Investors can help keep cash flow consistent while obtaining the finest, most qualified renters by running effective short term rental comps.

Table of Contents

- Is Owning a Short Term Rental Worth It?

- What Are Short Term Rental Comps and Why Are They Important?

- How to Run Comps on Airbnb

- What’s the Easiest Way to Find Short Term Rental Comps?

- Conclusion

It’s generally reasonable to say that every landowner wants to acquire the maximum possible rent. Nevertheless, desiring something and achieving it are two separate things, especially when it comes to real estate.

In addition to learning every detail about rental comps, in this article, we’ll talk about how to use Mashvisor’s short term rental comps feature. We’ll also discuss how to ensure that your investment property is as lucrative as possible by keeping rentals high and tenant turnover minimal. Let’s get started.

Is Owning a Short Term Rental Worth It?

To put it simply, yes, short term rentals are pretty profitable. There are a few reasons why that’s the case.

The primary benefit of purchasing short term units is the potential rental income. Nowadays, more travelers choose vacation homes offered on sites such as Airbnb and VRBO than hotels. Aside from being able to access an entire home, vacation rental properties are often less expensive for visitors.

Moreover, another point to think about investing in such properties is the ability to establish your own pricing. To optimize your profits as a host, you can adjust the rental charge based on demand and seasonality.

If we are talking about property upkeep, you exert more control over your home, unlike with long term rentals. You will be able to check in on your property frequently, clean it, and do any necessary maintenance.

In the end, short term rental properties allow you to meet individuals from various backgrounds and from all over the world. Such a side of the business might be appealing if you enjoy meeting new people and learning new stuff.

How Profitable Are Short Term Rentals?

They are very profitable. You can generate a substantial income from short term rentals, ranging from a few hundred to a few thousand dollars every month.

Although individuals see short term rental properties as a type of passive income, they require real estate expertise, time and financial investment, and excellent communication skills. However, with proper management and market-friendly factors, such an investment can become a profitable business that generates thousands of dollars yearly.

To maximize the profitability and value of your short term investment, study the five factors listed below before buying properties.

1. Property Taxes

Property taxes vary significantly from state to state, county to county, and even city to city. It is critical to understand the property tax rates that you will get on a specific property since higher taxes ultimately lower profit margins.

2. Location

The location of an Airbnb property significantly influences the type of customers and the rental amount you can charge. For example, a high-rise apartment complex in downtown will attract a different clientele than an older condo complex near a university campus.

3. Area Efficiency

Another thing to consider is how other units in the neighborhood are doing. If there is a significant vacancy rate within local rentals or if local units offer lower-than-average rental prices, it might indicate that the area is in decline. It means that people are relocating to more attractive places.

4. Surrounding Environment

Consider where the property is situated. Numerous renters will pay for services such as public transportation, quick access to an interstate, public parks, gyms, retail centers, and others. Moreover, accessibility makes a home more appealing to potential tenants and reduces vacancy rates. It also allows you to raise rental rates.

5. Local Labor Market

A strong local job market indicates good potential for property income. As more people come to a town or city, the prospective renter pool grows as the demand for housing rises. As a result, vacancy rates are lower, which tends to raise the local rates.

Related: Learn How to Calculate Vacancy Rate for Rental Property

Can You Claim Depreciation on Short Term Rental?

Yes, you can. However, for starters, you should determine if your property is eligible for depreciation deductions.

If you own real estate properties, you’re probably using a tax plan that includes depreciation deductions to maximize your savings when you report. Depreciation deductions on your income tax return might help you recover part of your property purchase price.

And when it comes to short term rental comps, investors can still utilize depreciation deductions to reclaim the cost of their real estate. However, the regulations for short term rental depreciation are different from the traditional tax approach.

Now, why would investors care about such an issue? Simply put, real estate depreciation might help you save money on taxes. Let’s see how it works with short term rentals.

