With inflation charges proceeding to climb, how can the motion of loan charges give a contribution to the wellness of our economic system nowadays?

A 12 months Can Make a Lot of Distinction

Loan charges, whilst nonetheless fairly low, have modified so much for the duration of only one 12 months. And what a distinction that 365 days makes.

Again in April 2021, the typical 30-year loan fee was once at simplest 3.06%. In mid-March 2022, the charges had been nonetheless underneath 5.00% however had been already neatly on their strategy to breaking the 5.00% mark. March ended with a 5.00% fee for purchases and 5.12% for refinancing. Rapid ahead to nowadays, consistent with Bankrate, the typical loan fee on a 30-year fixed-rate loan is already at 5.42%.

Take a look at how rates of interest for a 30-year fixed-rate loan have larger over the last 13 months underneath:

- April 2021 – 3.06%

- Might 2021 – 2.96%

- June 2021 – 2.98%

- July 2021 – 2.87%

- August 2021 – 2.84%

- September 2021 – 2.90%

- October 2021 – 3.07%

- November 2021 – 3.07%

- December 2021 – 3.10%

- January 2022 – 3.45%

- February 2022 – 3.76

- March 2022 – 5.00%

- April 2022 – 5.22%

A number of components come into play once we take a look at how loan charges have modified over the last few months. There’s the continued conflict in Ukraine, present inflationary pressures, and, after all, the ever-consistently inconsistent inventory marketplace efficiency.

With the best way issues are going presently, an individual is led to invite, how will loan charges behave in each the fast and longer term? Are we in a housing bubble? What does the longer term appear to be for belongings house owners, attainable patrons, and actual property traders?

Stay studying to determine what business mavens and execs have to mention in regards to the topic.

Conceivable Rising Traits within the Close to Long run

Because of the cases that recently impact the true property marketplace, a couple of business execs and insiders have given us their two cents on what to anticipate in the following couple of months.

Be expecting to Pay Extra within the Coming Months

In most cases, right through this time of the 12 months ahead of the COVID-19 pandemic hit us, we’d be on the top of homebuying season. Springtime has been traditionally confirmed to be the most productive season for the true property sector as people having a look to shop for homes and funding houses pop out and do their buying groceries.

Then again, dearer mortgages are inflicting a large number of attainable area patrons and source of revenue belongings traders to consider carefully ahead of getting into a freelance.

In keeping with Bankrate’s leader monetary analyst Greg McBride, an build up in upper charges is inevitable “with inflation nonetheless accelerating and the Federal Reserve at the cusp of beginning to run off their bond portfolio.” He then provides that the Might 2022 benchmark for a 30-year fixed-rate loan can be between 5.50% and 5.75%. If—and when—that occurs, it’s going to be the primary time since 2009 that we can see charges that top. 15-year constant charges also are anticipated to move as much as between 4.74% and 5.00%.

Nationwide Affiliation of Realtors’ director of forecasting and senior economist Nadia Evangelou just about has the similar prediction for Might and the approaching months. She anticipates an build up in loan charges for 30-year and 15-year constant mortgages to be at 5.20% and four.50%, respectively.

One in every of NYC-based Cassin & Cassin LLP’s companions, John Thomas, is quite extra pessimistic about what to anticipate within the coming months. In keeping with Thomas, many economists expect a fee hike of between 50 and 75 foundation issues in June to mitigate the results of inflation. That is validated via the Federal Reserve’s contemporary approval of an build up of fifty foundation issues to its coverage rate of interest to scale back the impact of inflation.

How Will Upper Charges Have an effect on the Housing Marketplace?

As the scoop concerning the Fed’s choice unfold, realtors, lenders, agents, and different actual property execs thought to be how it’s going to impact the housing marketplace. Realtor.com’s leader economist Danielle Hale stated that this choice affects “family budgets, stability sheets, and spending choices by way of their affect on rates of interest like loan charges.”

