Economists are urging Americans to refinance to take advantage of historically low refinance rates. These low rates have been fueled by the Fed’s efforts to boost the economy and are not going to last much longer.

Savvy homeowners are taking advantage and striking while the iron is hot in order to maximize their long-term savings.

Lock in your rate now, before the Fed meets

- Refinance rates are at historical lows: The Fed is artificially suppressing interest rates in order to keep them low. Note that these rate-suppressing programs could end sooner than expected. Jerome H. Powell, the central bank’s chair was recently quoted saying “when the time comes to raise interest rates, we will certainly do that”.

- Rates will rise: It’s inevitable and it is only a matter of time before rates will start to rise again. They could even rise the next time the Fed meets. Bob Broeksmit, President of the Mortgage Bankers Association all but ensured they would rise stating that “with mortgage rates well below 3 percent but expected to rise slowly this year, many homeowners are acting now.”

- It can save you a lot: On average, in January 2021, LendingTree users saved over $38K on the lifetime of their loan by refinancing.

- Mortgage rates are tied to treasury bond prices: This means that treasury bond yield trends could raise mortgage rates. If bond yields increase, mortgage rates would also increase, says Matthew Speakman, economist at Zillow.

- There is no risk and it’s free to look: By using LendingTree, you can compare rates tailored to you and see how much you can save for free. Our easy to use form only takes 2 minutes and there is no hard credit pull.

When lenders compete you win. Get matched with up to 5 offers and calculate your new payment. Additionally, a recent study showed that shopping around can have more of an effect on a rate than a buyer’s credit score or down payment. Don’t miss out on this refinance opportunity and finally check off mortgage savings from your to-do list.

Here’s how to get started:

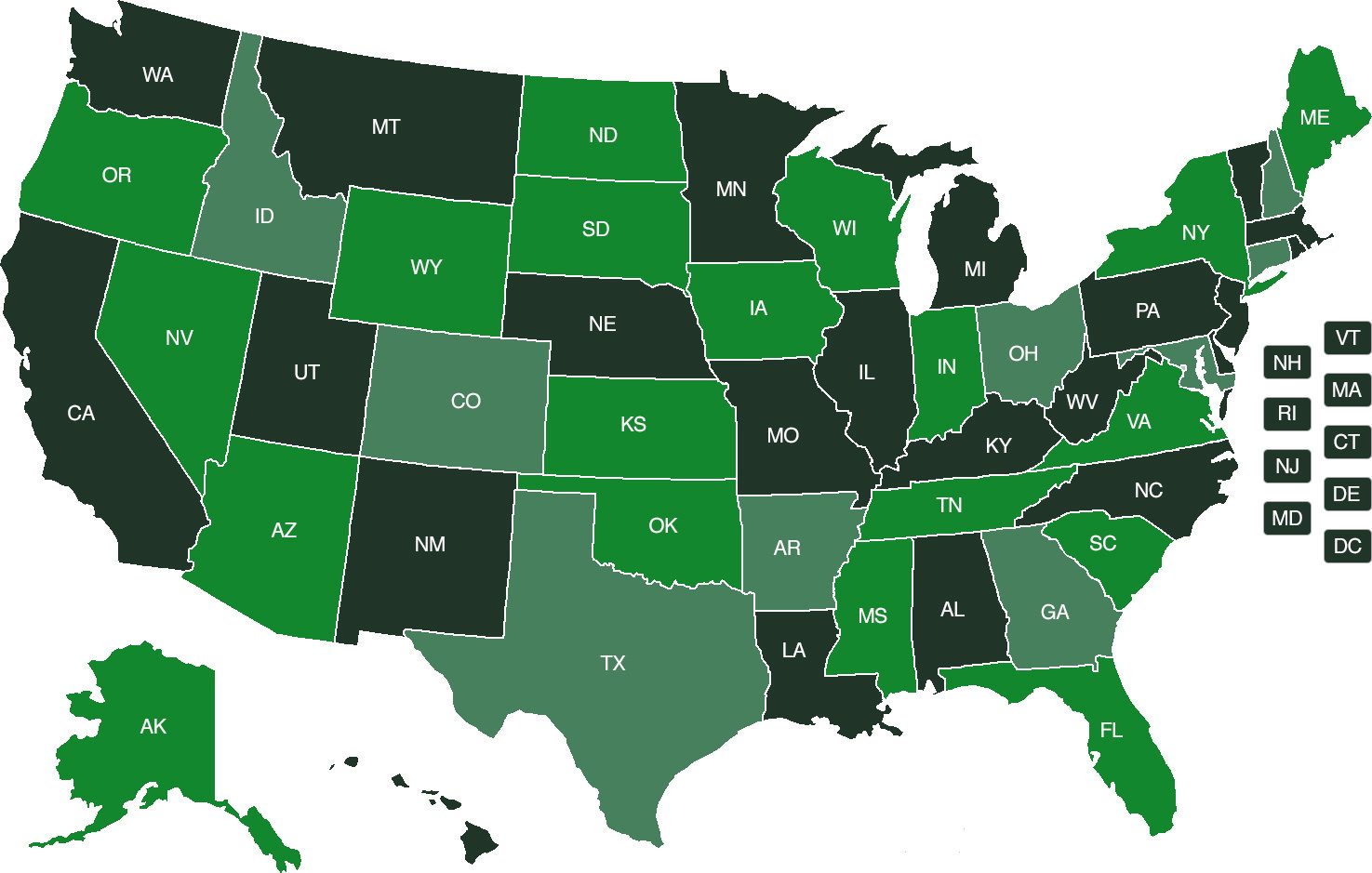

Step 1: Get started by clicking the map below.

Step 2: Once you go through a few questions, you will have the opportunity to compare the quotes from multiple lenders!