Tax season is right here once more, and for those who personal condominium assets, you’ll be required by way of the IRS to record and record all condominium source of revenue to your tax go back.

Desk of Contents

- What Counts as Condominium Source of revenue?

- Is Condominium Source of revenue Taxable?

- What Tax Deductions Are You Entitled to as a Condominium Belongings Proprietor?

- Best 7 Tax Deductions for Landlords

- Paperwork Landlords Want During Tax Season

- What Is the Right kind Option to Record Source of revenue and Bills?

- How Can Mashvisor Assist?

- Conclusion

Taxes will also be frightening for first-time and skilled landlords, particularly in gentle of new occasions. In spite of everything, one fallacious tax transfer would possibly end result for your condominium industry being pulled within the fallacious course.

We’ve compiled an inventory of the highest recommendations on reporting your tax on condominium source of revenue to steer you throughout the 2022 tax season and profit from your tax go back. Let’s get began.

What Counts as Condominium Source of revenue?

You must come with all hire bills for your annual income usually. Any quantity you get for the use or career of assets is known as condominium source of revenue. The source of revenue for your entire belongings should be reported. Except common hire bills, further quantities could also be source of revenue and should be recorded to your tax go back.

Advance Hire

Advance hire is any sum of money won ahead of the length lined. Without reference to the time lined or the type of accounting used, incorporate advance hire for your source of revenue while you download it. As an example, think you signal a 10-year rent to your condominium space. You are going to obtain $5,000 all the way through the primary yr’s fee and $5,000 for the overall yr of the rent. It is very important come with $10,000 for your source of revenue all the way through the primary yr.

Safety Deposit

Safety deposits applied as ultimate hire bills are thought to be advance hire. Come with it for your source of revenue while you get it. If you’re making plans to go back a safety deposit on your renter on the expiry of the rent, don’t come with it for your source of revenue while you download it. Then again, for those who stay a work or the entire deposit during any yr as a result of your tenant does now not observe the rent phrases, come with the sum you personal for your source of revenue for that yr.

The major difference between advance hire and safety deposit is how they’re controlled. Advance hire is a one-time expense for a selected time period. When the stated length expires, it turns into a value for the tenant whilst the owner earns an source of revenue.

However, safety deposits quilt all the contract period. The owner returns the deposit to the tenant when that length is up. They could, on the other hand, deduct positive fees from it.

Is Condominium Source of revenue Taxable?

Sure, it’s. Then again, this doesn’t point out that the whole thing you get out of your tenants is matter to taxation. Chances are you’ll decrease your condominium income by way of deducting expenditures associated with prepping your home for hire after which keeping up it as a condominium.

- Condominium source of revenue and bills are reported on Agenda E, Supplemental Source of revenue and Loss.

- Agenda E is then submitted at the side of your Shape 1040.

Comparable: How one can To find Homes That Promise Top Condominium Source of revenue

What Tax Deductions Are You Entitled to as a Condominium Belongings Proprietor?

Relating to taxes on condominium source of revenue, chances are you’ll deduct a number of condominium bills to your tax go back for those who earn source of revenue from leasing a residential unit. Belongings tax, loan passion, operational bills, depreciation, and upkeep are examples of such prices.

Chances are you’ll deduct common and crucial bills incurred in managing, protective, and keeping up your present house for hire. Standard charges consult with commonplace and well known fees within the industry. Hobby, taxes, promoting, repairs, utilities, and insurance coverage are all examples of essential bills.

You’ll be able to deduct the cost of positive items, fabrics, renovations, and upkeep you carry out to your condominium assets to stay it in superb operating situation. Additionally, if the bills paid by way of the renter are deductible condominium bills, you’ll be able to deduct them. You’ll be able to exclude the similar quantity as a condominium expenditure when the truthful marketplace assets worth or products and services are incorporated for your condominium income.

Condominium Source of revenue Tax Fee: Fees You Can’t Deduct

The price of renovations isn’t deductible. An source of revenue assets is upgraded provided that the finances are used to make stronger, repair, or adapt it to another or new use. Depreciation is used to recuperate the price of changes. You’ll be able to recuperate all or maximum of your enhancements through the use of Shape 4562 to record depreciation beginning within the yr your home is first of all put into carrier.

Additionally, initially of once a year, you are making an improve or upload furnishings. Just a portion of the prices is deductible within the yr they’re paid.

