If you wish to learn more about how to find multifamily investment properties and add them to your investment portfolio, here’s a guide.

Table of Contents

- Is Buying a Multifamily Home a Good Investment?

- What Is a Good ROI for Multifamily Properties?

- Evaluating a Multifamily Investment Property in 5 Steps

- How to Find Multifamily Investment Properties: Conclusion

Recently, multifamily homes have become a huge point of interest for investors.

The main reason for considering adding a multifamily property to their investment portfolio is that it can easily boost their income—and reduce the vacancy rate simultaneously. That’s an attractive combination of benefits and rewards; no doubt about it.

There is also the option of the investor living in one of the available units—something known as an owner-occupied income property—and renting out the others.

But the fact that they’re so desirable among investors means that it can be tricky to find such properties in the real estate market. There are fewer multifamily houses available—and they show up in listings much more infrequently. And if you don’t quite know how to find such properties—or navigate the US housing market, in general—you might be in for a bumpy ride.

That’s why today, we’re tackling the topic of how to find multifamily investment properties and make your plans a reality.

By the end of today’s guide, you’ll learn more about this type of investment property, the ROI you should aim for, how to find and evaluate multifamily properties, and so much more.

Scroll down for more information.

Is Buying a Multifamily Home a Good Investment?

The “quest” to find multifamily homes has indeed become a lucrative endeavor for real estate investors—and yes, there is no doubt that they can be potentially profitable investments in 2022.

How did it happen?

To understand the reasons behind the growing interest in the multifamily sector, we must first briefly go over what multifamily properties are.

In short, they are residential properties that contain more than one housing unit. Duplexes, condominiums, and apartment complexes fall under the “multifamily” category.

Until recently, real estate investors have primarily focused on how to find and invest in single family homes, as they have shown to be the most profitable option for maximizing returns and securing a passive income.

Yet, many are making the leap from single family to multifamily housing.

The migration between cities and the people’s need for a sense of belonging and being a part of a community have been some of the main reasons for this evident “switch” in real estate trends.

Plus, you need to factor in millennials, who currently dominate the rental market and seem to prefer the flexibility of rental housing over the costs of purchasing single family homes. That, and the fact that they can still work from home, is a substantial contributing factor.

Due to all that, even throughout the COVID-19 pandemic, the multifamily housing market in the US continued to show resilience. Also, investors saw a rising interest in suburban houses—or, more specifically, multifamily housing—at the beginning of the pandemic. Even in 2022, the suburbs remain a popular choice.

There’s simply a need for open layouts and buildings that contribute to a sense of peace and community—and that’s where multifamily homes fit right in.

Related: Single Family vs. Multifamily for Sale: What’s the Best Investment Property Type?

Why Invest in Multifamily Investment Properties in 2022?

The real question real estate experts should be asking is not so much how to find such properties but “Why is investing in multifamily properties in 2022 a good idea?”

We can go on and on about the benefits—more accessible financing, a chance to expand the portfolio, tax benefits, and better insurance policies, to name a few. Instead, we’ll focus on a few reasons why, as a real estate investor, you should strongly consider this option in 2022.

Sense of Community

The strongest reason and motivator for investing in a multifamily property would be a sense of community and familiarity among the tenants. Now, you can argue that it is more about the tenants than it is about the investors—but allow us to elaborate:

People are actively looking for efficient ways to find multifamily homes—and if you’re able to meet that demand, you are looking at considerable cash flow each month.

We get that spending time on different ways to find and the entire process of investing in the multifamily units may seem challenging and energy-draining at first thought. However, the key is in the proper organization and developing a strategy for your investment.

For starters, it’s important to recognize who your target tenants will be and ways to find them. So, if you end up buying a multifamily property, you can advertise it as “family-friendly.”

That way, your tenants will not only be familiar with each other, but they will develop a strong sense of belonging, too, having similar backgrounds and preferences.

Family-friendly properties are not the only option, though. There are many other alternatives, such as multifamily properties aimed at retirees, and so on.

Downsizing

Unfortunately, not all people are in the position to make their dream of finding a home come true; many won’t even qualify for a loan. And even though the US housing market is a huge one, the prices for residential properties are still skyrocketing.

People still need a place to live, though.

