International tech massive Google broadcasts its plans on increasing its operations and making an investment about $9.5 billion in america this yr.

Tech Large Google to Make investments $9.5 Billion in america in 2022

Google, one of the crucial most sensible and maximum recognizable tech corporations on the earth, has lately introduced its plans of making an investment an extra $9.5 billion within the U.S. this yr. That’s on most sensible of its already current hubs and facilities in several portions of the rustic.

Its workplaces and knowledge facilities function important anchors to native communities and lend a hand toughen their economies. The presence of a bodily Google place of work or middle supplies solid jobs to native other people.

During the last 5 years, the tech corporate has already invested greater than $35 billion in best 26 states. At a bit over part of the full selection of states within the nation, the corporate has generated over 40,000 full-time staff. That’s no longer counting the over $40 billion it has invested in 2020 and 2021 in analysis and construction inside america.

The extra funds is anticipated to create 12,000 extra Google jobs and much more the place native providers, companions, and communities are involved.

Now a few of you can be questioning that given the shift to faraway paintings and extra versatile operating preparations, why would Google put money into bodily structures at this day and age? Isn’t Google meant to be run via geniuses? Isn’t it relatively counterintuitive at the a part of Google?

It isn’t. If truth be told, Google anticipates that making an investment in bodily campuses will lend a hand stabilize the economies of communities they’re in with the roles they invent. The corporate’s presence creates an immediate and oblique affect at the native financial system. In 2021 by myself, Google helped supply over $617 billion in financial task around the nation. Android apps created virtually two million jobs whilst YouTube helped fortify 394,000 folks (content material creators and their companions) within the first yr of the pandemic.

The benefit of all this construction is that no longer best does it generate extra jobs for folks, however it additionally strengthens the virtual equipment that lend a hand folks, marketers, and companies thrive.

Similar: Why the Absolute best Towns for Tech Jobs Can Be the Best Towns to Put money into Actual Property

What Does This Imply for Actual Property Buyers?

Google is taking a look at a number of other places to convey their trade to. Those are simply one of the ones on their record:

- Atlanta GA

- Douglasville GA

- Austin TX

- Midlothian TX

- Clarksville TN

- Reston VA

- Pryor OK

- Council Bluffs IA

- Papillion NE

- New York NY

- Pittsburgh PA

- Boulder CO

- San Jose CA

- Portland OR

- Kirkland WA

- Seattle WA

- Storey County NV

- Henderson NV

As soon as the worldwide icon begins to roll out its plans, those places are anticipated to explode, particularly issues involving actual property. The selection of jobs it is going to generate will build up in-migration in every location as American citizens are nonetheless on the lookout for higher activity alternatives as of late.

Actual property buyers will do smartly to stay their radars on top alert and get started scouting possible successful investments. Whilst Airbnb companies is also doing smartly within the mentioned places (particularly the larger and extra standard towns), conventional condo houses are those that display a lot promise presently.

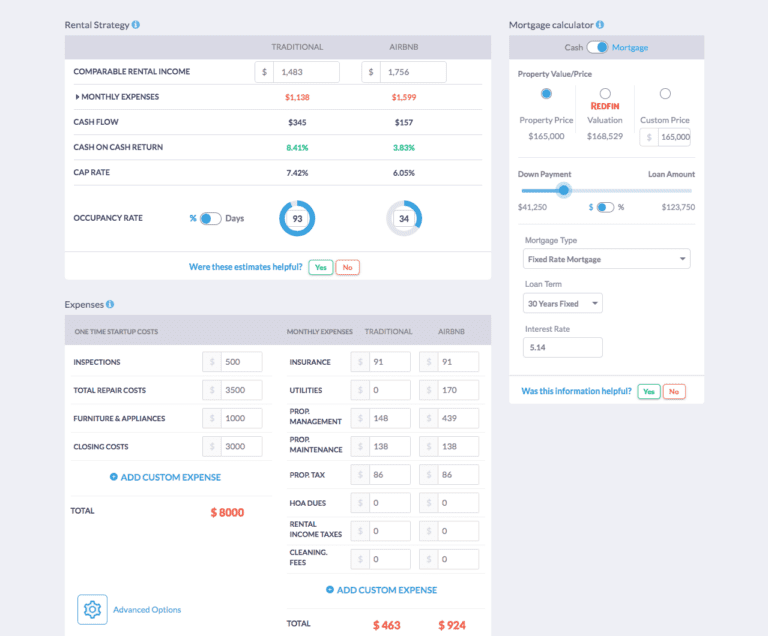

Sensible buyers will no doubt behavior due diligence at the mentioned spaces to look what the conceivable go back on funding will likely be in the event that they had been to shop for funding houses in the ones places. Discovering a possible revenue assets, inspecting the entire vital knowledge, calculating its profitability, and seeing how it is going to stack up in opposition to different condo comps is now more uncomplicated with a site like Mashvisor.

