ARV help you inform what renovations to make to get the best possible ROI, repair and turn houses rapid, and develop your actual property portfolio. This is how.

Desk of Contents

- What Is ARV in Actual Property?

- How Does ARV Paintings?

- What Are the Advantages of Calculating the ARV in Actual Property?

- Who Determines the ARV of a Belongings?

- What Is the Distinction Between After Restore Price and House Wholesaling Price?

- How you can Calculate ARV

- How you can Estimate Restore Prices to Calculate ARV

- Boundaries of Calculating ARV

- What Are Some Not unusual Errors Whilst Calculating After Restore Price?

- What Are Some Easiest Practices for The use of ARV as a Actual Property Investor?

- What’s Subsequent: Get Dependable, Up-to-Date Actual Property Comps With Mashvisor

As a fix-and-flip investor, you hope to make cash on each and every fixer-upper funding. As a house owner, you might also wish to know the way other upkeep impact the price of your own home. Possibly you need to extend its price to promote it quickly.

In both case, you don’t wish to spend an excessive amount of on upkeep that you simply’ll have bother recouping your funding.

The place do you draw the road between good and useless renovations? What’s the most quantity you will have to spend when purchasing actual property funding assets in its present state? And at what value will have to you listing it?

This submit clarifies the ARV which means in actual property and why it’s an important to each area flippers and householders. You don’t wish to have earlier enjoy in area flipping or as a normal contractor to be informed and apply the ways you’ll to find right here.

But even so what’s ARV, we’ll additionally speak about methods to estimate the most productive value for a fix-and-flip assets, how a lot to spend on upkeep, and what kind of to invite for it when it’s time to promote.

What Is ARV in Actual Property?

ARV, brief for After Restore Price, is the estimated marketplace price of a assets after upgrades, upkeep, and different renovation works are entire. In house flipping, the ARV refers back to the marketplace price of a assets that has been mounted and is able for flipping.

You’ll be able to fix a fixer-upper assets in different successful techniques, equivalent to transforming the kitchen, bogs, partitions, and ceilings or changing the floor, plumbing, and heating.

On the other hand, the ARV metric does now not account for different prices you possibly can incur when getting ready an funding assets on the market, equivalent to staging, realtor, advertisements, checklist, taxes, mortgage passion, insurance coverage, and shutting prices.

How Does ARV Paintings?

There are 3 sides to ARV in actual property making an investment:

1. Purchasing the Belongings in Its Present Situation

Knowledgeable flippers and traders incessantly wish to purchase fixer-upper homes at a reduced value, bearing in mind the price of long run upkeep. Those homes might or might not be in distressed situation.

You’re much more likely to benefit after renovating or bettering the valuables while you acquire it on the lowest conceivable value. However needless to say the vendor might decline your be offering if the pricing is just too low.

Comparable: How you can Discover a Fixer Higher Area for Sale

2. The Value of Maintenance

This refers back to the assets’s state of fix on the time of acquire. Renovation estimates will also be tough to resolve as a result of you might have to fix extra spaces than you firstly deliberate.

You’ll have simply integrated siding, floor, ceilings, and kitchen remodels for your funds. However as you fix the siding, chances are you’ll to find that you simply additionally want mildew elimination products and services for a number of partitions and the basement.

3. The Promoting Value After Maintenance

This refers back to the precise ARV. Right here’s the deal: if you happen to spend an excessive amount of cash on upkeep, possible consumers might not be keen to shop for the up to date assets on the prime value chances are you’ll ask. To keep away from overpricing, you need your promoting value to be inside the marketplace price of houses very similar to your home, inside the community, town, or area. This help you temporarily promote and recoup a sensible go back on funding (ROI).

Comparable: 4 Efficient House Pricing Methods for Dealers

Those 3 sides provide the assets’s present price, the estimated price of upkeep, and the house’s anticipated price after transforming.

What Are the Advantages of Calculating the ARV in Actual Property?

Listed below are one of the crucial robust advantages of the After Restore Price manner:

- Know whether or not making an investment in a selected assets makes financial sense. For instance, if the price of repairing a area and its present price exceeds the ARV of similar homes close by, the funding is probably not value it.

