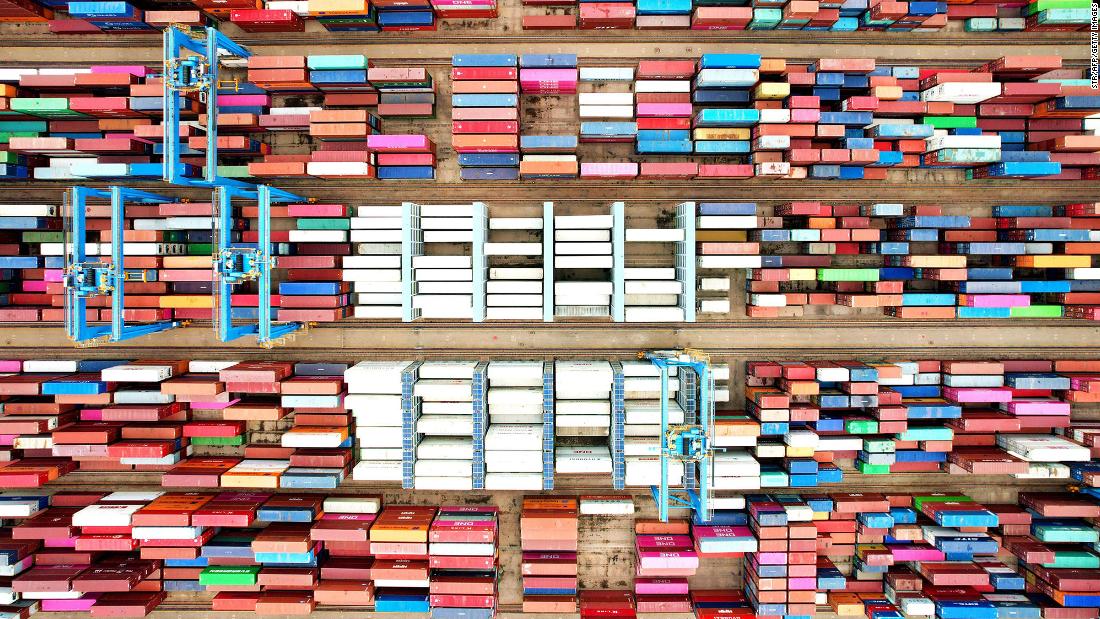

“These tariffs are adding to the cost of many goods that US consumers are buying,” Cohn told CNN.

“Overall, some of the tariffs make sense. But a lot of the tariffs just act as a consumption tax,” he said.

“There’s a variety of views on trade. My view on trade is pretty simple. If we manufacture something here in the United States, we should protect our manufacturers,” Cohn told CNN. “If we don’t manufacture something here in the United States, and we’re not going to manufacture here in the United States, I don’t believe we should put a tariff on it.”

Won’t solve inflation

“If you get rid of these tariffs, the price of those goods should go down,” Cohn said.

He conceded, however, that this won’t be a cure-all for inflation, which unexpectedly got worse in May.

“No one thing is going to solve inflation. We have to do as many things as we possibly can to try and lower prices,” he said.

Of course, there are bipartisan concerns about China’s trade practices. Unwinding tariffs could undermine efforts to tackle such problems as theft of intellectual property, illegal subsidies and dumping cheap products into foreign markets.

Asked if rolling back tariffs would reward China for failing to live up to its end of the deal, Cohn pushed back.

“Are we rewarding China? Are we rewarding US citizens because they’re going to buy these goods no matter what and we’re taking more disposable income out of their hands,” Cohn said.

‘Control our own destiny’

“Clearly, chips and computer chips are now the crucial limiting factor that go into so many goods that we all need as American consumers. It affects us in almost every part of our daily lives,” Cohn said. “It starts from the security of the country and the military equipment, all the way down to our everyday appliances that we have on our countertops and everything in the middle.”

The shortage of computer chips has derailed the production of cars, driving up prices for both new and used cars and contributing to today’s high inflation.

Cohn noted that the United States relies on Taiwan and China for the vast majority of its high-end computer chips, including semiconductors that go into weapons systems and airplanes.

“We need to get manufacturing back here in the United States so we can control our own supply chain and we can control our own destiny,” said Cohn.

The Senate passed legislation last summer to spend $52 billion on computer chip manufacturing and research in the United States. The funding has not yet been signed into law and lawmakers are still haggling over the details.

“Guardrails are needed to create and defend American jobs,” the lawmakers wrote in a letter.

Cohn, however, argued that these restrictions would disincentive companies from investing in America.

“If we put these guardrails on, what’s unfortunately going to happen is US companies will not take the money,” Cohn said. “They’ll take the money from foreign governments and they’ll build their facilities in foreign countries.”