Athleisure attire and shoes maker Lululemon (NASDAQ: LULU) inventory is down (-28%) within the 2022 undergo marketplace regardless of stellar revenue efficiency. The preferred retail health attire logo remains to be firing on all cylinders regardless of the go back of formalwear as customers go back again to paintings. The Corporate raised its full-year 2022 most sensible and base line steering with the new fiscal first-quarter most sensible line appearing 32% enlargement. It is direct-to-consumer (DTC) internet revenues additionally climbed 32% and made up 45% of general internet earnings. E-commerce gross sales confirmed powerful 40% enlargement charge. Those spectacular effects came about regardless of provide chain disruptions, inflationary pressures, and the China COVID lockdowns, which led to just about a 3rd of its 71 retail outlets to quickly shut for a time period. The Corporate plans to open nearly all of its 40 new retail outlets in mainland China because of its 60% three-year CAGR. The Corporate is experiencing emerging logistics prices and longer freight occasions however has additionally strengthened its stock to mitigate one of the most temporary demanding situations. Prudent traders looking for publicity in a store this is nonetheless running with powerful most sensible and base line enlargement can look forward to opportunistic pullbacks in stocks of Lululemon.

MarketBeat.com – MarketBeat

Fiscal Q1 2022 Profits Liberate

On June 2, 2022, Lululemon launched its fiscal first-quarter 2022 effects for the quarter ended April 2022. The Corporate reported diluted earnings-per-share (EPS) benefit of $1.48, beating consensus analyst estimates for $1.43 by means of $0.05. Revenues grew 31.6% year-over-year (YOY) to $1.61 billion assembly analyst estimates for $1.55 billion. Overall similar gross sales rose 28% and DTC revenues rose 32% YoY.

Lululemon CEO Calvin McDonald commented, “Within the first quarter of 2022, endured momentum within the trade enabled us to reach a powerful begin to the yr. Those effects supply a cast basis as we commence our subsequent five-year adventure and ship towards our new Energy of 3 ×2 enlargement plan. I wish to thank our groups all over the world for final agile and proceeding to execute at a prime degree to reach our objectives, whilst effectively navigating the demanding situations throughout the macro surroundings. We sit up for all that lies forward for lululemon as we keep growing the emblem.”

Upside Steering

Lululemon raised its steering for fiscal Q2 2022 EPS of $1.82 to $1.87 as opposed to $1.77 consensus analyst estimates on revenues of $1.750 billion to $1.775 billion. Complete-year fiscal 2022 EPS is predicted between $9.35 to $9.50 as opposed to $9.35 consensus analyst estimates on revenues between $7.61 billion to $7.71 billion as opposed to $7.58 billion consensus analyst estimates.

Convention Name Takeaways

CEO McDonald supplied the narrative of the full macro surroundings and the way Lululemon differentiates itself within the extremely aggressive health put on class. Briefly merely, the top quality of its core and new products has pushed call for and strong visitors to each retail outlets and on-line. It accomplished a 40% YoY enlargement in its e-commerce channel. The mitigate provide chain pressures, the Corporate has strengthened its stock place with upper than standard ranges to steadiness the momentum. The China lockdowns are best appearing modest affects as as much as a 3rd of its 71 retail outlets in China have been quickly closed sooner or later, however they’re beginning to reopen once more. Revenues keep growing over 60% on a three-year CAGR foundation. The Corporate plans on opening nearly all of its 40 new retail outlets in mainland China in 2022. The Corporate will proceed to put money into the area and stays fascinated about its trade in China. As for world provide chain, CEO McDonald commented, “When having a look on the world provide chain, general, the surroundings stays difficult. Ocean lead occasions don’t seem to be making improvements to, and air freight prices stay prime. To handle those problems, our staff is punctiliously balancing our trade momentum with time line uncertainties to assist make sure we meet visitor call for. This comes with a commensurate funding in air freight, which is vital given we see pleasing visitor call for as a concern.”

