As the US housing market stays savagely unhealthy, doing a single family rental market analysis properly has become more important than ever.

Table of Contents

- Should You Invest in Single Family Homes for Rent in 2022?

- What Is a Good ROI on Single Family Homes?

- What to Consider When Finding a Location to Invest in

- 5 Steps on How to Do a Single Family Rental Market Analysis

- Conclusion

There is a shortage of single family rental properties in the US housing market, which has been pushing rents up steadily for a while now. But when it comes to single family homes as an investment, they have always been tough to beat. Compared to cash, bonds, and stocks, the housing industry has always generated a consistent and impressive amount of wealth for investors.

Through rental income and appreciation, single-family US rentals continued to bring excellent returns during the past 15 years. Recent single family rental market analysis results show that, since 2010, these rental units have increased by around 3% per year. In the third quarter of 2021, these properties recorded the quickest yearly increase in the past 16 years.

Keep reading to find out what you need to know about single-family rentals in the state of the housing market 2022.

Should You Invest in Single Family Homes for Rent in 2022?

Even in difficult times of recession, historical data shows that single-family homes have always delivered excellent returns and recorded growth. But what you probably want to know is, what is creating that continuous growth? According to recent single family rental market analysis reports, renting a home has become a more popular and common choice among the family types and age groups traditionally more likely to own their home. This may be due to a preference for flexibility, higher lending rates, and rising home prices.

The Millennial generation is also a generation of people more inclined to rent their homes rather than buy. Even though they have a high enough income and necessary downpayment to make a purchase, many Millennials find that renting is their only option. According to a recent RentCafe study, high-earning Millennials submitted about 39% of all rental apartment applications in 2021. During last year, their share of rental applications grew by 20%, while the share of Gen Xers and Baby Boomers recorded a 12% and 7% growth, respectively.

Why Invest in the Single-Family Rental Market?

American rental homes bring numerous advantages to the table when compared to other property types. The tenants often have a better sense of ownership, while the houses are easier to buy and manage. If you’re thinking about whether a single-family rental is a smart investment, here are a few key reasons why they make a lot of business sense.

Investors Are Jumping Into the Homebuilding Business

Big investors and landlords are entering the homebuilding business because the demand for single family homes for rent is increasing. It means that rent in America is going up, so they’re trying to supplement the lack of inventory. And since more Americans have the flexibility to work from home, they’re searching for larger spaces to live in.

In the first quarter of 2022, there were about 13,000 new single-family properties that were listed on the rental market, which is an increase of 63% compared to last year.

There has also been a dramatic increase when it comes to investing in single-family rentals (both building new and buying existing homes). In 2020, $3 billion were invested in this housing industry sector, while the number topped at $30 billion in 2021. The projections say that, in 2022, the size of investments is going to reach $50 billion because landlords, homebuilders, and institutional investors are rushing into the single-family rental home market.

Related: A Guide for Investors on Buying Land for Home Building

You Can Get a Loan to Pay It Out

If you don’t have enough money to spend on a property, you can always leverage your purchase. In this investment practice, the investor uses borrowed funds to increase their returns. You can make it happen with a VA loan, conventional mortgage, or a hard loan from a private investor. The borrowed money will be paid out from the rent, while the property will continue to appreciate and its value will go up.

Learn More: The Complete Guide to Rental Property Loans

Source of Stable Income

Instead of just buying a property and waiting for its value to appreciate before reselling it, buying a single-family home to rent out will provide you with a stable income. You also won’t have to worry about the upkeep of your investment if you require these from your tenants in your rental agreement. Tenants living as families are usually dependable and are likely to take care of the property they live in. They also typically rent a place for the long term, so you won’t have to worry about tenant turnover.

Investment Is Less Volatile Than Stocks

Over the past 25 years, single family rental market analysis has shown that average annual returns from such rentals were almost identical to bonds and stocks. However, they were also far less volatile. For example, stocks had an average annual return of around 35% between 1992 and 2017, but during their worst years, they plummeted by the same percentage. On the other hand, single-family rental properties had an annual return of 17.5% and declined by just 2.5%, which means that their returns were more reliable.

Single-family rentals are more secure than bonds and stocks because they are tangible assets that will always go up in value. They appreciate in value, provide a steady income stream through rent, and are inflation resistant. The median sales price of real estate properties increases at a faster rate than inflation, which allows investors to be a step ahead of inflation numbers.

