Deep-rooted engagement is important to turn out to be vertical farming from a distinct segment to mainstream class if the sector is to feed a rising inhabitants with contemporary fruit and veg by way of sustainable way.

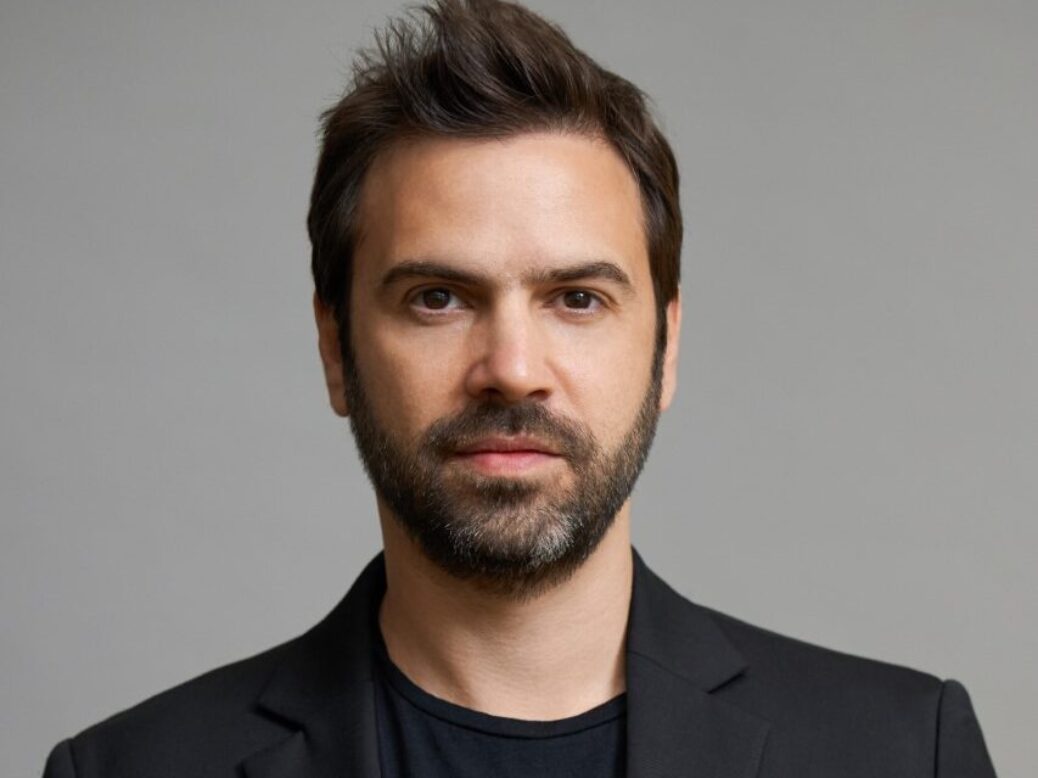

It’s an opinion no longer held solely by way of Erez Galonska, leader govt of Berlin-based Infarm, which claims to be the “pioneer” in Europe for city or controlled-environment indoor farming. Around the pond in the United States, vertical-farming peer Masses Limitless clings to the similar view.

Then again, no longer a lot has modified since co-founder Dr. Nate Storey spoke with Simply Meals 18 months in the past, pointing out “a large number of imaginative and prescient” will probably be required to foster the advance of the business and fasten the urgent factor of land availability.

The benefits of vertical farming over conventional agriculture are transparent – much less water utilization and land mass, 0 insecticides, freshness, and high quality because of proximity to the shopper, and bigger yields as a result of year-round cultivation. But boundaries are conserving again the business – massive capital outlays, top power prices thru synthetic lighting fixtures, and a top class value till there are sufficient international avid gamers with economies of scale.

Galonska says enter from governments and different establishments within the type of incentives and grants is very important to spur growth.

“Even whilst you have a look at COP27 and past, we’re already talking with policymakers, NGOs, with other varieties of organisations, to assist us galvanise other people to begin and take into consideration what we devour, what the availability chain goes to seem like at some point, the place meals goes to be produced, the lack of confidence of meals, what we will be able to do and what we will be able to’t do – the function of grants, subsidies, and regulatory problems,” he tells Simply Meals.

“We see there’s a joint effort right here to conquer the mega demanding situations that we’re going through.”

Monetary stresses

Get entry to to funding money is simply one of the crucial demanding situations to improve the capital-intensive nature of city farming and the preliminary arrange and working prices. Then again, synthetic intelligence powered gadget finding out and cloud-based data-collecting programs, each hired by way of Infarm, toughen efficiencies and assist carry prices down. They usually scale back labour to paintings the farms.

Indicative of the monetary stresses, France’s Agricool, based in 2015 two years after Infarm, went into receivership this yr.

“The declaration of cessation of bills used to be motivated by way of an inadequate turnover to finance the top structural prices function of start-ups, principally connected to the prices generated by way of investments in R&D and the loss of volumes essential to succeed in an running steadiness,” courtroom paperwork learn.

Get entry to to capital “is an excessively large downside for a tender business, which isn’t mature and there’s no longer such a lot of property producing benefit,” Galonska explains.

Whilst attracting funding price range isn’t a subject matter for Infarm – it has raised greater than US$600m up to now and has a valuation of round $1bn – the side of profitability is. It’s a pitfall prevalent throughout vertical-farming companies running in what’s a low-margin class.