Considerations for Depreciation

Real estate depreciation is an essential tool for landlords. It allows you to deduct the costs of purchasing and renovating a property from your taxes during its life span, lowering your taxable income in the meantime.

When deciding on a depreciation plan for your Airbnb property, you must examine the property’s qualifications and category. Moreover, to optimize tax savings, you should also explore alternative depreciation deduction strategies.

To begin, you must be aware of the IRS’s eligibility standards for depreciation deduction properties. According to the IRS, qualified properties must:

- Be utilized in a revenue-generating or business activity

- Be owned by you

- Have a minimum lifetime of one year

- Have a limited useful life (meaning it will wear out after a specific time)

- Can’t be categorized as excepted property

If your property qualifies for depreciation deductions under IRS guidelines, you can look into the details of short term rental depreciation. Evaluating deductions, whether you need to submit self-employment taxes, and whether you generated passive or active activity are all examples. Each of the said factors influences your tax filing technique.

Since depreciation is calculated as a percentage of an asset’s cost, you should acquire an asset only if it is guaranteed to be utilized in the business long enough to generate money. Otherwise, the proeprty’s depreciation will just continue, and your profitability will suffer. It results in a situation where you are unable to derive value from such an asset.

Related: Everything You Need to Know About Depreciation on Rental Property

What Are Short Term Rental Comps and Why Are They Important?

Rental comps are properties situated in the same real estate market and area as the one you own or want to buy. They may be long term investment properties (traditional comparables) or short term income properties (Airbnb comparables).

Similar to traditional ones, Airbnb comps are listings with comparable characteristics to yours and can help determine the value of your short term rental property. If you’re currently an Airbnb investor or considering becoming one and purchasing a vacation rental, you must identify and evaluate comparable properties.

Ultimately, it will tell you how profitable your vacation property is compared to others in the same neighborhood. It is the only way to ensure that you set a reasonable rental rate that will return a profit.

Therefore, the quick answer to why researching and using traditional and Airbnb comps is critical is because they will help you compete in the local rental market and flourish as an owner or host.

Now let’s see how actually to find them and analyze them.

How to Run Comps on Airbnb

The first step in locating rental comparables is deciding what metrics to look for. The comparables should be substantially similar to the property under consideration to obtain an accurate rental estimate.

Consider the following property features:

- General condition

- HOA presence

- Furnishings

- Square footage

- Number of floors

- Year of construction

- Property type

- Number of bedrooms

- Number of bathrooms

- Neighborhood

- Amenities

Moving on, here is a step-by-step on how to run comparables on the Airbnb platform.

1. Market Analysis

Begin by browsing Airbnb for comparable apartments in your neighborhood, keeping in mind:

- The type of your property

- The number of visitors you can host

- The number of bedrooms that you provide

- Your accessible amenities

Remember to check several future dates. Listings with competitive rates tend to book up faster, so avoid comparing against homes still available only a week or two away. They are probably the ones that didn’t book because they were overpriced.

2. Location and Amenities

Remember that everything you consider in your price may not be apparent to your guests. For example, the safety and charm of your area may mean little to someone unfamiliar with it. So, make sure to mention them in your listing.

In addition, breakfast or a welcoming basket full of delights may also help you justify a higher price, but you’ll need to clarify them in your description and images.

3. Good Pricing

Visitors are hesitant to reserve listings with no ratings. So, placing your pricing somewhat lower than your target amount is a good approach for new hosts to attract guests.

Once you’ve received a few positive reviews, you can boost your pricing to meet the demand in your location. Moreover, competitive pricing might also help your listing rank better in search results.

4. Smart Pricing Tool

If you don’t like doing everything yourself, you can try the Smart Pricing feature on the platform. The tool considers over 70 distinct parameters and the controls you’ve selected to calculate the optimum price for each open night on your calendar.

Your price will be automatically updated based on factors such as:

- Local popularity

- Lead time

- Seasonality

- Review history

- Listing popularity

You should never forget to set a minimum desired nightly fee in the tool to ensure that your listing price always fits your demands. Moreover, if you’re not satisfied with the interest rate established by the tool, you can enter a new one into your calendar.