To learn more about how Mashvisor will help you make faster and smarter real estate investment decisions, click here.

What Is a Good ROI on Single Family Homes?

In 2022, finance experts expect the average real estate ROI to improve, despite the fact that values haven’t risen as much as it was expected this January. Still, single-family rental homes continuously prove that they are the strongest sector for real estate investors. They deliver strong and reliable returns based on high prices, short supply, and sustained demand.

Let’s take a look at the recent iPropertyManagement ROI stats that can help your pre-purchase single family rental market analysis.

The average one-year return on a new single-family home investment is 1.32%. Last October, a new single-family house had a total net one-year ROI of $5,082.23. The advantage of single-family home rental properties is that they tend to have a lower vacancy rate and wear and tear than apartments.

- Single-family rental assets in the US total $2.3 trillion.

- The national average rent for single-family homes is $20,904 per year or $1,742 per month.

- The total net ROI of an average single-family rental is $10,637.

- The total ROI for a new single-family rental is $15,534.

- The lowest vacancies in May 2022 have been recorded in Rhode Island, New Hampshire, and Massachusetts.

- The highest rates of US rentals vacancy in May 2022 were recorded in Oklahoma, Kansas, and Alabama.

- The most lucrative single-family home market is in California, New York, Florida, and Connecticut.

Single-family property purchases usually appreciate in value over the long term, with local weather, maintenance, and location affecting the rate of return.

A good return on investment for single-family homes depends on how you calculate your ROI—if using the cash on cash return formula, a good ROI is 8–12%. If using the cap rate calculation formula, it’s around 10%.

What to Consider When Finding a Location to Invest in

When the time comes to perform your single family rental market analysis and narrow down the selection to the most lucrative properties, location is one of the deciding factors.

For instance, demand is always growing in expensive real estate locations, while supply is limited by regulations that limit residential developments and/or available space. Some of the most important factors that drive up prices and increase demand are:

- Mild or moderate climate. In such climates, the temperatures are pleasant across the whole year. No blistering summers or need to shovel snow in the winter (e.g. California).

- Thriving cities. Cities with high safety ratings, good job opportunities, infrastructure, and entertainment are always attractive for home renters. Prices in such areas always rise when inventory cannot keep up with the demand.

- Excellent schools. Single-family homes in school districts that enjoy great reputations for their quality of education and post higher test scores often come at higher property prices.

- Attractive geographical locations. Areas with popular rivers, beaches, lakes, and ski records usually command higher home prices. Wonderful scenic areas attract both tourists and real estate buyers, which eventually creates more competition for property between investors and homebuyers.

On the other hand, the features of neighborhoods with the cheapest real estate in US include:

- Few to no tourist attractions

- Less-than-ideal climates

- Non-thriving areas (usually rural)

Be sure to take into consideration all these factors when conducting your single family rental market analysis.

5 Steps on How to Do a Single Family Rental Market Analysis

Before we proceed with our step-by-step process of doing a single family rental market analysis, let’s explain what exactly is a rental market analysis.

What is Rental Market Analysis?

A rental market analysis (RMA) is a type of real estate analysis that aims to provide better insight into the state of the rental property market. Its function is pretty straightforward—by performing an RMA, you will be able to determine a property’s profitability. It provides insight into how your investment property can perform and what kind of rent you can expect to get from your renters.

How does rental market analysis work? It basically evaluates essential factors to help you figure out the rental potential of a specific property or area. It’s typically used for vacation rentals or long-term rentals, but not for properties intended for a fix-and-flip. Regardless of why you’re using it, the RMA process is more or less the same. So, if you’re looking for info on how to do a single family rental market analysis, keep reading.

How to Do a Single Family Rental Market Analysis

There are five main steps involved in the process of rent analysis. Once you’re finished, you should get a fair estimation of rent prices for a specific single family house for rent compared to similar properties in that area.

1. Evaluate the Neighborhood

This first thing on your checklist should be assessing the area the right way. In an ideal scenario, you’ll want to find a neighborhood that is full of respectful residents and offers good amenities. The factors you should pay attention to are:

- Low crime

- Good schools

- High walk score

- Access to parking spots or reliable public transportation

- Close proximity to attractions, parks, cultural events, and fun

- Enough malls, supermarkets, and restaurants

Overall, you should make sure that the area is safe, looks decent, and offers everything that a person needs to live there comfortably.