Best 7 Tax Deductions for Landlords

Virtually no different funding gives extra tax benefits than condominium actual property. Such benefits can ceaselessly be the adaptation between shedding income and creating a benefit on an funding house. The next are the highest seven tax breaks for house owners of residential condominium houses.

1. Hobby

Hobby is now and again the only biggest deductible merchandise for a landlord. Loan passion fees on loans used for renovating or purchasing assets and passion on bank cards for products and services or items utilized in a condominium industry are standard circumstances of passion that landowners can deduct.

2. Condominium Actual Property Depreciation

The true price of funding houses, condominium structures, or different condominium houses isn’t solely deducted within the yr of acquire. As an alternative, landlords recuperate their funding in actual property by the use of depreciation. It comprises subtracting a share of the valuables’s price over the years.

Comparable: Right here’s How one can Calculate Depreciation on Condominium Belongings

3. Upkeep

Renovations to condominium assets are solely deductible within the yr they’re carried out (assuming the upkeep are anticipated, essential, and truthful in quantity). Repainting, repairing gutters or ground, repairing leaks, patching, and changing shattered home windows are all examples of deductible upkeep.

4. Trip

Landlords can declare a tax deduction for lots of the touring they carry out for his or her condominium industry. As an example, you’ll be able to subtract your shuttle expenditures for those who power on your condominium condominium to maintain a renter factor or cross to the availability retailer and purchase an merchandise for a restore. Nonetheless, you can not deduct the price of shuttle to improve your condominium house. The prices should be implemented to the valuables’s tax foundation and depreciated over a protracted length.

5. Insurance coverage

You’ll be able to deduct nearly any insurance coverage premiums you spend to your condominium operation. It covers condominium assets hearth, housebreaking, flood injury, and landlord’s legal responsibility insurance coverage. You’ll be able to additionally deduct the volume of your workers’ healthcare and staff’ repayment insurance coverage when you’ve got any.

6. Place of job at House

In the event that they satisfy positive minimal stipulations, landlords can deduct house place of job bills from their taxable condominium source of revenue. The deduction covers place of job area and workshops or different residential workspace used to your actual property industry. It’s legitimate whether or not you personal or rent your house or condominium.

7. Private Belongings

Private assets used in a condominium carrier can generally be deducted in 12 months the use of the de minimis protected harbor deductions (for belongings costing as much as $2,000) or 100% bonus depreciation, to be had from 2018 thru 2022. Home equipment or furniture in condominium devices and gardening apparatus are examples of such personal possessions.

Paperwork Landlords Want During Tax Season

It’s essential to stay actual information as a landlord, particularly for those who’re going to say any of the deductions discussed above. Holding arranged landlord information may lend a hand in easing the weight of tax season. You’ll be able to merely determine receipts, track deductible spending, and record your tax returns in case your condominium information are arranged.

Stay the next information so as:

- Insurance coverage insurance policies

- Mortgage paperwork

- Tax information from the previous years

- Actual property funding paperwork

- Any paperwork associated with the industry entity

- Any allows bought for the valuables

- All prison paperwork

- All tenant contracts or condominium agreements for your entire houses

Landlords should additionally read about their non permanent monitor document. They’re documentation associated with source of revenue or bills for the tax yr in query. They are able to come with:

- Receipts for upkeep

- Receipts for hire bills

- Loan passion

- Receipts for application prices

- Bank cards for condominium companies

- Condominium assets advertising and record charges

- Criminal or skilled bills for attorneys and extra.

To finish your tax returns, you should stay correct information. The paperwork should again up the source of revenue and expenditures you expose. Normally, they’re the similar information that you simply use to trace your actual property actions and generate your monetary statements.

What Is the Right kind Option to Record Source of revenue and Bills?

Think you hire out actual property, equivalent to homes, rooms, or residences. At the related line of Agenda E, input your overall source of revenue, prices, and depreciation for every funding house. To decide the volume of depreciation to place on line 18, seek the advice of the Shape 4562 Directions.

In the event you personal over 3 condominium properties, fill out and connect as many Schedules E as it is important to listing them. You should fill out Strains 1 and a pair of for every unit, together with the road quantity/deal with.

Your loss could also be limited in case your condominium expenditure exceeds your source of revenue. The passive actions loss standards and the at-risk requirements would possibly restrict the volume of loss you’ll be able to subtract.

