interested in? Remember, most Airbnb owners make money out of tourists who visit their place. So, it is something that you should take into account. The tourism industry in the area can greatly affect your occupancy rate and overall profitability.

- Business: Aside from tourists, business travelers are another major driver of the demand for vacation rentals. Choosing a specific area with a thriving economy is a good idea if you also want to target business travelers. They can be a good source of occupancy during non-peak seasons.

- Home Values: Knowing the home values in the location can help you determine how much return you can generate based on the demand for rentals. If you invest in a location that is very expensive, it may take longer for you to realize your return on investment. However, if you invest in a place that is too cheap, your investment property may not appreciate. Find the right balance to get an ideal cash on cash return.

Related: What Is a Good Cash on Cash Return?

Step 2: Find Out the Local Short-Term Rental Laws

After you’ve selected a few potential locations for your investment property, the next important step is to find out the local Airbnb laws in those locations. In some cities, Airbnb rentals are not yet legal. It is why you must ensure that you’re buying a vacation rental property in a place where it is legal to operate short term rentals.

You can contact the local government to find out if Airbnb rentals are allowed. Know the rules and regulations you need to comply with and whether certain standards and restrictions exist regarding what type of property is considered legal. Some local jurisdictions impose certain regulations on vacation rentals, including zoning codes, planning codes, and city ordinances.

Step 3: Decide on a Budget

After coming up with a list of good locations that legally allow short term rentals, the next step is to set a budget. Planning a budget before searching for a home to buy is essential so you can easily filter your search. It also helps you set realistic expectations without breaking the bank. If your purchase is primarily for investment, make sure not to go overboard with your budget.

When setting a budget, do not just think about the selling price of the home. Try to include all other expenses you need to spend on, including closing costs, repair and improvement costs, insurance, and taxes. It’s best to research how much operating an Airbnb property actually costs in the area of your choice.

Step 4: Determine What Type of Property to Buy

After setting a budget, you can now decide what type of property you plan to invest in. Do you want to invest in a condo unit, a single-family home, or a beach house? The best property type for Airbnb investing is one that can generate the most profits and a higher occupancy rate. Before you decide, consider your chosen location, target guests, and inventory availability.

If you want to invest somewhere near a busy business district, you can opt to buy a condo unit or an apartment. These property types attract business travelers and those who travel solo. If, on the other hand, you want to target families or groups of friends, it’s best to buy single-family homes or a townhouse unit.

Of course, the type of property that you should buy should also depend on where you invest. For example, if you’re planning to invest in Florida and target holiday-goers, maybe a beach house is your best choice. On the other hand, if you intend to invest in a more adventurous location, you may also want to consider other unique properties like cabins.

Step 5: Look for Available Properties

Once you’ve chosen a location, determined a budget, and decided on the property type to buy, you can now start doing your investment property search.

There are several ways to look for an investment property to buy. Some investors use traditional methods like driving around the neighborhoods, asking friends, and working with a real estate agent.

However, the most common and easiest method that’s being used nowadays is through an online investment property search. Fortunately, there are several online platforms that can help you. The platforms allow you to find an investment property without the need to leave your home or office. It’s much easier and more practical compared to the old ways.

But not all real estate platforms provide complete and up-to-date listings. If you want to access MLS listings from all over the US, the best platform that you should use is Mashvisor. With Mashvisor, you can easily look for an investment property by city, neighborhood, or state. To filter your search, you can also set your preferred budget, property type, and rental income.

Most real estate investors buying an investment home usually find difficulty in searching for the perfect property. It’s because, most of the time, it’s hard to perform a search based on what you really want. Thankfully, with Mashvisor’s custom search filters, you can decide what properties you want to see in your search results, making the short-listing process a lot easier.

Related: How to Do an MLS Listings Search: A Real Estate Investor’s Guide

Step 6: Conduct Your Research and Analysis

Another factor that can help you become a successful Airbnb investor is learning how to conduct short term rental analysis. To do so, you first need to thoroughly research the property you plan to buy.

Some important things that you should find out include:

- Property information

- Rental income

- Cash on cash return

- Cap rate

- Expenses

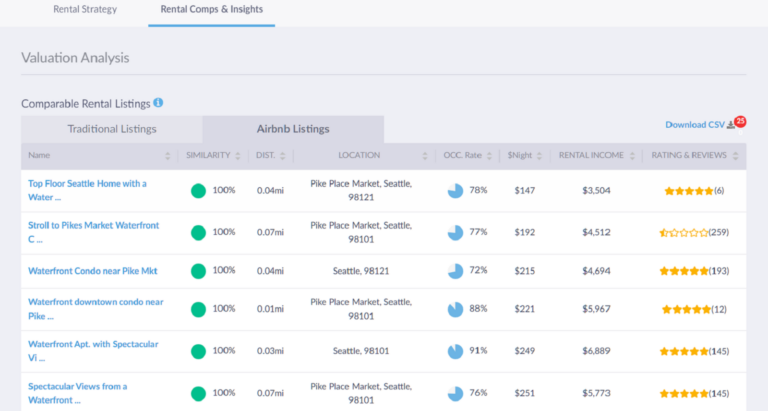

- Rental comps

- Neighborhood comps

Once you find all the necessary information, you can perform a rental analysis based on the data you’ve obtained. However, doing manual research and analysis can be very laborious and time-consuming. Plus, it can be prone to errors too.

If you don’t want to go through the hassle of conducting research manually, it’s best to work with a reliable rental market analysis platform. Mashvisor does not only help you search for available Airbnb properties; it also provides all the necessary data that you need. Moreover, it also offers a comprehensive real estate analysis to help you make an informed investment decision.

After finding a property that you like from Mashvisor’s database, all you need to do is to click on that property. Then, it will lead to a page where you can see all the necessary data about that property. You will also find the real estate comps to help you determine whether or not the property will make a profitable Airbnb investment.

In addition, you will also get to access the investment property calculator so you can see how much income you can earn. With Mashvisor’s Airbnb data analysis, you’ll be able to see which real estate strategy is best for that particular investment property.

Real estate investors use rental comps to compare their property to others in the same neighborhood and find out if it will be profitable or not.

Start Investing in Airbnb Rentals

The founders of Airbnb made history when they decided to rent out a spare room with just an airbed mattress, so they could make extra money to help with their rent. Several years later, Airbnb is now considered a huge business in the real estate market. Nowadays, many platforms offer home-sharing services that are helpful to both rental owners and guests.

The popularity of home-sharing platforms is one of the reasons why many Airbnb investment property owners become successful. If you want to start your own Airbnb investment, you should first learn how to buy property for Airbnb. The guide that we‘ve outlined above will definitely help you with the process of finding the perfect vacation rental.

Remember that location is key to successful investing. However, finding the best location is not as easy as it may seem. As mentioned, thorough research is needed to ensure you make the right investment decision. If you are unsure, Mashvisor will help you make an informed decision.

With Mashvisor, you can easily search for an Airbnb property that meets your investment criteria. It will also help you decide if such a property would make a good Airbnb investment based on accurate figures. Additionally, you can use its rental property calculator to see how much profit an income property can generate based on your expenses and mortgage.

Working with Mashvisor to find the most lucrative real estate investment is the best decision you can make to start your journey as a successful investor.

Sign up for a free 7-day trial of Mashvisor now, followed by 15% off for life.