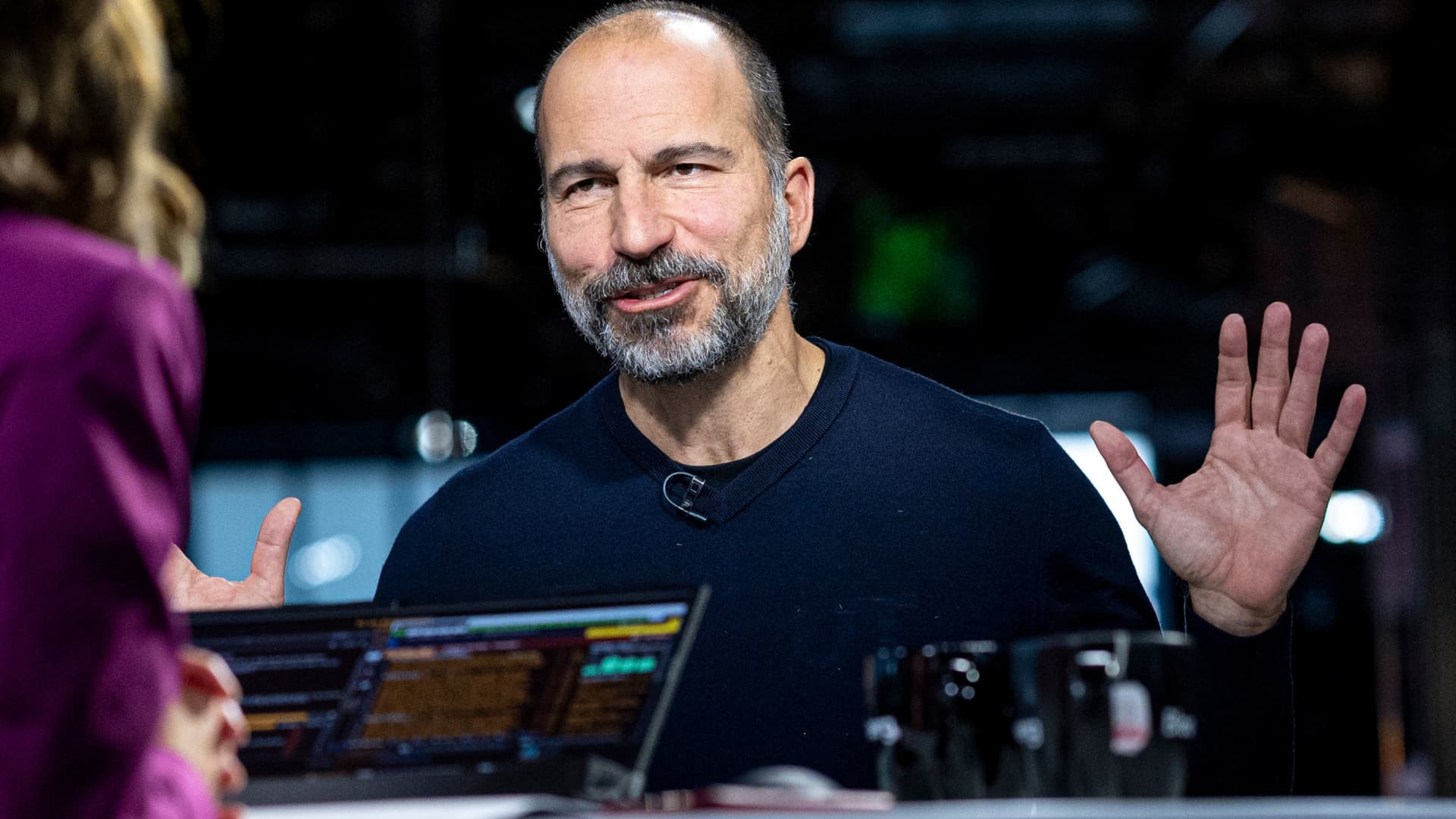

Inventory purchasing through company insiders has risen sharply in Would possibly, however retail buyers would possibly wish to hang out a little bit longer earlier than following their lead. Thru Would possibly 23, the ratio of insider purchase to promote price was once at its best per 30 days degree since March 2020, in keeping with information from The Washington Carrier. The collection of within patrons had already crowned 1,200, making it the most important month of the 12 months up to now, and was once on course to outnumber dealers for the primary time in additional than two years. The patrons come with CEOs at main corporations, reminiscent of Uber CEO Dara Khosrowshahi, who purchased $5.3 million value of inventory on Would possibly 6, in keeping with VerityData/InsiderScore.com. Probably the most contemporary purchasing has come amongst shares that had been down greater than 25% for the 12 months . Insider purchasing is incessantly noticed as a favorable signal through skilled buyers. The purchases through executives and board participants is usually a sign that individuals throughout the corporate are bullish on its possibilities. Traditionally, will increase in insider purchasing all over a marketplace downturn generally tend to occur close to the ground of the pullback. The sturdy purchasing in March 2020, for instance, coincided with the marketplace discovering a backside and roaring again, because the Federal Reserve stepped in to reinforce monetary markets. Insider purchasing additionally spiked in January 2019, in a while after the pointy Christmas Eve sell-off, in keeping with The Washington Carrier information. Alternatively, buyers will have to be wary about seeing this month’s building up as executives calling the ground of a marketplace sell-off, mentioned Ben Silverman, the director of analysis at VerityData. Whilst the purchasing has been sturdy, it hasn’t been overwhelming. “All the ones classes insiders made actually, actually astute marketplace backside calls, and that was once transparent through the ancient quantity of shopping for on the time. Whilst the numbers glance excellent now, they are at form of the low finish the place they had been all over the ones classes,” Silverman mentioned. Moreover, the bounce in purchasing quantity this month may have been helped through profits season. As soon as corporations record effects, their insiders are allowed to industry extra freely. For the primary quarter reporting duration, that impact is generally more potent within the first part Would possibly, Silverman mentioned. Because the month has long gone on, purchasing process has tailed off, in keeping with VerityData’s analysis. “We actually sought after to look purchasing numbers construct, after which maintain for a few weeks. And as an alternative we noticed purchasing numbers backpedal,” Silverman mentioned. Nonetheless, Silverman mentioned he’s “positive” that the extent of shopping for displays that some shares have grow to be undervalued. Insider purchasing has been specifically sturdy amongst Russell 2000 corporations, he added. Listed below are one of the corporations the place most sensible executives have purchased inventory during the last month, in keeping with VerityData: Paramount World Starbucks Common Motors Common Electrical Carnival Corp.