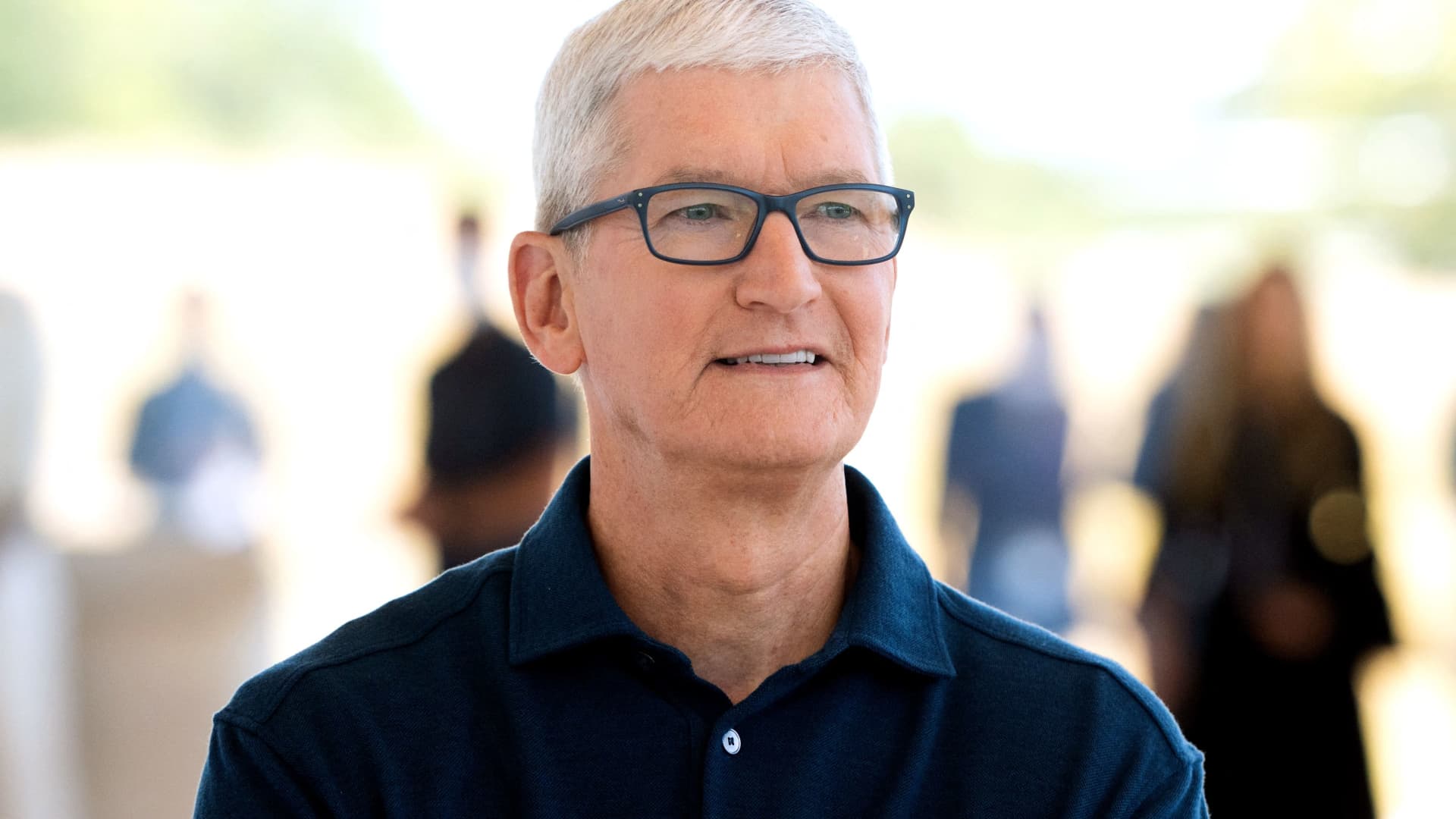

Apple CEO Tim Prepare dinner poses for a portrait subsequent to a line of recent MacBook Airs as he enters the Steve Jobs Theater all over the Apple International Builders Convention (WWDC) on the Apple Park campus in Cupertino, California on June 6, 2022.

Chris Tuite | AFP | Getty Photographs

A completely-owned subsidiary of Apple will take a look at consumer credit score and prolong temporary loans to customers for the corporate’s imminent temporary mortgage carrier, Apple Pay Later, Apple stated.

The brand new carrier, which can compete in opposition to an identical choices from Verify and PayPal, used to be introduced all over Apple’s developer convention on Monday. Later this 12 months, when the corporate’s new iOS 16 iPhone instrument is launched, customers will have the ability to purchase merchandise with Apple Pay and pay the stability off in 4 equivalent bills over six weeks. It is a kind of product regularly referred to as Purchase Now Pay Later.

Apple has partnered with Mastercard, which interacts with the distributors and provides a white-label BNPL product referred to as Installments, which Apple is the use of. Goldman Sachs, which problems the Apple Card, could also be concerned because the technical issuer of the loans, and the respectable BIN sponsor, the corporate stated. However Apple isn’t the use of Goldman’s credit score selections or its stability sheet for issuing the loans.

The behind-the-scene construction of Apple’s new mortgage product, and the truth that it’s dealing with mortgage selections, credit score tests, and lending unearths that the iPhone large is looking for to carry the framework and infrastructure for its monetary services and products in-house up to imaginable.

Apple has more and more damaged into the fintech business, however its strategic strategy to its Pockets app and monetary services and products is to make its iPhone extra precious and helpful to customers in order that they proceed to shop for Apple {hardware}, which stays the corporate’s primary supply of gross sales.

The loans from the Apple Pay Later product are not likely to be subject material to Apple within the temporary however counsel the corporate may use its prodigious stability sheet to provide extra monetary services and products sooner or later. Apple reported $378.55 billion in income in 2021.

Apple Pay Later

Courtesy: Apple Inc.

Apple will run a comfortable credit score take a look at to make certain that debtors are prone to pay again the loans, which might be capped at round $1000, the corporate stated. If Apple Pay Later loans don’t seem to be repaid, then Apple will not prolong the ones customers credit score. However it may not record the neglected bills to credit score bureaus.

Apple Pay Later will release in the US first. Apple Card, the corporate’s different credit score product, continues to be U.S.-only.