Listed here are the corporate’s making headlines in noon buying and selling:

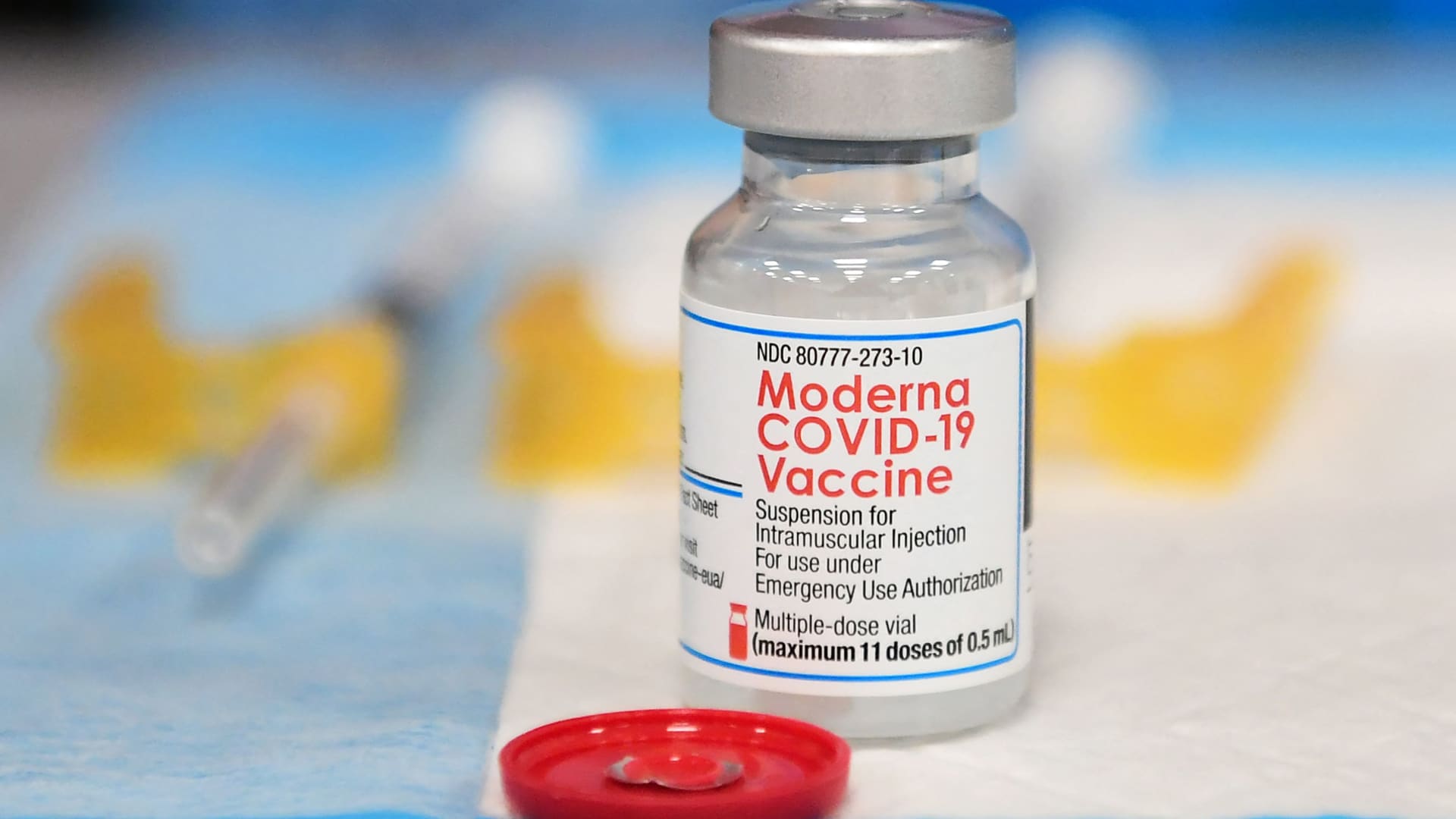

Moderna — The biotech inventory jumped 5.7% after a Meals and Drug Management committee voted to suggest Moderna’s Covid vaccine to kids ages six via 17. The FDA is predicted to authorize vaccines for youngsters later this week.

Robinhood — Stocks of the retail brokerage fell 2.5% following a downgrade to impartial at Atlantic Equities. Atlantic cited declining customers and regulatory problems as threats to Robinhood’s inventory.

Snowflake — The device inventory jumped 7.6% following an improve to shop for from dangle by means of Canaccord Genuity. The funding company mentioned Snowflake’s inventory appears to be like reasonable in accordance with the corporate’s long-term enlargement attainable.

Liberty Media System One — The sports activities media inventory rose greater than 5% after Morgan Stanley upgraded Liberty Media’s System One holdings to obese. Emerging passion within the racing sequence will have to result in “compounding enlargement for its buyers,” Morgan Stanley mentioned.

Boeing — The aerospace inventory rose 9.5% after Reuters reported that airline China Southern carried out check flights with Boeing’s 737 Max jet. Stocks of Boeing had been risky just lately and are on target for his or her 5th instantly consultation of a 4% or higher transfer in both route.

Skechers — Stocks of the shoe corporate added 2.4% at the heels of an improve from Argus Analysis. Argus cited emblem energy and provide chain enhancements as causes to be bullish on Skechers within the coming years.

Spotify — The streaming inventory surged 7.5% after Wells Fargo upgraded Spotify to equivalent weight from underweight. Wells Fargo mentioned Spotify has room to beef up its margins.

Microstrategy — Stocks of the tech corporate rose greater than 9% after CEO Michael Saylor defended the corporate’s means of making an investment in bitcoin on CNBC’s “Squawk at the Side road.” The corporate’s inventory has fallen sharply this yr as the cost of bitcoin has declined by means of greater than 50%.

Tapestry — The attire inventory jumped 3.5% after an improve to shop for at Jefferies. The funding company mentioned Tapestry’s development in its virtual industry and alternatives in China supply upside for the inventory.

Sweetgreen — Stocks won 2.8% after the salad chain was once named a highest small- and mid-cap thought by means of Cowen. Analysts preferred the inventory as a part of a virus restoration play, and for the corporate’s publicity to raised source of revenue shoppers.

— CNBC’s Sarah Min and Michael Bloom contributed reporting.