Closing week I used to be a “Doubting Thomas” when it got here to the endurance of the hot S&P 500 (SPY) rally. It simply appeared like but any other in a protracted line of failed bounces in 2022 ahead of the following leg decrease. Gladly this fresh soar gave us the chance to take extra earnings off the desk whilst shifting the POWR Price portfolio down to simply 69.5% lengthy the inventory marketplace (and created a hedge in Reitmeister Overall Go back the place there may be extra of a marketplace timing component to the trades. And sure, that portfolio if truth be told rallied this week because the marketplace tanked). The purpose is that the chances of endure marketplace are expanding by means of the day. And presently we’re collecting a third attack on a damage into endure marketplace territory (underneath 3,855). The the explanation why that almost certainly takes puts is shared on this week’s POWR Price statement. Learn on underneath for extra….

shutterstock.com – StockNews

(Please revel in this up to date model of my weekly statement from the POWR Price e-newsletter).

The principle headline these days is “Inflation is STILL Too Sizzling” after the now not so unusually prime +8.6% CPI document. This had the certain pre-market futures diving into unfavourable territory in a rush culminating in a -2.91% slashing of the S&P 500.

Thus, we finish the week a trifling 45 issues clear of endure marketplace territory at 3,855.

On peak of that the Client Sentiment announcement these days was once the bottom studying since Might 1980.

What is the similarity between that period of time? RAGING INFLATION simply ahead of a recession and endure marketplace.

The unhappy truth of is that the Fed is WAY at the back of the curve. Actually they must had been elevating charges and shrinking their steadiness sheet 6-One year in the past. Thus the chances of them managing a comfortable touchdown are between narrow and none (and sure, narrow could also be leaving the city 😉

Hiya Reity, how about the day past’s Jobless Claims document? Certain turns out like employment continues to be in excellent form.

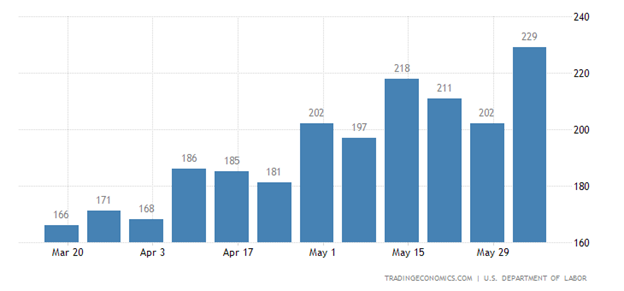

Jobless Claims on absolute foundation are nonetheless low at simplest 229K a week. However directionally the inside track isn’t excellent as noticed by means of the graph underneath appearing 3 immediately months of trending upwards.

If that continues, which is most likely, then it’ll additionally begin to display up in decrease process provides. Then at a undeniable level process losses and aggravating of the unemployment charge.

Understand that employment is a lagging indicator. Which means one of the vital ultimate financial information issues to turn weak point. More or less like a smoke detector that is going off after the home has already burned down.

Then again, even this early within the recreation of attempting to find a recession there are cracks within the employment basis which is but one more reason we have now gotten extra wary now.

In Tuesday’s Reitmeister Overall Go back statement I gave much more perception to turn why the chances of recession and endure marketplace are expanding. So test that out now when you have now not already as a result of there may be loads extra financial proof and smartly reasoned insights from different funding professionals.

Talking of alternative funding professionals, this information piece stuck my eye these days. That being famed investor, Stan Druckenmiller, is but any other in a rising line of pundits who sees this as a endure marketplace with extra drawback forward.

One of the most issues we have now to bear in mind is that we have got smaller portfolios and thus can actually activate a dime to head from bullish to bearish. In order that continuously has us striking on til the ultimate 2d to make adjustments.

Then again, other folks like Druckenmiller have BILLIONS of greenbacks invested…they are able to’t activate a dime. A few of their positions are so huge that in the event that they offered all of them in an instant they’d overwhelm the ones shares by means of themselves.

Plus they’re watched carefully by means of different traders which might produce other everybody working for the hills.