- Make a decision at the most value you’ll be offering to the vendor. The upper the fix prices, the decrease you’ll wish to bid at the funding assets.

- Calculate the buck price of long run fix works wanted so that you can listing the valuables at your required gross sales value.

- Estimate the quantity of benefit you may make from renovating a assets.

- Learn the way a lot rehab mortgage or financing you’ll be able to find the money for on your funding assets to assist with renovations. Maximum lenders wish to finance a rehab mortgage this is 75% not up to the ARV of the valuables.

- Decide which upkeep to prioritize to earn the best possible go back on funding.

- Get an figuring out of the forms of renovations that can make your own home extra sexy in a particular marketplace.

- Perceive what provides to simply accept after finishing anticipated and unexpected upkeep so you’ll be able to flip a benefit.

Who Determines the ARV of a Belongings?

Whilst you’ve been making an investment in actual property for some time, you might have picked up a number of actual property assets valuation strategies. If you already know your marketplace smartly, you’ll be able to additionally resolve what forms of renovations consumers for your house be expecting and pays extra for. On this case, you could possibly estimate your personal ARV.

If you’re new to actual property making an investment, you’ll be able to nonetheless determine ARV via running with an skilled actual property appraiser or authorized contractor.

The present marketplace price of identical homes within the house additionally finds treasured data. Crucial element to keep in mind here’s holding your assets funding bills low allows you to resell the valuables on the present native marketplace value and nonetheless make cash. We’ll speak about how to try this in additional element later.

Comparable: When and Why Do You Want a House Appraisal?

What Is the Distinction Between After Restore Price and House Wholesaling Price?

Whilst the ARV actual property which means is the estimation of the longer term gross sales value of a repaired assets, house wholesaling price refers to the cost of reselling an undervalued assets from an actual property wholesaler to an actual property investor — incessantly on a business-to-business fashion.

Wholesaling could also be other from flipping in different different ways:

- A wholesaler purposes as an middleman between the real house owner and the patron of distressed homes. The consumer is incessantly an actual property investor shopping to mend the valuables and turn it for a benefit or upload it to their funding portfolio.

- Wholesalers don’t acquire or promote the valuables themselves. As an alternative, they obtain a finder’s price for connecting the valuables proprietor with the actual property investor. ARV comes to traders purchasing a assets, renovating or bettering it, after which reselling it for a benefit.

- When purchasing or promoting a assets, flippers wish to calculate the After Restore Price and the Most Allowable Be offering (MAO). Wholesalers don’t wish to do that as a result of they promote the precise to promote the valuables (by means of double remaining or task of contract).

How you can Calculate ARV

Calculating ARV is easy sufficient. The system is:

ARV = Present Belongings Price + Price of Maintenance

The ARV system provides the present buck price of the distressed assets in its unrepaired state to the buck price of the enhancements you are making.

It’s conceivable to finally end up purchasing the valuables on the community’s present assets price. However this isn’t all the time the case, and we’ll proportion a system you’ll be able to use to estimate how a lot to pay for a fixer-upper assets later on this article.

How you can Estimate Restore Prices to Calculate ARV

As it should be estimating fix prices is each an artwork and a science. It’s not a good suggestion to underestimate the prices of renovations or overestimate the price of upkeep as a result of it might harm your earnings. This makes it extra essential to estimate the prices to fix an funding assets appropriately, completely, and realistically.

-

- Evaluate the house to identical homes close by that it’s going to resemble after upkeep are achieved. Search for homes that experience lately bought in the similar community or close by, with identical measurement, options, and different components equivalent to the similar or close by college districts.

- Ask your appraiser to come up with comparables if you happen to employed one to evaluate the house’s price. In a different way, chances are you’ll wish to collect the ideas by yourself.

- Get fix and renovation quotes from skilled actual property contractors. One of the most main points you’ll want to get from them are the price of development fabrics, hard work, length, taxes, and renovation rules in that house. Additionally, communicate to a number of contractors to get aggressive estimates.

- Use actual property comparables information from an lively MLS or actual property agent to know the native marketplace. Powerful actual property comps help you estimate how a lot price consumers in that house connect to explicit renovation works so you’ll be able to prioritize probably the most treasured remodels.

