(EV) charging community Blink Charging (NASDAQ: BLNK) inventory has fallen (-37%) all the way through the 2022 endure marketplace. The EV charging operator and supplier of charging apparatus had spectacular fiscal Q1 2022 metrics together with a 339% building up in revenues and 346% building up in provider revenues and a 99% building up in charging stations reduced in size or bought. Then again, those percentages can overstate the efficiency since the true numbers are small like best $1.5 million in provider revenues. The trajectory continues to be bullish as EV and electrification adoption are sturdy tailwinds with many huge automakers like Ford Motor (NYSE: F) shifting to provide those cars in quantity. Emerging oil costs also are bolstering call for for EVs. EV gross sales are projected to have a compound annual enlargement charge (CAGR) of 24% from 2021 to 2030, in step with the Global Power Company. That is developing a direct call for for EV charging infrastructure that may meet the desire of over 120 EV fees yearly via 2030. By means of comparability, there have been best 2.8 million fees globally in 2021. The U.S. legislative surroundings for EVs could be very favorable with the greater than $7.5 billion in govt allocation via the Biden management to construct a state of the art EV charging infrastructure. Prudent buyers searching for publicity to the EV charging infrastructure enlargement development can search for opportunistic pullbacks in stocks of Blink Charging.

MarketBeat.com – MarketBeat

Q1 Fiscal 2022 Profits Unlock

On Would possibly 22, 2022, Blink reported its fiscal Q1 2022 effects for the quarter finishing March 2022. The Corporate reported earnings-per-share (EPS) lack of (-$0.36) as opposed to consensus analyst estimates for a lack of (-$0.48), a $0.12 beat. Revenues grew 345.5% year-over-year (YoY) to $9.8 million, beating analyst estimates for $6.81 million. There used to be a 99% building up in charging stations reduced in size or bought Q1 2022 as opposed to Q1 2021 with 3,174 charging stations reduced in size or bought in Q1 2022. Blink CEO Michael Farkas commented, “Our sturdy enlargement within the quarter stems essentially from our distinctive industry style targeted round offering versatile and completely built-in charging answers to shoppers. As an owner-operator of a lot of our chargers, we are in detail eager about each and every step of the set up procedure and will facilitate upgrades and different repairs as had to give you the highest era for the positioning whilst additionally making the most of expected higher charging usage. We’ve lately expanded our product choices to incorporate next-generation charging era throughout all the EV ecosystem together with house, fleet, multifamily, retail, and federal freeway infrastructure, improving our place as a era innovator at the vanguard of the EV charging trade.”

Convention Name Takeaways

CEO Farkas highlighted the Corporate’s enlargement pushed via its forged platform, govt awards, and total EV adoption momentum. The Corporate reduced in size 3,174 industrial and home charters, up 99% from the yr in the past quarter. The Corporate continues to win new grant and rebate awards together with $3 million within the first quarter 2022 and $30 million since January of 2021. He commented, “The legislative surroundings surrounding the EV trade is amazingly favorable, and we imagine we’re situated to win many extra grants and rebates as federal, state and native governments allocate the $7.5 billion from the Biden management for state of the art EV charging infrastructure.” Blink got Electrical Blue Charging to increase its Eu presence in the United Kingdom including over 1,150 chargers put in or dedicated to supply. This suits into Blink’s way to determine multi-year unique partnerships via acquisitions to extend its marketplace achieve, which has grown to over 19 international locations.

