[ad_1]

Telehealth tool corporate Teledoc Well being (NYSE: TDOC) inventory has collapsed from a post-pandemic prime of $308 in Feb 2021 to a up to date low of $27.38 in Might 2022. To name this a tragedy for buyers on the peak can be an irony. On the other hand, stocks have been buying and selling within the $9s pre-pandemic in 2016. Telehealth shares have been a pandemic benefactor right through the COVID lockdowns, however the hype has blown off as vaccinations unfold right through the reopening. The easiest hurricane tailwinds have ceased because the narrative shifts against comfort, get entry to, and personalised healthcare aptly categorized as whole-person digital care which is represented through its Number one 360 carrier. Teladoc stocks have fallen backpedal to extra practical ranges within the $30s the place it dwelled right through 2017. Whilst expansion has ramped up right through the pandemic, its returning to customary ranges however remains to be within the double digits. The Corporate decreased its fiscal Q2 and full-year 2022 peak and bottom-line steering, which triggered a cave in after income. The shortfalls come from a discount in persistent care revenues and the release of its direct-to-consumer (DTC) psychological well being carrier BetterHelp, which is anticipated to have 30% to 40% annual top-line expansion. Teladoc is the main emblem within the virtual well being phase and has over $830 million in money. Prudent and affected person buyers in the hunt for publicity within the main telehealth participant can wait for opportunistic pullbacks in stocks of Teladoc.

MarketBeat.com – MarketBeat

Q1 Fiscal 2022 Profits Free up

On April 27, 2022, Teladoc launched its fiscal first-quarter 2022 effects for the quarter finishing March 2022. The Corporate reported an adjusted earnings-per-share (EPS) lack of (-$0.47) except for non-recurring pieces as opposed to consensus analyst estimates for a lack of ($0.52), beating estimates through $0.06. Revenues rose 24.6% year-over-year (YOY) to $565.35 million, falling in need of analyst estimates for $568.63 million. The Corporate reported a (-4%) YoY decline in adjusted EBITDA to $54.5 million as opposed to the $51 million to $55 million earlier steering. Teladoc CEO Jason Gorevic commented, “Whilst we proceed to peer sustainable expansion throughout our suite of services and products, we’re revising our 2022 outlook to mirror dynamics we’re these days experiencing within the direct-to-consumer (D2C) psychological well being and protracted situation markets. Within the D2C psychological well being marketplace, upper promoting prices in some channels are producing a lower-than-expected yield on our advertising and marketing spend. Within the persistent situation marketplace, we’re seeing an elongated gross sales cycle as employers and well being plans review their long-term methods to ship the advantages and care that their populations want. In spite of the revision to our 2022 outlook, we’re assured in our technique, along side our breadth and intensity of functions, which empower folks far and wide to reside fitter lives.”

Drawback Steering

Teladoc decreased its fiscal Q2 2022 earnings steering between $580 million to $600 million as opposed to $615.15 million. Adjusted EBITDA is anticipated between (-$200 million) to (-$190 million). Alter EBITDA is anticipated between $39 million to $49 million. The Corporate decreased its fiscal full-year 2022 earnings steering to return in between $2.4 billion to $2.5 billion as opposed to $2.58 consensus analyst estimates with adjusted EBITDA decreased to $240 million to $250 million from $330 million to $355 million.

Convention Name Takeaways

CEO Gorevic mentioned the BetterHelp expectancies to grown psychological well being revenues 30% to 40% once a year. Persistent care gross sales pipeline evolved slower than expected because of employer advantages managers being extra eager about COVID and the go back to paintings. The contest has gotten tighter with a large number of healthcare offers. The decreased steering assumes persistent care revenues develop within the low to mid-teens. He elaborated at the whole-person digital care with its Primary360 product, “Primary360 is designed to behave because the entrance door to deal with our participants. It opens pathways to Teladoc’s personal ecosystem of virtual and digital answers and coordinates care with third-party suppliers inside a well being plan or employer’s community when wanted. We proceed to be enthusiastic about the momentum we are seeing in Primary360.”

