Many traders are questioning when housing costs will drop, however few can know needless to say what the longer term holds.

Desk of Contents

- How Has the United States Housing Marketplace Modified In recent times?

- What Mavens Forecast About US Housing Costs in 2022?

- Why Tracking Housing Costs is Essential

- 10 US Towns With the Lowest Median Assets Costs

- How Mashvisor Can Lend a hand Traders To find Reasonable Houses

The brand new decade began with a sequence of occasions some describe as catastrophic. It made many traders both concern or hope for a housing marketplace fall. It didn’t occur, and the housing costs had been in truth emerging within the closing couple of years.

Now, the sector is coming into a brand new level of the industrial disaster, with power costs emerging and impacting the costs of fundamental commodities. Will it’s a consider US housing costs and can they drop later in 2022?

How Has the United States Housing Marketplace Modified In recent times?

So are housing costs taking place? Recently, the United States marketplace isn’t appearing any indicators of costs losing any time quickly. To the contrary, with provide somewhat dwindling and insist expanding, the costs are emerging and doing so at a record-breaking pace. In keeping with CoreLogic analysis, costs are up 20% since closing yr.

In fact, that’s a median and for those who take a look at the least expensive puts to are living in the United States, you’ll to find that costs haven’t modified that a lot. In some spaces that aren’t doing as neatly, housing costs can have dropped. However, on moderate, the costs are emerging. There are many spaces, most commonly metropolitan ones, the place costs are up greater than 20% since closing yr.

Median Assets Costs Throughout the United States

The median worth of a assets is now at a list $405,000, a 26% build up since 2020. For the reason that in March 2020, the pandemic and lockdowns simply began, one may just be expecting the marketplace to crash. It didn’t and as a substitute rose in worth much more, making traders thousands and thousands and, on the identical time, making it harder for brand spanking new householders to go into the marketplace.

Now not best did the housing marketplace leap again up because the 2008 crash, but it surely’s additionally been in a steep upward motion because the 2020 pandemic. And that’s in spite of the truth the United States entered a recession in 2020. How can it’s conceivable? One of the crucial explanations is loan charges are hitting a ancient low.

Since maximum homebuyers are the use of credit score, low rates of interest equivalent a less expensive space. Loan rates of interest hit the bottom level in January 2020, and the pandemic driven the rustic and the sector right into a recession. It was once the sign for a number of folks looking ahead to the very best alternative to grow to be householders to behave rapid.

Now, with costs surging that prime, greater than 70% of house patrons imagine it’s a bubble, in keeping with Redfin. However will the actual property marketplace crash any time quickly? Let’s see what the professionals have to mention.

Similar: What Is The Highest Position To Purchase Funding Assets In 2022?

What Mavens Forecast About US Housing Costs in 2022?

Will housing costs ever move down? In all probability, however they gained’t fall dramatically. Despite the fact that professionals vary in estimates of whether or not the housing marketplace costs proceed the meteoric upward thrust, most pros concur {that a} vital marketplace recession or perhaps a crash isn’t within the image. The explanation at the back of this is that the location is so much other from again in 2008.

The housing disaster was once led to basically by way of predatory lending practices, leading to many of us getting a mortgage they may no longer have enough money and foreclosing on it. Low loan charges purpose the present upward thrust in costs. This time, folks can have enough money the loans they’re receiving, so a marketplace crash is rather unbelievable.

What’s most likely going to occur within the coming years is that the present expansion pattern will decelerate considerably. It’s a prediction Daryl Fairweather, Redfin’s leader economist, stocks with a lot of her colleagues. The explanation at the back of the expectancy of housing costs losing is that rates of interest are being larger.

Provide and Call for

The larger call for for housing was once no longer led to by way of folks possessing extra disposable source of revenue as wages was fairly stagnant, and the price of residing was once somewhat expanding because of inflation. It’s led to by way of simple get entry to to affordable credit score. As affordable credit score slowly levels out, the rise in house costs goes to decelerate, as neatly. On the other hand, we most likely gained’t see a downward pattern, save for a small collection of submarkets.

