[ad_1]

When making an investment in actual property, you wish to have to imagine conceivable herbal failures that might happen particularly when purchasing belongings in Twister Alley.

Desk of Contents

- What Is Twister Alley?

- What States Are in Twister Alley?

- Issues to Imagine When Purchasing a Assets in Twister Alley

- Easy methods to Discover a Winning Assets in Twister Alley

- To Recap

On this article, we will be able to take a look at the other twister alley states situated within the U.S. We will be able to speak about what elements any investor will have to take into accout when buying a belongings that falls in any such places. Finally, we will be able to discover some actual property methods to lend a hand with source of revenue homes.

What Is Twister Alley?

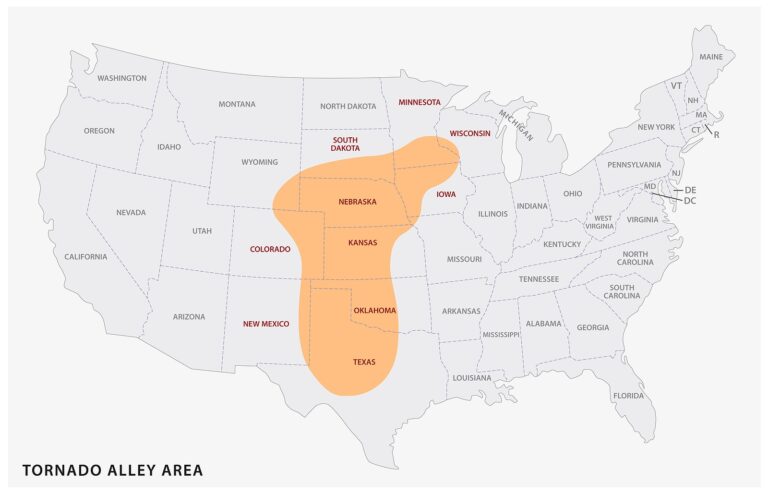

General, Twister Alley refers to a few states of the USA, in addition to parts of Canada, the place tornados are perhaps to happen. This used to be a time period created by way of the media, particularly the elements channels that account for the states that fall throughout the limitations of Twister Alley.

This title used to be created because of the truth that in those places, tornados don’t seem to be simplest much more likely to move thru but in addition have a tendency to be extra damaging than tornados in different spaces. Climate professionals have mentioned that the tornados are more potent in those states as many various kinds of air are ceaselessly blending. Air from the Gulf of Mexico has a tendency to be heat and wet, whilst mountain air is chilly and dry. This combination reasons those excessive tornados to happen.

Even supposing Twister Alley would possibly infrequently come with different within reach states, it most commonly is composed of Texas, New Mexico, Oklahoma, Kansas, Colorado, Nebraska, and South Dakota.

When Is Twister Season?

Even supposing the start of twister season can vary relying at the house in the usor the elements prerequisites all the way through the 12 months, it’s mentioned to be between March and August. This time of 12 months is thought of as to be twister season as a result of the various temperatures. In particular, the warmest summer time months together with June, July, and August are the high months of twister season.

Because the twister season has a tendency to fall in the summertime months, it may well be a good suggestion to buy a belongings in any of those places right through the cooler time of 12 months. Doing this may supply sufficient time to make any crucial adjustments on your belongings ahead of renting it out or ahead of twister season comes.

Then again, even supposing those summer time months are thought to be the high time for twister season, you will need to observe that they may be able to happen any time of the 12 months. Because of this traders will have to at all times ensure that their homes are up to the moment with regards to twister protection. Including the vital renovations or upgrades to properties within the twister states will even help in making your listings extra fascinating.

What States Are in Twister Alley?

As an investor, you will be questioning the place is twister alley. Regardless that those limitations don’t seem to be utterly outlined, it’s mentioned to begin in Texas and make their manner north, extending even into portions of Canada. The opposite U.S states that the twister alley runs thru are Colorado, Nebraska, Oklahoma, Kansas, South Dakota, and New Mexico.

