As a modern day actual property investor on the lookout for on-line actual property platforms and marketplaces, you may well be questioning: is Roofstock authentic?

Desk of Contents

- What Is Roofstock?

- What Does Roofstock Be offering?

- Roofstock Options

- Roofstock Downsides

- Most sensible 3 Roofstock Competition to Imagine

- Verdict: Is Roofstock Reputable?

Actual property has for a very long time been a foolproof approach of earning money and rising your wealth. Many of us with more money taking a look to take a position and multiply their cash ceaselessly have actual property on their radar.

There are lots of tactics to put money into actual property. Probably the most commonplace strategies is purchasing condominium homes and changing into a landlord to earn condominium source of revenue. Different traders additionally use this way to earn passive on-line source of revenue.

If you wish to purchase condominium homes, there are many alternatives for you out there. There are even particular platforms created for the only real objective of serving to traders acquire condominium homes. That is the place Roofstock is available in.

So, is Roofstock authentic?

This text is a Roofstock evaluate as we have a look at how this platform assist you to. We’ll additionally have a look at different choice platforms you’ll be able to believe.

What Is Roofstock?

Based in 2015, Roofstock is a web-based actual property platform devoted to revolutionizing actual property making an investment and making it extra available and reasonably priced for the everyday actual property investor. Since Roofstock understands that no longer all actual property traders are realtors, it seeks to provide traders turnkey funding homes.

Roofstock is an actual property market that majors in single-family properties. The original factor about Roofstock listings is that ahead of a assets is indexed at the market, it should be occupied through tenants. Additional, Rooftsock has strict tenant-screening tips that each and every tenant should meet.

As such, Roofstock’s primary target audience is busy execs who wish to put their cash into profitable condominium homes with out essentially having to position within the time and paintings themselves.

In contrast to many on-line platforms providing turnkey answers, Roofstock doesn’t personal any of the indexed homes. As an alternative, they provide their experience to lend a hand traders assessment, negotiate, and shut funding assets transactions.

In brief, they aren’t looking to promote you the rest. Their focal point is on including worth to an already current however in most cases sophisticated procedure.

So, is Roofstock authentic?

What Does Roofstock Be offering?

To respond to the query is Roofstock authentic, we should have a look at what it has to provide.

Ok Belongings Variety

One Roofstock characteristic that most definitely will get everybody excited is the abundant assets stock. Many turnkey assets platforms disappoint consumers since they’ve little to no stock. You’ll have to attend patiently as you’re subsequent in line for a renovation to happen. This ceaselessly leaves you feeling the drive to take what’s to be had.

This isn’t the case with Roofstock. Its attractiveness is in its huge stock that gives various costs and classes.

Affordability

Many of us shy clear of actual property investments because of the excessive prices ceaselessly required to begin making an investment. This isn’t the case with Roofstock merely since you don’t want any cash to begin taking a look on the homes.

In the event you’ve discovered a assets that arouses your pastime, you’ll be able to comprehensively learn the inspection file and communicate for your guide or agent. After deciding to buy the home, you’ll be able to pay the 0.5% Roofstock charge the use of your bank card. After you have the financing so as, the condominium assets turns into yours.

This affordability isn’t handiest one-way, since dealers additionally need to pay only a 3% list charge.

Many of us will have a difficult time comprehending how modern those low charges are. Whilst different on-line actual property platforms have made it conceivable to realize actual property publicity cost effectively, you’ll be able to’t at once personal funding homes outright.

Roofstock, however, is likely one of the actual property platforms with the bottom barrier to access.

Comparable: Reasonably priced Housing—How Actual Property Traders Can Lend a hand Whilst Profiting

Get started Incomes Straight away

We’ve already discussed that Roofstock listings are already tenant-occupied. Whenever you’ve closed on a condominium assets, you get started incomes condominium source of revenue in an instant. You merely think the contract from the former landlord.

