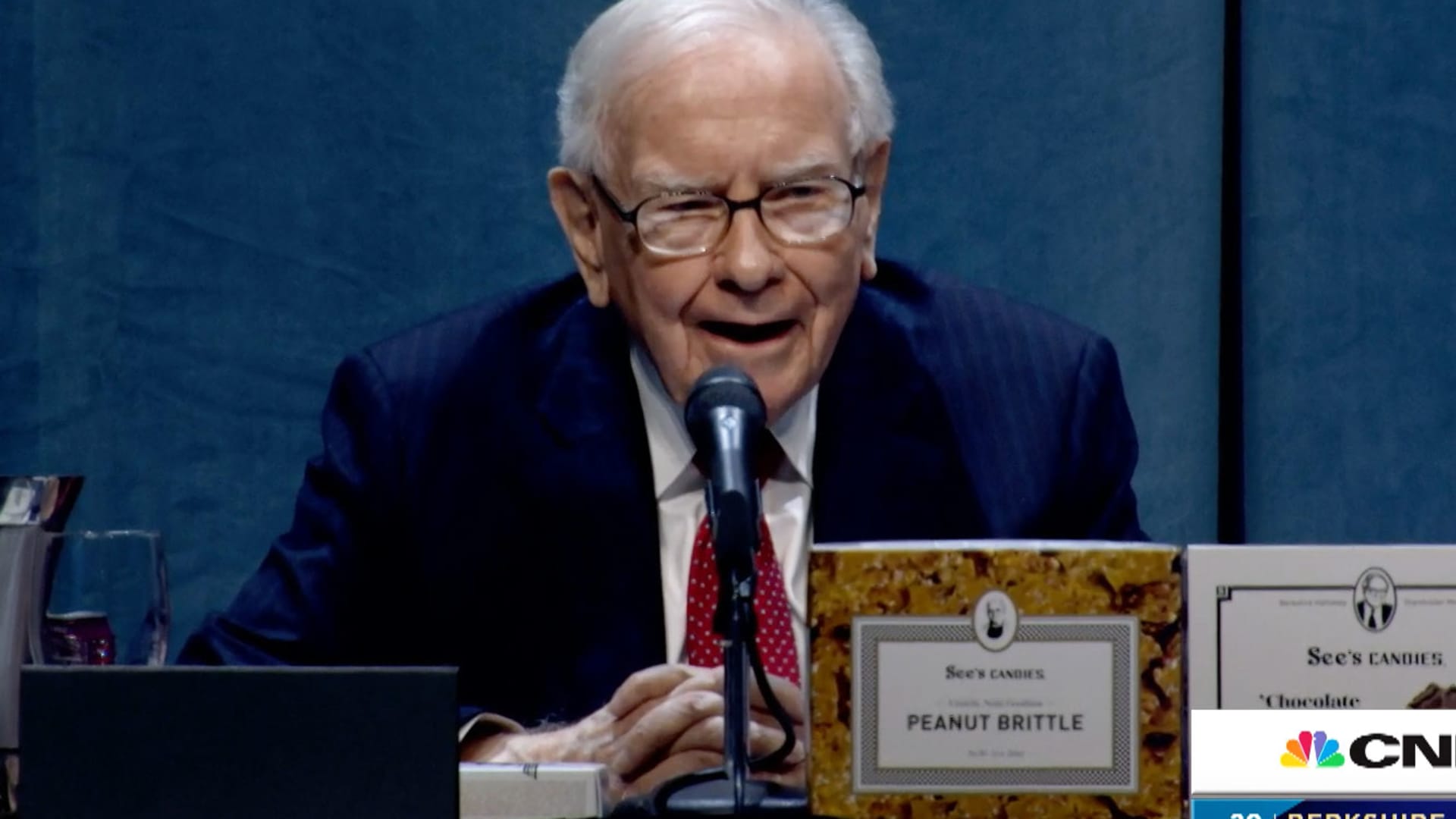

Warren Buffett’s Berkshire Hathaway made a couple of adjustments to its fairness portfolio within the first quarter, together with including a large stake in Citigroup , in step with a regulatory submitting. The conglomerate purchased greater than 55 million stocks of Citigroup to construct a stake price $2.95 billion as of the tip of March, the submitting confirmed. Every other monetary title that the longtime worth investor purchased used to be Best friend Monetary , which has fallen greater than 18% this 12 months. His stake used to be price about $400 million on the finish of March. The “Oracle of Omaha” additionally picked up chemical compounds corporate Celanese Corp (price $1.1 billion), insurer Markel ($620 million), health-care title McKesson (just about $900 million) and media company Paramount World ($2.6 billion) closing quarter. Buffett has been on a purchasing spree in recent years because the 91-year-old investor noticed worth in a marketplace that has declined considerably within the face of surging inflation, geopolitical dangers and emerging charges. At the promoting facet, Berkshire nearly dumped all of its Verizon inventory which used to be price greater than $8 billion on the finish of 2021. The conglomerate additionally exited its small place in Wells Fargo after trimming the wager closing 12 months. Listed here are Berkshire’s best 10 holdings as of the tip of March. It used to be in the past published in Berkshire’s income file that the conglomerate added to its Chevron wager considerably all through the primary quarter, to a stake price $25.9 billion on the finish of March. In the meantime, Buffett informed CNBC’s Becky Fast closing month that he scooped up $600 million price of Apple stocks following a three-day decline within the inventory closing quarter. Apple is the conglomerate’s unmarried greatest inventory maintaining with a worth of $159.1 billion on the finish of March, taking on about 40% of its fairness portfolio. It used to be additionally in the past reported that Buffett ramped up its Occidental funding. At the yearly shareholder assembly, Buffett broke down how he took benefit of the buying and selling mania to scoop up 14% of Occidental in simply two weeks.