Whilst some spaces are overpriced, housing costs aren’t falling within the nearest long run merely on account of the legislation of provide and insist. The call for for housing isn’t going away. Despite the fact that millennials reveal a miles decrease charge of homeownership than the former generations, best 18% be expecting to hire perpetually. Out of the ones, 70% achieve this in spite of their needs; they only don’t suppose they are able to have enough money a house.

At the provide facet of items, there’s a significant scarcity. Rob Dietz, the Nationwide Affiliation of House Developers economist, says the United States’s been underbuilding housing for many years. The adaptation between provide and insist was once as prime as 25% in line with NAHB estimates for 2018.

It’s most commonly because of rising administrative prices, the cost of lumber, and zoning regulations that don’t permit for a better density of housing. It creates a slight scarcity of houses that gained’t permit the marketplace costs to drop considerably. They’ll simply prevent rising as a lot within the nearest long run.

The Nice Migration

Some other pattern that’s going to proceed in the United States is folks shifting to reasonably priced towns. For the reason that pandemic made faraway paintings extra in style than ever prior to, and the Californian flight made the headlines, extra homebuyers were given at the bandwagon. A brand new buying development gave the impression with white-collar employees shifting to less expensive towns to save cash and prevent renting. So long as town isn’t in a recession and the home-owner is hired remotely, they’re just right.

What it way for actual property traders is that smaller towns at the moment are changing into a supply of source of revenue from conventional leases, no longer simply an Airbnb industry. Naturally, the web source of revenue goes to be so much smaller than in LA or NYC, however the money on money go back goes to be first rate, factoring in that the preliminary funding is small.

Since costs for single-family gadgets are beautiful prime, we might see a shift against denser housing. It way for those who’ve been on the lookout for a duplex on the market, it’s the fitting time to near the deal!

As well as, the common hire goes to develop a minimum of 7% in keeping with Redfin. It makes 2022 and the succeeding years the last decade of the small actual property investor.

Why Tracking Housing Costs Is Essential

For a home-owner who doesn’t need to transfer, house costs are beside the point. Positive, it’s great to grasp your own home is appreciating, however the majority of American citizens acquire properties to are living and lift a relations in, to not resell them.

However for a realtor or an investor, particularly for the ones with out thousands and thousands to take a position, pricing is essential. Investing exactly when the fee is true can assist optimize money on money go back and make the funding profitable.

It’s additionally essential to understand how the costs transfer in native submarkets. Discovering a scorching submarket corresponding to a small the city that’s turning into in style to transport into and buying a house there whilst it’s nonetheless somewhat affordable is usually a goldmine for a small investor.

Mashvisor is a device that can be utilized to seek out loads of goldmines like that and negotiate offers proper at the platform. Listed below are the highest ten towns with the bottom assets costs that supply a just right go back on funding in line with Mashvisor estimates taken from an MLS database.

Similar: How one can Get Get right of entry to to the MLS Database And not using a License

10 US Towns With the Lowest Median Assets Costs

Mashvisor’s analytical staff items estimates of median costs and a lot more in line with knowledge from open resources like Airbnb, Zillow, and MLS databases. Listed here are the highest 10 US towns with the bottom median assets costs, organized in descendin

1. Kingman, KS

To the west of Kansas Town, nearer to the border with Oklahoma, there’s the tiny idyllic the city of Kingman. It’s subsequent to a small river to the south, a looking reserve and fishing spots additional west, and a miles better town, Wichita, to the east. The median worth within the the city is not up to $100,000, and with 6% money on money go back, Kingman is a wonderful position to take a position.

Key Statistics:

- Selection of Listings for Sale: 6

- Median Assets Value: $90,900

- Moderate Value in line with Sq. Foot: $71

- Days on Marketplace: 27

- Selection of Conventional Listings: 0

- Per month Conventional Condominium Source of revenue: $875

- Conventional Money on Money Go back: 6.78%

- Conventional Cap Charge: 7.46%

- Value to Hire Ratio: 9

- Stroll Rating: 51

2. Garber, OK

Garber is located in the midst of farmlands. There’s no longer a lot occurring round it, except agriculture and several other rivers just right for fishing within the house. It won’t appear to be a lot, however many farm staff are temp employees and might be excited by renting. It’s why conventional money on money go back approaches 7% in Garber.

