We will give you a detailed walkthrough of Mashvisor’s rental estimate calculator so you can even start using it today. Read on to learn more.

Table of Contents

- Why Pricing Your Rental Is Important But Challenging

- How to Use Mashvisor’s Rental Estimate Calculator

- Conclusion

- FAQs

The mere possibility that your investment strategy can create profitable returns is insufficient. It takes much more than just crafting your approach. It also involves knowing how the market operates and collecting the essential tools to assist you in carrying out your investing strategy.

While there are several ways to determine how much to ask for rent, one of the most dependable is to utilize an investment property calculator. In this post, we’ll look into Mashvisor’s rental estimate calculator and discuss why every real estate investor should use it.

Why Pricing Your Rental Is Important but Challenging

Pricing your rental units correctly is critical to getting the most out of your investment. It applies whether you’re a vacation rental property manager operating tens to hundreds of homes or a vacation rental landlord trying to earn a profit on your own property.

However, short term rental pricing includes more than just nightly rates and taxes. It can rapidly become complicated—especially in a competitive industry like the tourism sector. And while it isn’t an exact science, it is worthwhile to try.

Here are a few challenges you can experience if you set the price without proper research and analysis, as well as the benefits of selecting the rental price correctly.

1. Determining the Value of Your Property

Rental properties are difficult to price because they are unique—which is why people adore them. As a result, it seems reasonable that a five-bedroom home with a pool within easy reach of the seaside will not be valued the same as a basic studio apartment in a city center.

Another aspect to think about is your occupancy goals. Always remember that vacation rental properties, by definition, do not achieve the levels of occupancy that a hotel does. Therefore, occupancy will be very unpredictable based on your location and the time of the year.

Solution: Study Your Competitors

Examine the calendars of a few short term rentals that are as close to yours as possible—the exact number of bathrooms and bedrooms and a comparable location is the minimum needed.

How frequently are they booked? When are they most busy? And what is their pricing like at peak times? What about the off-season? Make a list of the numbers and find an average to use as a foundation for rental estimate comparison.

2. Attracting Guests Without Losing Money

Consider how you can differentiate yourself to guests now that you know your competitors. It means that your overnight prices should be affordable for guests and still remain profitable for you.

Solution: Pick a Pricing Technique

There are two basic pricing strategies for rental homes: price cheaper than the competitors or offer a more luxurious experience.

You can do it with your vacation property by maintaining price estimates that are somewhat cheaper than your competition, especially during high seasons. If there are multiple houses in your area with similar layouts and facilities and you need a method to stand out, this is a viable solution.

3. Establishing Adequate Fees to Cover Expenses

Some expenses, such as the mortgage and utilities, can be included in setting the rate for your vacation rental. On the other hand, cleaning services, credit card costs, and OTA listing fees should be separately analyzed.

Solution: Don’t Go Too Far

Consider combining all your costs into a single one (with a detailed list available upon request). If you’re a vacation rental property manager, aim to take a load of fees off of the landowner. You can do so by splitting them with the guest as much as possible.

4. Changing Seasons Influence the Pricing

Like everything else in the tourism sector, the vacation rental price is heavily influenced by when and why individuals engage. Your seaside properties will be priced differently than Colorado townhouses, which will come with different rates than condominiums in Las Vegas or New York.

Basically, changing your pricing estimate to correspond with high and low seasons ensures that you always receive your money’s worth.

Solution: Determine Your High and Low Periods

For starters, examine your competitors’ rates to discover when their prices climbed or dropped. Are they exceptionally high at a festive season? What happens to them over a week? What about over the holidays in the wintertime or during summer vacation?

5. Doing It on Your Own

Pricing rental properties is complex and may require near-constant maintenance to make dynamic pricing work for you. Moreover, even vacation rental property managers with hired help can experience difficulty finding the time and resources to juggle different needs. They need to do research, evaluate the competition, and modify pricing to minute market changes.