Mashvisor is an actual property site that has helped hundreds of buyers make the most productive funding choices. Its equipment permit customers to seek out the fitting condo houses and get a hold of the most productive condo methods that yield the most productive money on money go back charges. Its funding assets calculator gives other options that make crunching numbers and finding probably the most ideally suited income-generating houses so much quicker and more uncomplicated.

Mashvisor’s Funding Belongings Calculator will let you discover a profitable conventional condo assets in one in all Google’s place of work and knowledge middle places.

Conventional Condominium Marketplace Information for Places With Google Places of work and Information Facilities

We’ve enumerated one of the spaces Google is making an investment in so we concept we’d take it a step additional and come up with Mashvisor’s newest conventional condo marketplace knowledge of the mentioned places. That is what the ones markets have to provide condo assets buyers in the event that they make a choice to shop for condo houses in a few of the ones places:

1. Douglasville, GA

- Median Belongings Value: $324,221

- Reasonable Value in step with Sq. Foot: $177

- Days on Marketplace: 64

- Selection of Conventional Listings: 195

- Per thirty days Conventional Condominium Source of revenue: $1,476

- Conventional Money on Money Go back: 3.11%

- Conventional Cap Price: 3.20%

- Value to Hire Ratio: 18 (medium)

- Stroll Ranking: 74

2. Pryor, OK

- Median Belongings Value: $393,026

- Reasonable Value in step with Sq. Foot: $175

- Days on Marketplace: 55

- Selection of Conventional Listings: 3

- Per thirty days Conventional Condominium Source of revenue: $1,269

- Conventional Money on Money Go back: 2.73%

- Conventional Cap Price: 2.85%

- Value to Hire Ratio: 26 (top)

- Stroll Ranking: 66

3. Atlanta GA

- Median Belongings Value: $601,992

- Reasonable Value in step with Sq. Foot: $465

- Days on Marketplace: 72

- Selection of Conventional Listings: 3,799

- Per thirty days Conventional Condominium Source of revenue: $2,425

- Conventional Money on Money Go back: 2.53%

- Conventional Cap Price: 2.59%

- Value to Hire Ratio: 21 (top)

- Stroll Ranking: 44

4. Reston, VA

- Median Belongings Value: $561,015

- Reasonable Value in step with Sq. Foot: $366

- Days on Marketplace: 39

- Selection of Conventional Listings: 682

- Per thirty days Conventional Condominium Source of revenue: $2,132

- Conventional Money on Money Go back: 2.32%

- Conventional Cap Price: 2.37%

- Value to Hire Ratio: 22 (top)

- Stroll Ranking: 86

5. Council Bluffs, IA

- Median Belongings Value: $331,690

- Reasonable Value in step with Sq. Foot: $138

- Days on Marketplace: 76

- Selection of Conventional Listings: 6

- Per thirty days Conventional Condominium Source of revenue: $1,328

- Conventional Money on Money Go back: 2.30%

- Conventional Cap Price: 2.41%

- Value to Hire Ratio: 21 (top)

- Stroll Ranking: 7

6. Papillion, NE

- Median Belongings Value: $484,698

- Reasonable Value in step with Sq. Foot: $206

- Days on Marketplace: 129

- Selection of Conventional Listings: 6

- Per thirty days Conventional Condominium Source of revenue: $1,769

- Conventional Money on Money Go back: 2.15%

- Conventional Cap Price: 2.19%

- Value to Hire Ratio: 23 (top)

- Stroll Ranking: 60

7. Pittsburgh, PA

- Median Belongings Value: $446,517

- Reasonable Value in step with Sq. Foot: $110

- Days on Marketplace: 80

- Selection of Conventional Listings: 1,255

- Per thirty days Conventional Condominium Source of revenue: $1,430

- Conventional Money on Money Go back: 2.07%

- Conventional Cap Price: 2.14%

- Value to Hire Ratio: 26 (top)

- Stroll Ranking: 53

8. Clarksville, TN

- Median Belongings Value: $348,115

- Reasonable Value in step with Sq. Foot: $175

- Days on Marketplace: 70

- Selection of Conventional Listings: 809

- Per thirty days Conventional Condominium Source of revenue: $1,225

- Conventional Money on Money Go back: 1.93%

- Conventional Cap Price: 1.98%

- Value to Hire Ratio: 24 (top)

- Stroll Ranking: 77

9. Kirkland, WA

- Median Belongings Value: $821,613

- Reasonable Value in step with Sq. Foot: $518

- Days on Marketplace: 41

- Selection of Conventional Listings: 63

- Per thirty days Conventional Condominium Source of revenue: $2,247

- Conventional Money on Money Go back: 1.69%

- Conventional Cap Price: 1.72%

- Value to Hire Ratio: 30 (top)