Many traders say discovering tenants is the hardest side of proudly owning and managing condominium homes. Roofstock has got rid of this problem through making it conceivable to possess homes with tenants who’ve a just right observe document.

On height of that, Roofstock has a “Hire Up Ensure” that gives your safety if your rent-ready house hasn’t discovered a tenant inside of 45 days. With this ensure, Roofstock covers your lease for as much as a yr.

Belongings Inspections

One more reason why Roofstock is fascinating to actual property traders is because of the thorough assets inspection each and every house has to head via. Roofstock inspections duvet the overall high quality of the home, estimated restore prices, and the entire budget you wish to have.

Because of this, you’ll be able to in fact purchase a super house on Roofstock with out seeing it previously. Whilst maximum traders will insist on seeing the home first, Roofstock inspections have made it an affordable chance to take.

Comparable: The Condominium Belongings Inspection Tick list

Obtainable Financing

Some of the toughest portions of shopping for condominium homes for many traders is gaining access to financing. Then again, Roofstock has an built-in financing possibility for folks with wholesome credit score histories and a minimum of 20% downpayment.

Roofstock claims that its built-in financing answer makes it conceivable to near a deal in as low as 30 days. Whilst it won’t be offering the most productive rates of interest, its accessibility and velocity are price taking into consideration.

Roofstock Options

Let’s have a more in-depth have a look at Roofstock critiques through going via one of the vital options that make it stick out from its competition.

Roofstock One

Roofstock One is a subset of the platform that’s utterly other from {the marketplace}. At the start, Roofstock One lets in traders to shop for assets stocks for no less than $5,000. This option means that you can turn into a single-family house fractional proprietor. Secondly, you should be an accepted investor to put money into Roofstock One.

Whenever you’ve invested in Roofstock One, their staff takes over the entirety from there, together with assets control. Because of this Roofstock One is a smart possibility for traders who’re on the lookout for a extra hands-off funding manner or would like to get publicity to various homes.

So, is Roofstock One authentic? The quick resolution is sure. Then again, take into account that Roofstock One’s investments are extremely illiquid. It is going to take a for much longer time to dump your private home stocks since there’s these days no third-party marketplace for Roofstock One’s stocks.

Roofstock Academy

Roofstock Academy is Roofstock’s newest brainchild. It’s tailored for newcomers questioning how a lot do actual property traders make and on the lookout for tactics to begin making an investment.

Right here, traders discover ways to grasp turnkey funding homes and the right way to generate passive source of revenue. This path will in fact move a ways that will help you acquire homes on their platform.

Something that makes Roofstock Academy stand out is that it combines each on-line studying and one-on-one training. As well as, you achieve get admission to to a non-public community of different skilled and amateur actual property traders.

Roofstock Downsides

We’ve already checked out some Roofstock advantages, equivalent to low charges, thorough assets inspection, assets control, and tenant-occupied homes. To comprehensively resolution the query is Roofstock authentic, it’s now time to turn the coin and have a look at Roofstock’s downsides.

They come with:

- Massive down fee – Should you don’t have the capability to shop for the valuables outright in money, you’ll need to search for loan choices. This may increasingly require you to pay a bigger down fee and make issues slightly tricky for you.

- Numerous paintings – Regardless that you could make a selection to take a position passively and cross all of the assets control duties to the Roofstock staff, proudly owning condominium homes isn’t at all times simple. For instance, you’ll have to position some cash apart for emergencies. In case the rest breaks in the home, the landlord (i.e. you) is answerable for it.

- Due diligence – You’ll have to hold out numerous analysis ahead of buying the valuables you’re considering of.

Comparable: Earnest Cash vs. Down Cost—What You Want to Know

Most sensible 3 Roofstock Competition to Imagine

As we promised, we’re now going to take a look at some Roofstock competition and choice passive source of revenue resources so that you can assessment is Roofstock authentic.

1. HomeUnion

HomeUnion is considered one of Roofstock’s primary competition. Identical to Roofstock, HomeUnion may be an actual property market. The one distinction is that the latter doesn’t concentrate on any form of assets. You’ll in finding various kinds of homes on HomeUnion, together with single-family leases and four-family complexes.