Families that have failed in their mission to find and purchase a single family home or get approved for a loan will most likely turn to multifamily buildings—primarily because of cheaper leases. And that is an opportunity for you.

You’ll have a larger pool of tenants, which may reduce vacancy rates and, in turn, lower the risks associated with your investment.

Investment Mechanism

Another perk of investing in multifamily properties is the “mechanism” through which you can realize your investment.

For example, you can invest in a multifamily property that you located and evaluated on your own. That’s, of course, much easier for seasoned real estate investors with experience in the management and distribution of finances.

Another option would be doing it through a partnership. If it’s an investor you’re working with, it means teamwork and sharing the costs—and the returns, of course—you might make in the process.

Note that you can also decide to invest through real estate syndication. It would allow you not only to find properties more easily but to reap the benefits from it—while enjoying a more passive role in the partnership.

Related: The 10 Best Real Estate Websites for Investors in 2022

Risks of Investing in Real Estate in 2022

The many advantages and the rising interest in multifamily properties are hard to deny. Still, there are certain downsides to investing in such properties:

Management Skills

Right off the bat, there’s the issue of property management. It is probably the first thing you should consider when thinking about your next investment journey—long before you start learning about finding multifamily units.

You’ll need strong management skills if you’re serious about multifamily properties. You’ll be dealing with more than one group of tenants, meaning you must make time for each and deal with unexpected problems.

Also, it implies more time on the field. You’ll be visiting your property more frequently than if you just invested in a single family home or an apartment unit, for example.

The good news is:

You can opt for the “owner-occupied property” approach, which may make dealing with some issues much more straightforward.

You can hire a property manager if you don’t want to be involved too much, though.

Price

Depending on where you look, prices for multifamily homes differ significantly.

For example, if you’re aiming for a more luxurious and busy area—such as San Francisco, NY, or Boston—the prices for such types of properties can easily reach millions of dollars. So, it may not be possible to get back on your feet immediately and balance your expenses and profits.

And on a related note, most lenders will require at least 20% for the down payment—which may be an unimaginable figure for some.

Competition

As we’ve already hinted, multifamily properties are bait for experienced investors, and they will be fighting and going neck-to-neck to find a profitable deal.

In other words, the competition will be tough. And the fact that multifamily listings are not as common doesn’t help, either.

How to cope with fierce competition?

Doing high-quality research and building an investment network that will allow you to tap into others’ knowledge and expertise play a significant role here. Investors who have been in the game for a long time enjoy a considerable advantage in this department.

What about newbie investors?

Well, for them, the best way to find multi-property homes is to partner up and invest in the properties together.

What Is a Good ROI for Multifamily Properties?

Determining a “good” return on investment (ROI) is difficult due to the fluctuating real estate market climate in the US. That said, 7% to 10% ROI is considered “desirable” for multifamily properties.

Return on investment is a popular real estate metric used to evaluate the profitability of your investment property more closely. To be more specific, ROI aims to provide some insight into the exact return of the investment relative to the cost.

Here’s the ROI formula:

ROI = (Investment Gain – Expenses) – (Cost of investment)

You must bear in mind that calculating ROI will not necessarily lead to a positive return. It is highly influenced by property management—and other factors, as well.

In case there is any doubt about it, the following fact confirms the fact that multifamily homes do well as investments:

The 1-year ROI for multifamily homes is 7.6%. And according to the latest reports, small apartment buildings and multifamily homes provide significantly better returns than large complexes.

That brings us back to something we noted at the beginning. Suburban homes and complexes offer a much better investment opportunity—and more room for profit.

Related: How to Increase ROI on a Rental Property

Evaluating a Multifamily Investment Property in 5 Steps

If you’re interested in investing in multifamily homes, that’s great. But first, you should take a moment to learn how to analyze the potential profitability of the property.

Listed below are the five steps that you can follow:

Step 1: Research the Location

With multifamily homes, researching the location is of the utmost importance.

On that note, your primary goal should be to find an area with different amenities. They include schools, retail shops, and job opportunities, among other things.

The location should meet the above criteria—but above all, it should be quieter and more community-oriented. Given that your target tenants here will be families, the emphasis should be on the feeling of “belonging.”

