Evaluations expressed through Entrepreneur members are their very own.

As I used to be speaking to one in all my early-stage founders about company governance ideas, I noticed that what I used to be sharing with him is not commonplace wisdom. Early-stage founders all the time right here “search sensible capital,” however I noticed that founders do not in point of fact perceive the entire intensity of that remark or why it’s so essential to be strategic when elevating capital, particularly within the early rounds (pre-seed, seed and Collection A).

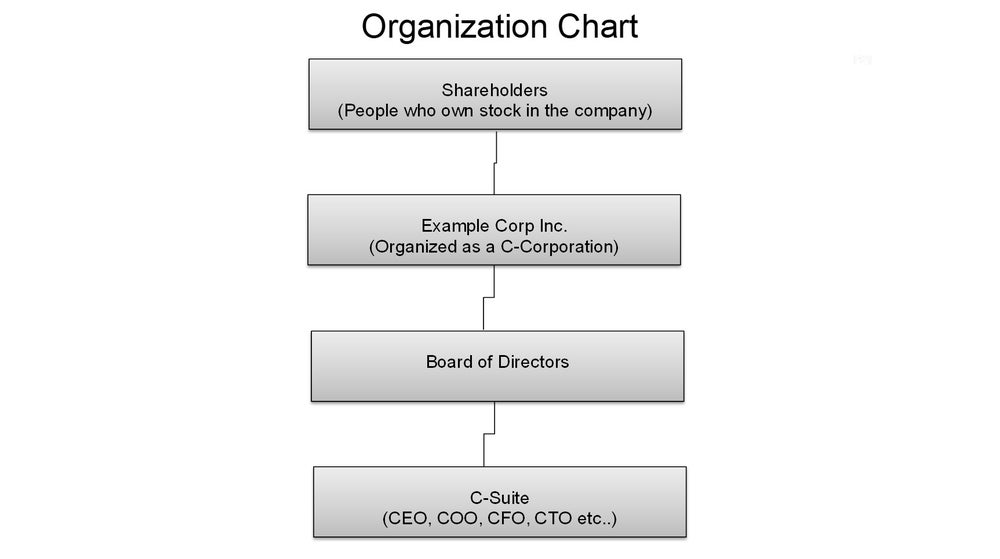

Let’s get started through converting the word “search sensible capital” to “search synergistic capital.” To crystallize the purpose of why searching for synergistic capital is so essential for early-stage founders, I wish to duvet some key issues of company construction and governance, as figuring out this from that lens will higher mean you can see the significance of the subject. Practice the organizational chart I have created underneath:

Symbol Credit score: Fredrick D. Scott, FMVA

It is not the prettiest org chart I have ever completed, however it’s going to illustrate this level smartly. An important takeaway from the chart above is figuring out how the hierarchy works. Ranging from the ground of the chart and dealing our method up:

C-suite executives

C-suite executives are regarded as “each day” managers of the trade. They’re liable for overseeing and ensuring the corporate and personnel are working inside the venture and imaginative and prescient, as defined through the board of administrators (with enter from the C-Suite). They be sure the corporate is working, in all facets, as successfully as conceivable and hitting the quite a lot of expansion metrics set to make sure the corporate is producing extra earnings 12 months after 12 months. Most significantly, you will have to keep in mind that an organization’s C-suite works to the desire and enjoyment of the board of administrators. This can be a key level of figuring out, and you’ll see why in a bit of.

Comparable: The Fundamentals of Elevating Capital for a Startup

Board of administrators

The following degree up within the hierarchy is the board of administrators. Their task is to offer oversight of the C-suite, to put in force macro coverage, governance paperwork and pace. Most significantly, their task is to give protection to shareholder pursuits through insuring two issues:

One, that the C-suite is working in an effective way and guidance the corporate within the route that, within the board’s opinion, will result in the most efficient conceivable likelihood of accelerating expansion, earnings and benefit margins 12 months after 12 months.

And two, that there are right kind guardrails in position that govern the best way the C-suite operates and supply enough chance mitigants towards “irregularities” and/or irrational methods that, within the board’s opinion, would erode shareholder worth. Extra importantly, the board, normally, has the power to effectuate swift motion towards a C-suite government within the tournament that they really feel such motion can be in the most efficient pursuits of the corporate, and through extension, the shareholders.

A just right instance of this performed out lovely publicly at WeWork when the now-former CEO, Adam Neumann, was once ousted from the very corporate he based through the corporate’s board of administrators, as a result of (briefly) they felt that his movements have been now not serving the most efficient pastime of the corporate, and through extension, the shareholders.