HomeUnion would possibly stand out since its set of rules recommends homes in accordance with your funding targets and monetary personal tastes. The platform is not going to handiest will let you choose the most productive funding assets for you, but in addition lend a hand you make a decision on the most productive financing possibility and purchase the valuables to your behalf.

In contrast to Roofstock, HomeUnion homes don’t have tenants. Then again, they’ll will let you marketplace the valuables and in finding tenants. For a proportion of your condominium source of revenue, HomeUnion too can arrange the homes for you.

HomeUnion Professionals

- Supplies in-depth analysis on all homes

- You’ll do the entirety from discovering appropriate condominium homes to discovering just right tenants and managing the valuables

- The platform is open to all traders

HomeUnion Cons

- You should have an account to get admission to the listings

- You should pay a three.5% assets acquisition charge. Should you don’t wish to take at the landlord duties, you should pay a ten.5% of the per thirty days condominium source of revenue as assets control charges

- The platform doesn’t have homes all over

2. Fundrise

Maximum traders will search for Roofstock vs Fundrise critiques when on the lookout for an actual property platform. Fundrise is without doubt one of the earliest actual property crowdfunding platforms. It’s a perfect possibility for traders who need to take a crowdfunding manner when making an investment in actual property.

Fundrise traders mix their sources to get admission to business and home funding alternatives that they may not have get admission to to on their very own. The property bought can generate source of revenue for the traders or develop in accordance with the most important pastime. You don’t should be an accepted investor to put money into Fundrise.

Fundrise’s funding merchandise are:

- eREITs – This feature means that you can put money into fairness and debt funding alternatives that fit your eREIT targets. Your eREIT purpose may both be to generate constant source of revenue or develop in the long run.

- eFUNDs– Fundrise eFUNDs let traders make investments at once into a various portfolio of listings positioned in high-performing neighborhoods in US metro spaces.

Fundrise Prices

Fundrise charges is also its primary problem. In comparison to its competition, the platform is relatively pricey. To control your eREITs and eFUNDs, it’s important to phase with 0.85% of your source of revenue for the yearly control charge. On height of that, it’s important to pay a zero.15% annual advisory charge for the account.

There also are different Fundrise charges related to liquidation and building. Such charges are charged on explicit tasks. Redeeming your funding ahead of the particular period will result in a redemption charge of three%.

3. Mashvisor

Now let’s have a look at the icing at the cake. Mashvisor is a web-based actual property platform whose primary purpose is to offer traders with dependable, correct, and newest assets knowledge. This information is helping traders make good funding selections.

What makes Mashvisor stick out from different actual property platforms is that it supplies knowledge for each conventional and momentary condominium methods. This is helping you select the condominium technique that fits your source of revenue and funding targets.

The platform additionally makes use of system studying and AI algorithms to come up with listings that fit your necessities. This may increasingly prevent numerous time as you seek for and analyze funding alternatives.

Ahead of we will be able to have a look at some Mashvisor options, make sure to’ve booked your demo:

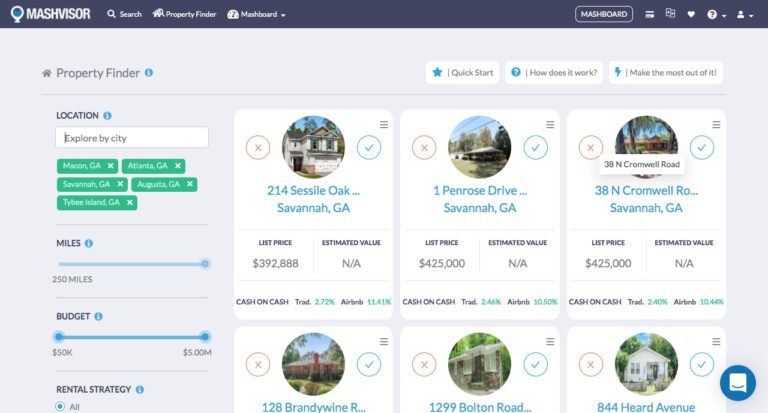

Belongings Finder

Mashvisor’s Belongings Finder is helping you in finding profitable funding homes in a couple of mins. The device comprises filters that will help you slim down the hunt effects to suit your standards. The filters come with assets sort, list value, excellent condominium technique, and the collection of bedrooms and loos.

