Unilever appears prepared to take a hit on volumes from pricing to combat inflationary input costs but in doing so is losing market share.

However, for a limited time only, was CEO Alan Jope’s response to Unilever’s moves on price translating to 53% of market share wins in the first half, down from 58% in the opening three months of its fiscal year.

The FMCG major saw group volumes drop 1.6% on the back of a 9.8% increase in pricing, with the second quarter more pronounced – a 2.1% volume decline based on pricing growth of 11.2%. Volumes were down 0.9% across the food and refreshment division in the first half linked to price increases of 8.3%.

Fielding analyst questions today (26 July), Jope explained his stance: “We are pricing ahead of the market, and we’re prepared to tolerate low single-digit volume declines and some compromise on competitiveness for a limited period of time in order to land that price. We want to keep it above 50% but our priority actually is the ability to continue to invest in our brands. We are careful not to push pricing levels to a point where we compromise the long-term health of the business.”

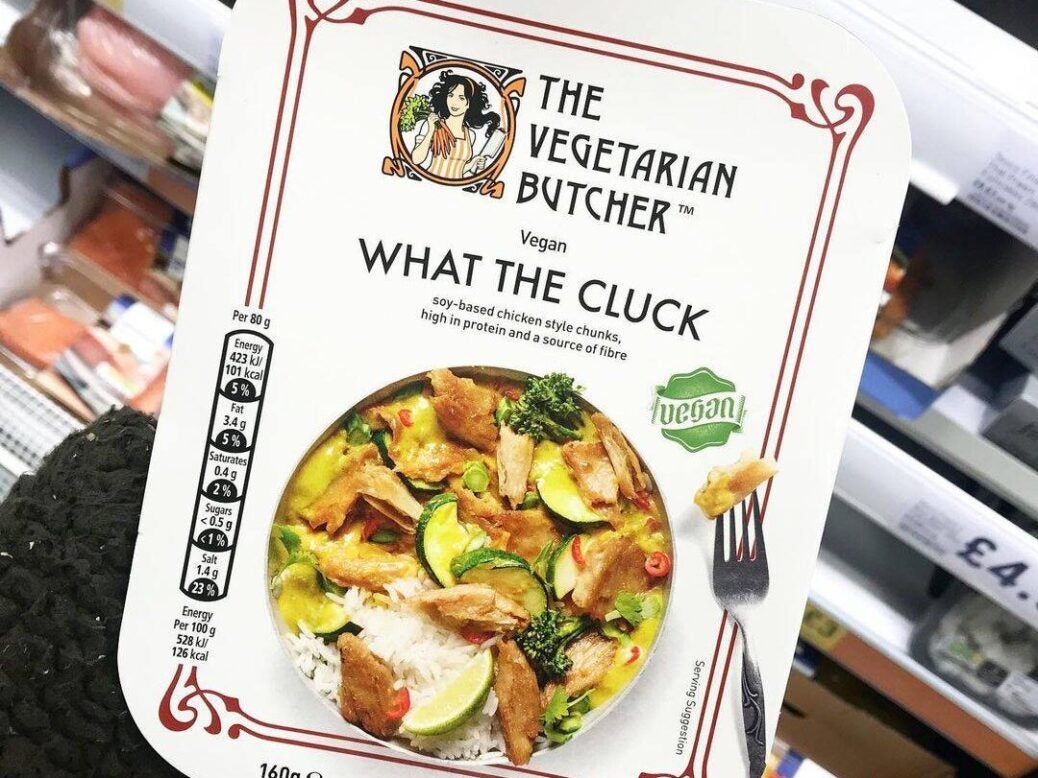

While Jope said some commodity spot prices have eased in “recent weeks”, the Marmite and The Vegetarian Butcher brand owner continues to face “record levels” of input-cost inflation, with a peak not expected until “sometime” in the second half of the year.

He emphasised how the risk of recession is starting to hurt consumer confidence, affecting “spending patterns” and purchasing behaviour.

Jope added: “We have a playbook, which has been fine-tuned in high-inflation markets over the years. It starts with precision pricing taken quickly and single-mindedly to protect the shape of the P&L and retain our ability to invest behind our brands. This is the correct strategy, even if it results in low single-digit volume declines in the short term.”

Pricing has also not yet been fully felt, with a further loss of volumes anticipated for the second half. Price increases have weighed on Unilever’s operating margin, which fell 200 basis points in the first six months to 15.2%, while the more closely watched underlying measure dropped 180 points to 17%.

Jope explained: “I anticipate that second-half volumes will be down by more than first-half volumes as the full impact of pricing lands. But I can also assure you that we are watching pricing category by category, brand by brand, country by country.”

Further pricing has not been ruled out either. “We would expect pricing in the second half to carry on in a similar territory to where we are right now, and that does mean that we’ll have to land some further sequential price increases in the second half to maintain that level of pricing versus a year ago,” the CEO said.

Unilever has been through some tough negotiations with retailers to get pricing through, an issue that led to a stand-off in the UK between Tesco and Kraft Heinz last month.

“I think there’s a sober and rational tone to the engagement,” Jope said. “Our US retail partners similarly have a strong growth mindset despite pushing back on price increases, but there’s a rationality in the discussions at the moment where everyone recognises the external environment.

“And, in Europe, we’ve been through now the intense period of price negotiation. We think we’ve come out in a balanced position. And I would say of all the issues that we have to deal with, there will still be patches of disagreement with our retail partners.”

Unilever still notched up underlying sales growth of 8.1% in the first half, with reported sales of EUR29.6bn (US$30bn). The underlying sales from the company’s food and refreshment division were up 7.3% at EUR11.4bn.

Underlying operating profit was up 4.1% for the group as a whole at EUR5bn.

Unilever’s guidance for its annual underlying sales growth was raised to “above” a previously expected range of 4.5% to 6.5% for the year. The operating margin, on an underlying basis, is envisaged at 16%, within the guided 16% to 17%.

Finance chief Graeme Pitkethly said commodity hedging has reduced uncertainty around pricing for the second half, with forward expectations around full-year input-cost inflation lower than the EUR4.8bn predicted in April.

Of the new EUR4.6bn outlook, Pitkethly said EUR2bn was already “baked” in during the first half. For the remainder of the year, “80% is now covered through contracts and inventories and hedging, reducing the levels of uncertainty for the second half, but also meaning that it takes a little time for spot price falls, if they’re sustained, to enter fully into our cost base”.

He added: “We are expecting to hit peak year-on-year inflation in the second half, and therefore, we will continue to price responsibly while managing consumer demand elasticity and competitive dynamics.”