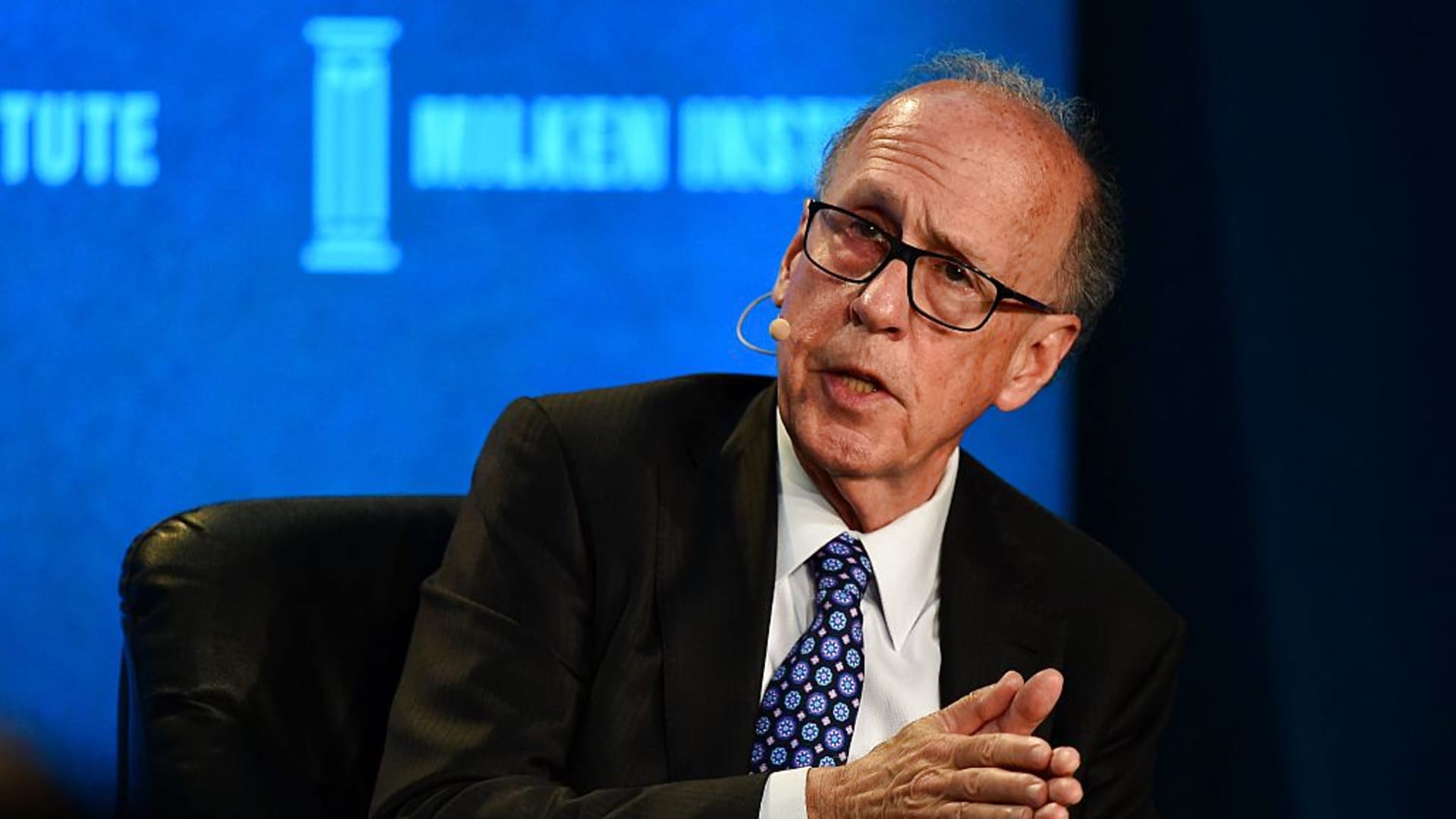

Stagflation is making a return, in keeping with former Morgan Stanley Asia chairman Stephen Roach.

He warns the U.S. is on a perilous trail that ends up in upper costs coupled with slower expansion.

“This inflation downside is popular, it is power and more likely to be protracted,” Roach advised CNBC’s “Rapid Cash” on Thursday. “The markets don’t seem to be even on the subject of discounting the whole extent of what will be required to deliver the call for facet beneath keep an eye on… That simply underscores the deep hollow [Fed chief] Jerome Powell is in at the moment.”

Roach, a Yale College senior fellow and previous Federal Reserve economist, calls stagflation his base case and the height inflation debate absurd.

“The call for facet has truly gotten clear of the Fed,” he mentioned. “The Fed has an enormous quantity of tightening to do.”

Roach expects inflation to stick above 5% in the course of the finish of the 12 months. On the present tempo of rate of interest hikes, the Fed would not meet that degree.

“50 foundation issues does not lower it. And, by way of ruling out one thing better than that he [Powell] simply sends a sign that his palms are tied,” added Roach. “The markets are uncomfortable with that conclusion.”

The Dow is on tempo for its 8th detrimental week in a row for the primary time since 1932. The S&P 500 and the tech-heavy Nasdaq are monitoring for his or her worst weekly shedding streaks since 2001.

Roach began sounding the alarm on Seventies-type inflation dangers two years in the past, all over the early phases of the pandemic. He indexed traditionally low rates of interest, the Fed’s simple cash insurance policies and the rustic’s huge debt.

His caution were given louder closing September on CNBC. Roach cautioned the U.S. used to be one provide chain glitch clear of stagflation.

And now he sees much more causes to head on alert.

“I might upload to that zero-Covid in China together with the repercussions of the conflict within the Ukraine,” Roach mentioned. “That may stay the provision facet well-extended with regards to clogging value discovery via the following a number of years.”

CNBC’s Chris Hayes contributed to this record.