Related: The Professional Guide to Efficient Property Management

Solution: Opt for Rental Estimate Calculator

A rent estimate calculator is an online software that uses rental data to calculate the rent on an investment property. Essentially, it removes the need to conduct traditional rental comp analysis. There are many rental calculators, such as Zillow’s, but let’s focus on Mashvisor’s rental estimate calculator and how you can employ it within minutes.

How to Use Mashvisor’s Rental Estimate Calculator

One of the crucial elements of how to invest in real estate includes utilizing the right investment tools.

It’s becoming increasingly hard for investors to stay up with the latest trends as technology advances and the real estate industry expands continuously. Such technologies help investors look for a profitable area for rental property.

Mashvisor’s rental estimate calculator can provide a precise rent estimate, letting you know how much rental revenue you can anticipate. It does the calculations through the use of big data and the capabilities of AI. Moreover, the rental data in Mashvisor’s database comes from various trustworthy real estate data sources, including MLS, Airbnb, and Zillow.

Several rental websites give realistic rent estimates. So, why not check Zillow’s rent estimate for starters? Well, it is because Mashvisor’s rental estimate calculator offers investors more than just a rental estimate—it provides an in-depth investment property analysis, which many online calculators don’t.

Below is a guide on how to use Mashvisor’s rental property calculator.

Step 1: Decide on Where to Invest

The very first step is to decide on your location and the property you are going to purchase.

Real estate market research is the preferred approach to finding the ideal location to invest in real estate. Ultimately, you will compare your rental property to other homes in the exact neighborhood that are comparable to it. It gives you a better understanding of the market pricing and the rate of appreciation.

Real estate market analysis is crucial since it deals directly with where you want to acquire an investment property. As a result, you cannot go about locating the finest area to invest in real estate without first doing a market analysis.

This is where Mashvisor’s Neighborhood Analysis comes in handy. As a real estate investor, you may use this data to compare different neighborhoods in hundreds of US cities. You can then determine how lucrative a specific neighborhood is and whether or not it is suitable for real estate investing.

And if you already know where to invest—let’s skip to the next steps.

Step 2: Select a Listing That Catches Your Interest

Unlike Zillow’s calculator, Mashvisor’s rental estimate calculator will give investors even more input into the best investment property type in the area after gathering all the needed data at the neighborhood level.

You can browse and examine each potential investment property using a few clicks only. If you see one that catches your eye—it’s time to research the property’s data.

The platform will present each property’s key data (rental income, costs, cash flow, cap rate, cash on cash return, and occupancy rate) using the rental estimate calculator, allowing you to determine which is the most lucrative.

That’s why selecting a listing first is vital and exploring your options. If you already know what property you want to buy, you can either double-check if it’s profitable with our calculator’s features or see the following steps.

Related: What Is a Good Cash on Cash Return?

Step 3: Review Mashvisor’s Property Valuation Analytics

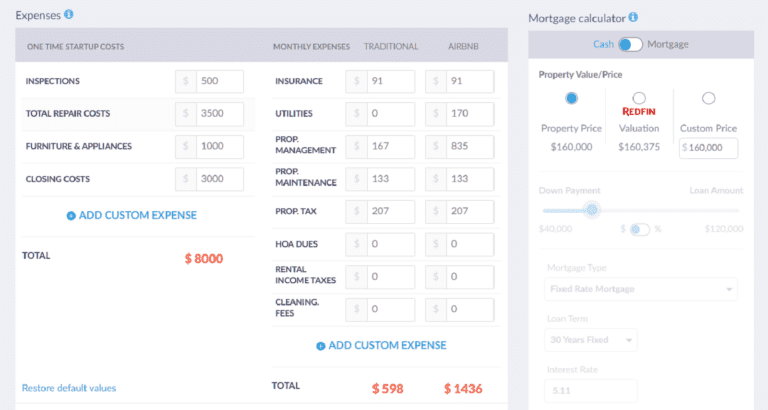

Primarily, the research will provide comparisons of rental strategies for both Airbnb and traditional rentals. Moreover, the comparison parameters include rental income (which may be modified), monthly costs, cash flow, cap rate, cash on cash return, and occupancy rate.

