Investor favorites Nvidia and Complicated Micro Gadgets have taken a beating this 12 months amid a broader tech sell-off and now glance ripe for traders to shop for the dip. However fund supervisor Jordan Cvetanovski is striking his cash into different chip shares — together with one he says is “the arena’s perfect trade.” The iShares Semiconductor ETF, or SOXX , which tracks the efficiency of semiconductors, is down just about 30% this 12 months, striking it firmly in undergo territory, as customers rotate out of riskier enlargement shares amid fears of an competitive rate-hike cycle by way of the Fed. With scorching favorites Nvidia and AMD down about 40% this 12 months, many analysts at the moment are urging traders to shop for the dip on those high quality chip shares . However Cvetanovski is opting for to stick at the sidelines for now. Chatting with CNBC Professional Talks , Cvetanovski, who’s leader funding officer and portfolio supervisor of Pella Budget Control, mentioned he thinks Nvidia is a “glorious trade” and there’s “no query” that his fund will ultimately personal stocks of the tech titan. “However presently, they’re nonetheless dear from a unfastened money glide enlargement viewpoint,” Cvetanovski mentioned. As a substitute, he lavished reward on Dutch chip maker ASML , an organization which he thinks is on the core of the semiconductor sector. “ASML is, in my view, probably the most perfect firms on the earth, if now not the most productive… As a result of with out ASML, in my humble opinion, no tech corporate in reality exists,” Cvetanovski mentioned. He highlighted ASML’s significance to the sphere. “Moore’s Legislation mainly does not exist with out them,” he added. Moore’s Legislation predicted that the density of transistors ready to suit on a chip would double roughly each and every two years . It has lengthy been held as a very powerful benchmark for the speedy building of the semiconductor sector. Chipmakers wish to use the narrowest wavelength of sunshine imaginable in lithography in order that they may be able to have compatibility extra transistors onto every piece of silicon. A monopoly in its personal proper ASML is essential to this procedure. It’s the handiest company on the earth in a position to making excessive ultraviolet (EUV) machines — extremely complicated machines which are had to manufacture essentially the most complicated chips. Those machines shine exceptionally slim beams of sunshine onto silicon wafers, permitting extra transistors to be fitted onto a chip. “We expect for the arena’s perfect trade on 3 plus p.c unfastened money glide yield with an order e-book of virtually two years and what is going down within the out there specifically, you might be seeing now not handiest the herbal enlargement in chip call for, but additionally each and every area in need of to have their very own in-house chip production on their sovereign land,” Cvetanovski mentioned. Learn extra Chip provide problems are nonetheless giving a few of global’s greatest firms a significant headache Intel CEO now expects chip scarcity to remaining into 2024 Citi downgrades NXP Semiconductors, says corporate’s margins are close to their height “Call for for [their EUV machines] is certain to proceed for many years yet to come. “Innovation can not come from any place however them… Nobody else can do what they do,” he added. Stocks in ASML are down greater than 30% this 12 months. Cvetanovski said that they may nonetheless fall additional however he’s status company at the inventory. “It is going to pass down with the marketplace if semis proceed to unload, however we predict we will be able to simply purchase extra if the fee is true,” he mentioned.

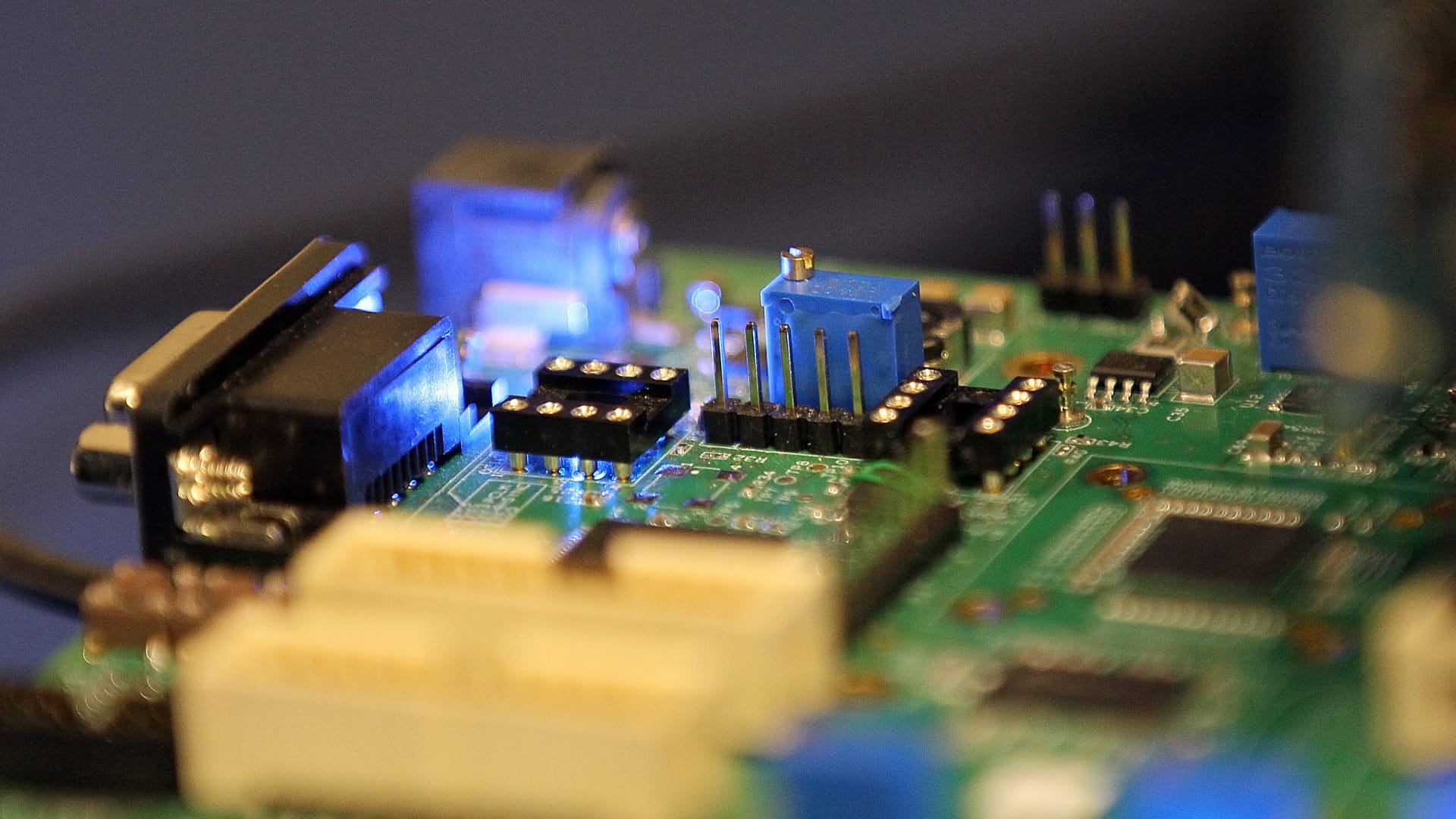

Justin Sullivan | Getty Photographs

Investor favorites Nvidia and Complicated Micro Gadgets have taken a beating this 12 months amid a broader tech sell-off and now glance ripe for traders to shop for the dip. However fund supervisor Jordan Cvetanovski is striking his cash into different chip shares — together with one he says is “the arena’s perfect trade.”