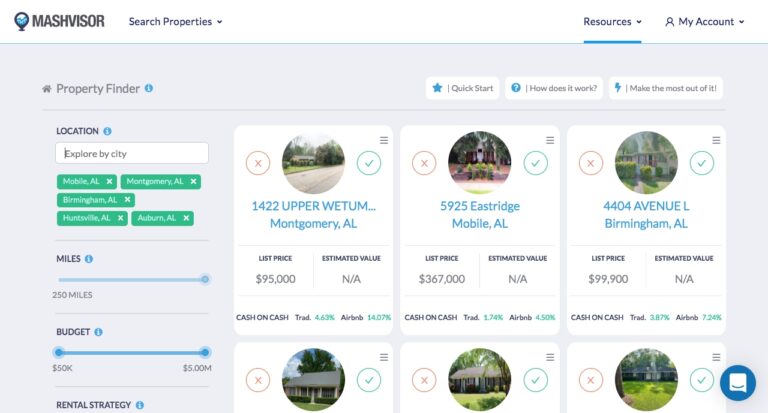

To house patrons and actual property traders, which means get admission to to extra inexpensive housing can be restricted. Because of this, patrons and traders want to exert some additional effort in on the lookout for the appropriate belongings that matches their standards and funding targets. An actual property site like Mashvisor is particularly helpful find the most productive conceivable offers in nearly any marketplace throughout all 50 states. Its actual property funding gear just like the Belongings Finder, Actual Property Warmth Map, and Funding Belongings Calculator make the method of belongings seek and actual property marketplace research so much quicker and extra environment friendly.

Get ready for Any Mid-12 months Changes and Adjustments

As we close to the midpoint mark of the 12 months, the place will the winds of trade blow our loan charges?

Business mavens agree that as inflation is anticipated to stick prime in the following couple of months, the upward development of loan charges will proceed. NAR’s Evangelou says:

The Fed will proceed its tightening financial coverage via a sequence of rate of interest hikes and via lowering its stability sheet. Thus, the 30-year constant loan fee might achieve 6.0 p.c via the top of the primary part of this 12 months.

Thomas concurs as he predicts that 30-year fixed-rate mortgages will hit as prime as 6.50% via mid-year with 15-year fixed-rate mortgages attending to about 5.50% via the top of the primary part of the 12 months.

Comparable: Actual Property Marketplace 2022: Which Predictions Got here True and Which Ones Didn’t

Give Cautious Idea to Loan Choices

Given the best way issues are presently, patrons and traders are confronted with a predicament: look ahead to belongings costs and loan charges to drop, or purchase what they are able to have enough money now and steer clear of paying extra months?

McBride says there aren’t any advantages to ready at this level. Then again, he additionally advises in opposition to purchasing now for worry of lacking out. In keeping with him:

Costs are very increased presently, and the extra you pay now, the longer you’ll want to keep in the house to recoup transaction prices and construct any transportable fairness.

Thomas, however, helps a carpe-diem mentality so long as you’re in a just right place to take action. This implies you have got a strong supply of source of revenue and are doing lovely neatly financially. He explains that purchasing a area now when you’re ready to take action is the most productive time since there’s just about no result in sight for belongings worth will increase and loan hikes.

Evangelou, on the other hand, issues out that whilst the typical per 30 days loan cost nowadays is $500 upper than a 12 months in the past, we’re nonetheless experiencing (and taking part in) low-interest charges traditionally talking not like, for instance, again in 2002 once we had a 7% loan fee reasonable.

Comparable: What To not Do Earlier than Purchasing a Space: 6 Errors You Must Steer clear of

Wrapping It Up

A lower in housing call for might settle down the process and stay mortgages decrease, however given how loan charges behaved previously 13 months, it is extremely more likely to repeat itself in the second one part of 2022.

With housing affordability slipping via our hands because of the continual upswing of loan charges, it will be important for patrons and traders to accomplish in depth due diligence to verify they get the most productive conceivable offers nowadays.

To be told extra about how Mashvisor assist you to to find successful funding houses, agenda a demo.