Comparable: A Complete Checklist of Condominium Belongings Bills for Buyers

How the Condominium Source of revenue Tax Purposes

Consistent with the IRS, condominium assets is one that you simply personal and rent to renters for 15 days or over once a year. The IRS defines condominium assets as a unmarried construction, condo, condominium, holiday house, or equivalent place of abode.

How is condominium source of revenue taxed? Any internet income generated by way of your condominium assets is taxable as common source of revenue to your tax go back. As an example, in case your internet source of revenue for the yr is $20,000 and you’re within the 30% tax vary, you’ll owe $6,000 in taxes.

How Can Mashvisor Assist?

Actual property traders should maintain figures and projections hooked up to their industry. Extra exactly, the investor should decide whether or not the plan will lend a hand them in producing income or now not—after which transfer accordingly. That’s why Mashvisor supplies one of the equipment that may assist with the research.

Condominium Source of revenue Calculator

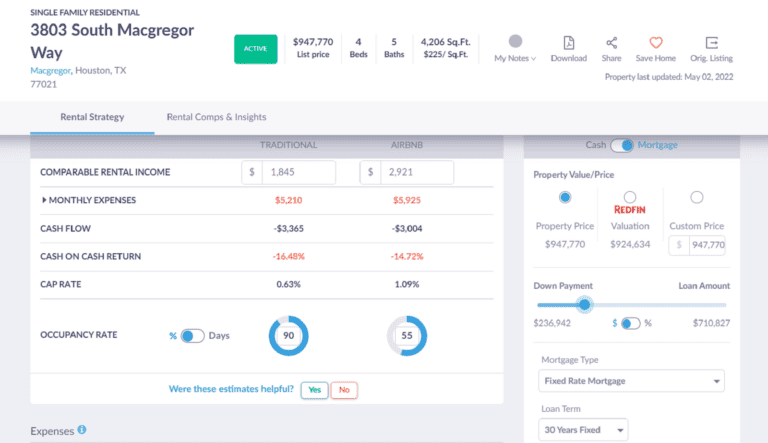

Mashvisor supplies one of the crucial biggest calculators for actual property traders. The platform employs the newest and in depth knowledge analytics to generate probably the most life like source of revenue forecasts for an Airbnb or common condominium assets. The condominium source of revenue calculator permits traders to habits group analyses to decide the optimum condominium technique for every location.

As soon as the consumer enters the entire assets’s crucial data, such because the one-time startup charges and per 30 days expenses, it calculates essential metrics equivalent to money on money go back, money go with the flow, and cap price on the assets degree.

Mashvisor’s condominium source of revenue calculator permits traders to habits group analyses to decide the optimum condominium technique for every location, in response to key metrics equivalent to money go with the flow, money on money go back, and cap price on the assets degree.

Loan Calculator

One of the essential charges related to buying and proudly owning a house is the loan. To make a benefit and succeed in their monetary targets, traders and householders should know the way to navigate the actual property marketplace successfully.

They should make a choice from other types of loan loans and acquire the most efficient loan charges. Getting probably the most really useful compensation stipulations additionally contributes considerably to keeping up a wholesome money go with the flow. A loan calculator will lend a hand you in taking advantage of your decided on loan financing kind to your assets.

Chances are you’ll use Mashvisor’s loan calculator to look for those who’ll nonetheless earn a benefit (or now not) after finishing your entire loan bills on your home. Merely input the valuables’s price, down fee, and rate of interest to start the use of the instrument. You’ll be able to additionally make a selection a loan type and a mortgage time period.

Conclusion

Proudly owning condominium assets supplies a number of advantages, with tax deductions and different perks being some of the important. Tax regulation in the US is especially favorable to actual property traders, which is why such a lot of folks spend money on condominium actual property this present day.

You’ll be able to use your condominium source of revenue to shop for multiple funding house whilst subtracting the loan passion price for those who use leverage correctly. You are going to pay lesser taxes whilst expanding your actual property making an investment portfolio. Good points from the sale of condominium assets can be useful in increasing your portfolio.

Along with an actual property calculator, Mashvisor comes with a very good set of actual property funding equipment that can assist you alongside the street. Whether or not you select long-term or non permanent leases, you’ll definitely to find the instrument really useful to your explicit wishes.

To get entry to our actual property funding equipment, click on right here to enroll in a 7-day loose trial of Mashvisor as of late, adopted by way of a fifteen% cut price for lifestyles.