In case you are taking a look into a number of towns, you’ll be able to use Mashvisor’s Belongings Finder to search out essentially the most winning assets in as much as 10 towns directly.

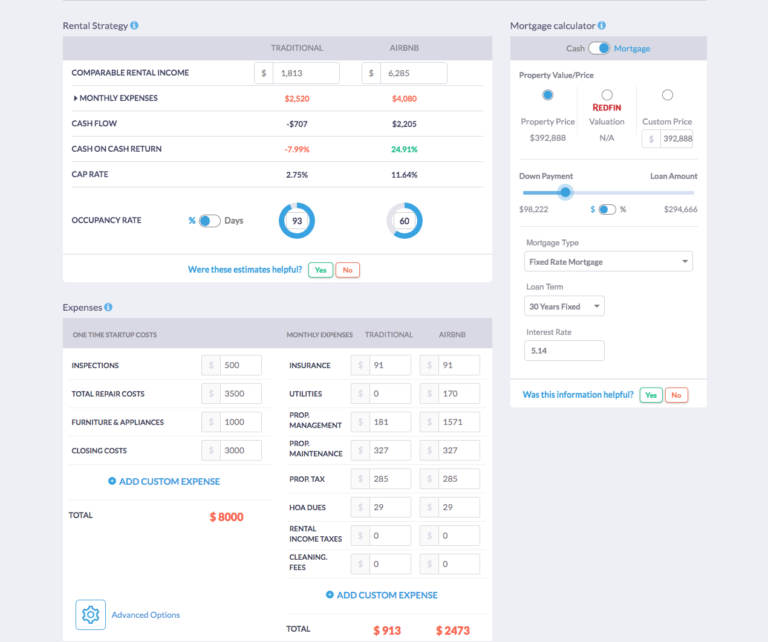

Funding Belongings Calculator

Additionally known as the Condominium Belongings Calculator, you’ll be able to use this device to investigate homes for each conventional and momentary condominium methods. You handiest need to enter the monetary prices, and the device will generate the numbers you’ll be able to be expecting for condominium source of revenue, assets bills, Airbnb occupancy fee, and go back on funding metrics, equivalent to money on money go back and cap fee.

Since our funding assets calculator is interactive, you’ll be able to regulate the monetary prices, source of revenue, and occupancy fee to look how they are able to have an effect on your money glide.

Mashvisor’s Funding Belongings Calculator is helping you in finding out the benefit attainable of the list you’re looking at.

Actual Property Heatmap

Mashvisor’s Heatmap is a color-coded device that displays you lively and top-performing neighborhoods in a undeniable house. The colour inexperienced represents lively neighborhoods whilst purple displays dormant markets. You’ll use metrics equivalent to condominium source of revenue, cap fee, money on money go back, and Airbnb occupancy fee to neighborhoods on our Heatmap.

Verdict: Is Roofstock Reputable?

We are hoping this Roofstock evaluate has helped you resolution the query: is Roofstock authentic? To summarize, this platform works neatly for lots of actual property traders because it has reduced the barrier to access. Whilst it’s a perfect profitable alternative, you continue to have to hold out your due diligence previously to steer clear of ugly surprises.

Mashvisor is without doubt one of the highest Roofstock possible choices, and it will also be a supplementary device. Our platform used to be advanced to lend a hand actual property traders make good trade selections and make investments their cash in winning alternatives.

Join to our platform these days and get started your 7-day unfastened trial.