BLNK Opportunistic Pullback Ranges

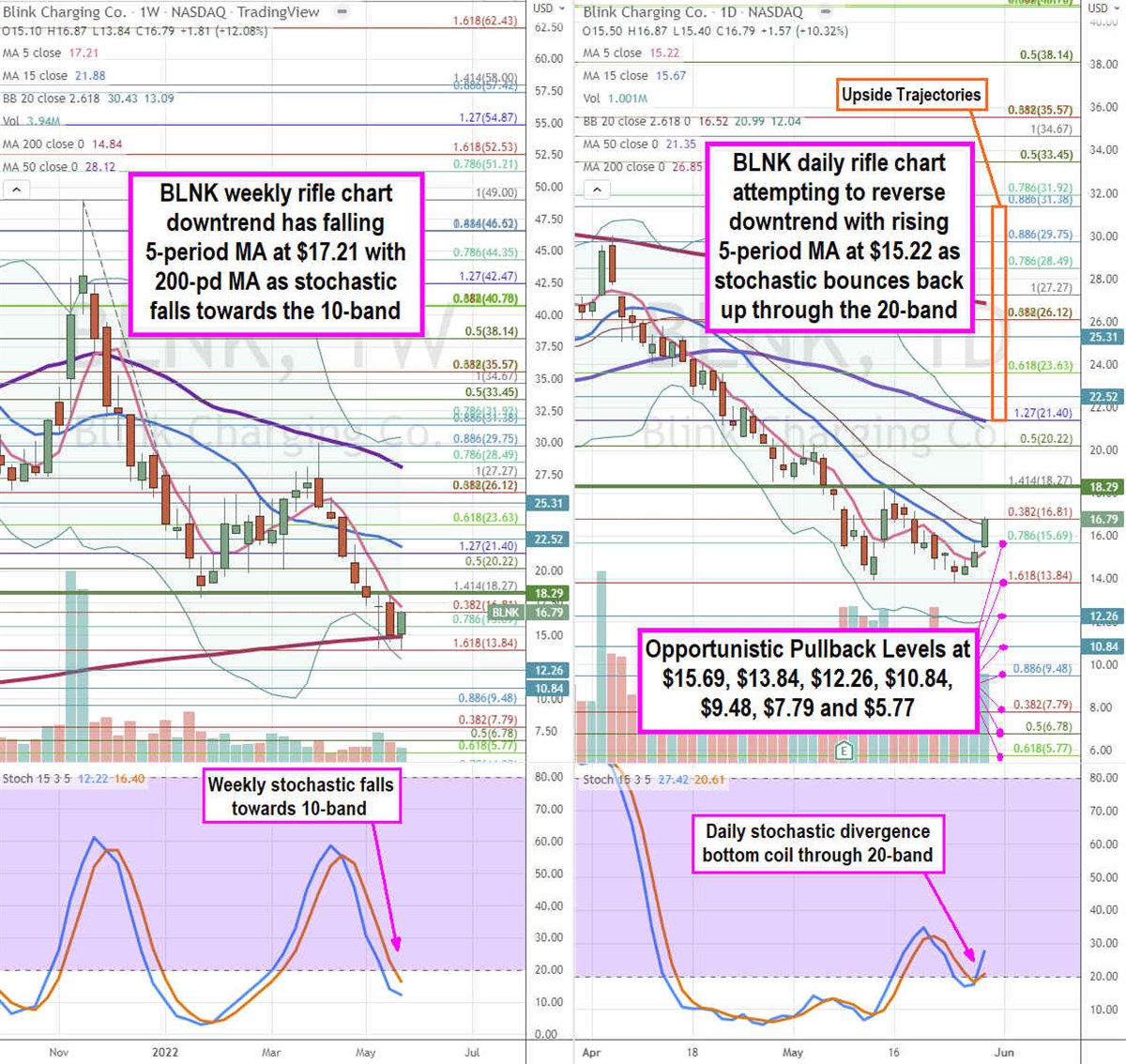

The usage of the rifle charts at the weekly and day by day time frames supplies the near-term viewpoint of the taking part in box for BLNK inventory. The weekly rifle chart peaked close to the $29.75 Fibonacci (fib) stage. Stocks collapsed to backside out close to the $13.84 fib prior to staging a restoration. The weekly rifle chart downtrend has a falling 5-period shifting moderate (MA) resistance at $17.21 with 200-period MA toughen at $14.84 and decrease weekly Bollinger Bands (BBs) at $13.09. The weekly 15-period MA continues to fall in conjunction with the 50-period MA at $28.12. The weekly stochastic has fallen underneath the 20-band and would possibly shape both a mini inverse puppy during the 10-band or leap on a move up. The weekly marketplace construction low (MSL) purchase triggers above $18.29. The day by day rifle chart downtrend stalled because it makes an attempt a reversal on emerging 5-period MA at $15.22 making an attempt to move up during the 15-period MA at $15.67. The day by day 50-period MA sits at $21.35 with higher day by day BBs at $20.99. The day by day stochastic has a divergence backside because the stochastic bounces again up during the 20-band. Prudent buyers can search for opportunistic pullbacks on the $15.69 fib, $13.84 fib, $12.26, $10.84, $8.48 fib, $7.79 fib, and the $5.77 fib stage. Upside trajectories vary from the $21.40 fib up in opposition to the $31.38 fib stage.