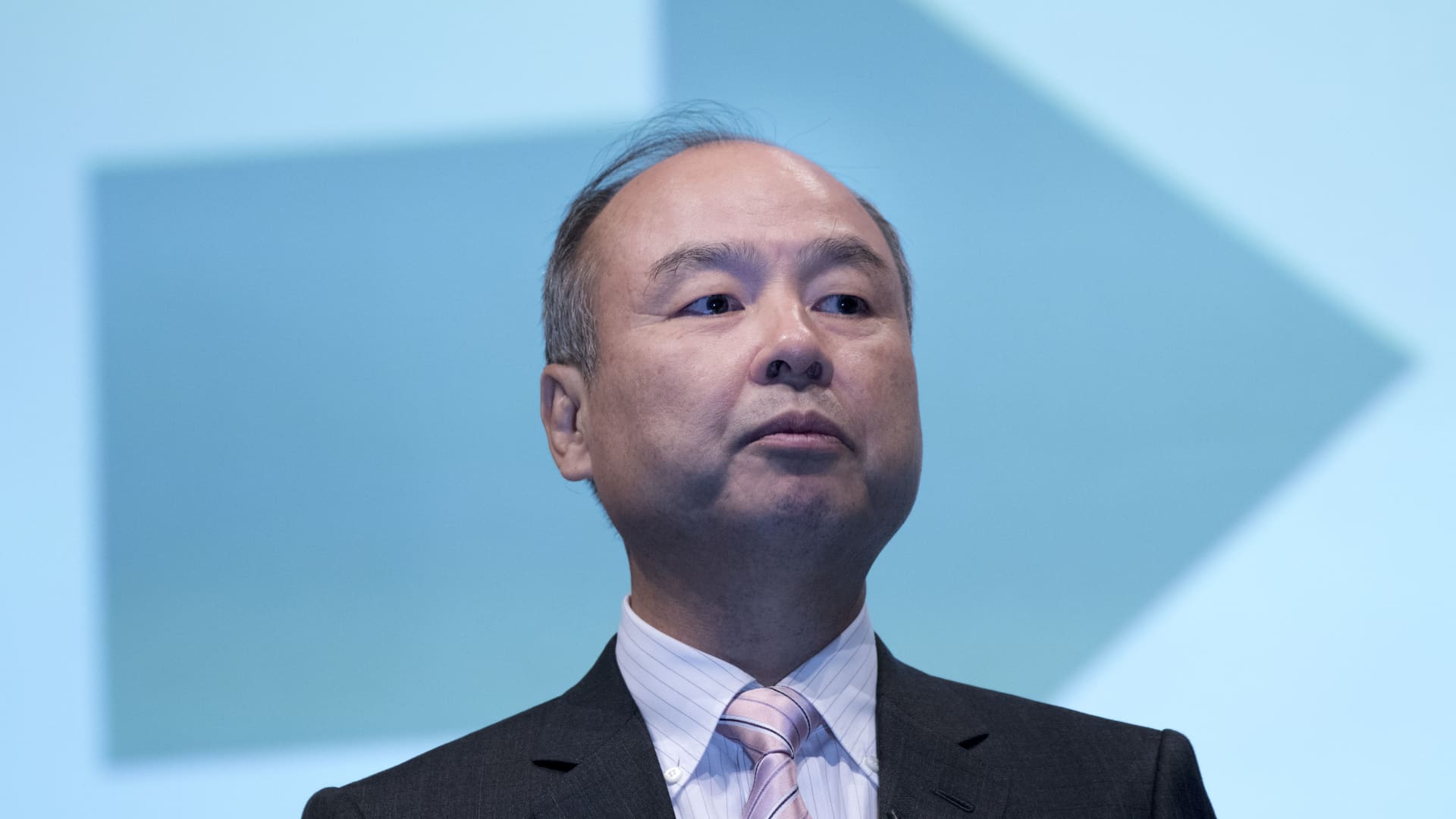

Masayoshi Son speaks right through a joint announcement with Toyota Motor to make new undertaking to broaden mobility services and products in Tokyo in October 2018.

Alessandro Di Ciommo | NurPhoto | Getty Pictures

Jap tech conglomerate SoftBank intends to stay a majority stake in U.Ok. chip clothier Arm when it lists the corporate via an preliminary public providing.

Masayoshi Son, SoftBank’s CEO, showed the inside track Thursday following a document from Bloomberg ultimate month that cited other folks accustomed to the topic.

Son stated that SoftBank plans to checklist Arm once conceivable, however he added that the corporate is prepared to attend if inventory markets proceed to be unstable. In February, Son stated Arm will be indexed throughout the fiscal 12 months finishing March 31, 2023.

The billionaire declined to touch upon what valuation he is in quest of for Arm, whose power environment friendly chip architectures are utilized in many of the global’s smartphones and plenty of different merchandise.

SoftBank used to be set to promote Arm to U.S. chip large Nvidia for $40 billion however the deal used to be scrapped in March amid intense scrutiny from pageant regulators within the U.S., Europe, China and the U.Ok.

With regards to the place SoftBank will checklist Arm, Son has prior to now stated that he intends to take the corporate public in New York, which is house to the tech-focused Nasdaq inventory trade.

The U.Ok. govt, on the other hand, needs Arm to be indexed at the London Inventory Change.

High Minister Boris Johnson despatched a letter to SoftBank urging the corporate to imagine list Arm in its house nation, in keeping with a document from The Monetary Occasions previous this month. SoftBank declined to remark when requested in regards to the letter.

Analysts have puzzled whether or not SoftBank would have the ability to make as a lot cash via an IPO versus a sale.

SoftBank reported a document loss at its Imaginative and prescient Fund funding unit on Thursday as era shares get hammered by means of emerging rates of interest and after Beijing’s regulatory crackdown.

The Imaginative and prescient Fund posted a three.5 trillion yen loss ($27.4 billion) for its monetary 12 months ended Mar. 31, the largest loss for the reason that funding fund started in 2017.