An enormous sell-off in semiconductor shares this 12 months has created a chance to shop for the dip, Morgan Stanley says, naming the 2 international chipmakers it expects to dominate. Semiconductor shares have taken a beating this 12 months, amid a broader sell-off around the tech sector. However Morgan Stanley believes this has created a chance to put money into one of the crucial “best high quality” and “maximum dominant” international semiconductor corporations at sexy costs. In a notice titled “Conflict of Chips” from Would possibly 20, the financial institution’s analysts, led by means of Shawn Kim, famous that there are 3 main manufacturers lately: Taiwan Semiconductor Production Corporate , Samsung , and Intel . Certainly, they stated the funding and operational excellence required to put into effect probably the most complex procedure applied sciences for semiconductor chips has pushed out all however those 3 corporations from the trade. “At the vanguard, we predict TSMC and Samsung to proceed to dominate complex semiconductor production within the subsequent decade, capitalizing at the huge and abruptly rising foundry alternative,” Kim stated. Intel’s function is “much less positive,” he added. TSMC and Samsung are the one two corporations working foundries for the fabrication of modern semiconductors, and rely the likes of Apple , Qualcomm and Nvidia amongst their largest shoppers. Each TSMC and Samsung stocks are down round 15% over the 12 months thus far, outperforming the iShares Semiconductor ETF , which is down greater than 26% over the similar length. Call for for modern semiconductors – the smallest and maximum robust chips – has been booming as innovation in spaces comparable to cloud computing, synthetic intelligence (AI), good automobiles, and 5G takes to the air. The financial institution predicts chip call for from high-performance computing, which incorporates cloud and AI, to check chip call for from smartphones inside of a couple of years. TSMC “TSMC is a number one participant in international semiconductors as a natural play foundry – and is now dominating in vanguard semiconductor production in relation to generation and marketplace proportion,” Kim stated. The corporate runs the biggest semiconductor foundry on this planet, has “bold” shoppers and is a “key enabler” for a couple of tech megatrends, consistent with Morgan Stanley. Basics additionally counsel awesome profits enlargement at TSMC, the financial institution stated. The corporate delivered compounded annual gross sales enlargement of 10% between 2015 to 2020, in comparison to 7% at Samsung, consistent with Morgan Stanley. That is anticipated to proceed into 2023, with TSMC anticipated to develop gross sales at a compounded fee of twenty-two%, in comparison to 15% for Samsung. Samsung Morgan Stanley famous that Samsung’s vertical and horizontal integration provides it a “distinctive edge” and added that the corporate has an “underpenetrated and underestimated” general marketplace alternative of $1.4 trillion. Kim estimates that Samsung’s working margins will stay solid at round 20% into 2024, with the corporate producing “huge quantities” of loose money drift of round $30 billion into 2023. Morgan Stanley’s value goal on TSMC represents a possible upside of fifty% as of Would possibly 24, whilst the financial institution’s value goal of 85,000 Korean received ($67.30) on Samsung represents a 27.8% upside attainable. Its analysts are overweight-rated on each shares.

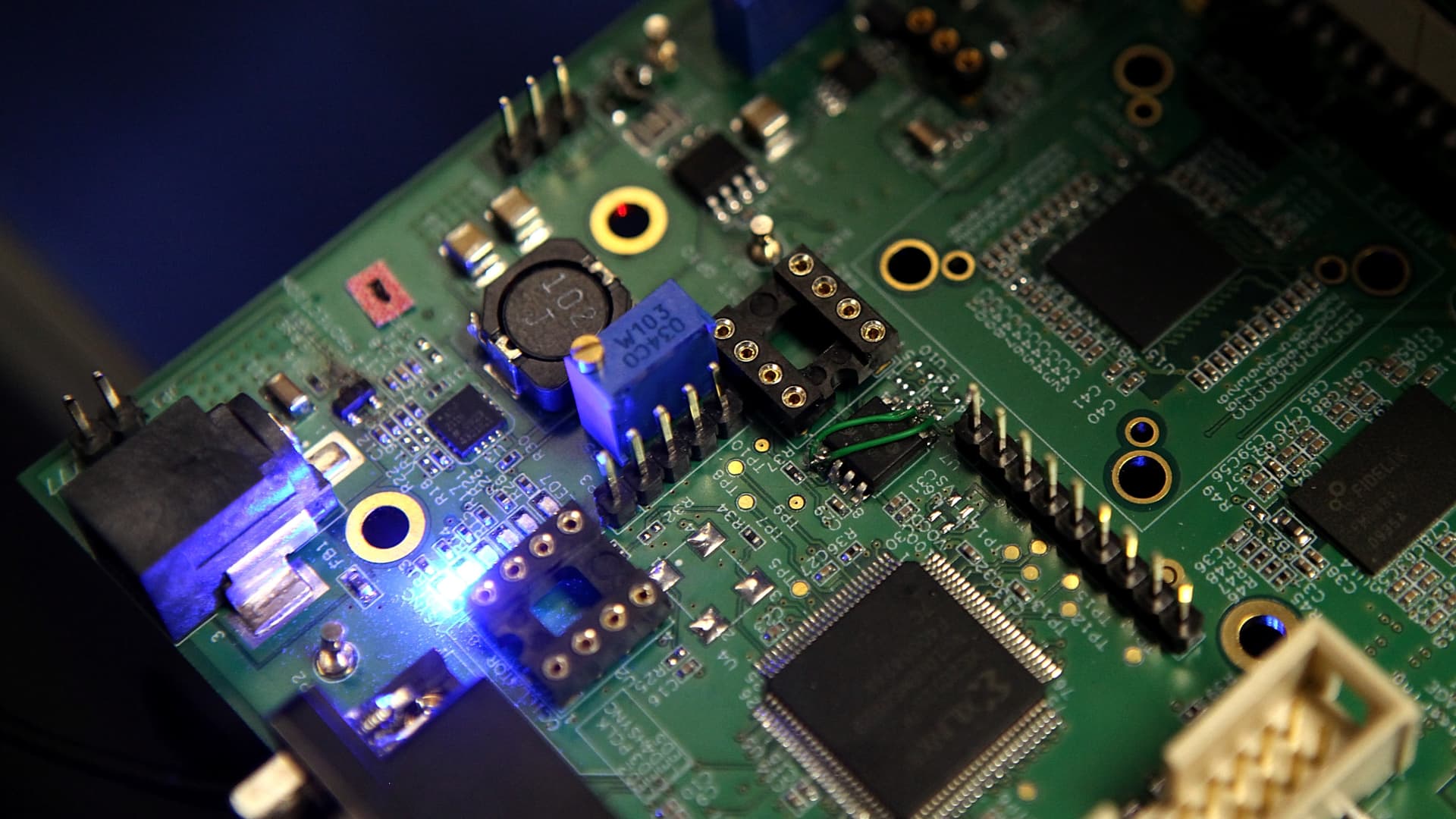

Semiconductors are noticed on a circuit board.

Justin Sullivan | Getty Pictures

An enormous sell-off in semiconductor shares this 12 months has created a chance to shop for the dip, Morgan Stanley says, naming the 2 international chipmakers it expects to dominate.