Medical health insurance will also be pricey, and this has led many of us to move with out it. In 2020, 28.0 million other folks did not have medical health insurance at any level all through the yr, consistent with america Census Bureau. It is not laborious to consider, when the price of medical health insurance helps to keep creeping up, with the common price of a circle of relatives plan surpassing $22,000 in line with yr in 2021.

With prices at a prime and scientific price transparency apparently at a low, it is no marvel that American citizens are on the lookout for new techniques to pay for healthcare products and services. This information explains 5 possible choices to buying groceries at the federal trade for medical health insurance, and the way you may be able to lower your expenses on healthcare with out giving up the advantages you wish to have.

Learn extra: Absolute best Existence Insurance coverage Corporations for Might 2022

Cost-sharing plans

Cost-sharing plans group people together to pool healthcare costs, resulting in lower payments. With a cost-sharing plan, you pay a monthly or annual membership fee. When you go to the doctor, you pay another fee (like a co-pay) and your organization covers the rest of your medical expenses. Cost-sharing groups partner with doctors and hospitals to negotiate rates, and the monthly membership fees often end up being less than traditional insurance premiums.

Many cost-sharing plans are religious or faith-based and require their members to adhere to certain lifestyle tenets. For example, Medi-Share is a Christian cost-sharing organization with a nationwide network that requires members to “have a Christian testimony indicating a personal relationship with the Lord Jesus Christ.” Sometimes, these groups won’t cover healthcare costs associated with activities they deem unacceptable, such as treatment for an STD that occurred from an extramarital affair.

But if you qualify for membership and happily adhere to the sort of lifestyle mandated by a cost-sharing organization, the benefits are many: Medi-Share offers 24/7 telehealth, access to over 900,000 providers nationwide, discounts on prescriptions and additional savings on select procedures. Other cost-sharing plans include Samaritan Ministries, Sedera Health and Liberty HealthShare.

Off-exchange insurance

You might find more affordable insurance by purchasing directly from a broker or insurance provider. Off-exchange insurance companies attempt to make it easier to find health insurance that’s appropriate for specific needs and lifestyles and focus on making the notoriously complex process less mind-boggling — important because insurance jargon can confuse people into enrolling in plans they don’t need.

Oscar, for example, is a tech-based health insurance startup that offers health insurance to individuals, families and small businesses. The company offers bronze, silver, gold and platinum plans that offer the same benefits but differ in deductible and premium costs — a bronze plan costs less each month, but you’ll pay more at the time of health services.

Oscar and most off-exchange plans offer additional benefits you won’t get with a federal plan, such as Oscar’s 24/7 “doctor-on-call” feature and the ability to chat with a registered nurse through the Oscar app when you have questions. Other enticing benefits, like Oscar’s step-tracking cash-back partnership with Google Fit and Apple Health, make off-exchange programs more appealing.

If you don’t want to buy insurance on the federal exchange, try an off-exchange broker or provider.

Getty Images

Health Pocket, Hooray Health Care and eHealth Insurance are other examples of off-exchange health insurance brokers. Off-exchange plans typically meet the requirements of the Affordable Care Act, but always check to make sure before you enroll.

Professional associations and trade groups

You may be able to find cheaper health insurance plans by joining a group or organization. For example, the National Association of the Self-Employed offers many insurance benefits for small business owners, entrepreneurs and sole proprietors.

Many trade groups, professional organizations and alumni associations work similarly to cost-sharing plans: You’re grouped with other members of the organization so your costs are pooled and lowered. Search for professional associations with insurance benefits in your industry — you might be surprised at the plans and rates you find.

You can also check with your state’s department of insurance to find group plans that meet ACA requirements.

Professional associations may help you save by sharing costs with other members.

Getty Images

Health discount cards

Health discount cards are not technically an alternative to insurance: They are for people who plan to pay cash for health services as costs arise. Also called “medical services discount cards,” these can be used for a variety of services at different types of health centers.