Underneath is Mashvisor’s actual property information at the seven states in Twister Alley, going from the south thru north:

1. Texas

- Median Assets Worth: $552,571

- Moderate Worth in line with Sq. Foot: $264

- Days on Marketplace: 76

- Per thirty days Conventional Condo Source of revenue: $1,884

- Conventional Money on Money Go back: 1.76%

- Conventional Cap Price: 1.82%

- Worth to Hire Ratio: 24

- Per thirty days Airbnb Condo Source of revenue: $3,108

- Airbnb Money on Money Go back: 2.90%

- Airbnb Cap Price: 2.98%

- Airbnb Day by day Price: $188

- Airbnb Occupancy Price: 49%

- Stroll Rating: 46

Similar: The Absolute best Condo Markets in Texas—The 2022 Information

2. New Mexico

- Median Assets Worth: $481,437

- Moderate Worth in line with Sq. Foot: $241

- Days on Marketplace: 73

- Per thirty days Conventional Condo Source of revenue: $1,522

- Conventional Money on Money Go back: 2.30%

- Conventional Cap Price: 2.37%

- Worth to Hire Ratio: 26

- Per thirty days Airbnb Condo Source of revenue: $2,725

- Airbnb Money on Money Go back: 3.79%

- Airbnb Cap Price: 3.90%

- Airbnb Day by day Price: $149

- Airbnb Occupancy Price: 59%

- Stroll Rating: 41

3. Colorado

- Median Assets Worth: $990,286

- Moderate Worth in line with Sq. Foot: $612

- Days on Marketplace: 133

- Per thirty days Conventional Condo Source of revenue: $2,120

- Conventional Money on Money Go back: 1.49%

- Conventional Cap Price: 1.51%

- Worth to Hire Ratio: 31

- Per thirty days Airbnb Condo Source of revenue: $3,505

- Airbnb Money on Money Go back: 2.25%

- Airbnb Cap Price: 2.29%

- Airbnb Day by day Price: $246

- Airbnb Occupancy Price: 51%

- Stroll Rating: 46

Similar: Flipping Properties in Colorado—The Entire 2022 Information

4. Oklahoma

- Median Assets Worth: $392,382

- Moderate Worth in line with Sq. Foot: $195

- Days on Marketplace: 59

- Per thirty days Conventional Condo Source of revenue: $1,450

- Conventional Money on Money Go back: 3.25%

- Conventional Cap Price: 3.38%

- Worth to Hire Ratio: 23

- Per thirty days Airbnb Condo Source of revenue: $2,726

- Airbnb Money on Money Go back: 4.74%

- Airbnb Cap Price: 4.91%

- Airbnb Day by day Price: $127

- Airbnb Occupancy Price: 60%

- Stroll Rating: 39

5. Kansas

- Median Assets Worth: $450,818

- Moderate Worth in line with Sq. Foot: $188

- Days on Marketplace: 92

- Per thirty days Conventional Condo Source of revenue: $1,640

- Conventional Money on Money Go back: 2.13%

- Conventional Cap Price: 2.20%

- Worth to Hire Ratio: 23

- Per thirty days Airbnb Condo Source of revenue: $3,190

- Airbnb Money on Money Go back: 4.54%

- Airbnb Cap Price: 4.68%

- Airbnb Day by day Price: $135

- Airbnb Occupancy Price: 66%

- Stroll Rating: 39

6. Nebraska

- Median Assets Worth: $361,000

- Moderate Worth in line with Sq. Foot: $187

- Days on Marketplace: 38

- Per thirty days Conventional Condo Source of revenue: $1,341

- Conventional Money on Money Go back: 2.06%

- Conventional Cap Price: 2.13%

- Worth to Hire Ratio: 22

- Per thirty days Airbnb Condo Source of revenue: $2,757

- Airbnb Money on Money Go back: 4.80%

- Airbnb Cap Price: 4.97%

- Airbnb Day by day Price: $141

- Airbnb Occupancy Price: 59%

- Stroll Rating: 46

7. South Dakota

- Median Assets Worth: $367,942

- Moderate Worth in line with Sq. Foot: $196

- Days on Marketplace: 62

- Per thirty days Conventional Condo Source of revenue: $1,216

- Conventional Money on Money Go back: 1.46%

- Conventional Cap Price: 1.50%

- Worth to Hire Ratio: 25

- Per thirty days Airbnb Condo Source of revenue: $2,838

- Airbnb Money on Money Go back: 4.49%

- Airbnb Cap Price: 4.61%

- Airbnb Day by day Price: $142

- Airbnb Occupancy Price: 63%

- Stroll Rating: 44

Similar: South Dakota Actual Property Marketplace—What Buyers Can Be expecting

Issues to Imagine When Purchasing a Assets in Twister Alley

If you’re taking a look to purchase funding homes within the Twister Alley states, you will have to take note of positive options your own home will have to come with making sure its citizens are secure from any herbal failures.