TDOC Opportunistic Pullback Ranges

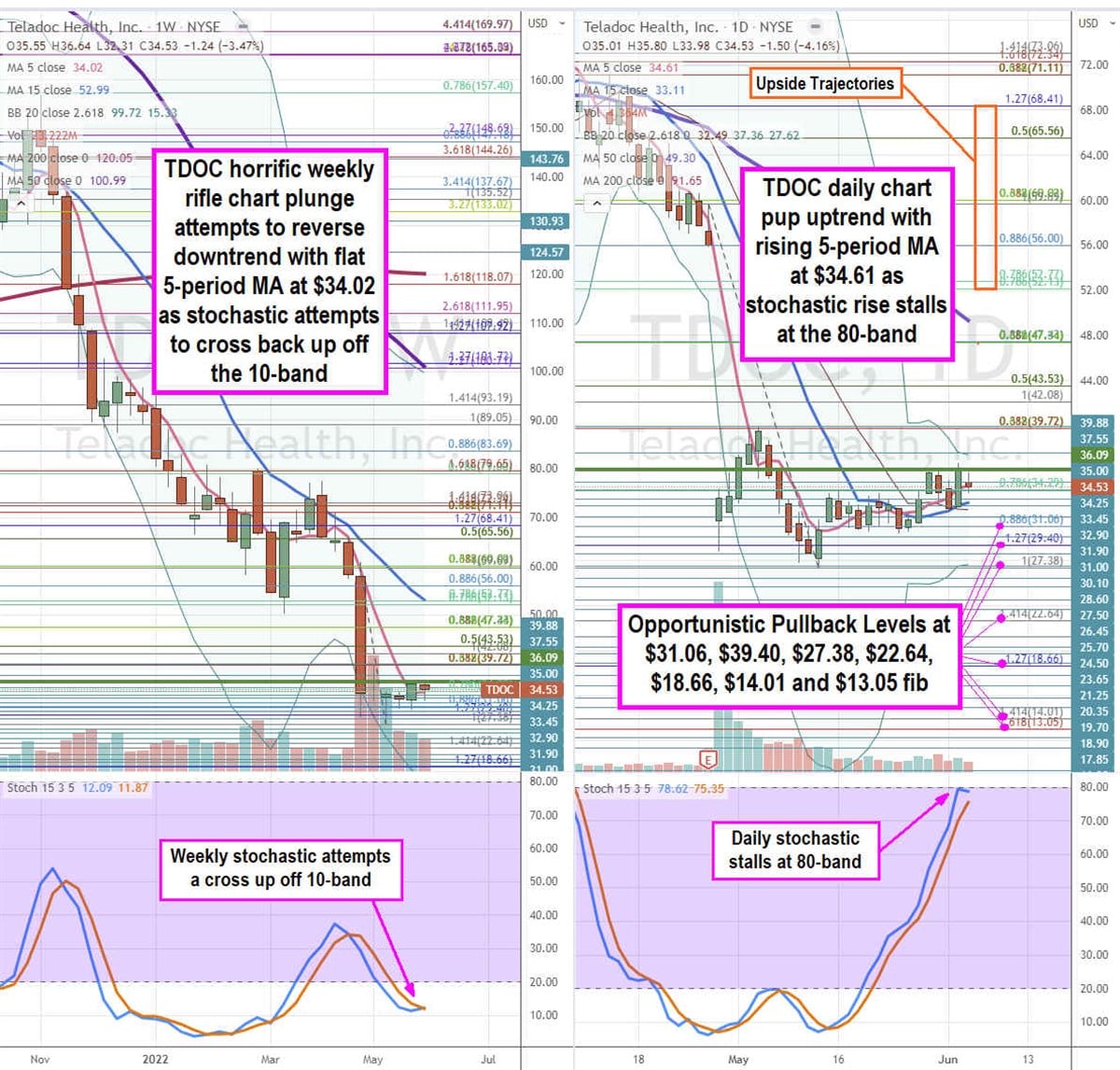

The use of the rifle charts at the weekly and day by day time frames supplies a precision view of the panorama for TDOC inventory. Stocks sat on the $56.00 Fibonacci (fib) degree earlier than its cave in on its fiscal Q1 2022 income unencumber hole down. The weekly rifle chart inverse doggy breakdown is beginning to backside out because the weekly 5-period shifting reasonable (MA) is pulling down at $34.02 because the 15-period MA continues decrease at $52.99. The weekly stochastic could also be making an attempt to coil simply above the 10-band. The weekly decrease Bollinger Bands (BBs) sit down at 15.32. The weekly marketplace construction low (MSL) purchase triggers at the $36.09 breakout. The day by day rifle chart has been in an uptrend with a emerging 5-period MA at $34.61 adopted through the 15-period MA at $33.11. The day by day higher BBs sit down at $37.36 and decrease BBs at $27.62. The day by day stochastic has made a complete oscillation as much as stall on the 80-band. Prudent buyers must no longer chase however reasonably watch for opportunistic pullback ranges on the $31.06 fib, $29.40 fib, $27.38 fib, $22.64 fib, $18.66 fib, $14.01 fib, and the $13.05 fib degree. Upside trajectories vary from the $52.13 fib up against the $68.41 fib degree.

[ad_2]