- Use the 70% Rule of area flipping. The rule of thumb states that traders will have to try to pay a most of 70% of a assets’s After Restore Price, minus the predicted prices of upkeep. The 70% Rule is helping actual property traders resolve an be offering value less than marketplace price whilst nonetheless being aggressive sufficient for the vendor to simply accept it. The system for the 70% rule is: Most Acquire Value Goal = (ARV x 70%) – Estimated Restore Prices

- Use a powerful actual property comparables software. But even so serving to you to find profitable funding assets in a space, a sophisticated Comparative Marketplace Research resolution like Mashvisor help you determine a number of fix-and-flip investments with identical options or ARV that experience bought in that community, town, county, or state within the remaining two to 4 months.

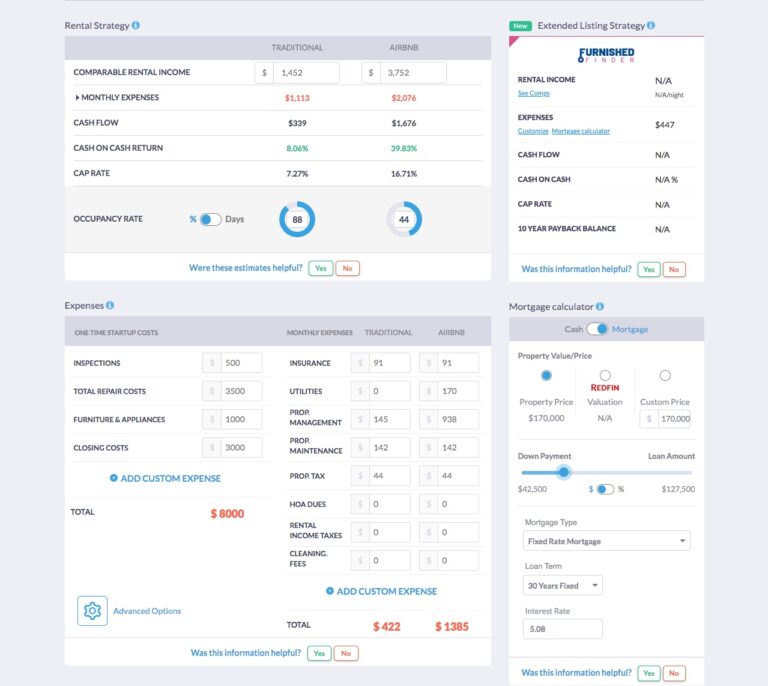

Mashvisor’s funding assets calculator offers you an concept of what prices and bills you might have to spend at the assets and the possible go back you may recoup.

Mashvisor’s Funding Belongings Calculator does now not simplest allow you to estimate fix prices on your ARV. It additionally initiatives the apartment source of revenue, per thirty days bills, coins glide, occupancy price, and returns that you’ll be able to be expecting with a definite assets.

See those Mashvisor options in motion via scheduling a loose demo.

Is the Value to Restore the Similar Because the Price of Maintenance?

The price of repairing an funding assets isn’t the similar as the price the renovations upload. Renovation can upload extra price than the real value of upkeep, which is the perfect scenario. However transforming is economically advisable up to some extent, then it stops making sense.

In keeping with Reworking’s 2022 value vs. price document, changing a storage door, putting in a manufactured stone veneer, and finishing minor kitchen remodels are one of the crucial renovation initiatives that recoup probably the most buck price at resale.

Then again, upscale toilet renovations, primary kitchen remodels, and master bedroom additions recouped simplest round part in their authentic prices. The worth a lot of these remodels upload for your After Restore Price isn’t as prime as the ones above.

On the other hand, the ARV metric isn’t easiest.

Boundaries of Calculating ARV

Some most sensible boundaries of the use of ARV in actual property making an investment are:

- Whether or not you are making an important benefit or loss depends upon how appropriately you estimate the price of long run upkeep. However instances trade. The home would possibly want further upkeep after you buy it, which will require extra money, time, and energy than you had anticipated.