Galonska emphasises scale is essential. “The largest problem for the business is execution, execution, execution, achieving that scale, which by way of definition, goes to create a winning, sustainable corporate that may develop into the following stages.

“You must funnel the funding into long term plants to conquer the large demanding situations that we’re going to face. However the actual problem is how are we going to feed the sector? We’re going to have as regards to 10 billion other people on the earth. Local weather exchange goes to switch the place we’re running and developing meals, so we need to get a hold of other choices and to find tactics to supply extra with much less.”

Whilst Infarm isn’t by myself in its unprofitable standing among urban-farming friends, Galonska is eager to show the German company has a “very transparent street to profitability” and is recently “executing in opposition to an annual contract price of $300m” for 2023-24.

Store scale

Arrange by way of Galonska and his brother Man with Osnat Michaeli, Infarm operates hydroponic rising centres in Europe, Canada and the United States. A brand new website online is ready to come back on circulate in Qatar subsequent yr, marking the corporate’s access to the Center East the place vertical farming is gaining traction to scale back reliance on meals imports in a area that has restricted agriculture because of the local weather.

Infarm has in-store gadgets in one of the crucial biggest supermarkets comparable to Kroger and Safeway in North The usa, Marks and Spencer, Edeka and Albert Heijn in Europe, and Summit Retail outlets in Japan. The trade has greater than 75 commercialised merchandise from herbs to salads, leafy vegetables and mushrooms, and an extra 40 listings deliberate.

Its so-called modular farms – separate portions that make up an entire gadget as such – make use of data-driven, cloud-connected finding out programs, and “minimise local weather and provide chain dangers”, Infarm mentioned. End result comparable to cherry tomatoes and strawberries and different veg like peppers and peas also are in building.

Galonska is of the same opinion vertical farming will stay area of interest for operators simplest rising a make a selection few plants however is adamant Infarm’s type, when it comes to set-up and collection, will lift the corporate past that appellation.

“We’re already running in a mass marketplace and all our contracts are tied to very large outlets,” he says.

Infarm operates round 17 rising hubs, a dozen of which Galonska describes as “very large amenities”. It goals to increase the ones to twenty-five within the subsequent two to a few years with an final goal to succeed in 100 in 20 nations by way of the top of the last decade. Acreage levels from 1,000 sq. metres to its latest, a 20,000 square-metre plot to be introduced in the following couple of weeks.

Street to benefit

Going public could be an alternate way to boost price range outdoor of personal fairness and project financing, however few city farming corporations have succeeded. US-based corporations AppHarvest and Kalera are indexed at the Nasdaq and Oslo exchanges, respectively.

AeroFarms, every other US vertical farming trade, pulled out of a proposed SPAC deal ultimate yr, when Infarm used to be mentioned to have employed Goldman Sachs to discover a merger with a Particular Function Acquisition Corporate. Each Infarm and the United States funding financial institution declined to remark.

As a personal corporate, Galonska declined to show precise numbers on Infarm’s revenues or earnings.

“So long as we execute and reveal operational excellence and proceed to supply our top class merchandise at reasonably priced costs, we’ve an excessively, very transparent street to profitability. And with our modular farms, we all know that during positive thresholds we move, we’re going to breakeven or generate benefit in top margins,” he explains.

“We paintings very arduous at the enter and the output from every farm. And we’re the use of modularity as a way to improve the transparency round unit economics, each from the interior but additionally from the availability chain or operational aspect.”

The additional advantage with scale is generation inputs will most probably come down, and in the long run the associated fee to the shopper. However which may be a way off with Galonska predicting every other ten years earlier than vertical farming turns into mainstream past leafy vegetables, herbs and make a selection fruit and veg. And shoppers could be anticipated to pay a top class for freshness and high quality with sustainability and planet-friendly credentials.

“While you’re beginning to talk about all of the fruit and vegetable basket – strawberries, tomatoes and cucumbers and so forth – we’re speaking concerning the five- to seven-year vary,” he says. “If you happen to suppose past 10 years from now, we’re going to be courageous sufficient and ambitious sufficient to mention that staple and different merchandise, which nowadays aren’t possible to develop inside vertical farms, are going to be a part of the portfolio and providing.”

All mentioned and finished, Infarm’s farming operations are aimed toward larger yields and profitability. And it’s additionally in the hunt for so as to add farms in different geographical areas comparable to Asia, although Galonska wouldn’t disclose main points rather than to mention, “we’ve a large number of trade building actions in Asia”.

In February, the trade opened a 2d US rising hub close to Austin, Texas, and plans 5 extra. The primary used to be introduced in 2019 in Seattle, Washington. And in June, Infarm will upload to its UK presence with the legitimate inauguration of a facility in Bedford, north of London, which the corporate claims is among the biggest in Europe.

“Costs pass down each from an operational point of view as you scale and as you leverage economies of scale. Each and every farm that we’re opening, each and every facility that we’re opening, there’s a transparent street to profitability consistent with rising centre – we take into consideration it nearly like an asset that’s going to be cashflow certain,” Galonska says.

“From a capex point of view, one goes to supply larger batches as call for grows, and that drives down the associated fee on the farm degree. In order that’s going to be less expensive and extra winning with time and scale. That’s additionally why we select modularity, which permits us to have other sized modules and rising centres.”

Simply Meals research, summer time 2021: Indoor farming and the potentialities for profitability