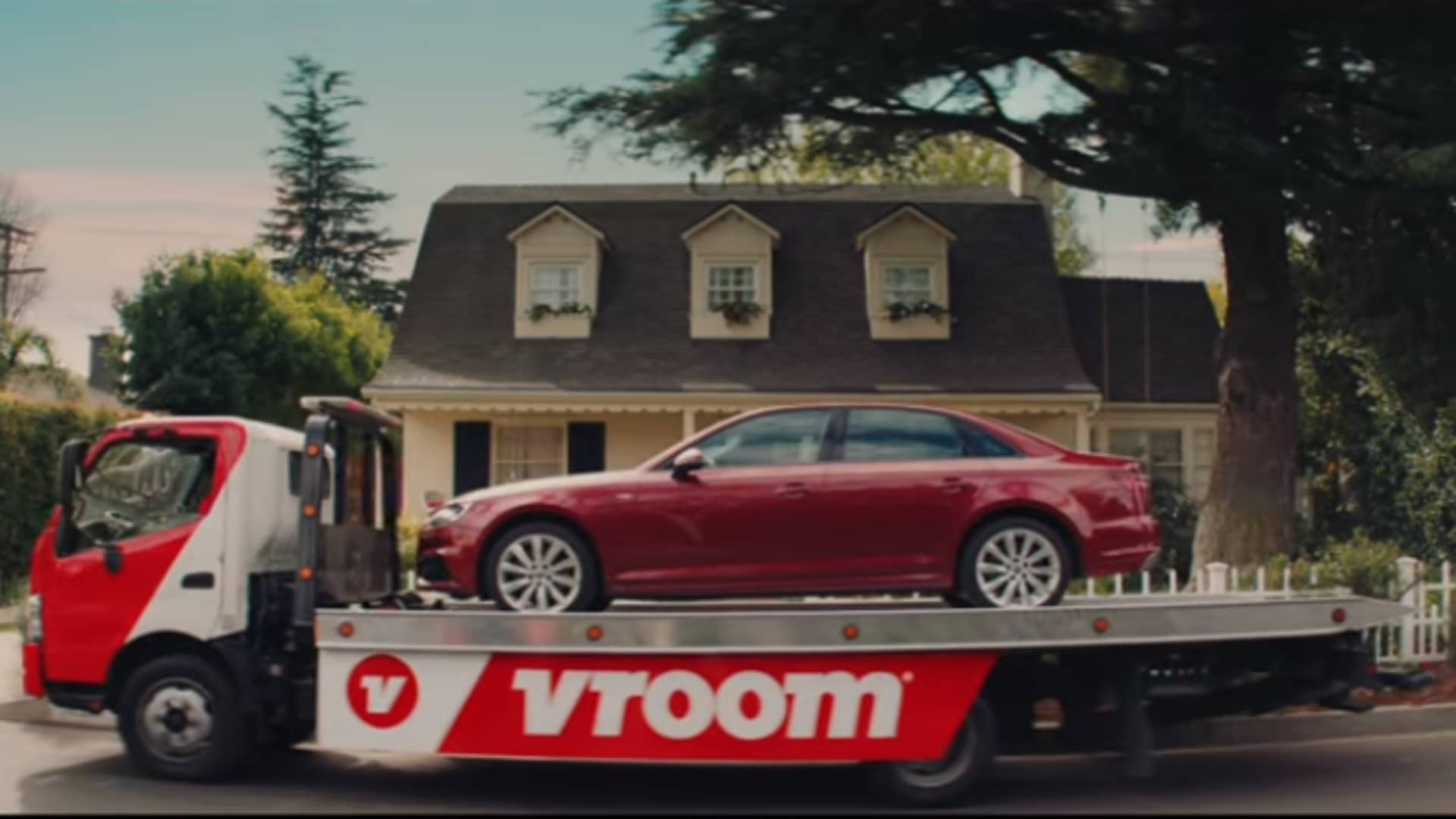

It’s time to sell Vroom , which has already plunged 80% this year, as the online used car retailer will continue to face challenges during an economic slowdown, according to JPMorgan Analyst Rajat Gupta downgraded the stock to underweight from neutral, noting that: “We continue to see a challenging backdrop for the used car industry and prefer companies that have ample liquidity and/or diversity in their business to navigate an uncertain macro backdrop.” Gupta added that, after taking a look at the company’s plans going forward, “there is clearly no easy/quick fix or turnaround due to which we struggle with the investment case in the near to medium-term. Vroom struggled this year because of deteriorating market conditions such as rising auto prices, increasing interest rates and slowing demand that have hurt online car retailers. Shares of Vroom are off 80% in 2022 and are 93% below their 52-week high. The stock lost 3.8% in Monday premarket trading. Gupta also downgraded competitor Shift Technologies to underweight. The stock, which has a market cap of just $104.69 million, is down nearly 64% this year. “Both companies are now ex-growth, burning ~35-40% of Mcap/quarter in cash flow and trading at ~4x 2023E EV/GP, a premium to many FCF generating and higher growth e-comm peers,” the note read. The analyst believes Vroom will need to slow cash burn, manage through a recessionary environment, and get closer to profitability, so that investors can gain conviction again in the stock. Until then, the firm prefers traditional brick-and-mortar car dealers that generate strong free cash flow. —CNBC’s Michael Bloom contributed to this report.