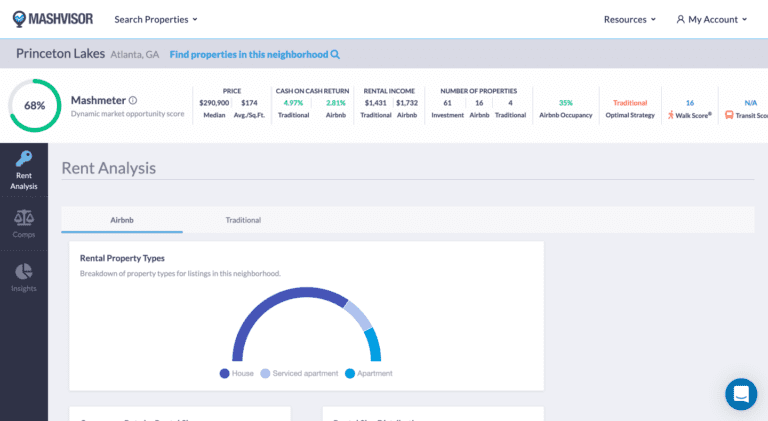

Mashvisor has a Neighborhood Analytics feature that helps you evaluate a neighborhood of your interest.

2. Find Rental Comps

The next step involves comparing the properties you got your eye on with similar single-family rental homes in the neighborhood. Look at the rents of those properties and adjust them based on amenities.

Factors to consider when comparing single family rental properties:

- Proximity to each other. They should be within a three-block radius (in urban areas) or within a few miles (in suburban and rural areas).

- The number of bedrooms and bathrooms. Needs to be the same as your target property; you should never compare a one-bedroom/one-bathroom home with a two-bedroom/two-bathroom one.

- Scope of the lot. This factor is pertinent in case of a single-family rental.

- Amenities. The comps should have similar amenities to your target home, but if not, you can adjust for them.

- Condition. The comps should also fall within the same category (e.g., original, updated, or distressed).

- Days on market (DOM). The property may have some type of flaw or is priced too high if it has been sitting on the rental market for longer than 60 days. Depending on the reason, you might be able to negotiate for a lower price by about 5%.

3. Estimate the Rent

How can you estimate the average price of rent in a neighborhood? We do it according to square footage, as well as the property’s condition and nearby amenities. These are all critical factors you should have in mind when setting the rent price based on comparables. For instance, if there is a pool, large yard, or sauna, you should rent it out for a higher rate than homes without such amenities.

4. Adjust Your Rent Price

After determining the average price of rent from the comparables you found, you need to adjust the cost of your single family rental home per square foot. First of all, your estimated rent for the property should be the rental rate of the house per square foot. However, if you take amenities and occupancy rates into consideration, you’ll have to correct your price accordingly. But how much exactly? It’s not that easy to estimate. It all depends on the city area, whether it has good security, and if the property has a dryer, washer, and other basic amenities.

Furthermore, the occupancy rate plays an important role because it reflects the home property occupancy during the year. If a property has under 90% occupancy, it’s considered low because it shows that it’s been vacant for 6 weeks each year. When investors conduct their single family rental market analysis and see a low occupancy rate, it’s a signal for them that there will be vacancy periods during which they’ll lose money.

Learn More: How to Set the Right Rent Price for Your Investment Property

5. Calculate the Property Cost

The final step for your single family rental market analysis is calculating the best purchasing price of your target single family rental property. To calculate this, you should take the rental price per square feet into consideration. This calculation will enable you to see if the investment can generate good cash on cash return and profit. Once you find a property that generates the best positive monthly return, you’ve found what you’re looking for.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Conclusion

Mashvisor can be your right hand when it comes to single family rental market analysis. Probably the most valuable tool you can find in our arsenal is the rental property calculator. It is a digital tool developed for investors to help them see if they should purchase a certain investment property or not. All the important metrics you need for making data-driven real estate investment decisions are here underneath your fingertips, available in a matter of minutes.

Also, you can use Mashvisor to find the single family house for rent to invest in by searching for and analyzing single-family homes. Our investment property search platform is always up-to-date with the latest rental data.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.