LULU Opportunistic Pullback Ranges

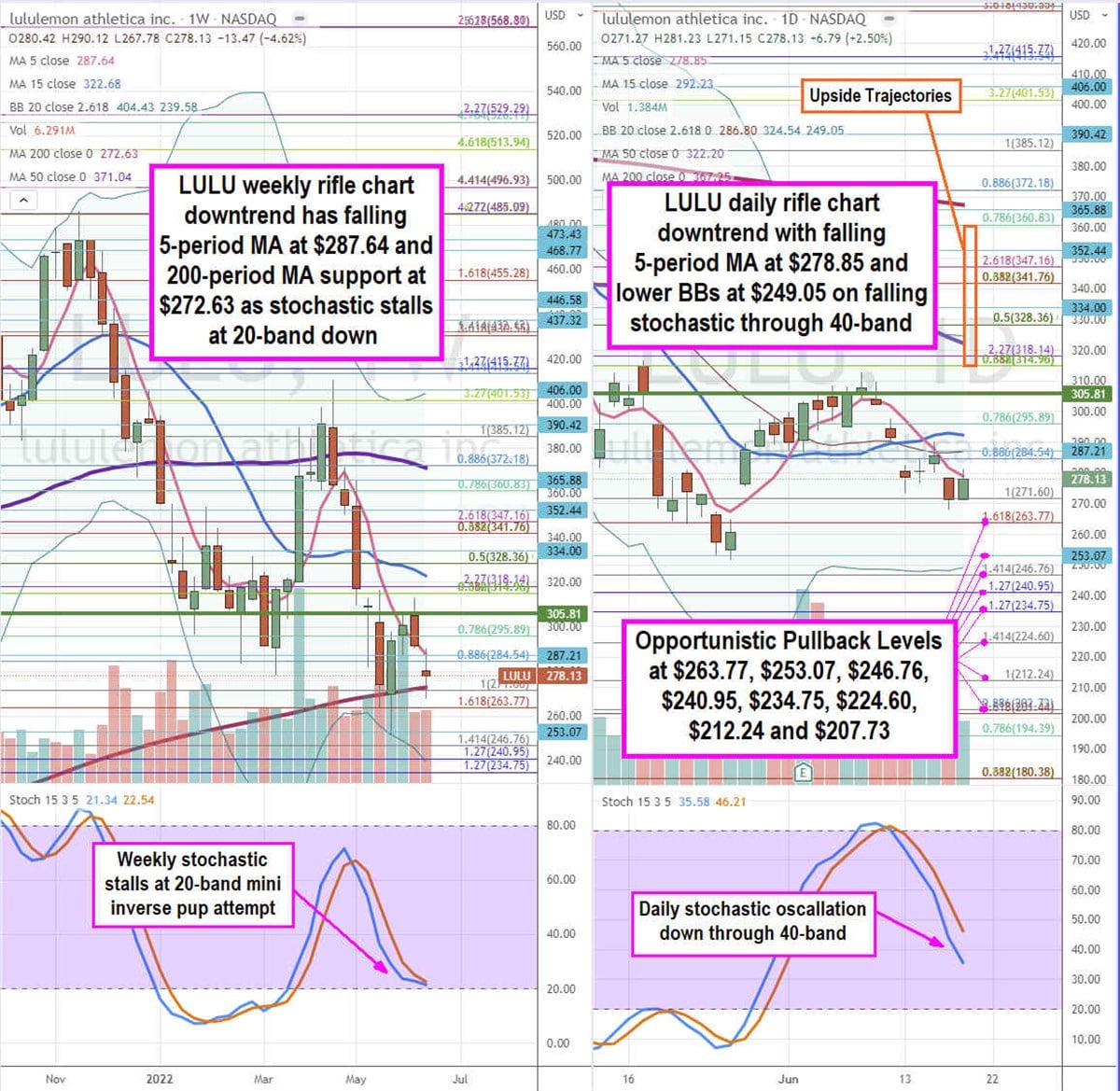

The use of the rifle charts at the weekly and day by day time frames supplies a precision view of the panorama for LULU inventory. The weekly rifle chart rejected at the leap strive close to the $314.96 Fibonacci (fib) degree as stocks fell during the weekly 200-period shifting reasonable (MA) at $272.63 prior to coiling again above it in an try to stabilize the cost. The weekly 5-period MA remains to be falling at $287.64 adopted by means of the 15-period MA at $322.68 because the weekly stochastic makes an attempt a mini inverse domestic dog on the 20-band. The weekly decrease Bollinger Bands (BBs) take a seat close to the $240.95 fib. The weekly marketplace construction low (MSL) purchase triggers on a breakout thru $305.81. The day by day rifle chart has a downtrend with falling 5-period MA at $278.85 adopted by means of the 15-period MA at $292.23 at the stochastic min inverse domestic dog falling during the 40-band. The day by day decrease BBs take a seat at $249.05. Prudent traders can look forward to opportunistic pullback ranges on the $263.77 fib, $253.07, $246.76 fib, $240.95 fib, $234.75 fib, $225.60 fib, $212.24 fib, and the $207.73 fib degree. Upside trajectories vary from the $314.96 fib degree up in opposition to the $360.83 fib degree.