You may pay a one-time membership fee for these cards, or a small monthly fee, but the discounts can be substantial, sometimes upward of 50%. Not all health discount cards have fees, though: WellCard is a free health discount program that offers nationwide access to both primary care providers and specialists.

Like traditional insurance plans, health discount cards often have network restrictions, so be sure to check for nearby participating providers before you sign up for a card — you don’t want to be surprised with a full-price bill.

Health discount cards are for people who want to pay cash for services when the need for care arises.

PhotoAlto/Frederic Cirou/Getty Images

Telemedicine

Like health discount cards, telemedicine is not a true alternative to insurance, but it might be the answer to a lot of problems. People who don’t have the resources — money, insurance, transportation or time — to see a doctor in person can use low-cost telemedicine services to get diagnoses and prescriptions without insurance.

Many telemedicine companies do accept insurance if you have it, but the price of seeing a virtual doctor is far less than the price of going to a brick-and-mortar clinic without insurance (and sometimes, even with it). Convenience is another key factor in the telemedicine craze.

Of course, telemedicine can’t do everything — many situations require an in-person professional — but it can serve as a low-cost alternative for easy-to-treat issues like the common cold, migraines, STD testing and pink eye.

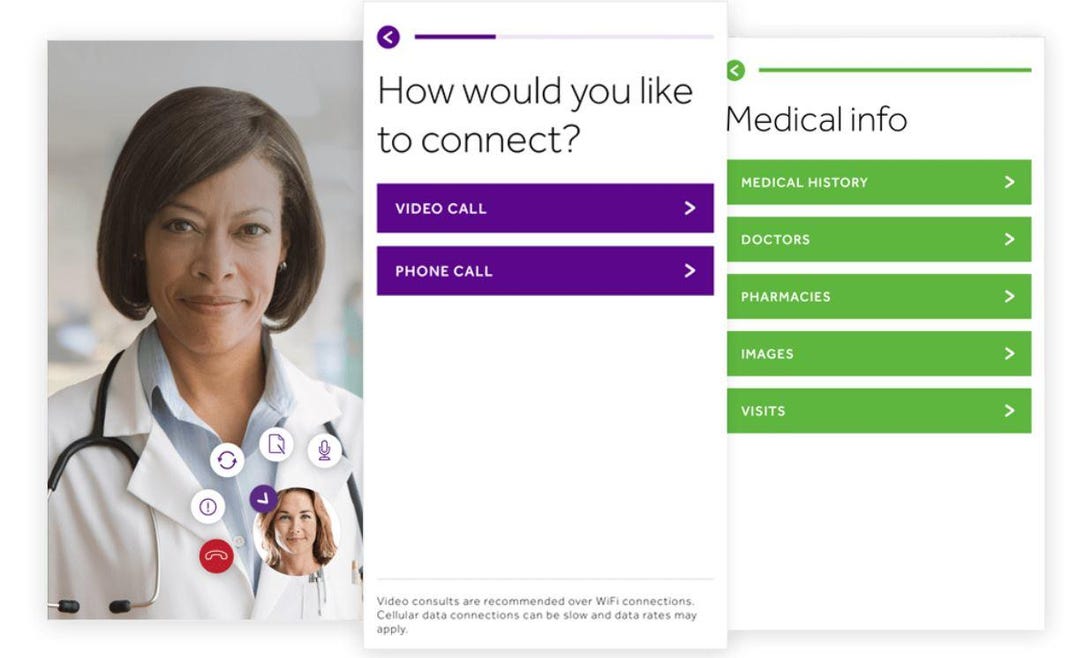

Most telemedicine apps and websites allow you to choose from video, phone or text to chat with a doctor.

Teladoc

The takeaway

Health insurance is expensive and a hassle, and many people can’t afford to — or don’t want to — enroll in traditional health insurance through the ACA. So, as healthcare costs continue to climb, people have figured out a way to take care of themselves without shopping on the federal exchange.

Benefits of these insurance alternatives vary and aren’t suited to everyone, but can be viable solutions when traditional health insurance just isn’t an option. Just make sure to read the fine print and understand what you’re getting — and what you’re not — when you sign up for an alternative.