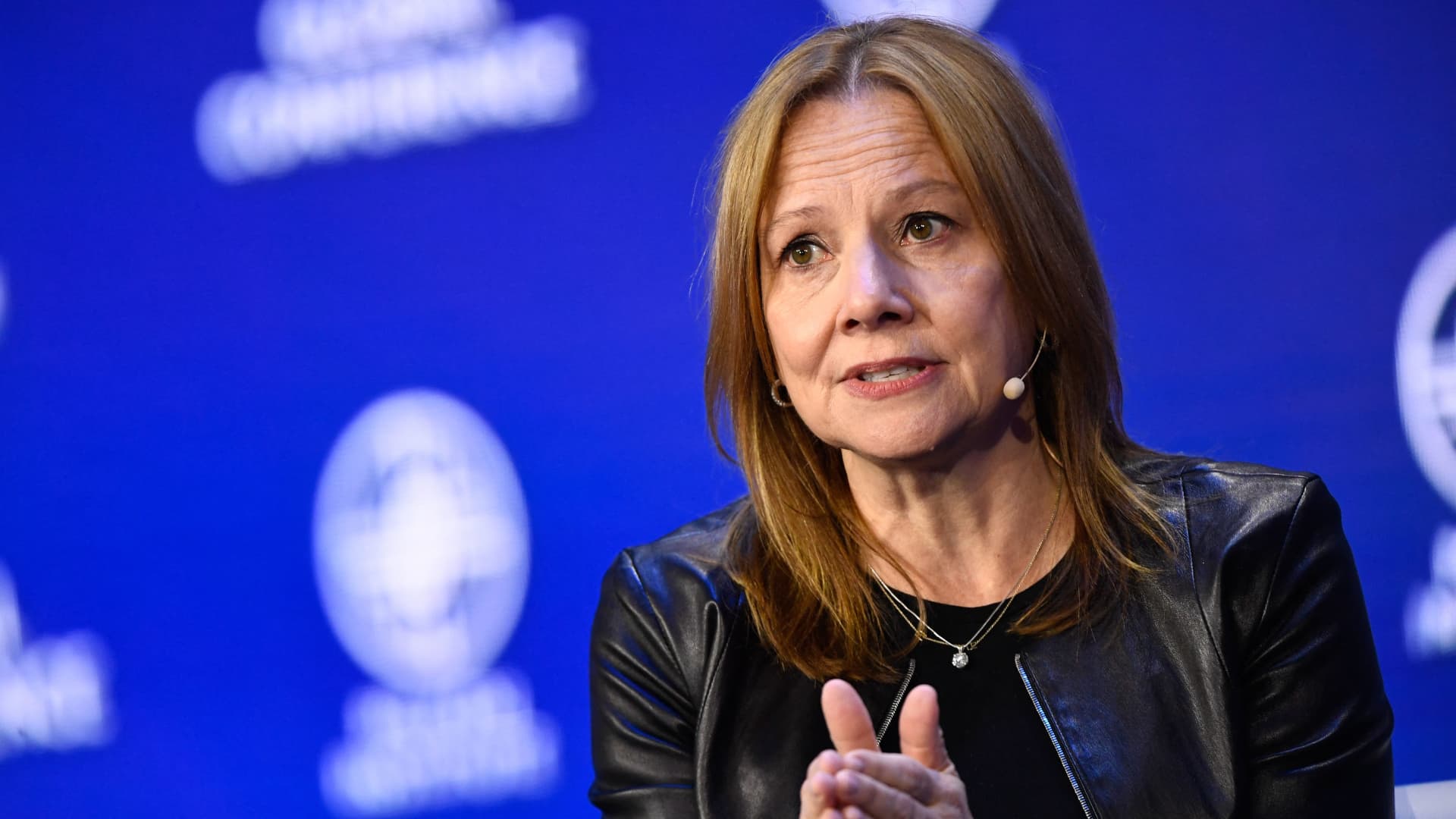

Mary Barra, Chair and CEO of the Common Motors Corporate (GM), speaks all through the Milken Institute International Convention in Beverly Hills, California, on Might 2, 2022.

Patrick T. Fallon | AFP | Getty Photographs

DETROIT — Stocks of Common Motors on Thursday hit a brand new 52-week low and opened at their lowest worth since November 2020, after Wells Fargo downgraded the inventory and considerably slashed its goal worth for the corporate.

Wells Fargo analyst Colin Langan reduced GM’s ranking after marketplace shut Wednesday to “underweight” from “obese” and reduce the corporate’s worth goal from $74 a proportion to $33 a proportion.

This 12 months may constitute a benefit height for legacy automakers, with the shift towards electrical automobiles eroding income within the years forward, he mentioned in a word to traders.

“We see headwinds from worth normalization, inflationary prices, and the 2023 UAW contract negotiations. Subsequently, we’re involved that 2022 might be the height income as GM shall be more and more compelled to take in BEV losses to satisfy top 2026 US regulatory hurdles,” he mentioned.

For a similar reasoning, Langan on Wednesday additionally downgraded Ford Motor to “underweight” and reduce its worth goal in part from $24 a proportion to $12 a proportion.

GM stocks fell about 6% to $35 Thursday morning after opening at their lowest level since November 2020. The corporate’s marketplace cap is set $51 billion.

Stocks of Ford declined greater than 4% to $12.27. The inventory’s 52-week low is $11.28 a proportion from Might 2021. Ford’s marketplace cap is set $49 billion.

Ford Chair Invoice Ford all through the corporate’s annual shareholder assembly Thursday mentioned he stays bullish at the automaker’s long-term industry plans, regardless of the inventory’s efficiency this 12 months.

“2021, our inventory was once on fireplace. This 12 months it is come again to Earth somewhat. The entire marketplace is coming again to Earth, however I have by no means been extra assured of our long term,” he mentioned. Later including, “you’ll be able to’t arrange the industry for inventory worth, you arrange the industry to construct a super and enduring corporate.”

Stocks for the Detroit automakers had been already beneath drive earlier than the double downgrade from Wells Fargo. Each shares have declined just about 40% this 12 months.