Key Statistics:

- Selection of Listings for Sale: 5

- Median Assets Value: $90,440

- Moderate Value in line with Sq. Foot: N/A

- Days on Marketplace: 63

- Selection of Conventional Listings: 0

- Per month Conventional Condominium Source of revenue: $852

- Conventional Money on Money Go back: 6.99%

- Conventional Cap Charge: 7.71%

- Value to Hire Ratio: 9

- Stroll Rating: 7

3. Clinton, IN

Clinton is a small the city in Vermillion nation, Indiana, this is located on a riverbank. With golfing lessons and parks close to the city and Indianapolis being inside of an hour’s force, Clinton is a smart and reasonably priced position to are living. The low median worth of $87,000 and an ROI of over 6% make it a good looking position to take a position, too.

Key Statistics:

- Selection of Listings for Sale: 7

- Median Assets Value: $87,357

- Moderate Value in line with Sq. Foot: $70

- Days on Marketplace: 61

- Selection of Conventional Listings: 0

- Per month Conventional Condominium Source of revenue: $817

- Conventional Money on Money Go back: 6.68%

- Conventional Cap Charge: 7.30%

- Value to Hire Ratio: 9

- Stroll Rating: 35

4. Beaver Falls, PA

Beaver falls is completely positioned relating to the ratio of town lifestyles and nature. It’s best 31 miles clear of Pittsburgh. The city sits on a river with scenic strolling routes alongside its banks. It’s positive to draw tenants who’re effective with a protracted force to Pittsburgh, particularly now that many roles are partially faraway. The median worth of $83,000 and a 7% money on money go back make it a very good funding hotspot, as neatly.

Key Statistics:

- Selection of Listings for Sale: 5

- Median Assets Value: $83,940

- Moderate Value in line with Sq. Foot: $114

- Days on Marketplace: 38

- Selection of Conventional Listings: 14

- Per month Conventional Condominium Source of revenue: $840

- Conventional Money on Money Go back: 7.01%

- Conventional Cap Charge: 7.86%

- Value to Hire Ratio: 8

- Stroll Rating: 75

5. New Ringgold, PA

New Ringgold is a small borough in Schuylkill County, PA. It’s a long way from massive roads and borders best small rivers and looking grounds within the nearest proximity. It’s best 37 miles from Allentown with all of its facilities, so attending to a big town for a weekend gained’t be an issue. Assets costs on the town are low, best $83,000 for a median space.

Key Statistics:

- Selection of Listings for Sale: 5

- Median Assets Value: $83,900

- Moderate Value in line with Sq. Foot: N/A

- Days on Marketplace: 102

- Selection of Conventional Listings: 1

- Per month Conventional Condominium Source of revenue: $707

- Conventional Money on Money Go back: 6.39%

- Conventional Cap Charge: 7.28%

- Value to Hire Ratio: 10

- Stroll Rating: 7

6. Cahokia, IL

Cahokia is part of the St. Louis agglomeration at the Illinois facet of the border. It’s an ideal position for an investor as it’s close to a significant town. It additionally draws extra folks on account of its price of residing. The median worth of houses in the community is $77,000, which is an extraordinary to find for an investor.

Key Statistics:

- Selection of Listings for Sale: 21

- Median Assets Value: $77,314

- Moderate Value in line with Sq. Foot: $70

- Days on Marketplace: 76

- Selection of Conventional Listings: 5

- Per month Conventional Condominium Source of revenue: $735

- Conventional Money on Money Go back: 4.96%

- Conventional Cap Charge: 5.51%

- Value to Hire Ratio: 9

- Stroll Rating: 40

7. Highland Park, MI

Highland Park is a real gem. Part of the Detroit agglomeration that’s as regards to an airport is bound to draw extra folks. Additionally, it’s value noting that Detroit is these days present process a revival. The housing costs are reasonably priced, with a mean of $75,000.