- Belongings values might also trade whilst renovations are underway, lowering your margin.

- Regardless of its simplicity, a assets’s After Restore Price depends on correct estimates of all upkeep. But, estimating the price of development fabrics, fixtures, hard work, contractor charges, taxes, or even house owner affiliation charges will also be difficult earlier than transforming.

- Low appraisal values can significantly hurt returns. Figuring out the native and total marketplace stipulations is an important whether or not you’re employed with an appraiser or actual property agent.

- Incessantly, unexpected upkeep upload to a assets’s renovation prices with out elevating its marketplace price in that community, town, county, or state.

- The ARV metric ignores different important prices in actual property making an investment, equivalent to remaining and staging prices and gross sales taxes, which impact the benefit you’ll be able to be expecting.

Blended with the next commonplace ARV errors, those boundaries may end up in pricey errors for a amateur in actual property making an investment.

What Are Some Not unusual Errors Whilst Calculating After Restore Price?

You’ll wish to keep away from those doubtlessly pricey errors when calculating the after-repair price of your funding assets:

- Calculating a correct ARV might appear to be a large number of paintings. So, it’s tempting to fail to remember main points in handsome homes and buy them at face price.

- Some actual property traders keep away from running with contractors or skilled house inspectors to keep away from session charges. If you are going to buy a assets with out their assist, chances are you’ll uncover it calls for further upkeep later. The end result: a upward thrust in fix prices that might wipe out your benefit.

- The use of erroneous or insufficient actual property comps information might result in overestimating the ARV. In consequence, chances are you’ll overspend on upkeep, simplest to search out that recouping the funding can be tricky.

- Buyers have a tendency to focal point at the assets’s explicit traits slightly than believe the overall pattern of the native economic system, nationwide actual property marketplace, and native tradition as smartly. But, marketplace stipulations, provide, and hard work prices can vary each up and down in a couple of weeks.

So, how are you able to keep away from those ARV errors as an actual property investor?

What Are Some Easiest Practices for The use of ARV as a Actual Property Investor?

ARV and the home flipping marketplace provide a couple of essential components to believe earlier than making a purchase order, a few of which might be already mentioned within the article. Listed below are one of the crucial key ones:

- Since the after-repair price is primarily based totally on estimates, it’s topic to modify through the years, affecting your go back on funding.

- Make an effort to investigate cross-check and appraise the valuables with an skilled, authorized skilled. The appraiser is an important to arriving on the After Restore Price of a assets you propose to buy.

- Know the native marketplace, together with what enhancements, upkeep, and upgrades the valuables will want so that you can promote at a benefit.

- Get a minimum of 3 to 5 estimates for upkeep and renovations. You wish to have to be sure that you get probably the most aggressive costs to give protection to your margin.

- Observe the guideline of 70 system most often. You don’t want an funding assets whose value to fix exceeds 70% of the ARV.

- Use a faithful actual property comps platform. You’ll get dependable actual property insights that can assist you discover a profitable funding assets.

What’s Subsequent: Get Dependable, Up-to-Date Actual Property Comps With Mashvisor

It’s difficult to resolve an funding assets’s After Restore Price or ARV. Chances are you’ll now not know what upkeep you want till you’ve dedicated and acquired the valuables. But, you don’t wish to lose profitable funding homes to others who can act quicker. So, what do you do?

The use of Mashvisor, you get the newest actual property comparables from lively MLS products and services, actual property platforms, and our companions, proper down for your desired community.

You’ll be able to additionally:

- Seek anytime, from anyplace you might be, so that you’ll by no means omit a chance to develop your portfolio

- Minimize down your seek time from days to mins.

- Scale back shifting throughout more than one places looking for the precise fixer-upper

- View the precise repair and turn funding assets on your funds, funding taste, cash-on-cash go back purpose, cap price, and so on., in one platform

- View the estimated bills you’ll wish to foot for each and every assets earlier than you devote to shopping for it.

- Evaluate as much as 10 funding homes side-by-side to hurry up your seek.

To get get right of entry to to our actual property funding equipment, click on right here to join a 7-day loose trial of Mashvisor as of late, adopted via 15% off for existence.