In order that they wish to make their strikes little by little in stealthy style over an extended time period. This is why they continuously name “endure” so early within the recreation when the remainder of us cannot actually see it with such readability.

Then again, a part of our process is to understand “development popularity“. As in appreciating what took place in earlier endure marketplace classes BEFORE IT WAS TOO overdue that may tip the scales in a path that we too must get started heading for the hills.

Reity, positive seems like you’re ringing the endure marketplace bell…are you?

I’ve surely tipped over the 50% chance line that odds of recession and endure marketplace are much more likely than continuation of the bull. And in all probability now sliding to 60-70% chance in my head.

However that shrinking 30-40% probability of bull marketplace continuation is huge sufficient to make me prevent in my tracks from doing extra right now.

As a result of if the marketplace does soar once more and keep on bull monitor then it will occur very swiftly that create severe injury to any investor leaning too onerous in a bearish path.

Thus, the 69.5% lengthy in POWR Price (and completely hedged in Reitmeister Overall Go back) is excellent sufficient til we see if certainly a damage underneath 3,855 is within the playing cards.

If that is so, then POWR Price will most likely wind its manner right down to the brand new minimal constitution of fifty% lengthy…however in additional conservative positions to mitigate injury.

While in Reitmeister Overall Go back I will be able to do away with the lengthy aspect of the hedge to make more cash at the inverse ETFs as we most likely see a 30-40% overall decline on this endure spherical (34% is the typical endure marketplace decline).

For the ones doing math at house that may be a most likely end result of two,891 to a few,372 for the S&P 500. Yikes certainly!

You realize the expression it; It’s satisfied hour someplace

Identical may well be stated this fashion for traders: This is a bull marketplace someplace

That bull marketplace simply could also be in shorting shares. (learn that one once more so it sinks in).

When you don’t seem to be happy with that…then my good friend…do not be an investor. Simply hand the cash to an consultant using out the highs and lows extra time. And sure, occasionally that suggests dropping a 3rd to part your cash when the following endure comes.

Then again, if you wish to have any fair appreciation that there’s an financial cycle which creates bull and endure markets…then it’s important to admire it’s as herbal as night time following day. Gladly there are able made answers for earning money in every surroundings.

Sure, much less folks know the way to do it throughout a endure marketplace. However heck, I simply laid it out for you. Now not that tough while you take into accounts it.

So if the definition of madness is doing the similar factor and anticipating a distinct outcome. Then let’s prevent that madness teach this time round by means of you making an attempt one thing new that if truth be told works for a transformation.

OK, I get off my cleaning soap field. I believe that this coming week is the make or damage for this marketplace. We’re ready for both end result. Let the chips fall the place they will and we will be able to react in sort.

Portfolio Replace

Our portfolio has crushed the marketplace for 4 immediately weeks together with a just about 3% benefit this previous week on my own. Now as we roll again the clock a complete month, we see the next:

-0.90% for S&P 500

+7.23% for POWR Price

I’m hoping that brings a grin for your face on an differently somber day for traders

What To Do Subsequent?

In order for you to peer extra peak price shares, then you definitely must take a look at our loose particular document:

What makes those shares nice additions to any portfolio?

First, as a result of they’re all undervalued firms with thrilling upside attainable.

However much more vital, is that they’re all Sturdy Buys consistent with our coveted POWR Scores device. Sure, that very same device the place top-rated shares have averaged a +31.10% annual go back.

Click on underneath now to peer those 7 stellar price shares with the appropriate stuff to outperform in those difficult markets.

The entire Very best!

Steve Reitmeister

CEO StockNews.com & Editor of POWR Price buying and selling carrier

SPY stocks closed at $389.80 on Friday, down $-11.64 (-2.90%). 12 months-to-date, SPY has declined -17.67%, as opposed to a % upward push within the benchmark S&P 500 index throughout the similar length.

Concerning the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews target market as “Reity”. Now not simplest is he the CEO of the company, however he additionally stocks his 40 years of funding enjoy within the Reitmeister Overall Go back portfolio. Be told extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory alternatives.

The put up Why the Odds of a Endure Marketplace Are Expanding by means of the Day seemed first on StockNews.com