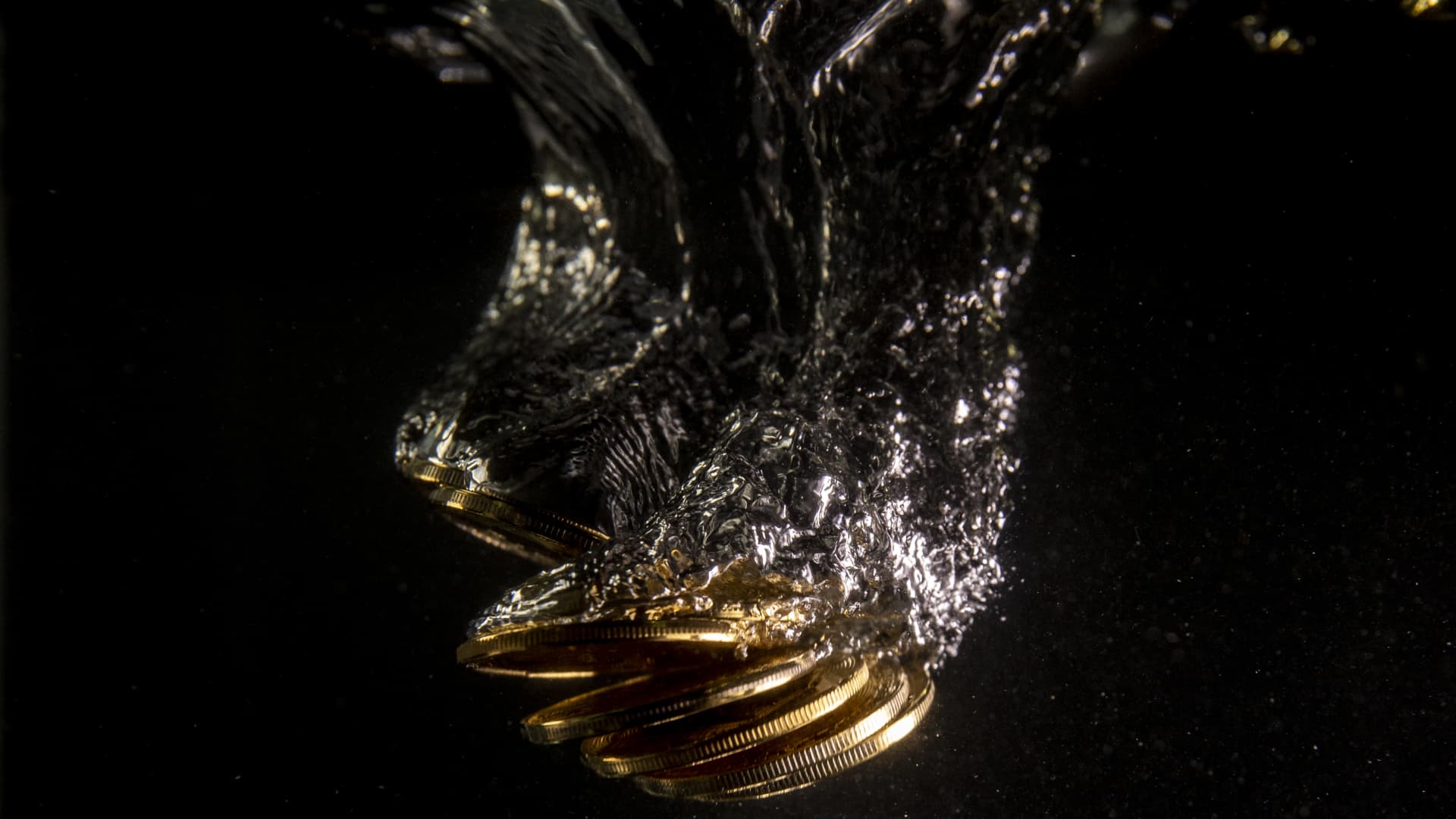

Luna, the sister cryptocurrency of arguable stablecoin TerraUSD, dropped to $0. The cave in of the algorithmic stablecoin TerraUSD has raised query concerning the long run survival of equivalent crypto property.

Dan Kitwood | Getty Pictures Information | Getty Pictures

Algorithmic stablecoins like terraUSD, which collapsed and despatched shockwaves in the course of the cryptocurrency marketplace, are not likely to live to tell the tale, the co-founder of virtual foreign money tether instructed CNBC.

Stablecoins are one of those cryptocurrency this is in most cases pegged to a real-world asset. TerraUSD or UST, is an algorithmic stablecoin which used to be meant to be pegged to the U.S. buck.

While stablecoins like tether and USD Coin are subsidized via real-world property similar to fiat currencies and govt bonds with the intention to handle their buck peg, UST used to be ruled via an set of rules.

UST misplaced its buck peg and that still resulted in a sell-off for its sister token luna, which crashed to $0.

The debacle has resulted in warnings that algorithmic stablecoins may now not have a long run.

“It is unlucky that the cash … used to be misplaced, alternatively, it is not a wonder. It is an algorithmic-backed, stablecoin. So it is only a bunch of sensible other people attempting to determine the way to peg one thing to the buck,” Reeve Collins, the co-founder of virtual token corporate BLOCKv, instructed CNBC on the Global Financial Discussion board in Davos, Switzerland, remaining week.

“And numerous other people pulled out their cash in the previous couple of months, as a result of they discovered that it wasn’t sustainable. In order that crash roughly had a cascade impact. And it is going to more than likely be the tip of maximum algo stablecoins.”

Collins may be the co-founder of tether, which isn’t an algorithmic stablecoin. However tether’s issuer claims it’s subsidized via money, U.S. Treasurys and company bonds. Within the crypto marketplace turmoil remaining month, tether additionally in brief misplaced its buck peg prior to regaining it.

Jeremy Allaire, CEO of Circle, some of the corporations at the back of the issuance of the USDC stablecoin, mentioned he thinks other people will proceed to paintings on algorithmic stablecoins.

“I have when put next algorithmic strong cash to the Fountain of Adolescence or the Holy Grail. Others have referred to it as monetary alchemy. And so there’ll proceed to be monetary alchemists who, who paintings at the magic potion to to create these items, and to seek out … the Holy Grail of a strong price, algorithmic virtual foreign money. So I absolutely be expecting endured pursuit of that,” Allaire instructed CNBC remaining week.

“Now, what occurs with legislation round this is a other query. Are there going to be, you already know, transparent traces drawn about what can have interaction with the marketplace. What can have interaction with … the monetary machine, given the dangers which are embedded,” he added.

Legislation forward

The crytpo business is anticipating more difficult legislation on stablecoins, particularly after terraUSD’s cave in. Bertrand Perez, CEO of the Web3 Basis and a former director of the Fb-backed Diem stablecoin venture, expects regulators to call for that such cryptocurrencies are subsidized via genuine property.

“So I be expecting that when we have now a transparent legislation of stablecoins, the elemental laws of the legislation can be that you’ve a transparent reserve with a suite of property which are robust, that you are matter to common audits of the ones reserves,” Perez instructed CNBC remaining week.

“So you’ll be able to have an auditing corporate that comes frequently to just remember to have the correct reserves, that you’ve additionally the correct processes and measures with the intention to face financial institution runs and different, shall we embrace, adverse marketplace stipulations, to ensure that your reserve is truly protected, now not handiest when the entirety is going smartly.”