Shareholders

Let’s take a deeper have a look at them. Shareholders (often referred to as stockholders) are the homeowners of an organization. They purchase inventory within the corporate, and every inventory they purchase represents a share of possession within the corporate. How giant or small that share of possession depends upon how a lot inventory the corporate problems and what number of of the ones shares an individual or every other corporate (either one of that are regarded as traders) buys. Let us take a look at two very, quite simple examples of this:

Corporate A has issued 100 stocks of inventory. An investor comes to a decision they wish to purchase 10 stocks of Corporate A’s inventory. That investor now owns 10% of Corporate A.

Corporate B has issued 1,000 stocks of inventory. An investor comes to a decision they wish to purchase 10 stocks of Corporate B’s inventory. That investor now owns 1% of Corporate B.

Notice that those are, once more, quite simple examples, and issues can get fairly a bit of extra complicated than that once taking a look at an organization’s fairness construction. Then again, the aim of those examples is as an example the purpose that shareholders are part-owners of the corporate.

Comparable: Must You Pitch Your Startup to Early-Degree Buyers?

The significance of searching for synergistic capital

With the above issues established, let’s read about why searching for synergistic capital as an early-stage corporate is crucially essential. As defined within the above dialogue, it could look like everybody is operating in opposition to the similar finish: To earn more money for the corporate, and in flip, earn more money for the shareholders of the corporate. Within the preferrred scenario, everyone seems to be aligned utterly in that undertaking. Then again, issues are hardly ever preferrred in the actual international, particularly for early-stage firms. Whilst without equal purpose is also the similar (to make more cash), there generally is a divergence of critiques among senior executives and the board of administrators on the easiest way to move about attaining without equal purpose. This divergence is the place bother can start and the place failure can ensue for early-stage firms and/or their founders.

The difficulty lies in how the vast majority of early-stage firms cross about elevating capital. Normally, on account of the very nature of being a startup trade and all of the hindrances that come along side that, founders who’re looking to carry capital for his or her companies (particularly within the early rounds), are so determined for capital that they’re keen to take it from someone who is keen to offer it.

The problem with taking this means is that, a large number of instances, your earliest traders (particularly the ones with revel in in early-stage making an investment) will most likely require that they’re given a board seat as a situation to supplying you with capital. The reason from an investor’s viewpoint is that they would like in an effort to workout oversight at the corporate — and through extension — using the capital they provide the corporate, to be sure that the capital is getting used correctly and successfully.

When a founder understands this reality, what turns out like this kind of minor factor (giving for free a board seat) is not so minor anymore. Keep in mind, the board’s task is to give protection to shareholders’ pursuits and do what they really feel goes to force shareholder worth the quickest. Their trust on how that may be completed would possibly not align with a founder’s imaginative and prescient for the corporate.

Now, a large number of founders studying this text will say “Smartly I personal maximum of my corporate’s stocks so this can be a non-issue for me.” That can be true TODAY, alternatively, as you carry increasingly capital, you need to give away increasingly possession of the corporate (referred to as dilution), so briefly: The extra you carry, the fewer you personal. With out right kind making plans, it’s simple to seek out your self, as a founder, within the minority possession place of the very corporate you began.

Couple that with a board of administrators that does not absolutely see eye to eye with the best way you’re working the corporate, and it is advisable simply to find your self at the out of doors taking a look in (which means fired). Even though you’re the chairman of the board, it’s not relevant, you’ll nonetheless be outvoted through the remainder of your board.

A laugh reality: Do you know that, in keeping with Roberts Regulations of Order (the gold usual for the way to habits board conferences), the chairman of the board does not even get to vote until it’s to wreck a tie?!

Because of this searching for synergistic capital is so essential for early-stage founders. You need to be sure that the people who find themselves making an investment in you and your corporate are absolutely aligned with you and your imaginative and prescient. You need those that consider in you that can assist you upload accretive worth on your corporate by means of revel in, relationships,and time funding into your construction as a founder and CEO (and into the improvement of the corporate itself). Individually, anything else wanting this can be a recipe for eventual crisis (have in mind 94% of project capital-backed firms sooner or later fail).

The most productive likelihood a founder and their corporate need to prevail is through being strategic and intentional in each side in their trade endeavors, and that’s particularly essential within the side of elevating capital. Founders need to remember the fact that project capital does not paintings with out firms to put money into, so you will need to have in mind this level, and lift capital as a founder, now not as a pauper!

Comparable: Elevating (Sensible) Capital And Why It is Now not Simply About The Cash