- Stroll Ranking: 39

10. Henderson, NV

- Median Belongings Value: $780,168

- Reasonable Value in step with Sq. Foot: $317

- Days on Marketplace: 50

- Selection of Conventional Listings: 2,596

- Per thirty days Conventional Condominium Source of revenue: $1,984

- Conventional Money on Money Go back: 1.69%

- Conventional Cap Price: 1.72%

- Value to Hire Ratio: 33 (top)

- Stroll Ranking: 23

11. Midlothian, TX

- Median Belongings Value: $541,933

- Reasonable Value in step with Sq. Foot: $207

- Days on Marketplace: 79

- Selection of Conventional Listings: 87

- Per thirty days Conventional Condominium Source of revenue: $2,094

- Conventional Money on Money Go back: 1.44%

- Conventional Cap Price: 1.47%

- Value to Hire Ratio: 22 (top)

- Stroll Ranking: 57

12. Portland, OR

- Median Belongings Value: $735,590

- Reasonable Value in step with Sq. Foot: $520

- Days on Marketplace: 54

- Selection of Conventional Listings: 553

- Per thirty days Conventional Condominium Source of revenue: $2,261

- Conventional Money on Money Go back: 1.12%

- Conventional Cap Price: 1.14%

- Value to Hire Ratio: 27 (top)

- Stroll Ranking: 53

13. Reno, NV

- Median Belongings Value: $665,547

- Reasonable Value in step with Sq. Foot: $390

- Days on Marketplace: 54

- Selection of Conventional Listings: 639

- Per thirty days Conventional Condominium Source of revenue: $1,659

- Conventional Money on Money Go back: 1.12%

- Conventional Cap Price: 1.13%

- Value to Hire Ratio: 33 (top)

- Stroll Ranking: 16

14. Seattle, WA

- Median Belongings Value: $1,402,453

- Reasonable Value in step with Sq. Foot: $688

- Days on Marketplace: 35

- Selection of Conventional Listings: 1,546

- Per thirty days Conventional Condominium Source of revenue: $2,738

- Conventional Money on Money Go back: 0.93%

- Conventional Cap Price: 0.94%

- Value to Hire Ratio: 43 (top)

- Stroll Ranking: 64

15. New York, NY

- Median Belongings Value: $1,464,804

- Reasonable Value in step with Sq. Foot: $1,577

- Days on Marketplace: 141

- Selection of Conventional Listings: 54,518

- Per thirty days Conventional Condominium Source of revenue: $3,396

- Conventional Money on Money Go back: 0.85%

- Conventional Cap Price: 0.86%

- Value to Hire Ratio: 36 (top)

- Stroll Ranking: 61

16. San Jose, CA

- Median Belongings Value: $1,467,036

- Reasonable Value in step with Sq. Foot: $868

- Days on Marketplace: 34

- Selection of Conventional Listings: 509

- Per thirty days Conventional Condominium Source of revenue: $3,143

- Conventional Money on Money Go back: 0.80%

- Conventional Cap Price: 0.81%

- Value to Hire Ratio: 39 (top)

- Stroll Ranking: 48

17. Boulder, CO

- Median Belongings Value: $1,564,083

- Reasonable Value in step with Sq. Foot: $705

- Days on Marketplace: 47

- Selection of Conventional Listings: 518

- Per thirty days Conventional Condominium Source of revenue: $2,581

- Conventional Money on Money Go back: 0.71%

- Conventional Cap Price: 0.73%

- Value to Hire Ratio: 51 (top)

- Stroll Ranking: 51

18. Austin, TX

- Median Belongings Value: $959,017

- Reasonable Value in step with Sq. Foot: $544

- Days on Marketplace: 57

- Selection of Conventional Listings: 2,963

- Per thirty days Conventional Condominium Source of revenue: $2,114

- Conventional Money on Money Go back: 0.52%

- Conventional Cap Price: 0.53%

- Value to Hire Ratio: 38 (top)

- Stroll Ranking: 51

Similar: Best 30 Places for Conventional Money on Money Go back in 2022

Wrapping Up

As Google continues to construct workplaces and knowledge facilities globally and amplify its operations, the communities they put money into get more potent economically from the selection of created jobs to houses offered or rented out. Financial expansion is certainly one of the crucial elements that buyers use to look whether or not a location is value making an investment in or no longer.

On this case, the communities those Google workplaces and knowledge facilities are constructed will trap in condo assets buyers to shop for revenue houses on the market to transform into long-term leases. However earlier than they make any choices, it’s nonetheless essential for them to accomplish due diligence.

To get get right of entry to to our actual property funding equipment, click on right here to enroll in a 7-day loose trial of Mashvisor as of late, adopted via 15% off for existence.