Step 2: Calculate the Cap Rate

The capitalization rate—or cap rate for short—is another standard real estate metric to keep in mind as you move forward. Much like the ROI, it refers to your return rates based on your net income.

Here’s the formula for the cap rate:

Cap Rate = Net Operating Income / Current Market Value of Asset

But unlike the ROI, investors shouldn’t strive to find a property with a high cap rate. The thing is, buildings and apartment complexes with higher cap rates are perceived as riskier. Following that same logic, low-risk areas are generally characterized by lower cap rates.

The average cap rate goes from 4% to 10%. So, it would be wise to perform a more in-depth analysis if you encounter a cap rate that falls outside the given parameters while doing market research.

Step 3: Calculate the Costs

Since you’ll be dealing with a much larger property here, the costs that you will encounter on a daily basis must be taken into account—and analyzed thoroughly.

Here, we’re mainly referring to operating expenses that are important for multifamily homes:

- Utilities

- Repairs

- Insurance

- Property tax

- Landscaping services

- General maintenance

So, do a detailed breakdown of all relevant costs and then see how they relate to your current financial situation—and, more importantly, the estimated income of your multifamily property.

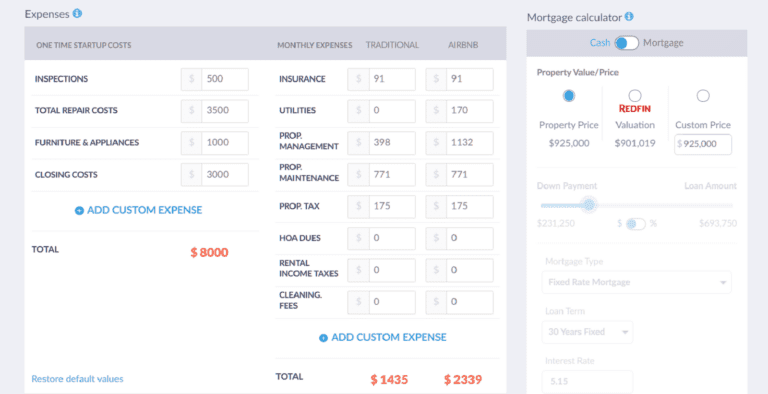

One of the steps involved in evaluating a multifamily investment property is preparing a detailed breakdown of all relevant costs and determining its impact on your current financial situation.

Step 4: Do a Comparative Analysis

As an inevitable part of your research, you should conduct a detailed comparative analysis.

Take the multifamily property you are interested in and compare it to similar units in the area and beyond. See if the prices line up—and whether the owner has overpriced or underpriced their property.

It should give you insights into how much the potential investment property can contribute to your cash flow—and whether it will be positive or negative.

Step 5: Ask Questions

We don’t mind guiding you through the process of how to find a multifamily property. But at the end of the day, it’s up to you to stay “curious” about the property in mind.

So, as you do your research, make sure to ask as many questions as possible. It involves talking to fellow investors who are currently interested in—or have previously dealt with—such a type of investment.

Also, be sure to talk to the current owner of the property—the seller—and focus on questions that have to do with their reasons for selling the property. Is the owner selling an apartment complex because they’re retiring—or perhaps because it is not generating any profit?

They’re something you’d want to know before putting money on the table.

How to Find Multifamily Investment Properties: Conclusion

We’ve completed the topic on how to find multifamily investment properties. Here’s what you’ve (hopefully) picked up from the info we’ve laid out—and what you should take away from this guide.

By definition, multifamily properties are residential properties with several units. Despite the pandemic’s impact on the US housing market, the popularity of such investments is not slowing down.

Investing in multifamily properties is a good idea for two reasons: people who don’t qualify for a loan and people who are moving from big cities.

A good ROI for multifamily houses would be higher than 7%. However, it’s just one of the many factors you should analyze during your search. You should also examine the locations, cap rates, and operating costs you’ll come across while managing this type of property.

And although the boost in income can be tempting, the competition and prices are one of the biggest obstacles when developing your investment strategy.

You can still be on top of your game by relying on Mashvisor’s Property Finder to assist you in your search. So, when it comes to how to find multifamily houses, use our tools to pinpoint profitable investment locations across the US housing market.

Sign up for a free 7-day trial of Mashvisor today, followed by 15% for life.