Related: The Complete Guide to Making Your Listing on Airbnb Stand Out

What’s the Easiest Way to Find Short Term Rental Comps?

Several sources are available for locating rental comparables. However, many of the old approaches come with significant drawbacks for a real estate investor. To begin, manually obtaining data might take days or even weeks. You must also enter the information into a property investment analysis spreadsheet, which takes time and is prone to mistakes.

Listed below are several methods for locating rental comparables, both offline and online. Here are some popular traditional solutions:

- Speaking with local property management companies

- Employing a leasing agent

- Speaking with local landlords or hosts

- Doing it all by yourself

- Using rental platforms

But the easiest way to include rental comps search to your overall real estate strategy is to use Mashvisor.

Using Mashvisor to Find Rental Comps

Regardless of your real estate background, Mashvisor’s rental property calculator allows you to obtain and compare traditional and short term rental comps in a couple of minutes.

To begin, you must choose an income property that fits your budget and meets your investment criteria. The criteria can be property type, cash flow, cash on cash return, income, desired rental approach, and others.

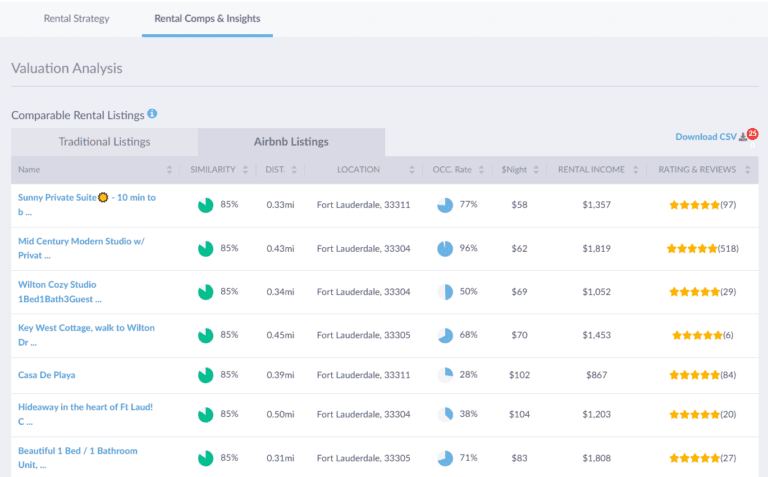

You can simply locate similar properties on the real estate software platform, or you can input the location of an off-market property. When you select the Rental Comps and Insights page, you’ll be presented with a selection of similar Airbnb and traditional properties.

Mashvisor’s traditional and Airbnb data and records are all precise. They come from various credible sources, such as Airbnb (verified listings only or listings with at least three positive reviews).

You will be able to view the following metrics for each Airbnb comp:

- Address

- Percentage of similarity to the property you are analyzing

- Distance from the property you are analyzing

- Occupancy rate

- Daily rate

- Monthly rental income

- Rating and Airbnb reviews

The property calculator comes with an outstanding feature that lets users download the list of rental comparables as a CSV file. As a result, you can quickly access them anytime you want and share them with real estate specialists in your network to gain further insight.

You can go to Mashvisor’s Rental Comps & Insights page to look at different properties and compare them based on several metrics.

Conclusion

It is critical to obtain strong short term rental comps if you want to increase the value of your investment. Rent comparisons assist you in determining the fair market rent for units similar to yours.

Once you’ve determined the Airbnb comps, you’ll be in a good position to rent your home for the greatest possible price. It is a price that is suitable for renters who will most come back to your rental place if they get the chance.

Now, in 2022, collecting reliable data makes starting a rental property business easy for everyone, regardless of experience. If you’re wondering how much to charge for rent, Mashvisor’s rental property calculator might help.

To start using Mashvisor’s real estate investment tools, sign up for a 7-day free trial today, followed by 15% off for life.