Basement Stipulations

If you’re buying an funding belongings within the twister alley, it is very important that the site features a basement. In the case of tornados, your citizens will want a spot to visit if one have been to move thru. Mavens say it’s best to head someplace, ideally underground, and not using a home windows. Regardless that this can be a vital protection characteristic for properties the place tornados happen, a basement too can upload worth on your belongings.

As basements weren’t as commonplace some years in the past, it’s best to search for properties which have been constructed throughout the previous 30 or so years. Those homes are a lot more more likely to have a basement for twister coverage.

Further Insurance coverage

When buying an inventory throughout the limitations of the twister alley, further insurance coverage is also wanted. That is particularly essential for traders to verify their condo belongings is secure from herbal failures.

Earlier than buying any belongings, take a look at with insurers to talk about further insurance coverage choices to your construction.

Development Main points

When buying money go with the flow homes close to tornados, this can be a excellent thought to concentrate on explicit development main points of that belongings. It’s because some fabrics are higher for each the security of the home in addition to the renters.

First, properties with steel connectors that run from the roof to the basis are a lot more most likely to resist the affect of a twister. If your own home does no longer already come with this selection, it can be a excellent funding so as to add on your belongings.

Subsequent, imagine searching for a dome belongings if it falls throughout the vary of tornados. In particular, dome structures made out of concrete are anticipated to be extraordinarily efficient when a twister happens.

Even supposing the valuables isn’t dome-shaped, concrete fabrics are identified to resist the affect of a twister. Concrete external properties are ready to carry up towards even the easiest winds.

Protected Rooms

Some other nice characteristic to have in homes which are close to possible tornados is secure rooms. In most cases, those rooms are made usually of steel, concrete, or metal. A secure room can both be above flooring or underground like a basement. Despite the fact that they’re very small, secure rooms can offer protection to people towards any herbal crisis.

Community Consciousness

Regardless of how secure your explicit belongings is, this can be a excellent thought to discover the community precautions towards tornados. Your renters can have school-aged youngsters attending categories within reach. If all the community is able for a twister to hit anytime, it is going to make your renters really feel more secure at the belongings.

Development Codes

One explicit construction code to bear in mind when searching for the best possible position to shop for condo belongings close to tornados is the 2012 World Residential Code. Any belongings that meets or exceeds this explicit construction code could make an enormous distinction when taking into consideration coverage towards a twister or any herbal crisis.

This is a excellent thought to at all times take a look at your state or native town codes to verify your own home is up to the moment on construction codes concerned with herbal failures. This may ensure that your renters will probably be secure from any tornadoes that might move thru.

Easy methods to Discover a Winning Assets in Twister Alley

There are a couple of techniques you’ll cross about searching for new possible funding homes. The primary manner is you’ll seek thru native newspapers with up to date to be had listings, or touch brokers approved for your most popular location.

Then again, you’ll seek thru on-line platforms that can make discovering your highest belongings more uncomplicated. The standard manner of discovering homes could be too time-consuming for many traders. There are lots of on-line platforms that may lend a hand with discovering funding homes, reminiscent of Mashvisor.

Regardless of the website online you employ, you will have to to find one with many clear out options that may kind thru each and every to be had list, and unmarried out those you could need. Moreover, taking a look at positive metrics can lend a hand display how a success the list will probably be. Condo information reminiscent of a cap charge is a great metric to imagine when figuring out profitability. Any investor is aware of that the charge of go back is without doubt one of the maximum essential sides of making an investment.

A commonplace technique observed for making an investment in twister alley is the BRRRR technique. Mainly, this implies to shop for, rehab, hire, refinance and repeat funding homes. This can be a common technique amongst traders as it allows them to acquire a belongings, then improve it. After those renovations, they can hire it out for some time till it’s time to promote the valuables and start all the procedure once more.

This can be a fascinating technique for funding homes within the Twister Alley, as an investor can renovate a house to be twister secure. This manner, whilst you promote the valuables once more, it is possible for you to to generate a far greater benefit and promote the house at a better worth than you to start with purchased it for.

To Recap

If you’re an actual property investor taking into consideration buying a belongings within the twister alley, seek advice from Mashvisor that will help you analysis, analyze, and make sensible choices. Mashvisor gives a wide variety of equipment and services and products to lend a hand to find probably the most a success homes. Our funding belongings calculator software is excellent for finding successful listings in any new Twister Alley location. Even supposing Tornado Alley is transferring, Mashvisor will let you with any a part of the funding transaction.

To get get entry to to our actual property funding equipment, click on right here to enroll in a 7-day loose trial of Mashvisor lately, adopted by way of 15% off for lifestyles.

[ad_2]