By displaying the data, the comparison helps you understand why and how a type of approach is preferable for that investment property.

Next, you examine the rental estimate calculator’s financing/mortgage part. The feature allows you to select the form of financing for the property: mortgage or cash.

For example, the mortgage choice allows you to alter the down payment, loan type, loan size, and interest rate, providing you with a better knowledge of the future cash flow based on the given mortgage parameters.

Finally, unlike the Zillow rent estimate, Mashvisor’s rental estimate calculator tackles the expenditures connected with the rental property. The expenses are separated into two categories: one-time startup costs and monthly expenses, both of which you can easily alter.

The one-time startup costs include:

- Inspections

- Total repair costs

- Furniture and appliances

- Closing costs

And the recurring monthly expenses include:

- Insurance

- Utilities

- Property tax

- Maintenance

- Property management

- HOA dues

- Rental income taxes

- Cleaning fees

Mashvisor’s rental estimate calculator allows investors to enter different types of expenses and determine their impact on the rental income.

Step 4: Edit the Data as You See Fit

Mashvisor’s rental estimate calculator computes one-time and recurrent expenditures connected with purchasing, operating, and renting out an investment property, as we mentioned.

In addition, you may experiment with different numbers and choose the optimal financing approach based on the outcomes. Modify the amount of the down payment, for example, and the rental estimate calculator will recalculate all figures connected to the investment.

It comes in handy, especially when you’re deciding on an investment strategy. The rental strategy is one component that influences how successful an income property will be as a real estate investment.

Here, you may out rent the property homes through traditional means or Airbnb. In addition, rental revenue, occupancy rate, costs, cap rate, and cash on cash return vary by rental method. So, again, you will need a rental estimate calculator to determine the best rental plan.

Step 5: Make a Decision

Mashvisor’s rental estimate tool also assists you in determining the best rental strategy for your income property. And it’s pretty simple. The platform divides all data into two groups based on the rental strategy: traditional and Airbnb data.

The tool will inform you which rental plan is most lucrative based on the real estate investor’s feedback and the area and property analysis.

Moreover, the data provided by Mashvisor for such rental properties can help novice investors focus on the potential for profit while avoiding many of the risks involved with investing in them.

With such a comprehensive tool, you can be more than sure that your property will be profitable in the long run. However, there are more options for you if you wish to explore more.

Other Features of Mashvisor

We’ve covered the major benefits of Mashvisor’s investment property calculator, but that’s not all it can offer. If you opt to use the platform, you’ll also be able to access and try some of the following features, such as Neighborhood Analysis and Rental Property Analysis.

Related: A Step by Step Guide to Rental Property Analysis

Conclusion

One of the most profitable opportunities in the US real estate market is investing in a rental property. It requires that investors thoroughly understand the real estate sector and stay current on trends and statistics.

The good news is that the rental estimate calculator will simplify the procedure, boosting your chances of success.

So, whether you’re a new or an experienced investor, Mashvisor’s rent estimates are reliable. Furthermore, the platform’s rent estimate tool helps you to evaluate your potential return on investment and cash flow.

To start using Mashvisor’s real estate investment tools, sign up for a 7-day free trial today, followed by 15% off for life.

FAQs

How Do You Calculate Rental Value?

The easiest way is to use a rental estimate calculator like Mashvisor’s. However, there are also some traditional ways for it. The rent you charge your residents should be a proportion of the market value of your house. Usually, landlords charge rentals ranging from 0.8% to 1.1% of the home’s worth.

How Do I Calculate Rental Rates in My Area?

By using a rental estimate calculator. For example, Mashvisor provides a rental estimate tool that can give you insight into the comparable rates in your area and your ideal rate, among other things (rental strategy, expenses, rental income, and more).