Key Statistics:

- Selection of Listings for Sale: 6

- Median Assets Value: $75,633

- Moderate Value in line with Sq. Foot: $54

- Days on Marketplace: 128

- Selection of Conventional Listings: 1

- Per month Conventional Condominium Source of revenue: $675

- Conventional Money on Money Go back: 2.17%

- Conventional Cap Charge: 2.34%

- Value to Hire Ratio: 9

- Stroll Rating: 70

8. Giant Beaver, PA

Giant Beaver is a borough in Pennsylvania, some 25 miles clear of Pittsburgh. Throughout the borough, there are two golfing lessons and a river that’s just right for fishing. The low housing costs, averaging at round $67,000, and closeness to a big town make where absolute best for households searching for extra reasonably priced housing.

Key Statistics:

- Selection of Listings for Sale: 5

- Median Assets Value: $67,920

- Moderate Value in line with Sq. Foot: N/A

- Days on Marketplace: 40

- Selection of Conventional Listings: 0

- Per month Conventional Condominium Source of revenue: $590

- Conventional Money on Money Go back: 5.80%

- Conventional Cap Charge: 6.55%

- Value to Hire Ratio: 10

- Stroll Rating: 0

9. Donora, PA

Donora is located in a bit curve of Monogahela river, 20 miles south of Pittsburgh. A little bit a long way from a freeway, it nonetheless supplies a quick shuttle to town whilst providing a number of superb nature round. Probably the most notable issues—there’s a skate park on the town, which makes it a great spot to lift a teenager.

Key Statistics:

- Selection of Listings for Sale: 5

- Median Assets Value: $65,820

- Moderate Value in line with Sq. Foot: N/A

- Days on Marketplace: 113

- Selection of Conventional Listings: 3

- Per month Conventional Condominium Source of revenue: $671

- Conventional Money on Money Go back: 6.63%

- Conventional Cap Charge: 7.47%

- Value to Hire Ratio: 8

- Stroll Rating: 52

10. North Appollo, PA

North Appollo is a borough as regards to Vandergrift, simply at the different facet of the Kiskiminetas River. It’s a big sufficient conglomeration with the entire town facilities, however there’s additionally Pittsburgh some 30 miles westward. The borough provides one of the most lowest costs in the United States, as in line with Mashvisor knowledge. It’s every other great spot to are living, which makes it an funding goldmine.

Key Statistics:

- Selection of Listings for Sale: 5

- Median Assets Value: $55,320

- Moderate Value in line with Sq. Foot: N/A

- Days on Marketplace: 101

- Selection of Conventional Listings: 0

- Per month Conventional Condominium Source of revenue: $581

- Conventional Money on Money Go back: 5.67%

- Conventional Cap Charge: 6.48%

- Value to Hire Ratio: 8

- Stroll Rating: 35

Similar: What Is a Excellent Money on Money Go back?

How Mashvisor Can Lend a hand Traders To find Reasonable Houses

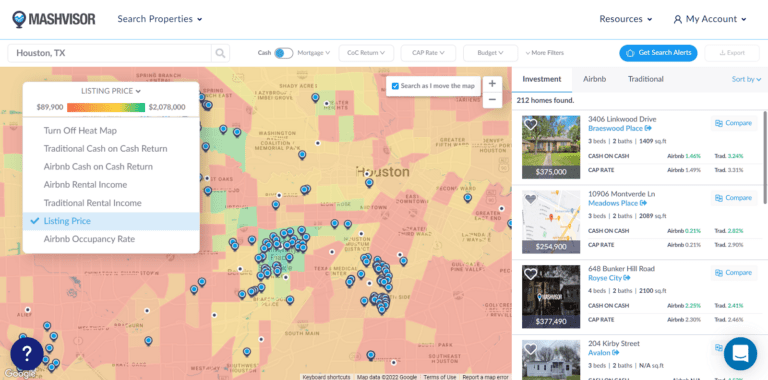

Except gaining access to the entire condominium comps like the guidelines you’ll be able to see above, Mashvisor can assist in lots of alternative ways. You’ll be able to see a actual property heatmap of your preferred house with as much as six filters being displayed at the map.

Some other main characteristic Mashvisor provides is the Mashboard. With Mashboard, you’ll be able to no longer best to find a really perfect assets but in addition touch the vendor and shut the deal proper at the platform.

Sounds promising? You’ll be able to take a look at Mashvisor free of charge for 7 days by way of clicking right here! After the trial duration, you’ll be able to get a cut price deal.